Additional Broadridge resources:

View our Contact Us page for additional information.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

A storm of increased tax complexity has steadily descended upon broker-dealers of all sizes across the globe in recent years. Accelerating government regulations, increasing tax reporting requirements, and growing client demands have significantly expanded tax compliance risks and costs for brokerage firms.

These factors place increasing pressure on broker-dealers’ tax departments. Small cracks in tax systems are growing larger under the stress of processing more data and resulting in more errors and costly corrections. Brokerage firms will continue to bear a growing burden for documenting tax details and withholding proper taxes.

Time is of the essence to make changes in order to attain tax reporting economies of scale and achieve regulatory compliance as tax management evolves from a seasonal to a year-round activity.

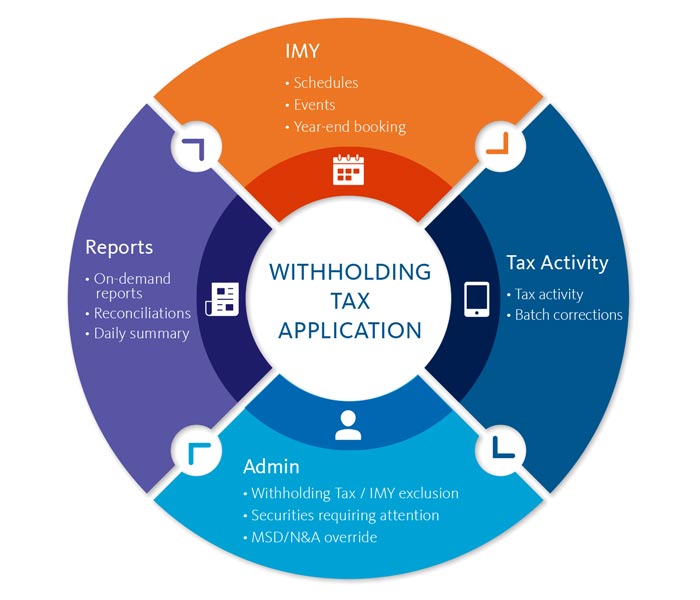

Adding efficiency to operations, accelerating the adoption of new technologies, and responding to business conditions is critical. Broadridge’s Withholding Tax Application is an alternative to the costly resource and expense-draining manual process or an in-house developed program.

Withholding Tax Application provides immediate visibility into transaction-level events subject to withholding to assess and validate rate/exemption determinations based on Account Holder reference data and Payment classifications. In addition, the application supports Sub-Accounting structures, whereby beneficial owners and Non-Qualified relationships can be managed, updated and adjusted for payment/withholding allocations in real time.

Withholding Tax Application enables firms to maintain all their foreign and domestic account withholding tax activities in one agnostic and modernized web-based application, allowing for real-time adjustments / corrections and on-demand reporting.

This tool allows users to access three prior years of data, while being able to update current and prior year data and automates real-time updates, what historically has been a manually intensive process, including:

Withholding Tax Application is designed to integrate seamlessly with the BPS Backoffice and to support your daily processing as a Tax Information Reporting Utility

Clients need tools to turn disruption into opportunities—enriching client engagement, navigating risk, optimizing operations and growing revenue, and meeting the needs of today and tomorrow. We help them make decisions that create this transformation.

Contact your Account Manager or visit Broadridge.com.