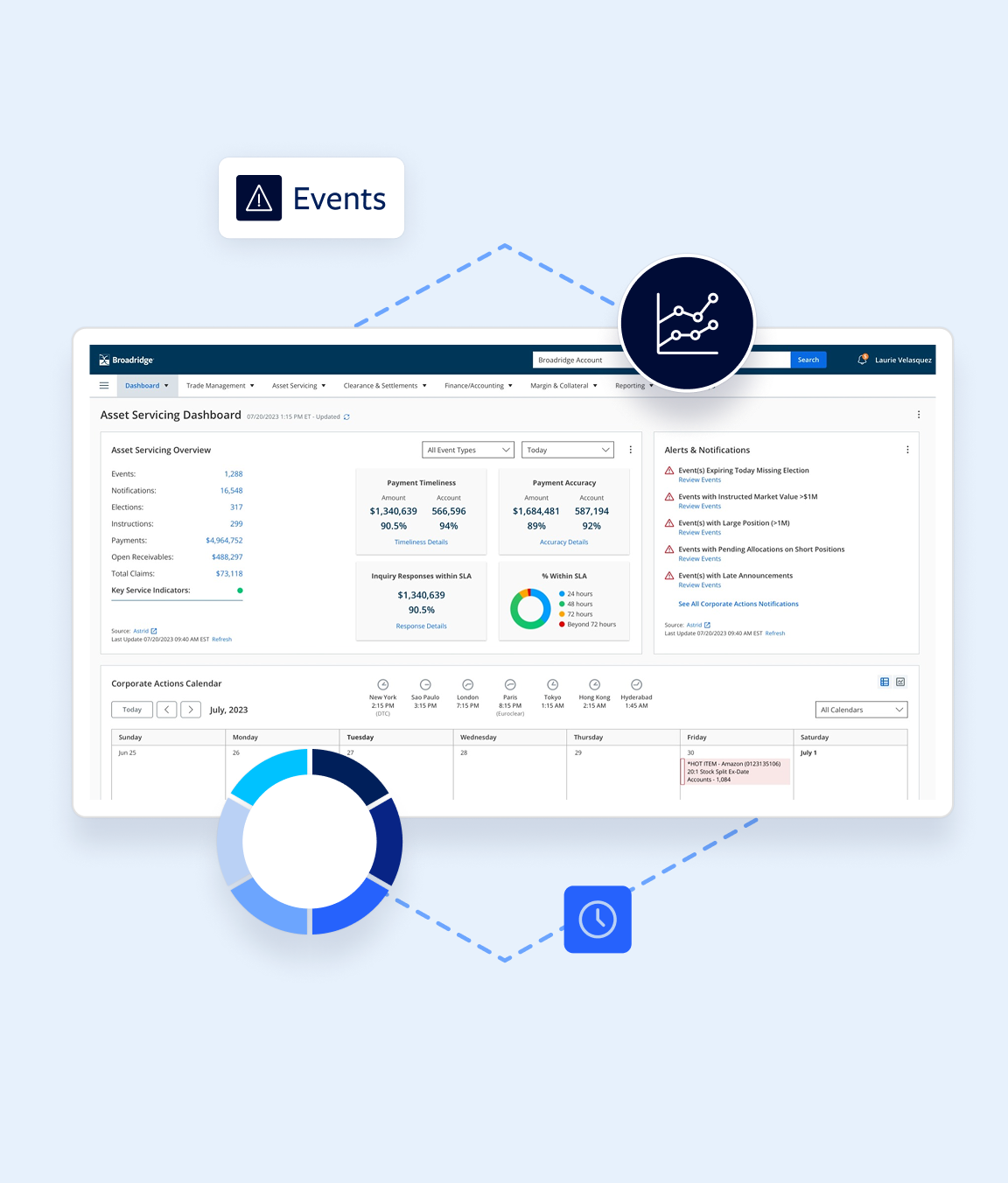

Asset Servicing

Harmonize operations across the entire asset servicing lifecycle—powered by a single source of truth. Manage across capital markets, wealth and asset management, and global custody.

Fortify your asset servicing ecosystem

Add every capability you need, when you need it

-

Transform on your own terms with API-driven components

-

Drive efficiencies and create value

-

Reduce risks and obstacles to growth

Enhance precision with real-time data

-

Unify datasets and accelerate real-time processing

-

Perform rapid, accurate reporting using an incremental data model

-

Prepare for challenges like T+0

Use our single gateway for an easy integration journey

-

Create a flexible single-entry point for easy integrations

-

Add additional components as challenges emerge

-

Adapt to evolving OpEx budgets and business goals

Use a modular approach to eliminate weak links

-

Eliminate fragmented point solutions and complex integrations

-

Remove all weak links at once

-

Ensure efficient interoperability