Global Custody Solutions

Transform custody operations with unified workflow automation

-

Streamline with automation and enhanced straight-through processing

-

Take command with a single view of custody operations across the organization

-

Gain greater accuracy, agility, efficiency, and control

-

Plan your transformation with a modular, API-driven approach

-

Accelerate action with greater precision

-

Understand exposure and mitigate risk

-

Track volume, market, and client activity

-

Perform trend analysis, monitor key metrics, and more

-

Act as direct custodian across multiple markets

-

Maintain a direct custody advantage in the U.S.

-

Simplify affiliate clearing

-

Manage third-party local custodians globally

Expand your global reach

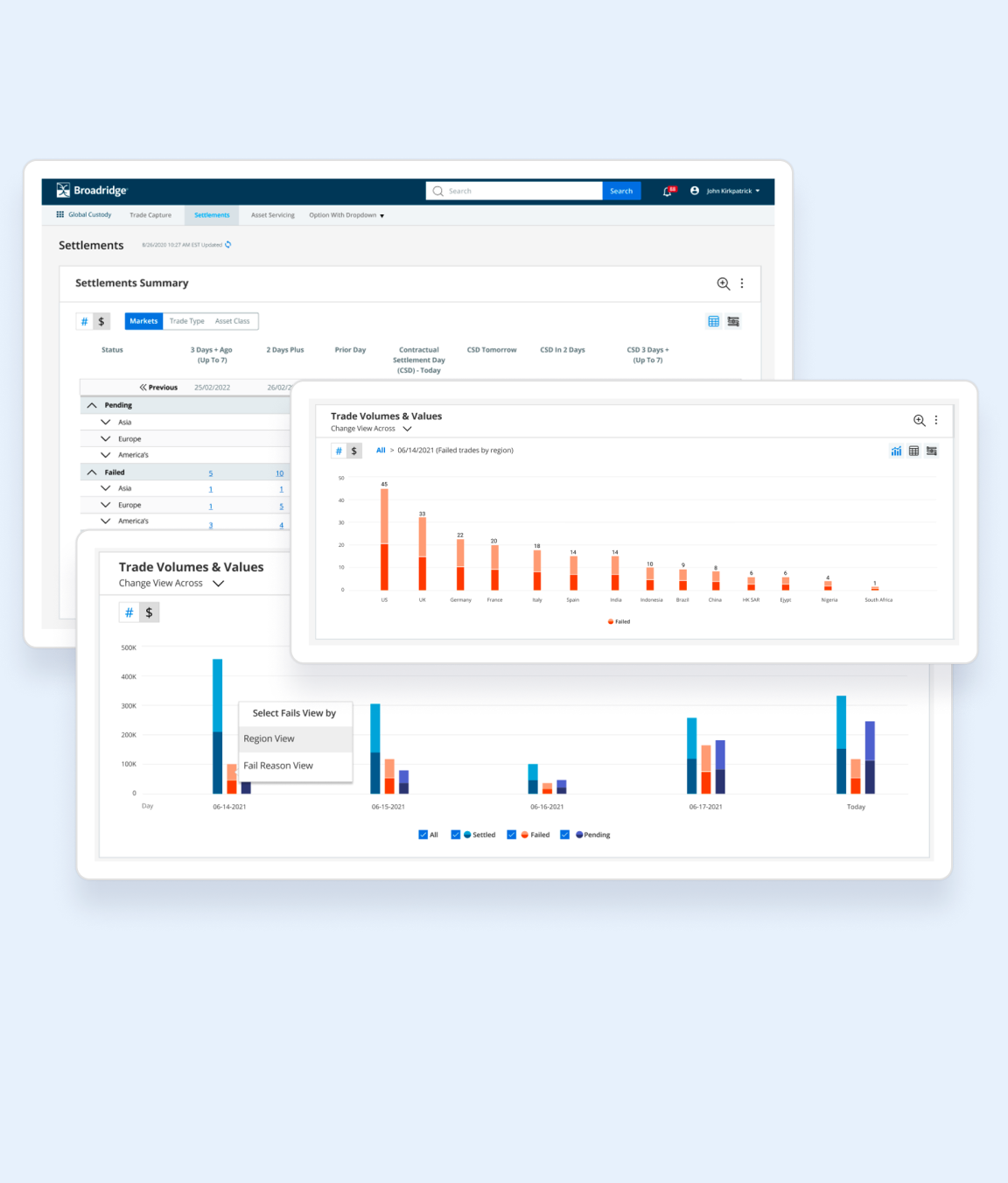

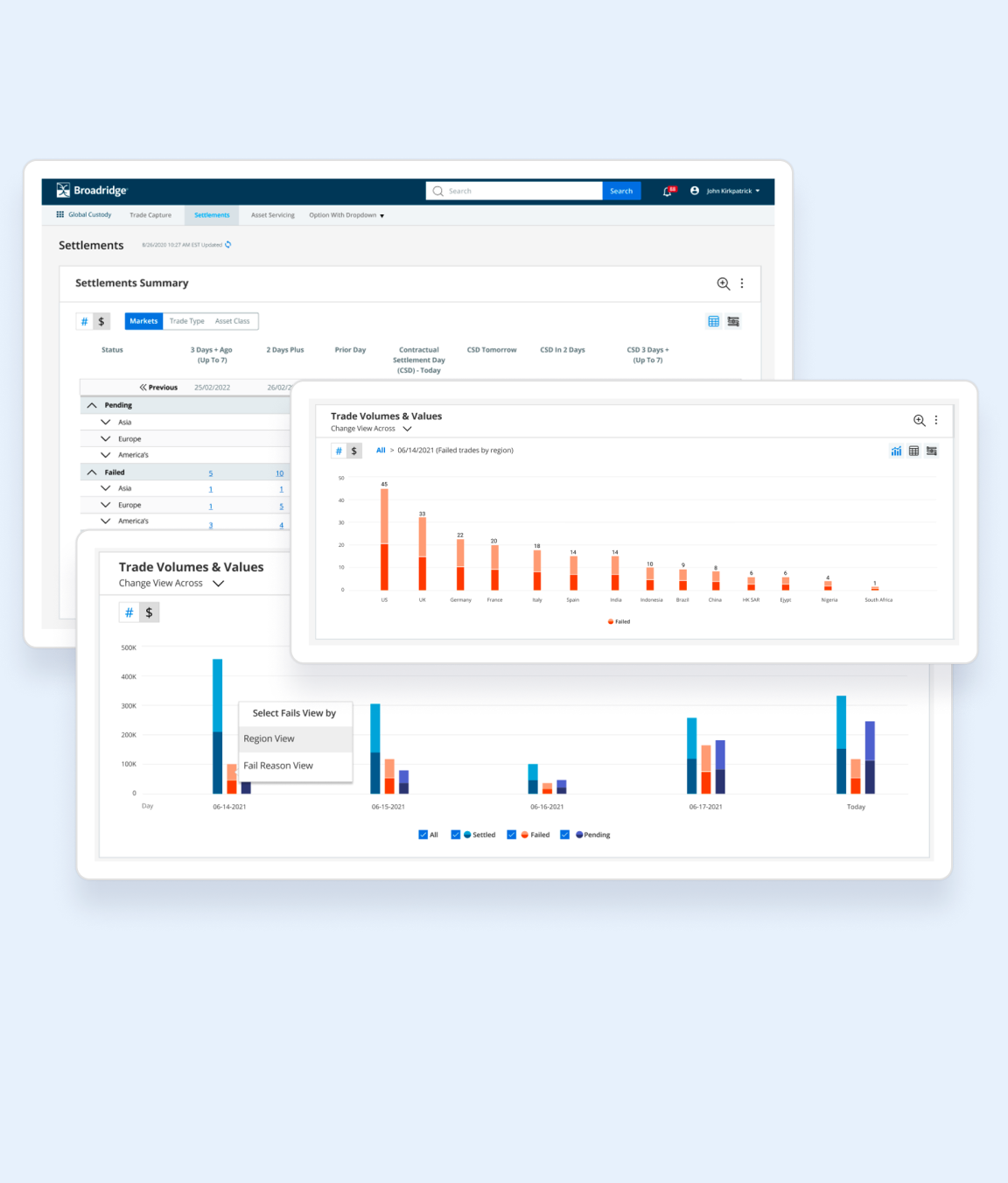

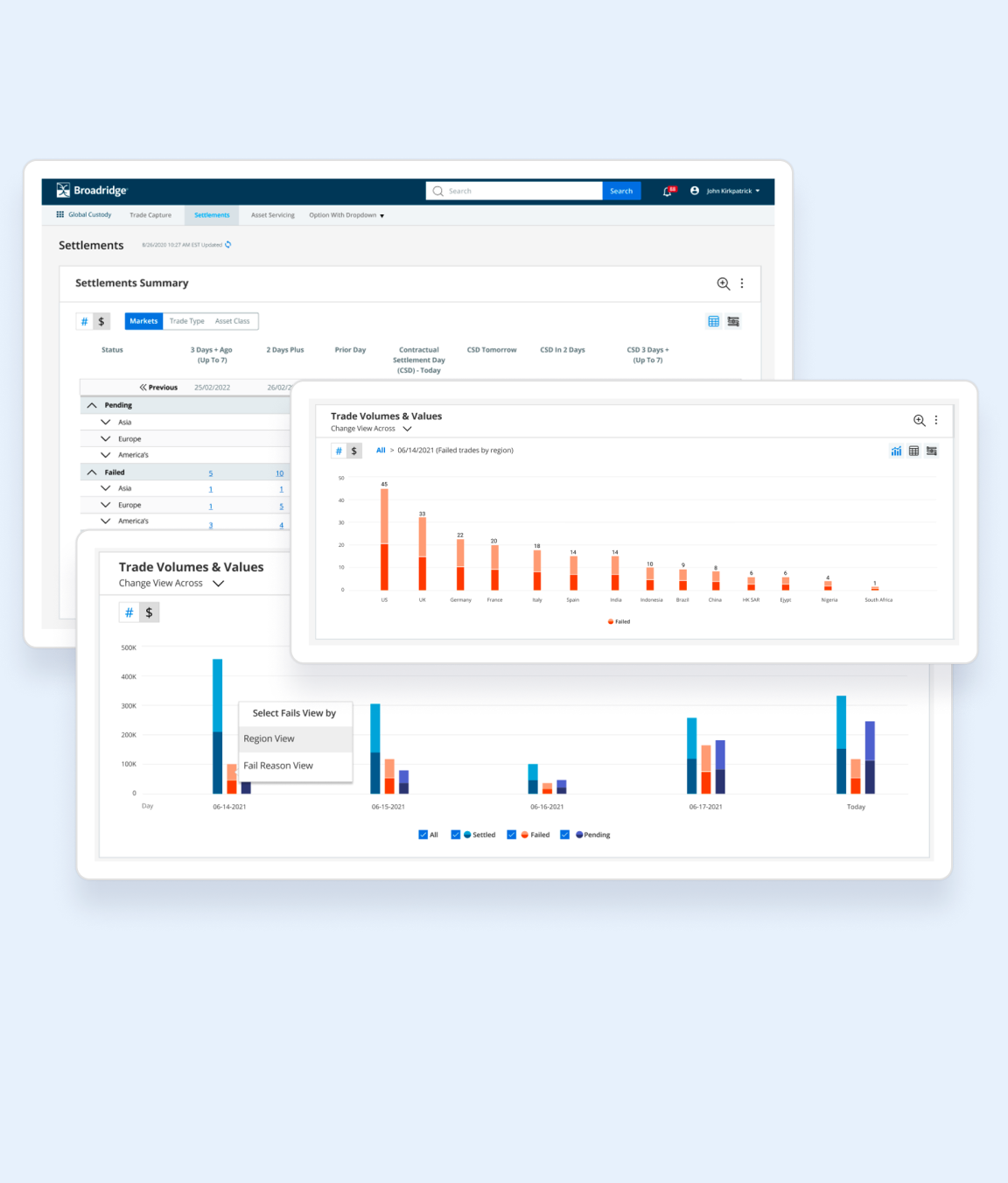

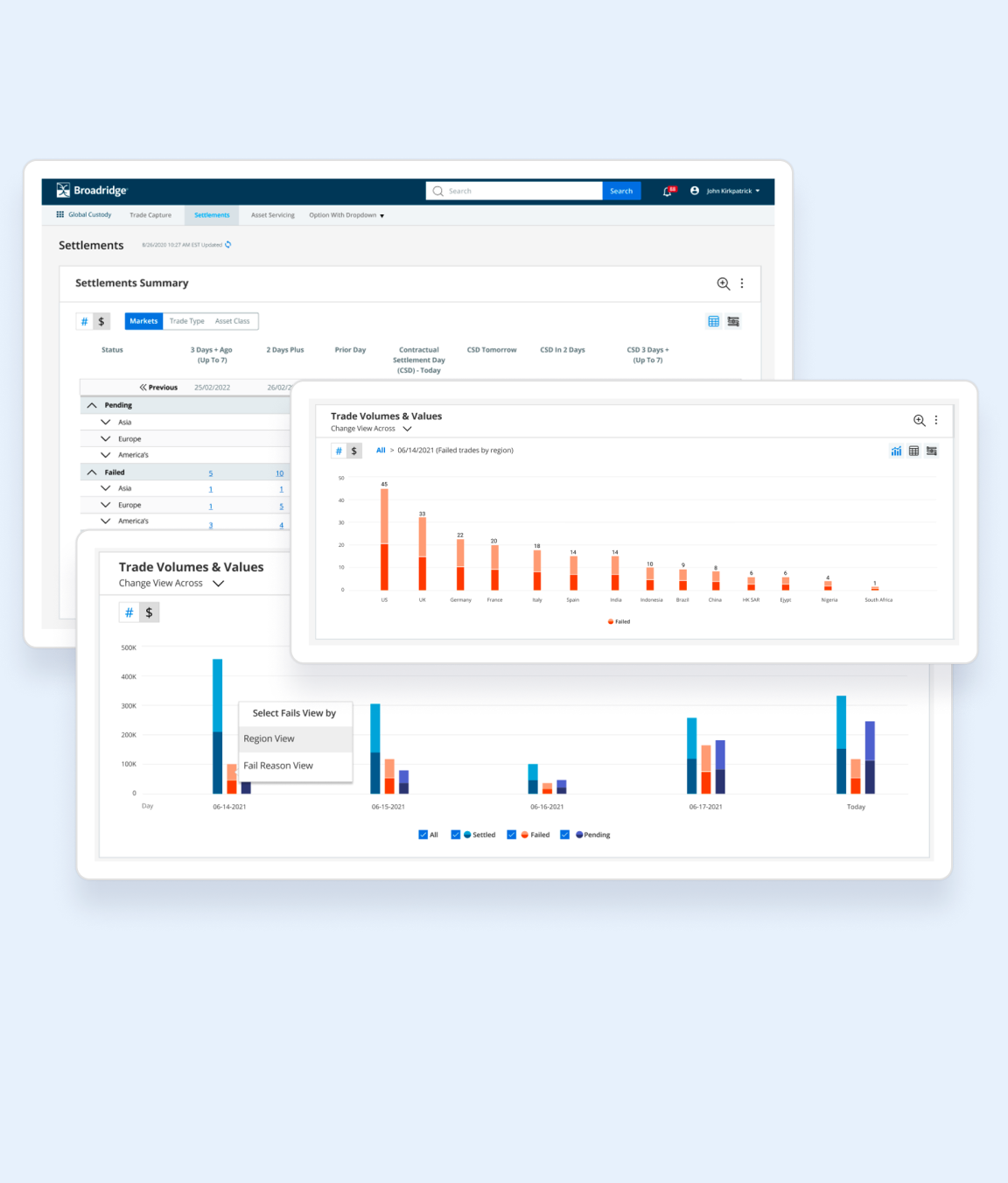

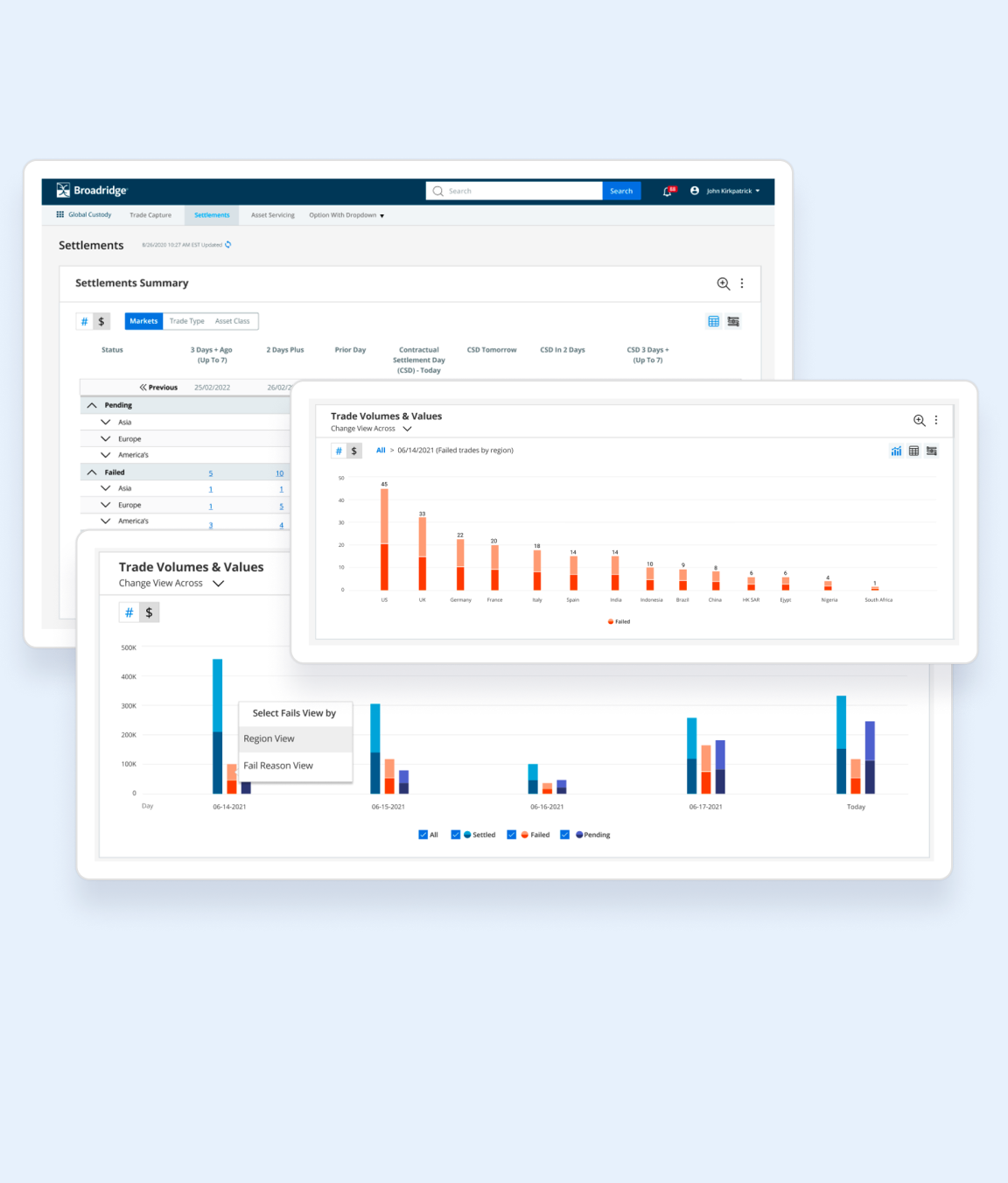

Global custody operations console

Gain a unified view of processing and workflows across all of your systems including in-house, third-party, and Broadridge solutions.

Fully integrated workflow

Automate daily custody and settlement transactions, asset servicing, tax services, and asset-related searches.

International custody services

Act as direct custodian in the U.S. and internationally with a single, integrated platform.

Unified metrics and insights

Leverage aggregated data, processing, and reporting to monitor key metrics and derive actionable insights.

Exceptions-based workflows

Safeguard assets with accelerated exceptions triage driven by rapid detection, efficient exceptions-focused workflows, and automated alerts.

Insights & perspectives

What's next for your business?

Global Custody Solutions FAQs

A custodian is a financial institution that safeguards assets and provides a range of post-trade services for institutional investors across multiple markets. A global custodian consolidates these services across multiple countries and regions, managing sub-custodian relationships in local markets – a more complex and inter-dependent process.

We provide integrated technology and asset servicing solutions that help large-scale custodians manage complex cross-border processes, from settlement and reconciliation to reporting and compliance.

They ensure assets are secure, processed accurately across markets, and reported transparently, which supports investor confidence and regulatory compliance. Money isn’t left on the table with robust automation.