Additional Broadridge resources:

View our Contact Us page for additional information.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

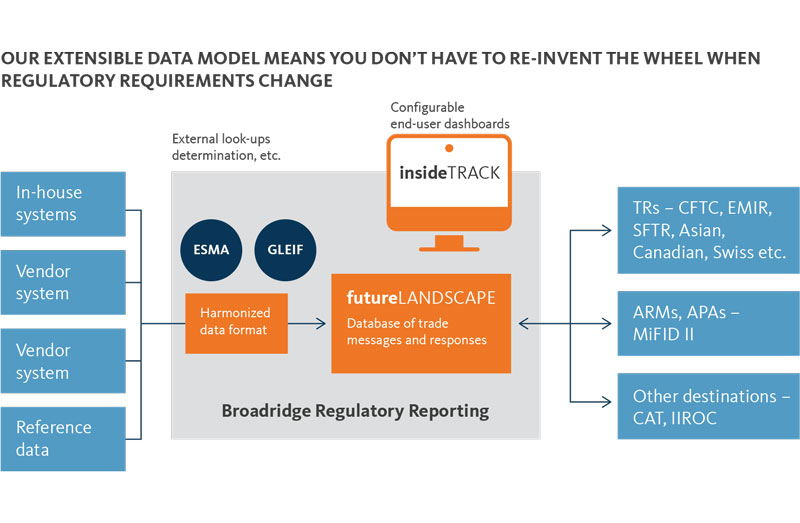

Broadridge was recognised for futureLANDSCAPE, a multi-jurisdictional and multi-asset class solution that features a powerful rules engine and a comprehensive suite of functionalities that help automate trade reporting across different markets.

Product Specifications

Trade and Transaction Reporting

Control and transparency for reporting to multiple repositories in North America, EMEA and APAC from multiple internal systems across asset classes

Enterprise Control Framework

A fully configurable workflow exception management solution with dashboards and reporting to assist root cause analysis

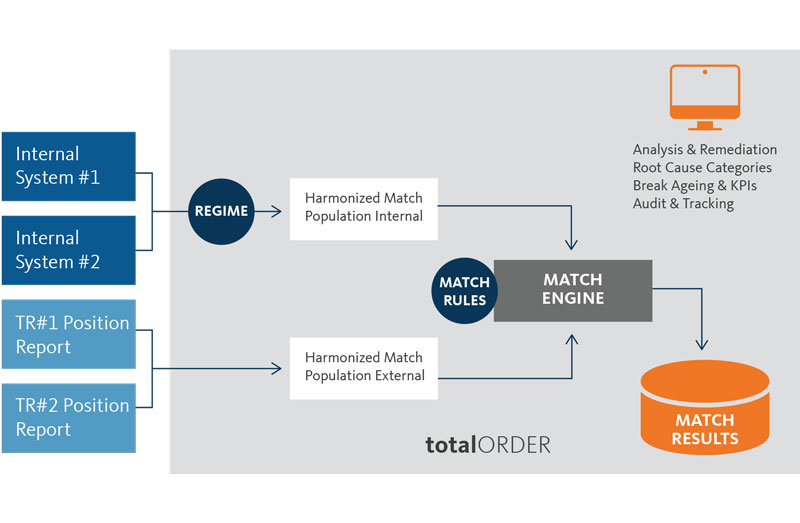

Trade Position Verification

End-to-end position or activity reconciliation for each reporting obligation proving completeness and accuracy of your reporting through a single platform