Navigating APAC Derivatives Reporting Rewrites In 2024 and Beyond

Overview

Mandatory reporting of OTC derivatives transactions was among the G20 reforms introduced in response to the 2008 Global Financial Crisis. Over the past few years, regulators have been working to enhance their rules at the local level to bring greater harmonization to the data requirements and enhance global risk monitoring.

In this webinar, we discuss the key changes to derivatives reporting requirements, decisions firms need to make, and practical implementation challenges.

Key Takeaways:

- Implications of CFTC Rewrite, EMIR Refit, JFSA regime

- Adoption of ISO 20022, UPI, UTI and related challenges

- Implementation of ASIC and MAS regimes

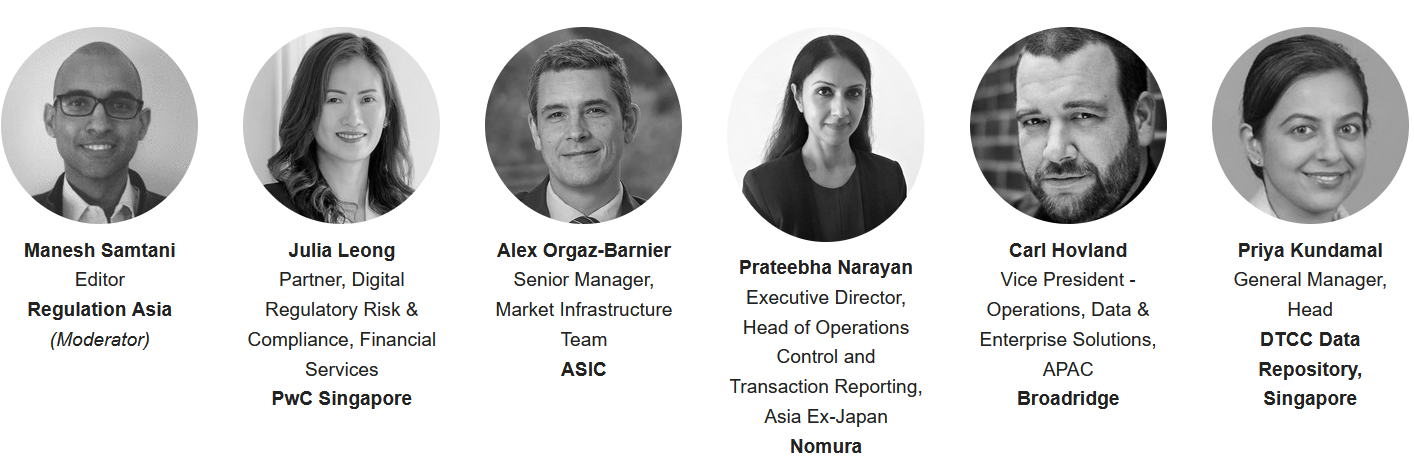

Panelists

Video Transcript

Speaker 1 [00:00:01] Hello, everyone. Welcome to today's webinar. My name is Manish Sultani and the editor for Regulation Asia. Today we're here to discuss, the ongoing reforms to the, mandatory rules for reporting OTC derivatives transactions. The reforms were introduced certainly in response to the, 2008 financial crisis. And over the last few years, they've been under review to improve harmonization and standardization of the reporting requirements. So we've been we've seen reforms progressing in the, in the US, EU, UK, Canada, Japan, Australia, Singapore, Hong Kong.

So today we're here primarily to discuss, the changes coming up in 2024. Some of the jurisdictional nuances and implementation challenges, that in scope firms are facing. We have, quite an esteemed panel with us today. Well, I think we'll be starting to turn on their videos now. But just as quick introduction, we do have a lot to cover. But, but I'll do some quick introductions. First off, we have, Julia Lin, partner, digital regulatory Risk and compliance for financial services at Singapore. Welcome, Julia. We have Alex Auguste Barnier, senior manager for the market infrastructure team at Essec in Australia. Welcome, Alex. We have Pratibha Narayan, executive director, head of operations, controls and transaction reporting for Asia ex Japan at Nomura. Hi, Pratibha. And we have Karl Hovland, vice president for operations, data and enterprise solutions for Apacs at Broadridge. And last but not least, of course, Priya Kunda, mall general manager and head of GTC data repository in Singapore. Welcome.

So just a very quick, sort of, housekeeping before we kick off the discussion. So we did invite, questions from from those of you that are registered beforehand. So, so I would first like to thank all of you who submitted some questions. We've tried to include them as much as possible in our in our discussion. Given that we do have quite a few things to cover in, in in the discussion today. So we'll try to address your questions throughout the discussion. But also feel free to keep sending questions if you see if you find anything unclear or you'd like further elaboration.

Anything we don't get to during the discussion. We'll try to respond to by email afterwards. Can I also remind all the attendees that the webinar will be one hour and 15 minutes total? We decided to make it, a little bit longer than our usual one hour just because of the number of panelists we have and certainly the number of topics that we're hoping to get through. A number of you asked for, asked whether the recording will be able afterwards. The answer is yes. We will have a recording available afterwards. But in any case, I hope you can all stay till the end. So.

Yeah, guys, that's all the housekeeping from me. Without further ado, I'd like to kick off. By first acknowledging that we do have a big event in this space coming up next week. And that is the second phase of the CFTC rewrite, which goes live on the 29th of January. So the first phase of the rewrite was in December 2022. I wonder if we can start with Carl. Perhaps you can start us off by talking a bit about the CFTC rewrite. What's different about this second phase? What will in scope firms in April actually be looking out for? Go ahead. Carl.

Speaker 2 [00:04:06] Sure. Thanks for that. And, thanks very much, for hosting. And, of course, all the other panelists who are joining us. So, yes. CFTC rewrite phase one, as you say, was December last year. It's the the first major revision on CFTC and in fact, kind of kicking off a wave, as we know, revisions across all the other kind of G20 jurisdictions. So, you know, broadly limited, we are probably focusing on the kind of general theme of equivalency. And the CPI also reforms. It introduced a number, a number of new fields, to the regulation.

Most notably the common to the CDE fields. As an extra form of mapping, so keys will be straightforward in implementation. It's really about rationalizing those points that lived in the formal model essentially, or the data model, into a more coherent, equivalent space going forward. So as we look through the other jurisdictions, we can have a simple representation of where some of these fields live. A number of the ones we already have. Expiry dates, strike prices, spreads. But they also introduce some more flags, such as federal and state indicator of a certain indicator, which you wouldn't just have to report before where you would normally have most of these fields.

We would expect we see, you know, clients of orders in this data would be coming into the, into the reporting engine, but not necessarily being used, perhaps more metadata around, how you would process and how you would report. In addition, and perhaps most majorly, collateral was added to the CFTC in the rewrite, phase one last year. New to CFTC reporting. And obviously we've been doing that, for asset and admin for a number of years. Notable in its difference in that we have to report I have a van valuation separately.

So multiple portfolio codes, a level of aggregation required for a lot of our customers and a lot of the industry, I'm sure, to separate those values out or get them into the engine in a way that may not have been, available in the past. Some challenges there as well. As far as the portfolio code, which you use to tie your valuation to your actual rates, appears in the valuation message. And so it's lots of timing issues about when do you how do you assign the collateral, the linking between the collateral and the trades? In a timely fashion?

