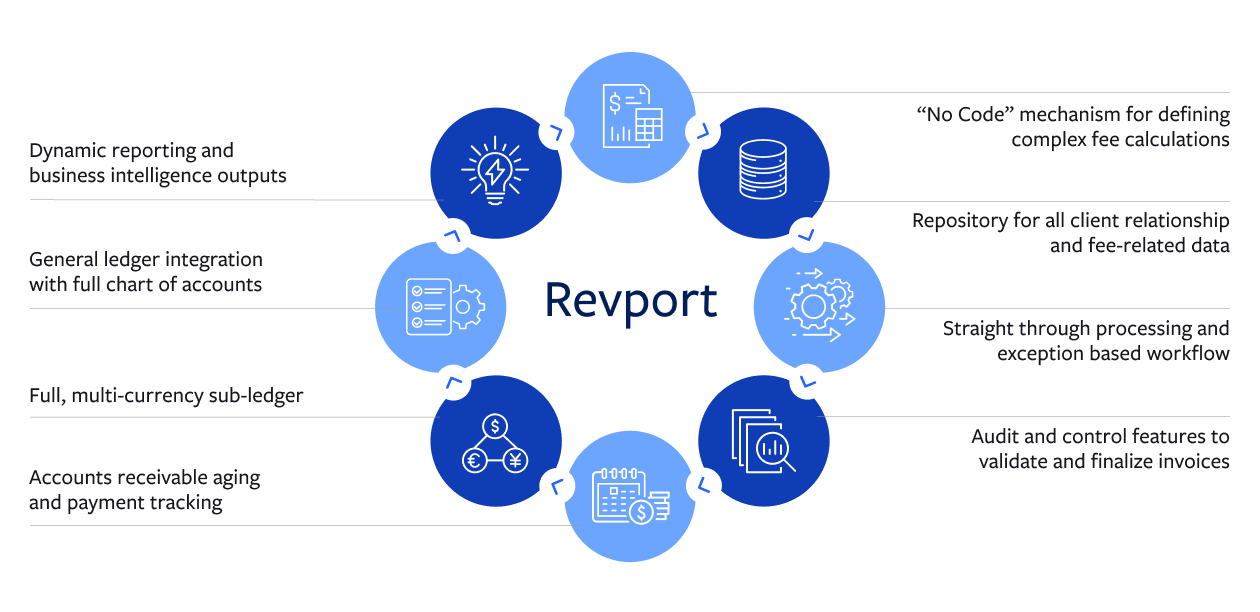

Key Capabilities:

- Revenue billing

- End-client agreements

- Client invoicing

- Multi-currency

- Cashflow proration

- Flexible fee rules

- Multi-tier fee schedules

- Tax management

Support for unlimited fee types, including:

- Management fees

- Performance fees

- Custodial fees

- Transaction fees

Case Study:

Global Asset Manager Shortens Invoice Cycles and Streamlines Compliance | Broadridge

“Identified and recovered over $1 million of misallocated revenue and minimized errors through streamlined processes.”