1. INTERNATIONAL OPT-IN LITIGATION

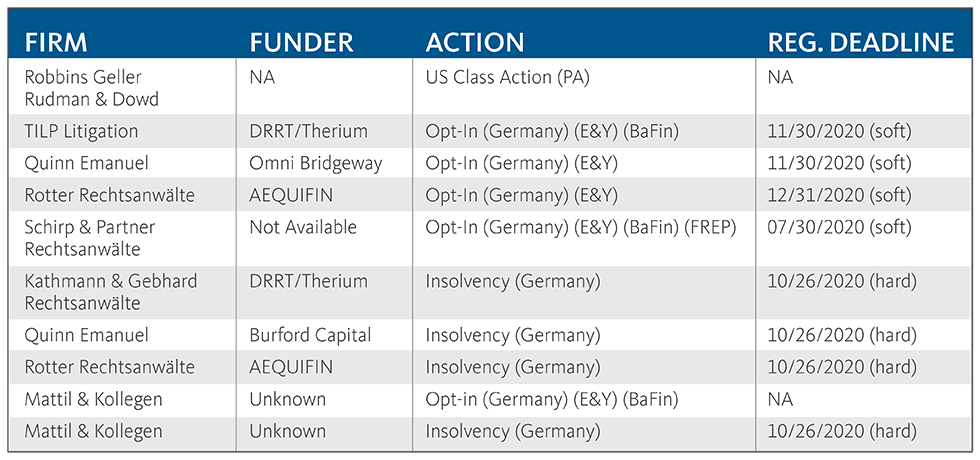

As part of Germany’s opt-in litigation mechanism, if an investor wishes to participate in one of the German actions, it must proactively join the litigation prior to settlement. Claimants must work with a law firm and litigation funder, and the process can be longer and more involved. Further, there are multiple cases that could proceed on parallel tracks. In order to weigh their various options, claimants must understand the differences between the cases, legal theories, damage calculations, and potential outcomes. They must also understand how their trading patterns may impact their losses, which requires a detailed individual review. Finally, the various firms and funders may have different or preferable contractual terms.

2. MULTIPLE PROCEEDINGS

With no fewer than six class actions and parallel insolvency proceedings, it is important for institutional investors to understand the time periods, defendants, and damage theories in relation to their trading patterns, and appetite for exposure. For example, an investor may be prohibited, or may decline to bring a claim against the auditor defendant Ernst & Young, while still pursuing recovery against BaFin or participating in one of the insolvency proceedings. With Wirecard in insolvency, each of these proceedings must carefully be considered because future recovery efforts may not be pursued.

3. INTERNATIONAL EXCHANGE AND COMPLEX INSTRUMENTS

Eligible securities were those listed on the Frankfurt Stock Exchange in Germany and Wirecard ADRs publicly traded over the counter in the United States. This requires a higher-level review to locate each transaction and confirm the transaction occurred on the correct exchange.

4. GERMAN LAW AND CLAIM FILINGS

The participants in the German proceedings will need to affirmatively opt-in to the litigation. Based on the German collective proceeding mechanisms that will apply, this option will require more open and active participation in the litigation by the investor.

5. CONCURRENT INSOLVENCY ACTIONS

The indebtedness and insolvency of Wirecard will complicate recovery as shareholders’ fraud claims will be part of the same pro rata distribution with other unsecured claims.

6. ADDITIONAL FILING COSTS

Participating in an opt-in litigation may involve additional costs and additional contractual relationships. Unlike a US class action, each potential claimant is treated separately, and each individual case has its own funding and paperwork requirements. Typically, there are fees associated with filing in these matters. Funding agreements and costs will differ depending on the case in which the claim is filed, and the law firm and litigation funder.