The link message, which we used to use in the past, plasma wasn't great. So that was certainly a challenge. And, one I think as well was all by now, I think finally the, the, just getting on what we did last year, the other kind of major change, is more emphasis on reconciliation. So. Strictly speaking. The requirement is to reconcile all of your swap dates and everything you report. Where you are the reporting counterparty you would need to reconcile. Previously you were limited to the portrait. There was some discussion amongst, the industry about whether it's every single field or what was actually stipulated. But nevertheless, a real emphasis on the control process after you report it, as a major extension and, you know, obligated, to an extent for the first time.

The CFTC, moving on to phase two, which, as you say, is Monday. We had the major, entrance, various EPR, so universal product indicators, I'm sure we'll talk about in much more detail later. Supplied by the DSP. So, essentially we need to rather than having the normal kind of this taxonomy, if you've known love for so many years, it's adding in another, taxonomy as such indicator, which kind of generally fits in between Eisen. And see if I add in this granularity. So, we. A few days away from that. It's been, a relatively smooth path. Headquarters to kind of, for our class to kind of break that connectivity to bring down from an, not so much of a challenge that they've been, available for a long time to be very supportive, I think, and making sure that the industry is putting a time to test for that. However, at the same time, it does introduce a lot more validation based around the API that you present. So, in the past that X11 validation that I know, favorite HCC, as

I push it through the TR through the to make sure that your actual data within your message correlates directly towards the API. So there's certainly been some data challenges around that. I think we will see on Monday how it all folds and the uplift voice. Everybody will have to uplift their positions. AGP is this coming weekend for Monday. My my opinion is it's going to be relatively smooth. We'll see some anachronistic problems, most of which I'll expect to kind of appear after a few days off. The kind of reconciliations have been vulnerable crises at all.

On this day, one day to day three, I think for a it's very much a watch this space. It'll be interesting to see how this foundation, as a result of the API impacts the full set of reported data for had given a controlled pace. But with all those edge cases come in at wide, the wide gamut of, product types and nuances. And so it's going to be an interesting few weeks. Very much watch this space for what that means going forward. Throughout the rest of the year.

Speaker 1 [00:10:16] Thanks, Carl, for for that. And certainly I'm sure we'll all be watching this space, next week and moving forward. Certainly we have a few other deadlines coming up relatively soon in April. In Japan and in the EU. Maybe. Priya, I wonder if you could briefly tell us a bit about the status of preparations for these rewrites. Maybe you can talk also a little bit about how, a global trade repository copes with, with updating, the repository for all these revised requirements at the scale.

Potentially, Pratibha, you might have, something to add about how all of this impacts apex jurisdictions as well. Things. Many shall. I will, I'll go first, and then I will, hand the reins to, to Pratibha. But first thing. Thank you. Manish and, to my, fellow panelists. Really excited to be here. And I know it's been a busy morning. So for those of, the attendees who just got off the industry working group calls, by DCC this morning. Thank you for for joining us. So I think to sum it up, I think one thing that we do, to, to help support the industry for these rewrites, is through our, industry working group sessions. And I think when the industry is plugged in, locked into these working groups, it just lends itself to a much more smooth, testing phase. And then they feel much more common, as part of the goal line, because it's a forum for for them to discuss, ask questions. What's happening in the runbook, what's happening on the we can go live as well as, you know, what are the changes coming as well. But that aside, in terms of, you know, managers two part question, what is part of the, git repository and then what's coming up next? So maybe I'll start with the three repository.

But in terms of, you know, being the GDR, I think all of y'all know us. We've stayed the course since the very beginning. I think I've lost count of that 14 years back, since the very start of all these deliveries. Colleagues, finally, you know, talk through what's coming up, today, over the weekend. You know, obviously the UPI, aspect for, for CFTC go live. But we've been, you know, supporting all of you and through engagement with you, the regulatory community, everyone in this trade reporting ecosystem to help us through this whole customer experience journey, which we really focus a lot on. And it's been a long time making sure, we are there to support you through all the delivery. So from that aspect, you know, getting ready week ahead, you know, releasing those project documentation in time is a key part of what we do, for, for the community.

But I think if you bear with me for for a minute, I think as a repository, the one thing that we are really obsessed about is also innovation. So, you know, the Gt-r today is very barely recognizable from the first communications, 14 years back, we have completely modified the technology. So that's much more consistent across the jurisdictions and the asset classes. So that's much more stable, driven and predictable, allowing easier meetings and change. So, you know, as the trade repository, we have invested a lot on automation, you know, that, you know, we are in the cloud right now. We are also collaborating with partners in AWS as well as snowflake to improve our data processing abilities. So that's something that we spend a lot of time and focus on. And that lends itself well for us to be ready, to deliver, as part of these, revised requirements in this, year of the Dragon that we are going to be assuring. So on that front, you know, enabling testing. So having the up phase, ahead of, of the goal, right. We try to target for about six months before, the go live. But even prior to that, we also, release the simulator tool as well to enable, folks to start testing their messages and functionality as well. So that's really, really important to us.

So as Maneesh mentioned about the other deliveries that are happening, really close off to CFTC, one that is really near to us is the GFC go live. So from that aspect, what we are seeing, from the time that we release the simulator tool and we are already in, the unty phase and we are actually been, you know, doing, multiple releases in the ready phase as well. The industry has started testing for sure. We have seen the rates, you know, steadily go up. Now we are seeing about, you know, 60, 70%, 70%, positive at rates. But overall, you know, from, you know, from our vantage point, the overall industry testing can still be improved. We are seeing about 50% or so, 50%, I think, you know, maybe, you know, folks are busy with the CFTC, go live. I understand that's really important. And it's, coming up very soon. But, you know, I think, as I mentioned, while we've not seen major issues, being observed or raised by the industry, I think that early testing, would really help industry to get ready, you know, through this real big sea of change in, 2024. But if I can, I pass it over to you to, to add into my points.

Speaker 3 [00:16:00] Sure. Thanks, Maria. Thanks. We're putting this together. And thanks to all the co-panelists as well. As to your question on, I think it said, how does it impact impact jurisdictions? You mentioned this in college, mentioned we've been quite lucky in this space, to have had the flexibility to watch the space and see how the other jurisdictions are really going about the rewrites. So from an effect standpoint, I would say there has been a sufficient run out to go live. For Massac Mazzone, rewrites were reporting entities. Considerable number of CDs have been harmonized by the global regulators. Therefore, with implementations for CFTC and even JFC proceeding Massabesic, bulk of the CCD bills could simply be leveraged off by firms, from their global bills. Of course, there are elements of nuances with respect to the current rules that required to be baked in. And then there are the non CD components as well that need to be understood well and designed.

Now getting a skilled project management, team in place, as well as being able to draw comparisons with past rewrites as well as the in-flight ones, are some of the other areas that firms in Epoc have been able to get off to an early start on, thanks to the likes of CFTC and emerging, the global implementations have indeed re-emphasized the importance of testing. Prior spoke quite a fair bit about testing as well. I think I would conclude by stating, make sure you're factoring in a longer testing phase, that allows you to analyze as many situations as possible. Activation.

