Additional Broadridge resources:

View our Contact Us page for additional information.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

While the birth of the Fixed Income Clearing Corporation’s (FICC) Sponsored Repo (SR) Program began in 2005 with State Street as its inaugural sponsor, it has only recently taken off with strong market interest when FICC expanded sponsored member eligibility, moving from just Registered Investment Company (RICs) to Qualified Institutional Buyers (QIBs). This not only expanded the number of cash providers eligible for the program but opened the door for collateral providers as well.

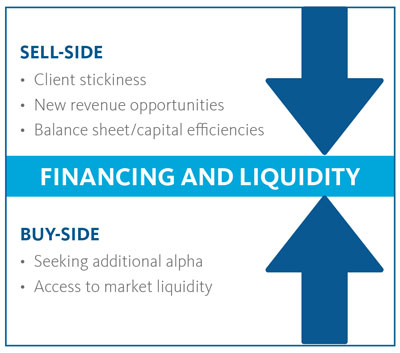

In January 2019, recognizing the milestone SR represented between sell-side and buy-side marketplace roles, Broadridge issued thought leadership on what this type of deal represented for capital markets. Sell-side firms are looking for ways to keep buy-side clients ‘sticky’ as well as new and creative ways to generate more revenue with competitive costs and acceptable business risk and the buy-side is looking for additional alpha. SR checks many financing goal objectives for both sides of the street.

The influx of firms moving to open their doors for SR business (or are in the process of ramping up to offer SR) inside two years is substantial at the time of writing. Volumes are anticipated to climb steadily throughout 2020 as newly approved SR FICC members enter the marketplace.

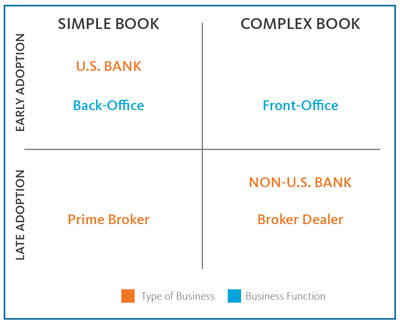

Like any other trading methodology that grows from immaterial to material in relation to the size of the overall industry book of business, there is a natural progression from early adopters to mainstream participants. There are also trends inside firms for technology and operations initiatives to support these trading methodologies.

This paper delves into the trends Broadridge has witnessed for early adopters of SR and the upstream/downstream departmental impacts on operations and technology. It also looks at the next SR waves anticipated as this trend of sell-side and custodians facilitating access into new deal structures to the buy-side and others continue to evolve.

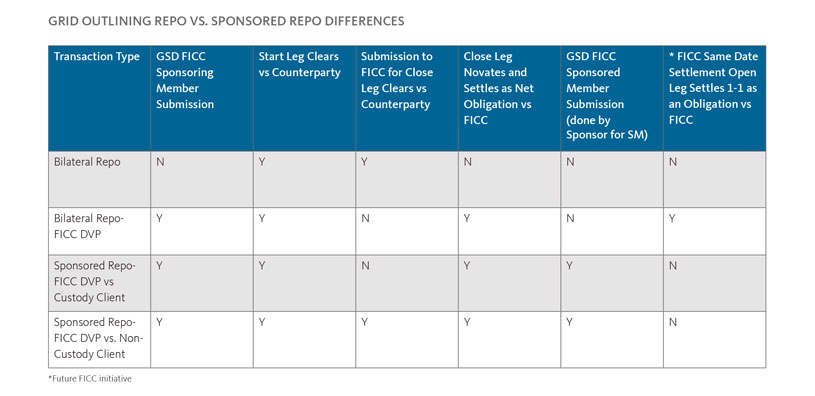

If the birth of SR was in 2005 with the inaugural member State Street, it has started to jump in a growth spurt with JP Morgan Bank and BNY Bank as catalysts entering the marketplace under Category 1 SR. Category 1 SR allows U.S. based banks to apply to FICC for permission to trade in SR. Sponsored members are only permitted to trade with their sponsor in clearing delivery-versuspayment (DVP) services with securities eligible for comparison. All netting is at FICC and FICC acts as the central counterparty (CCP) for all transactions by Category 1 Sponsoring Members. Securities eligible for SR include T-Bills, Bonds, Notes, US TIPS, STRIPS, FRNs and Non-Mortgage Backed Agency Securities.

