Additional Broadridge resources:

View our Contact Us page for additional information.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

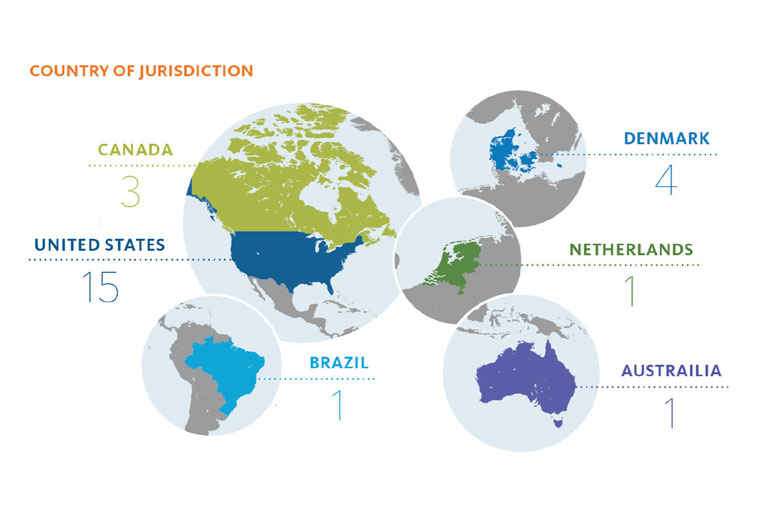

Class action cases involving securities and other financial products have grown in volume and complexity. Billions of dollars are distributed every year, and many firms are leaving money on the table. As a global Fintech leader with deep class actions expertise, Broadridge brings a unique perspective. More than 900 of the leading brokers, investment firms and asset managers already rely on our relationships, experience and technology.

Here you’ll find case studies, annual reports and insights that can help keep you abreast of market trends and important industry developments.

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.