Speaker 1 [00:17:33] Thanks so much, Priya. Thanks, Pratibha. And speaking of maps and Isaac, where we have the pleasure of having, Alex with us today from Aztec in Australia. And that kind of brings us to our next point. In Australia and Singapore, the new reporting regimes are coming into force on the 21st of October. So both Australia and Singapore. I do understand, you know, there's been a lot of work between the Australian and Singapore regulators and industry, bodies to sort of align their work. And we've talked about this a bit in the past, Alex. I wonder if if you can kind of talk a little bit about that journey towards finalizing our six rules. How did you approach consultation? How did you approach trying to reduce, the regulatory burden and jurisdictional fragmentation? Anything you'd like to share with us on that?

Speaker 4 [00:18:29] Sure. Thanks. Thanks. Hi, everyone. So, yes, we are. We have been working closely and, and regularly with, mass, also with Hong Kong and Japan. In developing this, this, there's rules and as you said, we are approaching the end of that journey in Australia. We consulted to harmonize the trade reporting rules back in 2020, and we made the trade reporting rules in December 2022. So for the last year, we have been now turning our focus on the implementation for this commencement date that you just mentioned of 21st of October this year. However, I have to say at this time, we haven't fully finalized the changes to our trade reporting rules.

And the main reason for that is we made the rules. As I said in late 2022, aiming to give ample implementation time to the reporting entities within 20 months of implementation time. However, in the mean in the meantime, in the course of this last year, the standards for the data fields and the supporting systems has continued to evolve. For instance, the CDC technical guidance has continued to be updated and it was finalized in September 2023, adding 11 data elements and revisiting definitions and guidance for further 18 data elements. The ISO 222 message definitions have also been revised. The Upei service commenced production services in October 2023. So that's a lot of a lot of change. And also over the course of the last year, we've been engaging with industry on the preparations for implementation.

And that engagement gave rise to a number of industry requests for clarifications and additions of data elements. So we felt like we we had to respond to these developments. And in November last year, we issued a third consultation paper that closed in December last year. And that will result in the next month or so. In in the addition of seven or so data elements to the SCC 2024 reporting rules and clarification about the meaning and scope of a number of other data elements. So we are expecting that this sort of last batch of changes will take effect with the rest of the new rules. So the rewrite on the 21st of October, and I just mentioned that I think this. So to call them last minute or this, this change, these last tweaks to the rules that illustrate a tension that we face as regulators. Between achieving maximum alignment, and a ruleset that is up to date with latest developments at the same time. We want to provide certainty and ample implementation time, so need to sort of balance those two, objectives. But once these changes are made, we will have finished framework as it relates to CDs. And we will continue to work with industry to assist with the implementation efforts.

Speaker 1 [00:21:47] Thanks so much, Alex. And certainly. You know, from from our previous conversations, it's been quite clear that a lot of work has gone into kind of trying to harmonize as much as possible. And certainly we've achieved a lot of convergence on, you know, data standards and message formats. I suppose still, in terms of the data requirements, we do still see some jurisdictional, nuances. Can you talk a little bit about, about how the regimes in, say, Australia and Singapore, are different or similar compared to the regimes in the US, maybe EU, Japan? How will the different data requirements, impact firms from an Australian perspective? I wonder if maybe, you know, Julie and Priya might also have a few points, to, to add on the Singapore perspective. Go ahead, Alex, you go first.

Speaker 4 [00:22:42] Sure. Thanks. Yeah. Well, you know, as you mentioned from the outset of this rule, we write and, you know, we are a we are not a large jurisdiction. And from the beginning, a key objective, of the rewrite was maximum alignment. And I expect that just like Pratibha was saying before that in terms of the West Australian regime, once you have a build, for any of the other major jurisdictions like the, the effort that you need to put into, reporting to, to Australia should be marginal or should be, small as we can. We have one of the smallest data sets compared to other jurisdictions, and 92% of our fields will be coming to the CFTC, Esma or both of them.

There are some differences, as you've mentioned, and Pratibha mentioned that in on these, there are five data elements that I expect that there will be as only fields. And these are not critical data elements, but there are important, elements for our jurisdiction, either because they, they, regard a particular product that is prevalent in our jurisdiction or the reflect a particular exemption for and for example, in Australia, we have these small scale by side investor exemption or event, sometimes because domestically industry has requested that we add a specific local, field. But apart from that, we've been very deliberate in trying to maximize alignment. We've discussed all over this process, but the benefits of aligning are so clear in terms of reducing inefficiencies, complexity and the cost of compliance for reporting entities and for our from a regulatory perspective, to facilitate the aggregation across jurisdictions, to improve data quality and in a large, etc..

Speaker 1 [00:24:41] Julia. Julia, do you want to talk a bit about the data requirements from the from the Singapore side?

Speaker 5 [00:24:47] Yeah. I'm sure. I think from a Singapore, perspective. Right. If we look at it from a regulatory, expectations standpoint, I think, certainly from, industry perspective, I think, I mean, this has been, quite circumspect, you know, to, make sure that the industry is not overburdened, right, with these, requirements, that one shot. So since the beginning of, time, when this, court reporting system is about, you know, ten years ago, I think, and has always been adopting a phased, approach, to create now reporting and, and each phase, right, the focus on, you know, specific asset types rolling out, gradually. And I think in this, round of debate that's going live in Singapore in, October this year, I think, similar to, what Alex has said. Right. The goal is really to achieve, you know, maximum alignment to the global standards as much as possible. And, this is actually, pretty, research, stance that has also articulated, in their response back to the industry, when they released, their responses, last year, around the complexity. So, so I think from a data requirements standpoint. Right.

We see, harmonization, right, to facilitate data aggregation as the overarching, objective. So for instance, on duty requirements, industry participants, you know, gets the feedback on how, you know, can we modify, right. The I'll source the PMI waterfall rules, to prioritize, you know, financial, agreements. Right. Five. So that was considered, but and, you know, speaking of, global harmonization, at least from, from, Singapore perspective. Right. We are going to hit right, with, waterfall, insights. So this is an example, right? From global harmonization. And then if we can look at the, the critical data elements. Right. I think there's also that effort, right, to harmonize as much as possible. And I think, from a regulatory standpoint, it is really about, let's listen to the industry, but and let's also be proactive and make sure that, it can be operationalized. So, for example, you know, for some of the link contracts, you know, give listen to the industry feedback and say that, okay, look at, you know, package identifier so that we are able to link all these parts that are separately, negotiated.

So just an example. The last point I'll make is that, you know, is not, also straightforward global harmonization. As you know, my fellow panelists have also mentioned there will be differences in city views and city reviews and so forth. So, for example, in some jurisdictions, you know, have got, you know, for valuation purposes have included, right, CDs, complex attachment and detection points. But, because it's not included in that. That's right. So this is just an example of some of the nuances that I think from the implementation standpoint. Comes with global footprint. We just need to yeah, do a few by few town policies. But I would say that, from the Singapore perspective, in terms of, detail requirements, alignment as much as possible, and I think just round up in what particular area global firms are able, should be able to leverage. Right on, if not in other jurisdictions. Maybe you want to add on.

Speaker 1 [00:28:40] Yeah. Thank you. Julia and, Alex, you all have actually touched a lot of ground, and actually, I want to call out and from on, on behalf of the panel as well as, the industry, the work that think, miss the apex for and the global regulators have done to achieve this level of harmonization as we go into the, the rewrites, in 2024, it's been quite remarkable. The journey. But I just want to summarize some of the points that Julia made, Alex made, and then also provide you with some high level sets where there is fragmentation but where there's an opportunity. So if you can bear with me, let me just kind of, summarize, the points mentioned by my, other panelists on on this topic. So, yes. Because, I mean, one of the side effects, is, as Alexandra mentioned, the previous lack of harmonization has been the inability to aggregate this data, from a global systemic risk perspective.

