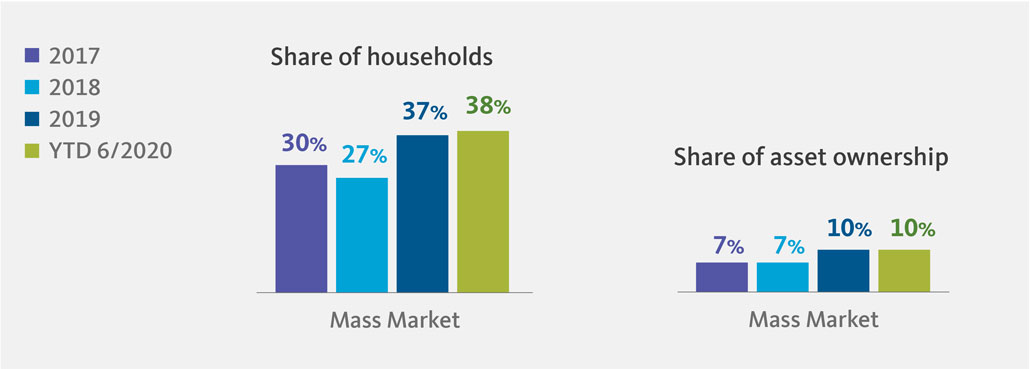

The rise of the Mass Market

Investors with less than $100,000 in investable assets increasingly represent a larger share of investor households and AUM.

“We are all witnessing an unprecedented and accelerated democratization of U.S. investing.”

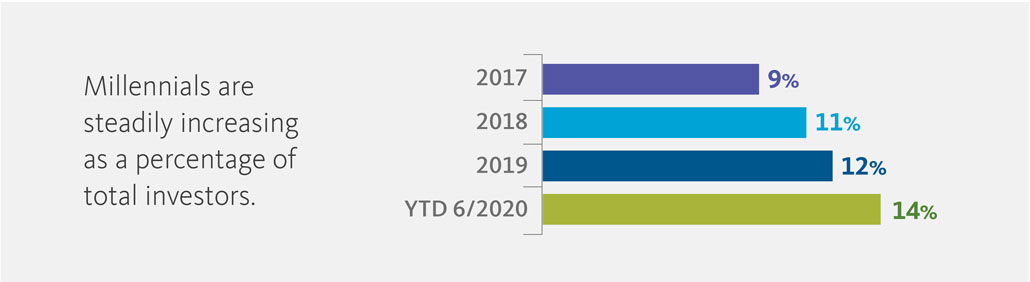

Millennials: The up-and-comers

Millennials (born 1981-1996) are the fastest growing generation of U.S. investors.

Developments behind democratization

Ongoing market developments make investing more attractive, affordable and accessible.

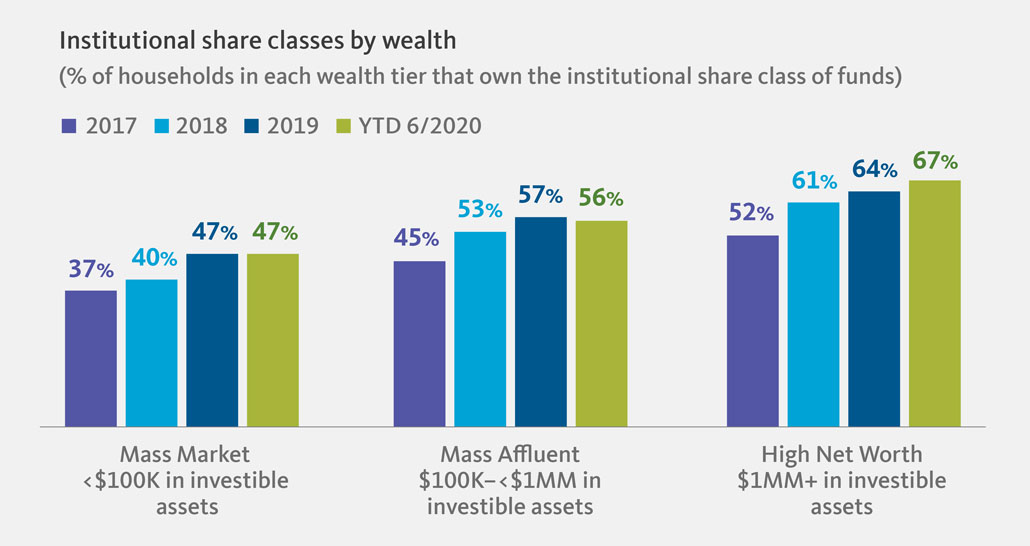

Institutional share classes hold wide appeal

Once only available to High Net Worth (HNW) investors, institutional share classes have grown steadily as a percentage of holdings across generations.

