Managed Services

Partner with Broadridge to transform your financial operations with our technology-first approach, delivering scale, resilience, efficiency, and continuous innovation.

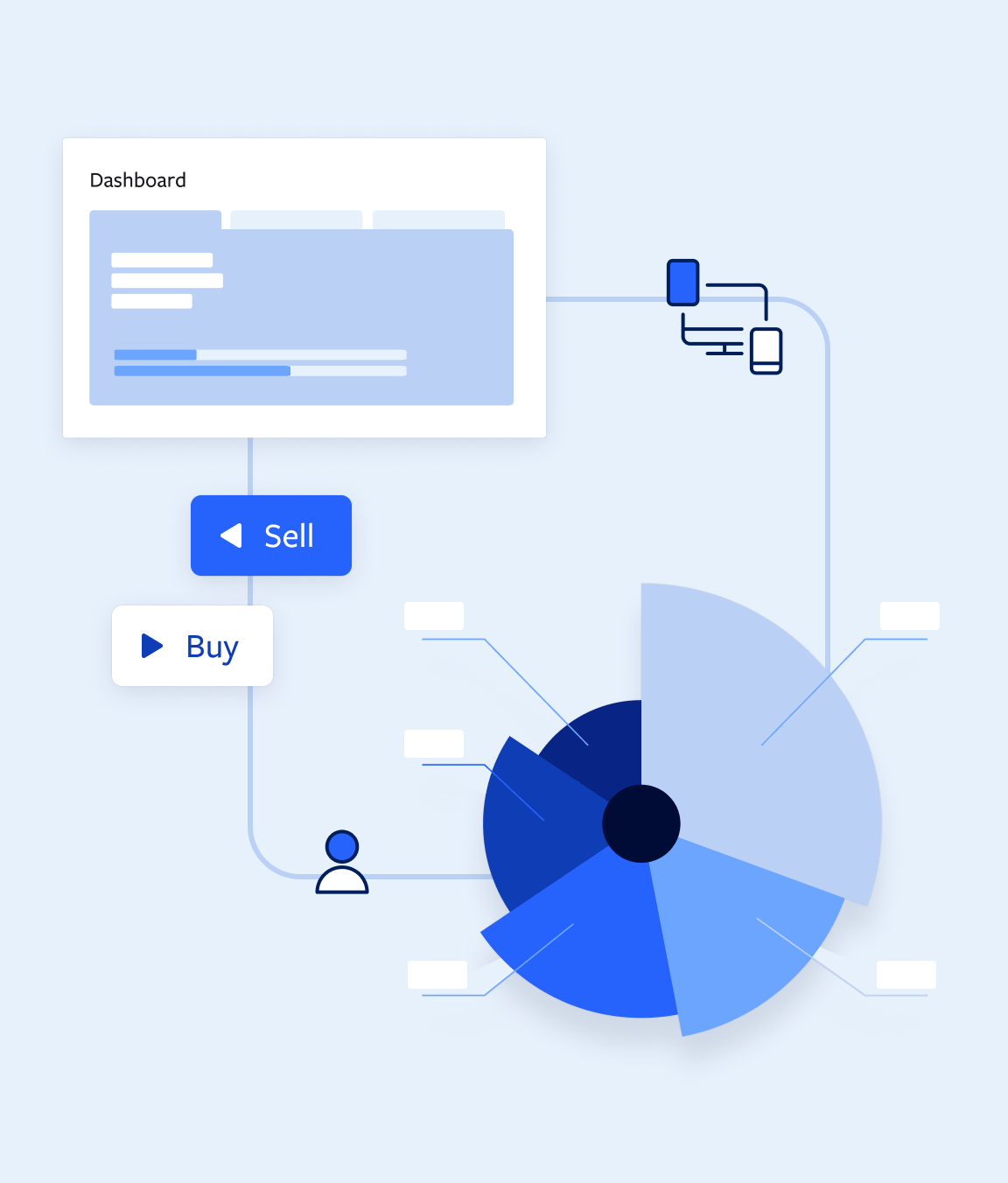

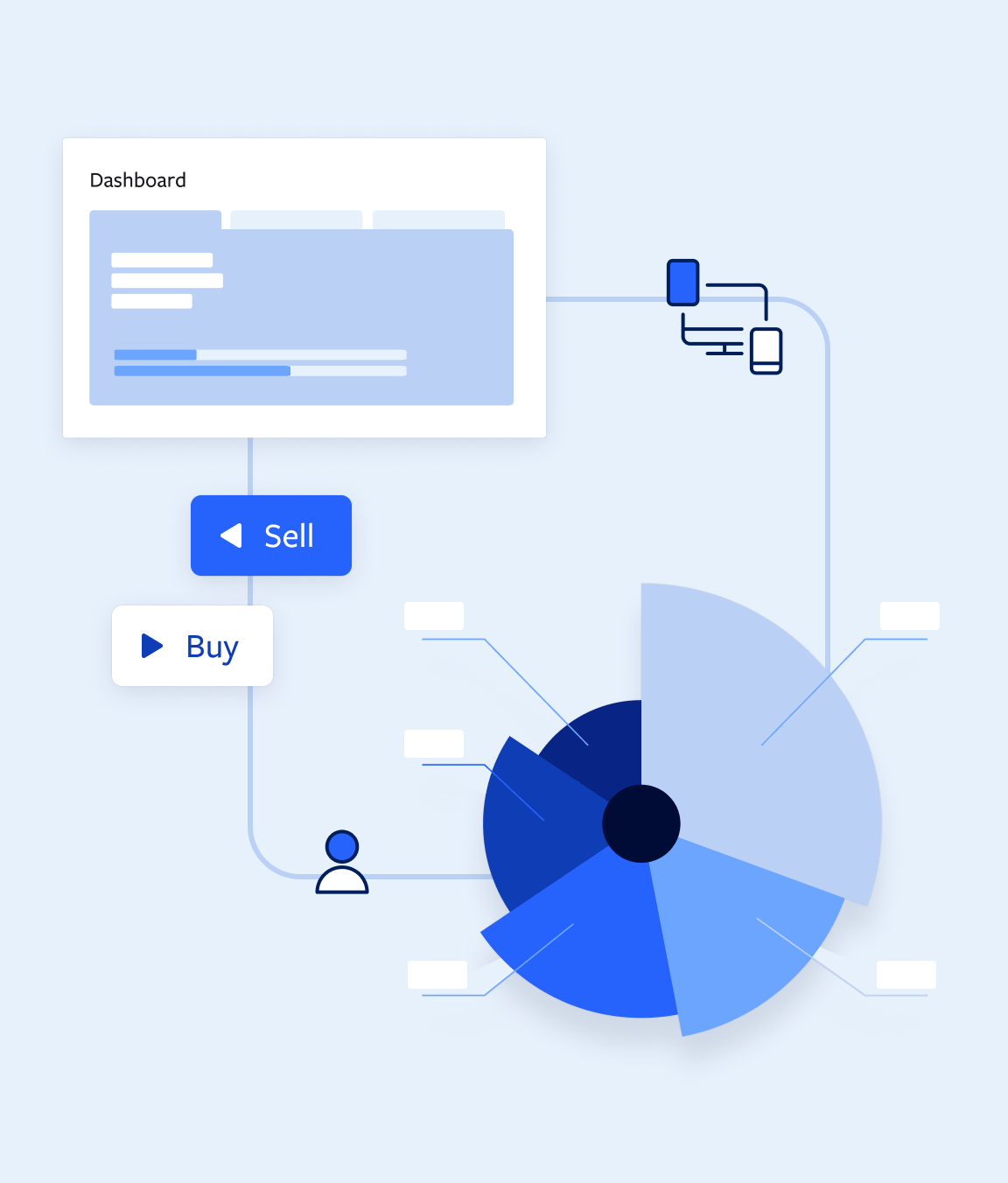

Optimize operations and focus on growth

-

Maximize trading, data, and customer service capabilities

-

Minimize human error and risk of non-compliance

-

Free up resources to spend on strategic activities

-

Aggregate, cleanse, and enrich data

-

Improve data accuracy and consistency

-

Integrate insights from multiple systems

-

Identify and mitigate potential risks

-

Simplify operations through a single vendor

-

Establish a holistic view and integrated approach

-

Reduce overhead across the asset lifecycle

-

Scale operations using cloud-based technology

-

Perform flexible integrations with API modules

-

Access continuous upgrades

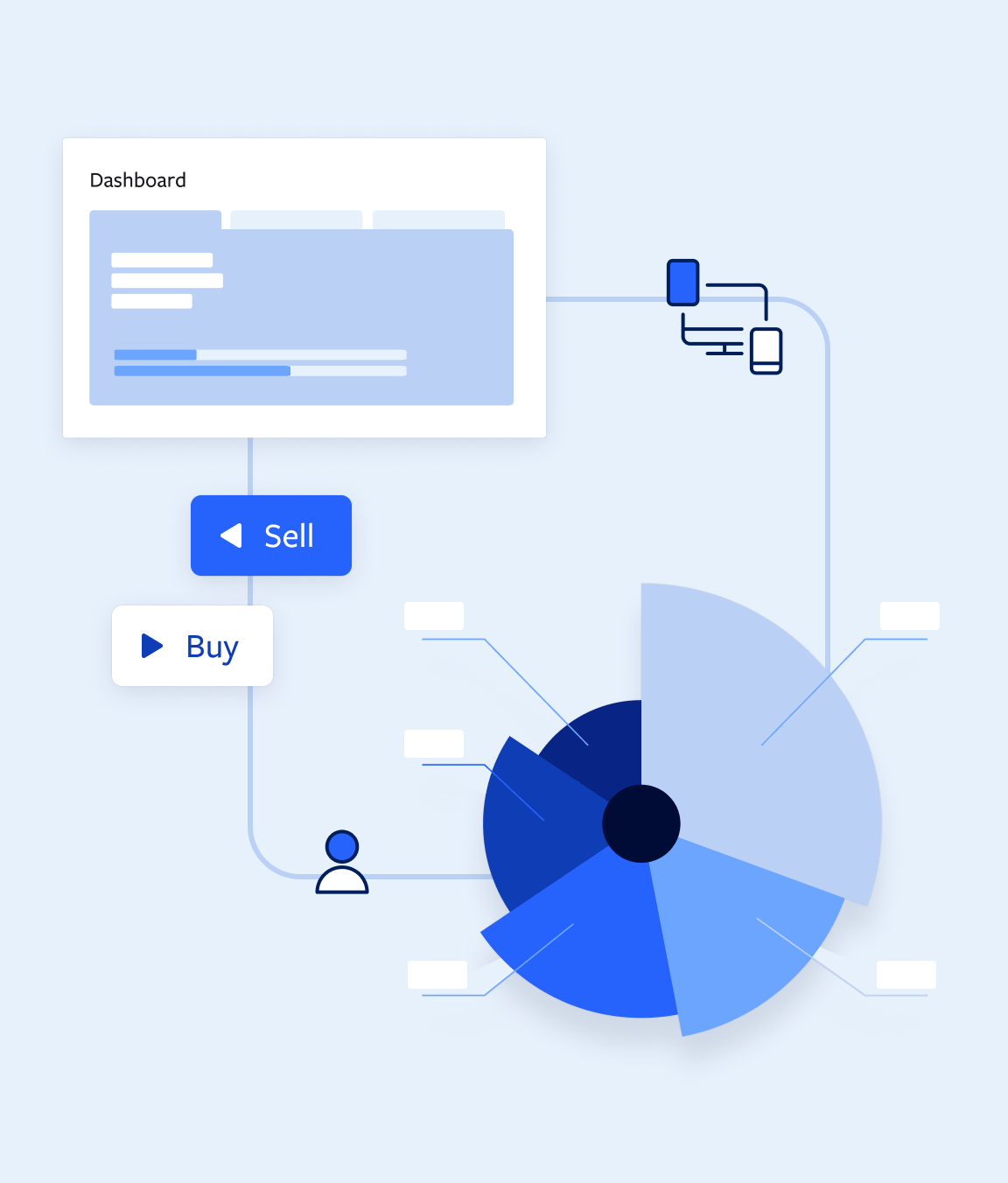

Back, middle, and front-office outsourcing made easy

Seamlessly manage trade confirmation, settlement, and reconciliation with our industry-leading platforms, delivering greater accuracy, transparency, and efficiency across the trade lifecycle.

Explore Trade Processing & SettlementAutomate the end-to-end corporate actions process—including event notifications, entitlement calculations, event processing, shareholder communications, and meeting management—to reduce risk and ensure regulatory compliance.