And today, still jurisdictional, broad jurisdictional differences do exist. Single sided, dual sided. Of course, you can get down to the levels of the data fields as well. But let me assure you, with the introduction of the UPS isotope right way to its AML messaging schema, as well as the adoption of, the CDS, being largely, consistently applied, there's now an opportunity, for, for us to reuse that code, in a different way within the systems we have today. That is the the opportunity to unlock this, from from a global systemic risk perspective.

So just want to, you know, bring everyone back to the purpose of of why we are all collectively listening in today and working so hard in this journey. So once all these changes come into force, what does that mean from a, from a numbers perspective? So our analysis and we spend a lot of time, you know, as some of you may know, originated, the effective you know, the DCC analysis shows that, you know, 41, out of the 110 critical data elements identified by CPI in my school, had been implemented consistently and adopted consistently across jurisdiction. A year and a half back when we had our core leadership piece, the number was 52. It dropped to 41 one. So as you jurisdictions came in, you know, the final rules, the number dropped where from a consistent application point of view, one might argue 41 out of ten. Yeah. I mean, we did some analysis, you know, based on this number with common adoption, we feel it is still gives a good enough base, for the industry to build a better picture of the overall market risk. Of course, you know, this journey has take place to to see whether this comes to to real action, right? And, from a mathematics perspective, the number of 41 goes up immediately to 61, where the KDS, adopted, commonly adopted across the board, but from a, just a reporting data fields point of view. The number is huge, right? So it's a real it's a real common entity. So that's why from a DPC perspective, we run our second best working groups together. You know, from from a Goliath perspective, they have aligned for October 21st, 24.

You know, there is a lot of common commonality. And I know that a lot of the industry participants have reporting obligation. But so it really pays off, you know, from from economies of scale and, and the work both regulators have done to, to achieve this. And then from a global scale, you know, as we started this, panel where, you know, we are looking at, CFTC implementation as my in your implementation, these are important, too, because a lot of the jurisdictions that mass and e-cig have adopted either the, I mean, CFTC or as Ma, kind of feels right. So if you are a global reporter and really working hard on both of these deliveries, it would lend itself well, as you think through your, your, your, implementation for these systems. Went over to you. Yeah. Thanks. Thanks so much, Priya. I and again, I think so far we've kind of talked about, you know, quite a lot already. We still have quite a bit of ground to cover. Let's turn, focus a little bit towards, some of the more, more specific aspects of, of implementation. Maybe we can start with ISO 2002 two. I understand this is seen as a relatively big change. That has been challenging for some firms. Probably we don't we won't be able to spend too much time on it. But but, I, I do I do understand it will be first, introduced, in Japan in April. I wonder if. Karl, can you talk a little bit about what ISO 22 two adoption means for its scope firms? What has it been challenging and kind of what what are what are the ways firms are adopting?

Speaker 2 [00:34:12] Sure. Thanks for that. I mean, fundamentally, you know, we've been reporting to various, various but, jurisdictions have obligations for many, especially if you're going via DC informal. The for for me. And, I said to you all, well, actually there's already been some I said 2022. So, for those, firms are impacted by that. But fundamentally, it's normally been based around FEMA. FEMA is a the most highly referential, highly suitable model, and it's very good at expressing what it needs to do. But it's complicated. ISO 220 22 and its nature is actually, at least we say that a board is a more simplistic message board. And this is what we want to achieve, right? As Peter was talking to about we got it's about how do we simplify and standardize. This this reporting process as a whole. And this is what everybody's drawn to for, you know. I remember when I came back in. Many, many years ago. Equivalency was the best password. Then, and, you know, here we are a decade later, we're still trying to strive to find that equivalency. And these are great inroads getting there. And I said 2022 is a big step in that in that direction. So as a technical challenge, it's it's probably more simplicity. Where. Where I see the biggest challenge over this next year is. The staggered adoption of Easter 2022. So we start with Japan as as he said Wednesday. And then we'll roll out for, Amen Asmr. And then, you know, the FCA as well as the for the UK and onto onto Mars. And so over the next nine months, for those of those people who have multi-jurisdictional obligations, you have to maintain an SBL for CFTC in Canada, perhaps you may have you know, you will still be ISO for a man. You'll still be amount potentially for your regimes.

And what we have for that journey is multiple different code bases, essentially. And the good old days, you could, what good is speculative? You can report single message, single jurisdiction. Right. That is again, is kind of counter-intuitive to what the industry started to achieve. But so if we have your you you're trading with a European counterparty, the very fact you need to report and I so for one part of that, obligation, you still have to report it everything else without it. So how do you maintain good governance over those translations? What impact does it make to your, regression testing? How do you operationally need to make sure, that your, you know, whether you're, whether you're, you know, in-house or vendor, it's largely the same problem. How do you maintain that kind of quality through all that? And you make sure that a change you made in April for a mayor isn't going to damage what you're doing now. And subsequently, when we get to a more harmonious future in October, are you still going to be aligned? So that's that's a real challenge. One of the things we do, abroad is, is investing very heavily in our, automation and processing of regression with this in mind. So rather than focusing more on the model output, we're fortunate that we have a very strong coming from a data enterprise, part of the business. I should be saying this, a very, very strong orders, overall data work. So we concentrate very much on looking about how we store our harmonized data and using that to drive progression. So we know that if we if you know that your core data model is soft, the changes you make and all the kind of connections going out, you have a lot more.

There'll be a lot more inherent veracity to those results, but it will be a challenge. And one that everybody spoke very close attention to, I think. Another issue that I so brings about, and is perhaps, you know, it is it is a technical challenge, regardless if you're if you're currently reporting a lot of low volume or any volume through CSV upload, which is supported for all these regimes, and you may be using this for very low volume trading, kind of more exotic, esoteric, trends are, you know, perhaps are captured broadly, you know, upstream oil for radiation that you need in the CFTC. You have a short amount of time to do that that isn't necessarily available to you. So you are being channeled into generating programmatic XML to be able to do that. So I feel will be, you know, a marked change for, for, especially for those more limited jurisdictions, single jurisdiction firms from us that's coming. How do you how are you making sure that you still have that operational power or control to be able to remediate quickly, succinctly. But at the same time, whilst. Slightly being stymied by having to push this all through. You know, the mechanical process of such a large. It does lead to great benefits. But, you know, it's all about the long term goal, as Perry was alluding to. And Alex as well. You know, if you the more you force through a proper, regulated process in your reporting and your audit will be stronger, your control prices are improve your confidence, in your reporting and an entirely of course, your compliance obligations will will be greatly strengthened. But yeah, I think it's it's going to be. Yeah. It's a long journey over the next a few months. But it happened very quickly at the same time.

Speaker 1 [00:40:24] Thanks, Carl. And I like a line you said earlier. More harmonious future in October. Very much looking forward to that. Yeah, I guess I'm just kind of moving on from ISO 22 to 2. Another important change is the introduction of the UPI. A completely new way to provide, you know, we've mentioned this earlier that the service just launched in October, I believe. But it's a new way to provide a consistent way of describing products across regimes. Pretty. But could you talk a little bit about, the UPI in terms of pros and cons? What are the big challenges for implementation?