In April 2019, the SR growth spurt continued as the gates opened wider for SR with the approval by FICC for Category 2 Sponsoring Members. This facilitates expanded application submission eligibility to FICC for SR to include prime brokerage, broker dealers and non-U.S. based banks. In addition, Category 2 SR expansion allows sponsors under a sponsored member to trade with counterparties other than themselves. This feature is anticipated to provide sponsored members with the same execution flexibility as they have in the bilateral market.

The introduction of Category 2 SR has seen many non-U.S.- based banks stepping into the arena. Many of the larger U.S. and now non-U.S. banks are also looking to adopt SR in multiple silos of their business. The bank is typically the first entrant for a firm. The broker dealer or the prime brokerage arm then typically follows, depending on how bullish each firm is for the indications of interest (IOIs) they have from each of their clients in the different lines of business. The trend is that these lines of business are being setup and run independently from each other much in the way it has been done previously for other trading methodologies.

In April 2019, JP Morgan Securities was the first firm to be approved under Category 2. JP Morgan was also the first firm to adopt a second line of business for SR services. JP Morgan worked with FICC for the development of Category 2, so they knew it was in the pipeline. This explains why they were able to execute the first Category 2 SR trade shortly after FICC announced the launch of Category 2 expansion for FICC, as JP Morgan worked concurrently on their systems, operations and IOIs in preparation of potential Category 2 approvals for the broker dealer side of the business.

Broadridge has been in conversations with over 30 firms interested in SR adoption and more than 20 that are in various stages of evaluation, FICC application approvals, systems adoption and/or are live. As non-U.S. banks explore the opportunities for SR in their books of business combined with U.S. banks exploring additional groups that should be members, Broadridge expects entrants to the SR marketplace to continue at a steady pace well into 2020.

With any new industry trend, there are early and late adopters and they fall into streams driven by activity and focus. Under Category 1, the early adopters were U.S.-banks only and the entrance of Category 2 facilitates discussions across non-U.S. banks, broker dealers and prime brokers. As SR has grown in size and complexity, technology adoption is starting to take shape as well.

For a methodology type that smoldered for over a decade before it caught fire, it raises the question of why now? SR has seen a significant rise in appetite amongst both buy-side and sell-side firms in 2019. With the introduction of Category 2 SR by FICC, growth is now global with the entrance of non-U.S. banks - but what is the attraction creating both the supply and the apparent demand? Examining other factors in the marketplace helps explain the appeal and growth.

SR ATTRACTION: BUY-SIDE

The buy-side has started to become a more significant player in the securities lending and collateral management space in recent years. Historically, securities lending has been a secondary focus for their long-only portfolios and handled largely by their custodial providers. As rates of return on portfolios for pension, insurance and other asset management firms have struggled, buy-side firms are looking for additional alpha to bolster returns.

There are two main roles the buy-side is playing in financing and liquidity:

SR represents an interesting route to market for the buy-side:

Regardless of individual firm motives in the short or long term, FICC members offering SR are seeing appetite from the buy-side. This growth does not appear to be slowing any time soon, either in the U.S. or cross-border activity.

SR ATTRACTION: SELL-SIDE

For the sell-side, SR helps provide opportunities for enhanced customer relationships through the provision of agent services and to solidify working relationships. First and foremost, SR facilitates balance sheet neutrality and is an attrition play by the street to keep clients ‘sticky’. There are opportunities for their books of business and interesting plays for securities lending, but keeping clients engaged and tethered to them is a very high priority.

As commissions for trades are quickly evaporating in a competitive execution market for broker dealers and others, eyes are turning to other revenue generating opportunities in collateral management, securities lending and SR as sources of revenue and trade activity.

As with any trading methodology that begins to grow as part of the book of business pie chart, other non-trading departments at a firm start to sit up and take notice. Most notably the functions that start to raise their voice about business and operational risk concern are accounting, compliance and risk (both credit and market risk). Understanding repo in general as a starting point helps various departments get up-to-speed quickly when learning of the impacts of SR to their functions.