Explore Corporate ActionsStay ahead of evolving regulatory demands with robust, automated trade and transaction reporting that ensures transparency, compliance, and audit readiness.

Explore Regulatory Trade & Transaction ReportingStrengthen client relationships with secure, scalable document production and multi-channel communication solutions for both print and digital, ensuring timely and impactful delivery.

Explore Customer CommunicationsStreamline the entire trade lifecycle with integrated execution, order management, and post-trade processing, enhancing speed, accuracy, and operational control.

Explore Order ManagementElevate your wealth management operations with tailored outsourcing for client reporting, portfolio administration, and advisor support—boosting productivity while delivering a superior client experience.

Explore Wealth OperationsEmpower proactive risk mitigation with real-time risk assessment, monitoring, and compliance tools, designed to safeguard your business and support regulatory requirements.

Explore Risk Management

FINRA registered broker-dealer

Broadridge BPO is a FINRA-registered broker-dealer, delivering compliant operations support and outsourcing services for regulated clients.

Hiring practices and registrations

All BPO associates worldwide undergo thorough background checks, including fingerprinting with FINRA, ensuring only qualified professionals support our clients.

Financial reporting

We strictly adhere to capital requirements, submitting FOCUS reports to the SEC and FINRA and publishing an annual Statement of Financial Condition for transparency and trust.

Business continuity planning

Our comprehensive business continuity plans are in line with FINRA Rule 4370, ensuring critical client functions continue uninterrupted. Each client receives a tailored continuity plan.

Recordkeeping

In line with SEC Rule 17a3/4, we securely archive all electronic communications for at least seven years in a non-rewritable, non-erasable format, ensuring robust accountability.

Supervision

We enforce rigorous written internal supervisory procedures consistent with FINRA Rule 3110 to maintain the highest standards in every client engagement.

Securities registrations

Pursuant to FINRA Rule 1240, our associates are subject to continuing education requirements, ensuring they remain at the forefront of industry regulations and best practices.

Regulatory forums

Our FINRA registration enables active participation in industry committees, giving us valuable insights and relationships that enhance our services.