Speaker 3 [00:41:03] Germany. A unique product identifier, or the UPI, as we call it, is a unique theoretical concept on paper for all jurisdictions at the moment, as I see it. Now, based on what we know from the theory, is the greatest advantage is the fact that you centralized disbursement by a single provider aims to keep this identifier unique. But where the issues dot, the, the populations around the operational challenges. Unlike prescriptive rules and many reporting elements, none of the regulations prescribe who must obtain a UPI. Now, let me try and elaborate that a bit. If you look at UTI, I waterfall on one hand, for example, there is a direction provided on who generates the identifier, who consumes it, and so on and so forth. But in the case of UPI is both parties to a transaction could very well be knocking at Arnold's door to get a UPI. Now the operational challenges do not stop there.

Really. UPI, like many other static data, is not a simple piece of static data. There's much more to it. It's a combination of multiple attributes. It could vary based on the way your traders spoke to the way your underlying information is hosted. Now the question is what if the attributes that combine to form a UPI are defined differently by the two parties to a same transaction, especially in the case of exotic or structured rates, which could be booked differently by different firms? How unique can the industry then expect this identifier to really state? I don't have the answer yet. Now, as we speak, I'm sure most of us are waiting to see how UPI reporting transpires with CFTC starting next week. A lot of what I just spoke about is it simply conjectures what is there more to the whole UPI concept that we haven't even thought about?

Speaker 1 [00:42:52] Hmhm. Yeah. That's interesting. I've talked to Carl about this, before as well. You know, certain scenarios where, you know, two sides of the same trade might be reporting a different UPI. Carl, do you have anything to to add to that? How do you see these, these sort of challenges being resolved? I don't know if you have any specific examples where this could occur. You want to share?

Speaker 2 [00:43:19] Well, we'll certainly work for teams just mentioned. This is completely on point. You know it. A union UTR has a unique identifier which is not. Atomically unique to a trade because of dual sided reporting. Right. So this is a this is this is something which is affecting. Hey back. It's going to be less of a volatility on a single sided jurisdictions over in North America. I mean, yes, you know, settlement type, certainly. It's one of the key fields. I mean, I think that, you know, beyond structures and, and those kind of nuances there are. Interesting elements in some of the nonstandard trials. So, you know, if you look at something like an ethics trade, right okay. So settlement targets for prices and they start with the complicated, as far as what you pass through there for the validation sample. But if you go to a nonstandard, you know, you have to report the API, the underlying. Okay. Well, there's another place I have the same challenges that you will find scientific data which is set so you're not assigned to trade with the API, one underlying which again may not be aligned because it isn't a, you know, there is a waterfall. And then further, if you don't have the API for it underlying, you have to report out the characteristics of the underlying trade.

Kind of hearkens back to the basic two days where you know your fields 42 to 56 whatever your the structure where you didn't have a nice. So you've got all these extra points of, of risk around the data, which perhaps they're in a lower volume places, but there's still all these areas where you could quite quickly be in disagreement with your with your trading credibility. I think the other thing that's interesting is with the API is where when do you get that? Right. So are you taking this in upstream? Is it something? Much, as I said, is widely something you would expect to upset. I mean, you know, in the middle of its front office. It was something you capturing are at the moment as a relatively news nation things in October. You see it much. You know, there's a lot of people I think a lot of firms will be looking at ingesting that at the point of reporting. So, you know, is that is that a sensible place to it? I mean, what would hope as we mature and it's more commonly adopted throughout ITC space, that it would be as high as possible. But then if you have a tie up, you also have the issue where you guys change there.

We have a day Delta coming down from out of the East Bay. UPI you reported on trade yesterday. You're doing this as extremely similar to trade today. Is it the same you I it may not be okay. So you have to go and check again. is that going to come from upstream? Probably. No. What if you do you need then remediate because API has changed in some fashion. All of your previously reported transactions for. Yes. So how does that work. And that's much more of a reporting engine process. So there's a lot of. Flexibility and flexibility. I love variety in how and where that should be adopted and further challenges around, you know, if you are having to alter your API, there is like API, you know, needs one. So you, you know, you you go into any DSP and you also your API or you know how it issued much as you would do again, you know, as a an aside for MiFID two under that regulation I will go and issue a brand new UI. but that may not come down to the next day. So some obligations you don't have the API you need. And so do you want to possibly what do you do then. Do you report and then have to remediate and exit re report.

You hold things back. So that's the challenge which I don't really feel is established. I mean the industry, it's hard to find best practice but. You know, in interior life and finding out these issues, it's hard to kind of do much more than the best intentions. And I think I find the process of asset ethics swap issue that we've been dealing with for a very long time, as you know, is, in effect, slow to forward and forward the two forward legs essentially, or two forwards. Is it the Board of Ethics? What do you use the API of the swap on both legs? Do you use UPI for forward pass legs, forward legs, leg forwards? I mean, there's not much variation, but the traditionally asthma has a different opinion to a lot of the other, regulations. For a lot of other regulators, it's still kind of unsettle. We see we, we, we see across our, our clients and across the industry, but makes depending on how you should do that, a different interpretation. We, we work hard utilizing these kind of, these conversations within our but our client base. But it's still really hard to kind of really pin down some of these, some of these nuances. And it'll take some time to settle for sure.

Speaker 1 [00:48:43] How about the duty generation? So I suppose even with, a waterfall. There are certainly some challenges. I understand there are some issues with certain cross jurisdictional trades, where it's maybe not entirely clear from the waterfall. Who will generate the duty? Do you want to talk a bit about this?

Speaker 2 [00:49:04] Sir. Sir? Yes, sure. The waterfall is expressed fairly clearly. And you know the. It's designed in a way to try to reduce the kind of, the burden when it comes down to, you know, when you get past, some of the early stages. I think the real issue with cross jurisdiction is that fundamentally, everybody wants to generate the UTR. Okay. It's the most convenient way to do it. Doing control of that, you can report straight away. You're able to kind of get that through into data afterwards at the end of the things, you know, you've met your obligations, you can move on. You can work, you know, KPIs or anything else you need. I think cross jurisdictional need, you know, when we get past the early stages around, platforms, and services generating that, we have a rule which essentially is saying there is to report. So, you know, whether obviously with CFTC being the most rapid and the obligations, but you have the T1 and T2 as you go across time. So that's that's a bad thing. But if you're if you're getting your if you're you paying counterparties issuing the easy and you have it, you need it out here at any time.

I think for example, taking a look at the how quickly can you exchange or how are you, how long are you holding on before you get your data? This all leads to operational costs. And it's more it's more people in Vegas having to have more process, more control order, more mediation to do so. That's it adds risk and cost. And in addition, I mean, we talked earlier about ice, about the different. Adoption points. So that's a safeguard. So Europeans from Maine will be using DJI waterfowl. To use actually. Yeah. You can still report with your title. That's perfectly valid. So, you're going to want to a lot of firms want to report without a title ID to meet the obligation. But then you have a point in October where you need to go and find that auditor because it's already reported adopted. So again, it's it's. It's adding extra burden and cost, and you know what you need about that and access to full time procedural processes to be able to find these trades, identify them, flag them and take action. Ideally, you know, an idea of what is automatically is possible. And then make sure you know that as part of the, audit controls around that, because the end of the day, regulators come knocking as well. And getting to know what why you made the decision. So traceability and lineage, process required around that to.