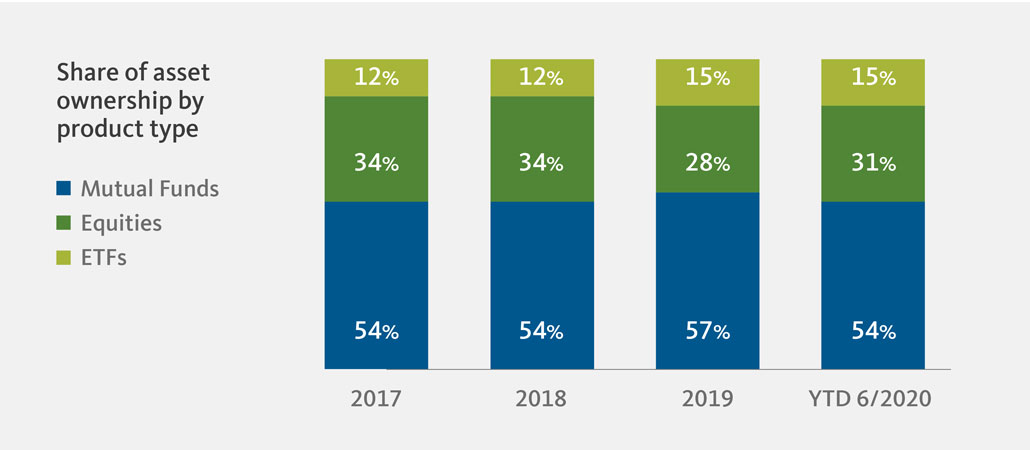

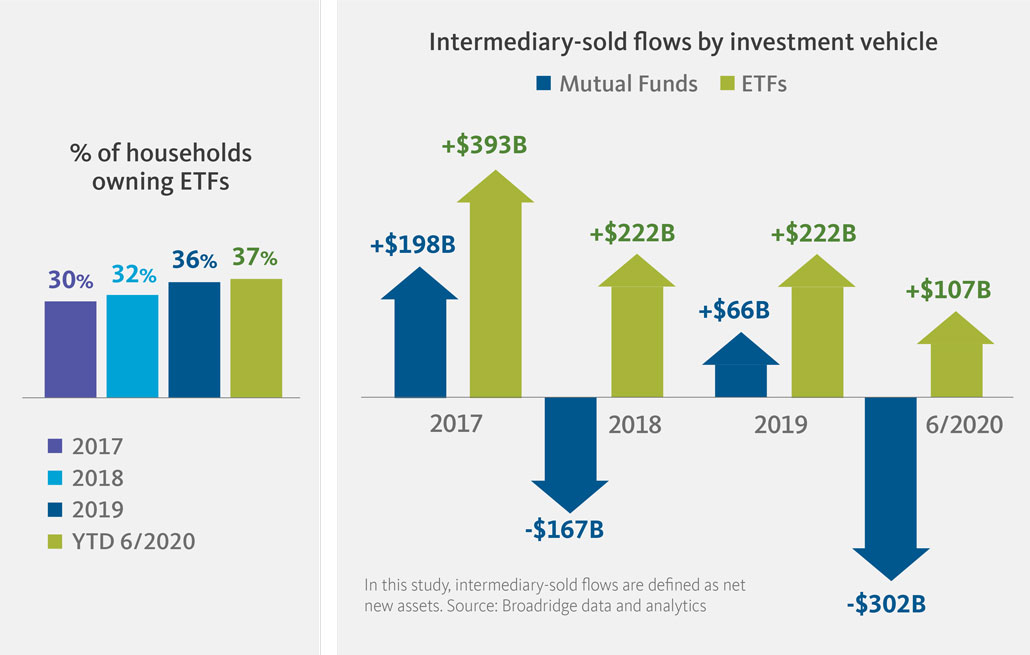

ETFs are on a steady rise

ETFs attract a greater share of households. Plus, fund flows for ETFs have been unfailingly positive since 2017, whereas flows for Mutual Funds have declined.

“Money is expected to continue to flow into low-cost investment vehicles such as passive and active ETFs, and Millennials and Mass Market investors will continue to gain influence as their assets grow.”

Equities grow as a percent of AUM

In 2020, equities grew while ETFs held steady and Mutual Funds declined.