Other firm functions impacted by sponsored repo include tax and client billing. The go to initial tool for trading desks and most other emerging functions for new trading methodologies in a firm is often Excel. The most typical scenario is the desks start managing their deals in Excel. They then share details with accounting and settlement functions who struggle to account, price, settle and track in their corporately supported platforms.

Accounting and settlement teams are usually the first ones to put up their hands and ask for new technology to support new deal types. Traditionally, as a footprint in a trading methodology grows, firms invest in accounting/back office technology and operational procedures. As the book of business grows, investment in front office trading and risk analytics tools becomes necessary to ensure business and operational risk oversight grows in parallel to the size of the exposure and opportunity.

While there are many advantages of engaging in SR trades for sponsoring members such as increased balance sheet optimization, capital efficiencies and reduced liquidity risks, SR establishes a new type of exposure and risk which requires examination by risk tolerance functions as the book of business grows. Most notably for SR trades:

Given the obligations to FICC for its clients, sponsored members are picking the best quality clients to help minimize obligation risk. In addition, risk teams are assessing the risks of exposure, handling of failed SR trades and other scenarios that may occur as firms partake in SR and open their FICC membership to selected clients.

Since the inception of Category 2 in April of this year, a stream of non-U.S. banks have been steadily lining up to take part in the next wave. Prime brokerage looks like a probable candidate engaging with FICC on sponsored repo. A primer on sponsored repo for prime brokers is therefore provided below.

PRIMER ON SR FOR PRIME BROKERS

Core concepts:

Pre-requisites (impact focus):

The devil is in the details:

To support the sponsored repo trade submission on behalf of the sponsored member (aka prime broker customer), when a sponsored member trades against the firm (‘done with’ transaction):

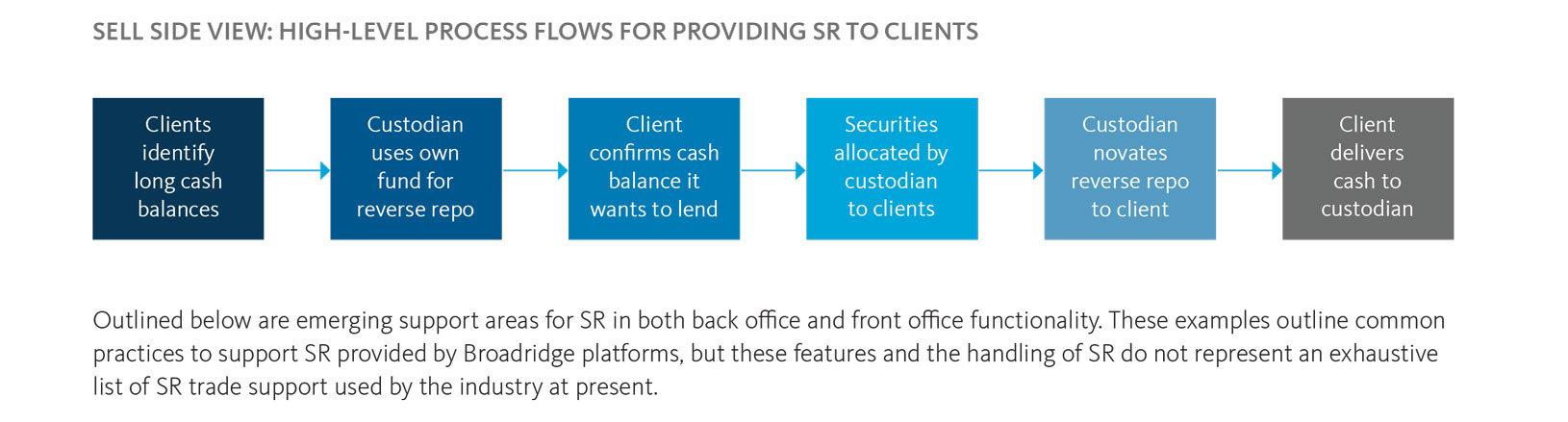

The creation of the SR deal and surrounding process flows to execute are straight forward but involve several steps and can be challenging for organizations to wrap their heads around. Introduction of technology to support these workflows is gaining traction to help ramp up volume without creating undue business, operational or deal risk.