Speaker 1 [00:51:56] Pretty, but do you have anything to add to that?

Speaker 3 [00:52:00] How many? I think all covered most. Most, the ground here for us. I think all I'd like to say is, unlike unique product identifiers that we spoke of a couple of minutes back. Unique trait identifiers, according to me, is a very well embedded concept. While it may not have had matching and bearing of duties until the rewrites, we have been generating and consuming utilize for most bot and given utilizes one of the many reporting elements that reporting entities need to worry about. It is important to contextualize the scale of the problem here. Since you refer to cross jurisdictional streets, specifically, the cross jurisdiction or the pseudo jurisdiction eligibility determination is around step five of the Utai waterfall that we again spoke about. Now, most jurisdictions except Korea, has a T plus two reporting obligation, which means where trades with global jurisdictions are involved, you would likely be consuming the UTC already reported in that sooner jurisdiction now coming to trades with API counterparties. these will typically fall into your bilateral agreement step of the waterfall.

It's therefore important to understand, what percentage of your trades fit into the first few categories of the waterfall, i.e. executed on a trading venue with CCP cleared or electronically confirmed? And what is the residual population that you think would go through to the sooner jurisdiction or the bilateral agreement section of the waterfall, and then accordingly, invest resources and time and effort to try and understand how you would want to sort that aspect of the waterfall. Now, in terms of the industry effort, there has been a lot of work on this. There has been, concerted drive towards getting a precise understanding of this waterfall. ISDa has been bringing industry participants together across the last almost three, four months, to try and coordinate a lot of these discussions and get some optimal adoption practices around implementation.

Speaker 1 [00:53:59] Hmhm. Okay. Thank thanks so much. I think, so, so we have about 20 minutes left. I, I want to talk a little bit about the, the, the Aztec and Mars, regimes and, you know, in terms of regulatory expectations. Alex, would you be able to just kind of, give a little bit of your of your view on the regulatory expectations in terms of implementation? In fact, there was a question from from the audience. I think it could be a quick one. So maybe you can address this together. About the as we write it, the the attendees asking a few smaller firms in Australia are confused if the single main post.

Speaker 4 [00:54:44] Right? Yeah, I understand it in writing, but yeah, sure. I mean, in terms of our expectations are, you know, that people continue to engage with, you know, the working groups, like the one that did you see the Pria mentioned just before? We have been running, sell side and by side separate working group since April 2023 to support industries implementation. So that's the right for us to raise issues and to and to do you know, regulatory reporting. This is not project collaboration is it's very beneficial. So get out. Basically our expectation is that they, engage, continue to engage. And we are pretty encouraged from what we see there in terms of the preparation for most of the entities.

Look, I wanted to also just mention, I mentioned before that we have sort of consulted on a number of additional fields. There's another consultation that we have in the, in the pipeline that we are expecting to, to release in the next few weeks, maybe, around mid to late February to address some of the particular issues that we have in our current framework that we think are not working and that we want to to, to fix. One is to simplify, the can we exclude exchange traded derivatives from our regime providing like a very comprehensive like in a definition rather than having a list that needs to be updated. Secondly, clarifying the for foreign entity reporting what's in scope. There's been some confusion around that. We are, you know, using the concept and definition of nexus derivatives, as is currently understood under our Nexus exemption, we're going to use that hopefully more clear, scope in definition. And finally, and most importantly, we want to address our concerns with the operation of alternative reporting, which is a unique Australian type of farm exemption. We don't think it's it's working. At the moment we don't have enough visibility, of the use of this form of substitute to comply.

And so we are going to propose to, to scrap it basically. And that links to the question that I think I answered in writing before around, single sided reporting, single cell reporting will continue. But obviously, as I just mentioned, if alternative reporting is eliminated, then obviously if your foreign counterparty is you cannot rely on a foreign counterparty. That is in turn relying on alternative reporting anymore, for single sided reporting that your country or foreign counterparty will need to start that reporting directly to a, licensed TR that is licensed, by basic. Hopefully that's that that's clear. So just wanted to flag this last consultation to, to fix some of the longstanding concerns that we have about our rule set. And hopefully we are future proofing the, our framework for the next ten, 15 years after this, these changes. Thank you.

Speaker 1 [00:58:15] Thank you for sharing that, Alex. And, I'm sure we'll be writing about the consultation, at Regulation Asia. So just again, something for the listeners to to keep in mind, there will be another consultation, next month from Isaac, to, to finalized, some of these different aspects of the rules. Can we can we quickly have Julia maybe share a little bit about the regulatory expectations coming out of Singapore from from M&S? I know the close to final requirements were issued last year. What is the status of of guidance, of additional guidance. What should firms be doing to prepare for the October go live from the Singapore perspective? So maybe Julie, as well as Priya might have something there.

Speaker 5 [00:59:02] So. Thanks, Manish. So I guess from, Singapore, perspective, I think there's been, a few developments late, last year. So, in November. Right. The AMA has actually issued a circular to reporting entities that the effective date is set, for two because, October total for this year. So, what if we costs, you know, our minds to last year there was a bit of uncertainty in terms of, okay, are we going live? Even though there was a lot of, you know, seminars and also indications right from Miami is that it is likely to happen in October 2024. So that has been confirmed in a circular, that was issued to November. And then in terms of the, you know, expectations and also, guidance for implementation, I think at the bigger picture, the message from, the MERS is very clear. Get ready to report by to the 1st October. And that was the message, you know, that was, reiterated in a DTC, seminar that, MERS and so, you know, spoke at together with Portugal and other industry practitioners. So I think that's the first message, right? In terms of, you know, it is going to happen. So start implementation if you haven't already.

Now let's talk about, you know, the guidance that has, the health minister. So from a simple, perspective, there are really, two parts in terms of guidance. I think, one is, there are changes right in the, CDC. So, in the local context, all this occurred as a future site would need to be amended. So that will take time. Time, because it needs to go through a parliamentary approval process. However, in terms of, you know, industry, you know, the information they need to get ready. There is actually, a guideline document, that has already been, released. They haven't really so-called finalized it, but actually, in terms of the content is already done.

What I mean by that is that actually it goes down to all the, additional, data fees. Right? What are the, what is the from it by data view? What is the definition? And also, you know, what are some of the, so-called things to watch, right, in terms of understanding, the definition for that particular data frame. So, and so I encourage you, participants will need to look at, mass implementation to really, use that, that loads document as a starting point. And the reason why is guideline document is, this has also been, you know, shared by the mi mers publicly is that it allows for the changes. So I like, you know, talk about, you know, some of the, global guidance around cities are still holding. So I think from an industry standpoint, even though that, you know, still changing, but from a, you know, implementation standpoint, I encourage, you know, everybody to, get going if they haven't started, already because, you know, is that it is home to you, right? Those changes, yes, may impact them. But, you know, we do have sufficient, information, to get going.

And in terms of the more time that, reporting entity would need to go through to work out, what are the additional data requirements, you know, where would that information come from and how do they integrate that system. And also adopting that information, which all that would take time. So that that's and finally I would say that it's, self guidance. Right. We always, rather for this particular, regulatory requirement. There is, life, ethic document. So again, you know, that contains so fairly, comprehensive information, to help, firms for their guidance. And I think, you know, as the industry, will have continue to have questions coming through as they go through, the details, we can expect, you know, the ethics rules to also be updated right on an ongoing basis. And I think last point is just to also emphasize the point I made earlier, the entry that industry, forms. Right? DGC is hosting itself is hosting. We get together, right on very regular basis now. And so again, you know, those are platforms that are reporting entities that enter into as they do the implementation.

Speaker 1 [01:03:47] Thanks. Do you have anything? Yeah, I. For the interest of time, I'll be quick in and just add on to to the points that, Alex and, and Julia have covered. Just add on, bits to it. So just three aspects to this, pot. One is I really want to commend the effort, by the regulatory community to continue this engagement process. So as, I mentioned about the upcoming consult and really clarifying the expectation, for the industry and alternative reporting and other aspects, it's just very, very helpful. So, really commendable.

Also, Julia mentioned about the thank you document, that Ms.. Is, putting together and and the guidance that they have, you know, published again, you know, all this takes a lot of effort is an ongoing engagement and is really commendable for for that regulatory engagement. So and also there are, you know, on the industry groups, rightly so. We, we have done a lot with is the there's also beside working groups as well. I ama and I am as well as so as Julia mentioned, we did have a forum before. Yeah. And where the, the mass actually, you know, provided, clear, guidance and basically, you know, a call to action to industry to work towards the, October 21st, 2024 compliance goal for life events as well. So that was really clear. And Julia went through, the documentation that's been out, from the regular, regulator. So I just want to let you know that, you know, depending on what kind of reporting entity you are, you know, there are different forums to really, you know, share that work as well as it's put together, you know, clarifications that you might have as you go through this implementation. It's a journey. And we are all in it together.

Right. So, you know, if you do need help, you can reach out to DCC. We can, generally to the right industry groups as well. And lastly, on the trade repository working group. So, yes, we do have, event working groups as Sigma's working group. We also run a Japanese, and for our Japanese title, we run it in tandem, both in English as well, in the Japanese language. But globally, we do run, working groups, for the industry community, across both all the global implementations, coming up. So there's a forum to really cover through, details on the project documentation, which is already been released. So there was a question that came up, you know, live on, you know, overall readiness. How do I get ready and what do I need to do, you know, in phases and open up? I mean, it's okay, but the documentation is that there is already, you know, the functional change document, also the message specs on, you know, the detailed formats on all the data fields and business rules and XML exports also, usage guidelines, information, you know, that supplement these, message spec.

So really, all that has been really worked together with, the regulators. So, you know, that is a way for you to get started. Also, great news, you know, hot off the press. Also, in terms of release of, testing. So we do have the exec, simulator to to test your, messages for, for the upcoming cycle life as well, that just got released, yesterday for the industry. So again, we keep, you know, rolling tools out and, and, and, you know, enable testing and, and provide, a lot of content on documentation. So if you are not in those working groups, please join them as soon as you can. You know, we are happy to help. And also we do have a repository called the, Learning Center where you keep all this content. Also, you know, a way for you to engage with, you know, things that you might have, missed. All right. So, many shall, pass it back to you. Thanks. Just kind of, to, to finish up, maybe we can talk a little bit about some of the key decisions that that firms need to be making. But maybe positive. I don't know if you want to talk a bit about the reporting architecture. Julia, you know, maybe in terms of project implementation, addressing the practicalities of implementation. Go ahead. Pratibha.

Speaker 3 [01:08:22] Sure. Thanks, Maneesh. I'll try and keep it as short as possible. You could potentially write a book on reporting architecture. But, from a reporting architecture standpoint, there are a few options available to reporting entities. And now what option you adopt is entirely dependent on your firm's internal capabilities, your jurisdictional reporting obligations, and most importantly, your firm's internal cost structure. The first option and probably the most. Forward. One is the self reporting or in-house reporting, but you would use your in-house staff to prepare and submit reports to the trade repositories. The best part about self-reporting is that, excuse me, is that it's fully customized to your needs and your requirements, which, counterintuitively, is also a disadvantage in many ways, which I'll come to shortly. You would have full control over your, report submission, your associated controls misses, dashboards. You know, you have experienced personnel. You would build institutional knowledge from project management to change management to operational staff. All good stuff. But on the flip side, it's expensive, consumes time and effort and the same, customized build, which was an advantage a few seconds ago, starts playing back as a disadvantage from minor to major rule changes everything from your technology architecture to your report production to control design. Everything needs amendment. And this starts playing on your costs. So that's option one.

The second option is vendor reporting or assisted reporting essentially involves engaging a vendor who will assist you in your, report submission obligations, report preparation and submission obligations. There are quite a few players in the market, and they support most, if not all global jurisdictions. In in this model, you would simply outsource your report preparation and submission responsibilities to a vendor. But remember, the ultimate accountability or the reporting obligation continues to be with the reporting entity or with you. Vendors usually tend to use the best technology there is to neutralize data sets across clients. And therefore this model tends to be more scalable and, cost effective generally, given a vendor's familiarity and expertise in the reporting space as well. This also proves to be operationally efficient for many, many FOBs.

Flip side service levels of vendors may not fully meteoric expectations. Inability to control your reporting process. If the vendor solution does not fully or partially meet your requirements, there is an almost complete reliance on the third party vendor while you are still answerable to the regulator. The third and the last option is delegated reporting, which enables one firm to report on behalf of another party. But the ultimate accountability and responsibility of reporting still continues with the one obligated to report. Now, for Asian jurisdictions with the Nexus reporting requirement, the delegated reporting could pose quite an issue for the delegated party. This means that the delegated party is expected to be systemically alerted of the client's trading nexus at a per trade level, to be able to report to one or more of Singapore, Hong Kong, Australia. All of which have, Nexus requirement. Now, this bill becomes exceptionally challenging and disrupts the operating costs of the delegated party, not to mention the, legal and compliance concerns it could pose from the point of view of the client who is obligated to report but would like to delegate. It isn't very simple either. One of the biggest known cons of delegated reporting is the lack of transparency. The underlying client potentially has on the submissions. Made to the repositories, the feedback from the trade repository and rejected trades or any other issues with the trade submissions.

Now, going back to the point about the ultimate responsibility being with the client, this could become a fundamental issue. From a regulatory standpoint, if you look at masses rules, this aspect has been, this aspect of reporting has been left open to the market to decide upon. Is this, for example, had a safe harbor provision earlier which has been removed with the rewrite by clients, could still potentially continue to delegate the reporting, the expectation from the regulators, the client to implement greater monitoring and reconciliation over their trade reporting to ensure accuracy of information. Now, this whole emphasis on greater, monitoring and reconciliation indicates a need to have a full suite of controls over trades being reported and accepted, which does not appear to be very cost effective either. Therefore, delegated reporting, in my opinion, has a regulatory compliance implication as well as a cost implication that both sides need to consider. Now, as I said earlier, that is no one size fits all managed from a regulatory architecture standpoint and what you would like to use, there is no right or wrong approach. It really depends on the options you have. You'd have to weigh your options based on all of these dynamic factors and what works best for you yourself. Back to him. And he.

Speaker 1 [01:13:32] Thanks. Julia?