Outlined below are emerging support areas for SR in both back office and front office functionality. These examples outline common practices to support SR provided by Broadridge platforms, but these features and the handling of SR do not represent an exhaustive list of SR trade support used by the industry at present.

BACK OFFICE SR SUPPORT

The most common methodology firms are using to handle SRtrades in their settlement process is flip trades.

FRONT OFFICE SR SUPPORT

Beyond settlement, as SR interest grows, firms are seeking additional functionality to optimize their books of business and are looking for functionality to help them with SR methodologies, deal management and execution.

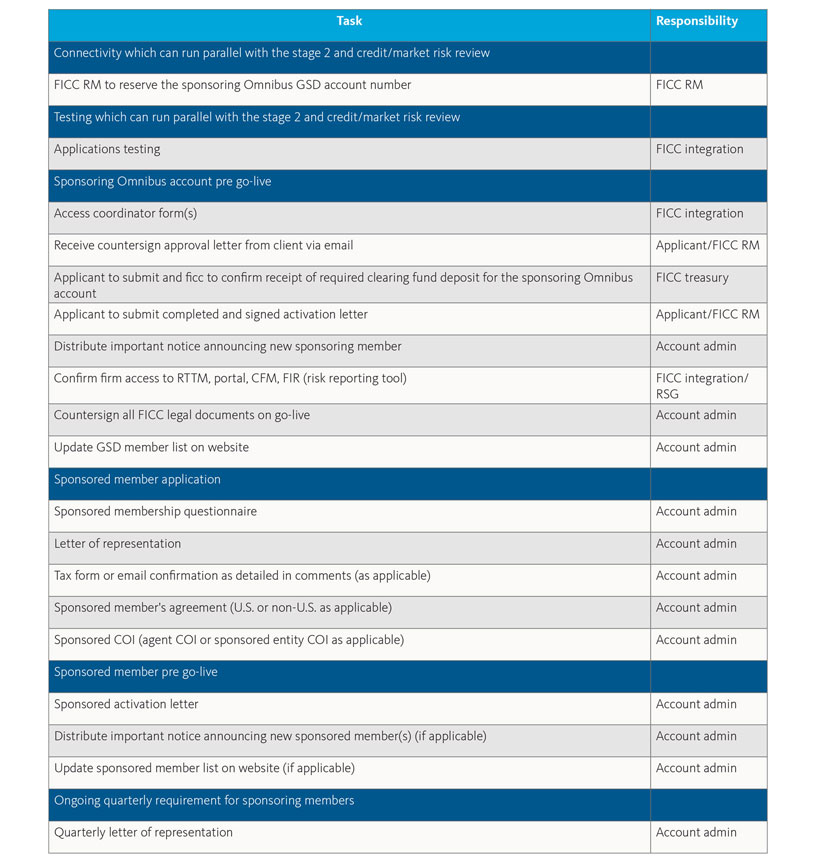

The checklist below is not an exhaustive view of tasks to be completed by firms FICC for legal, credit, accounting, tax,technology, interfaces and administrative setup but will give readers an idea of the tasks and complexity involved if planning for their own SR adoption.

As the popularity of sponsored repo rises, the industry will see more types of entrants to the marketplace. Firms will invest in technology for front and back office platforms to support these trade methodologies. Firms will also look to optimize workflows and tweak upstream/downstream functions such as risk, tax,client billing, reporting and processes to support SR for both client reporting needs and internal business operations.

The industry has already seen strong adoption of technology to support the back office for SR. As these SR books of business grow, firms are investing in planning/strategy to optimize growth and invest in platforms such as front office decision making and trading to optimize SR books of business and reduce operational and exposure risk.

Broadridge Consulting Services can help you expedite your time to market with a gap analysis, business case preparation, our knowledge of proven solutions for SR support, industry/peer activity for common practices in this space and assistance we have provided other firms to ramp up these types of methodologies/programs.

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.