Speaker 5 [01:13:34] Yeah. Okay. Interest of time. I'll. I'll do it really quickly. Okay. So from a project implementation, I think, safe to say, the reporting entity, you know, should get a project team, up and running, because if we then think about, you know, the outcome, right, that we're trying to achieve here is really about, accuracy of reporting and also the completeness of, of reporting. And, when it comes to reporting, when we are talking about, you know, data that needs to go from trade capture systems all the way to reporting systems. We do need different parties in organization to, come together and, trade as your treasury ops, you know, be compliance and IT team.

So first and foremost, get a project team up and running. they should, you know, have the relevant expertise, right. And also, the bandwidth right to do this, complex, that change. Then I think in terms of some of the, key decisions, I think maybe what's useful to the, listeners is actually to be aware of what are some of the potential, pitfalls, right, when it comes to implementing, such a change? I think if we looked at, you know, issues, from before. Right, it is really about, erroneous, reporting that arises less from an interpretation standpoint, more arising because of the, you know, complex interaction of news products. And we are looking models, right? That results in, you know, traits are not being picked up or traits being picked up, not the wrong views, you know, being reported, as actual. So I would say that there are a few things, to take note of during implementation.

I think one is around, the, quality of your data, and looking at not just data, get data, you know, I think, but also actually how do you maintain your kind of data and product reference, data, especially for complex, organizations with multi jurisdictions reporting different, trade capture systems. Right. You know, you you really have to go through, right, some of your, existing, reference data and make sure that, you are picking up, you know, about a few that meets the regulatory, definition. Then I think, we, control is really important here. I think in some of the jurisdiction, like, the that front of that reconciliation is, are now an explicit regulatory, requirement. And, you know, if we think about the various reporting architectures that pretty much about talks about, you can delegate right to execution, but responsibility ultimately lies with the reporting entity. So how do you then also, and even if you are doing in-house, you got to make sure that, you know, you have controls at every checkpoint to ensure that data is flowing through currently, right at in a computer, session.

Then I would say that lastly, you know, this, reporting typically is like, is a back office issue, right? My observer would take care of that, you know, so as a result. Right. Ownership and accountability is not always clear. And if you think about it, right, the data sets, actually upstream, if you don't have the right data to go in this, you know, likely you experience, you know, data issues later. So I think this, ownership and accountability issue, is, something there's an opportunity, right, for firms to actually, take stock streamlining for that, streamline the whole reporting, process, try to be as cost effective as possible, but also, you know, being very clear to everybody in the organization as to, who does what and who's responsible for what, data, requirements. And I just want to also just, emphasize that actually regulators around the world, for example, like the FCA, you know, underestimate just regime this, you know, put this into increased focus. And even for and yes, right. There's also an explicit requirement to say that you've got to have written and, policies and procedures, right, to actually, articulate your whole recording, accesses. So I think in summary, set up a project team if you haven't already, dedicate, you know, the right resources with expertise, in it. Take note of, some of these, challenges around, control points and, having the right, data within your, reporting on and making sure that your people know, one thing to watch out for.

Speaker 1 [01:18:03] And the debug just to add on. And just from a very, quick key decision, from the cheat repository. Testing, testing and testing. You know, as, as Julia. But people outline either using vendor or in-house or you're a delegate or delegate. You know, we saw some questions coming in. You know, it's a very busy landscape with all the regulatory mandates, coming up, also, you know, testing, for the connectivity, setup, you know, like, does it work? Would it not working on the go live test early? We have enabled, that framework for, for the industry. So, you know, leverage that as an opportunity. And, you know, any questions? Reach out to our, help this, through, through our support teams in an example. So, I will hand it over to you to, close it up. Thank you. Thanks. So, yeah, apologies to everyone. We've gone a bit over, even though we left extra time. I know some of you have to jump off the call, but but but just to finish off, I do want to ask, Karl. Pratibha, can you just quickly, you know, share a bit about what you what comes next post implementation? What do you foresee? Go ahead. Carl.

Speaker 2 [01:19:27] Well, as all these implementation, I perhaps I'll leave. What comes next to the team is specifically around, the 25 and over, which I think I just want to touch on some of the points that Peter made and Julia and Priya, I think. I was, well, too much on, buy versus build versus delegate. I think the most important thing is to understand that. This isn't going away. You know, this is the first substantial amount of change in the cycle of decades. Yet I expect that to accelerate as we try and get through this equivalence. Say so. It's important that we say what I need to concentrate on and flexibility. So, you know, flexibility of platform, of connectivity. You know we've seen across various regulations.

People come in and out of our space, and our new ones are people who have left. We saw a lot about arm in arm if it. So make sure you concentrate. And make in that level of flexibility. How do you got into regulation? How quickly can you do this? You know, concentrate on components izing the architecture. I think always have an eye on what you think will happen next year and what and if it's possible that the unknowns as well. Right. You have to be flexible in this. You know, when we started ten years ago, it was all about getting the data out the door, getting it to the regulator. The business is over. Everybody is very different. It's about. Data, validity, accuracy, and the controls process to make sure that what you're sending out and you have tracking over. We know what you're doing. You're able to operate, in your reporting obligation quickly and efficiently. It's not going away. It's it is it is here to stay. And I feel that. Yeah, flexibility, platform connection. And actually, just because we haven't said testing enough, today, testing, testing. Interesting.

Speaker 1 [01:21:34] They had final word for Pratibha. So.

Speaker 3 [01:21:39] A c 2024 is slated to be one of the busiest years, many years since the inception of data repository reporting more than a decade back. So if anyone thinks, okay, I'm going to get through to December 2024 and all of this is going to be behind me. That's not going to happen. The last decade was absolutely about institutionalizing the reporting framework. As Carl alluded to, this year looks to implement reporting rules that not just harmonize the global reporting from us as reporting entity standpoint, but hopefully also provides regulators with greater transparency towards detection of systemic risks, which is the ultimate objective of trade repository reporting. Therefore, in my opinion, there will be and there ought to be further changes in the future's to future to keep this reporting relevant. But the only difference would be the changes made this year, the start acting as a baseline or reference point point for all of those future changes coming up.

Speaker 1 [01:22:35] Thanks so much for tuba. And with that, we are well out of time. We could have we could have done with a whole extra hour, I think. In any case, let me first, let me first, thank all of our panelists. Carl. Julian, Pratibha. Alex, Priya, thank you so much for taking the time to, to talk to us about this very important topic. I, I, I'd also like to remind everyone to keep an eye out for ethics consultation coming up, next month. Thank you again, Alex, for for sharing. For sharing about that. And then certainly we'll we'll all be keeping an eye on the CFTC go live, next week. I know we haven't got to the questions that that we had planned to, but certainly, we'll put together sort of our own sort of Q&A at the end of this and try to address all of those questions by email. So everybody who's registered, for this webinar and any of your colleagues that, that couldn't attend. We'll, we'll be sending answers to those questions. We'll also have the recording available. Thank you all for taking the time to, to to join us on this call. And yeah, good luck with all of your implementation efforts and hope to speak to you all again soon. Give me one.

Speaker 3 [01:23:59] Thank you. Thank you everyone.

Speaker 2 [01:24:01] Thank you everybody.

Speaker 5 [01:24:01] Thank you.

Speaker 1 [01:24:04] Thanks very much.

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |