Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

Additional Broadridge resource:

View our Contact Us page for additional information.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Why has the use of managed services for reconciliation grown exponentially in the past two years? Increased focus on risk, regulations, and cost reduction has heightened the need for greater transparency and efficiency across all areas of financial services operations. Today, leading firms are partnering with an expert solutions provider to streamline their reconciliation function and manage operational risk. It’s time to rethink how your firm is approaching reconciliations. Discover how leading firms are centralizing their reconciliation platforms to improve efficiencies and enhance risk management.

Reconciling activity requires financial services firms to overcome the challenge of managing across an expanding set of asset classes, currencies, business entities and markets. As regulatory demands increase, so does the cost of falling further behind the industry standard for a reconciliation center of excellence.

Reconciliation processes have historically been inconsistent and embedded within different entities creating ad-hoc, manually intensive and non-standard silos, often using spreadsheets or inhouse grown solutions. These processes have evolved incrementally due to: 1) the interdependencies involved in system expansions and integrations; 2) cost constraints; and 3) speed-to-market pressures.

The “path of least resistance” has been to maintain one-off reconciliations, rather than allocate the time and resources to implement scalable best-in-class solutions.

The need for change is being driven by:

These changes require increased reconciliation staff expertise, as well as proven industry-leading technologies. In ways we will explain, the weight of combined pressures is forcing firms to consider an alternative path – leveraging a service partner to manage reconciliation centers of excellence for labor and technology.

Repercussions from the 2008 financial crisis have increased regulatory requirements around the globe including Dodd-Frank in the U.S., the European Market Infrastructure Regulation (EMIR), and Basel III globally (see box below).

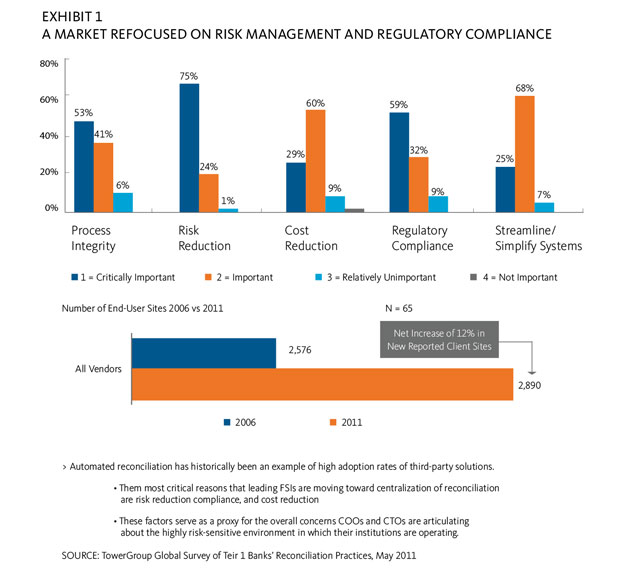

The risks and implications created by reconciliation errors, imbalances of books and records, overdrafts or trade fails elevate the need for seamless risk management and world-class reconciliation performance. Risk reduction is now viewed as a “critically important” driver of reconciliation processes by 75% of Tier 1 banks.

The accord known as BASEL III, adopted in 2010-11, is a model for a new era in global risk management standards. It calls for more stringent reform measures on capital and liquidity requirements, e.g., global liquidity coverage. By reducing leverage limits, BASEL requires financial firms to further optimize and more actively manage collateral and capital around the clock to avoid additional costs.

One of the ways to face these capital, collateral and liquidity pressures is to create standardized, real-time reconciliation processes to ensure your books and records are promptly and fully balanced. Reconciliation tools will also need to have mark-to-market capabilities, and the ability to convert currencies and create centralized reporting with risk alerts in a real-time manner.

As most financial firms will not be able to pass the costs created by these new regulations through to clients, sell-side and buyside firms are increasingly motivated to partner with technology and labor service providers. Historically, financial services firms have primarily outsourced non-differentiating functions for cost savings. However, the BPO industry has evolved enabling firms to leverage industry expertise and operational best practices without diverting investment dollars from areas that generate competitive advantage.

Financial services firms operate in global markets around the clock, driving demand for multi-entity reconciliation functions. Firms are challenged to clear, reconcile and settle trades in real time and report and correct any problems quickly. Sell-side and buy-side firms trading globally face the additional risks of currency conversion, capital charges, execution delays and markto-market requirements.

Additionally, as a result of the 2008 financial crisis, buy-side firms are increasingly faced with reconciling more diverse information sets while avoiding costly errors and optimizing collateral.

These firms are also spreading trading and collateral across multiple prime brokers, CCPs and custodians, significantly increasing the importance and complexity of reconciliation processes for buy-side firms.

As global securities markets never sleep, risk managers must respond faster by focusing less on gathering information and more on evaluating risk “hot spots” and understanding trends quickly, wherever and whenever they emerge. Reconciliation systems must be able to adjust for local market nuances quickly and cost-effectively. Automated reconciliation services have become a key to managing and prioritizing counterparty risk, managing capital, meeting deadlines, optimizing collateral and reducing associated costs.

Trading volumes have increased across many instruments and asset classes – especially derivatives, foreign currencies and fixed income – in part due to the growth of high-frequency trading (HFT). New regulations are expected to increase trading volume and transparency in the OTC derivatives market, which in turn will impact liquidity and increase collateral requirements. Operations areas will also continue to face increased workloads and other demands while facing pressures to reduce costs and improve processing service levels, often without the necessary investment funding.

“Engaging a leading financial technology and BPO provider reduces the time needed to consolidate and match data, affording the flexibility and ability to handle growing trade volumes and providing a broad view of their risks and opportunities to new initiatives, instruments and markets.”

Reconciliation activities account for about 30-40% of firms’ total back-office labor costs, and the vast majority of this cost cannot be passed through to customers. The pressure to reduce backoffice costs and keep them aligned with firm revenues has fallen heavily on operations departments. Adopting a centralized reconciliation function and partnering with an industry-leading service provider for time-consuming manual reconciliation tasks helps financial services firms achieve significant cost savings, while also increasing speed of information and accuracy.

In Summary: Given the continued pace of new regulations, increased risk management focus and global market expansion, financial services firms recognize that adding new reconciliations incrementally within silos is not a cost-efficient way to achieve enterprise goals. Since many reconciliation processes are performed on-demand or with high frequency, firms also face a transition risk in implementing changes.

Centralization of reconciliations through an outsourcing provider is the next evolution for our industry. The combination of BPO solutions with industry-leading technology enables these providers to deliver scale and efficiency benefits. Centralization can range from a global hub to smaller units, all providing standardization across business lines. BPO reconciliation functions can be implemented quickly and cost-effectively, with minimal expenditure, by firms on both the buy- and sellsides. They offer 24/7 access to data with standardized global risk-management processes, increased flexibility to respond to local markets requirements and reliable operational bestpractices. Furthermore, BPO providers often reduce exception rates in excess of 25% while offering best-in-class Service Level Agreements and ongoing investments.

A multi-currency global reconciliation outsourcing strategy across the front, middle and back offices and all layers of a firm and its strategic partners (affiliates, custodians, counterparties, etc.) increases straight-through processing (STP) rates while eliminating manual steps, input errors and labor-intensive silos. These functions can frequently accelerate the speed to market for new products, services and regulatory changes offsetting expanding cost pressures on capital, liquidity and collateral.

“Centralized reconciliation functions represent a paradigm shift for the industry. Historically, financial firms spend 30-40% of back-office costs gathering and preparing information as part of disconnected reconciliation processes. Partnering with an industry reconciliation leader can leverage global centers of excellence to create standardized risk management processes. This increases firms’ ability and agility to enter new global markets, expand products, and comply with more complex regulations while significantly reducing costs and risks.”

By reducing firms’ FTE staff costs and capital commitments for new technologies, the centralized functions also increase flexibility to reallocate investment dollars to your firm’s core differentiating services. With experienced global reconciliation staff in place, a flexible BPO process retains expertise and leverages it to quickly expand into new opportunities – markets, currency, asset classes, etc.

Today’s state-of-the-art BPO reconciliation solutions employ versatile, powerful and multifaceted technologies with the power to quickly enable any kind of reconciliation for any type of global asset, currency or financial institution. The reconciliation function can also flag and resolve exceptions based on customizable business rules, improving the ability to identify and minimize risk exposures while responding rapidly and costeffectively with sensitivity for local market regulations and business-model nuances.

Finally, they can address a high priority of many financial services firms: providing automated and centralized risk management across reconciliation processes enterprise-wide to help diverse financial firms identify, evaluate and remedy common and costly exception patterns in real time.

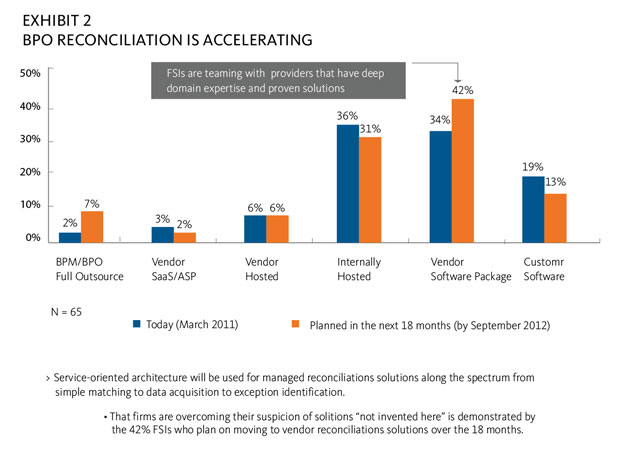

Tier 1 Banks have already heightened their reconciliation focus by adopting third-party reconciliation services. According to a Tower Group survey in 2011, only 2% of respondents had already implemented full reconciliation services. Over the next 18 months, respondents indicate that the adoption of outsourced reconciliation solutions will grow by 350%.

In choosing a BPO provider, financial services firms should require proven experience in implementing reconciliation solutions onschedule and on-budget. The chosen provider should also have a deep pool of talent to help clients make transitions or expand systems. The goal is to partner with a provider that can help your firm design and implement an industry-leading reconciliation utility, fully integrated with your core software and processes, onbudget and within a defined period of time.

As cost pressures and regulatory requirements continue to rise, financial firms should assess their current reconciliation capabilities across four key areas: Technology and Operations, Expertise, Risk and Cost.

Technology and operations provide the critical foundation for supporting enterprise-wide reconciliation transparency. Firms should also assess their current or planned capabilities to identify processing gaps that increase risks to the firm.

Reconciliation technology and operations must seamlessly handle inbound and outbound data mapping, matching and exception management across all global asset classes, with the business intelligence to provide value in new ways – by improving risk management and by enabling the optimization of business relationships.

Self-assessment: Technology & Operations Key questions firms should ask themselves to evaluate their reconciliation technology and operations are:

Reconciliation and exception management require a seasoned staff with strong domain knowledge, including the ability to evaluate and adopt the industry’s best practices across business units.

Self-assessment: Expertise

Key questions firms should ask themselves in evaluating their reconciliation expertise are:

A consolidated reconciliation function can be the key to enhanced risk management by: 1) identifying potential exposures before they occur; and 2) providing the expertise to appropriately respond to exceptions and issues, before they escalate costs and risks.

Self-assessment: Risk

Key questions firms should ask themselves in evaluating their risk management effectiveness:

As operating expense pressures continue to mount, financial firms must continue enhancing reconciliation while achieving cost savings and conserving capital.

Self-assessment: Operating Cost

Key questions firms should ask themselves in evaluating the cost of supporting their reconciliation capabilities are:

The benefits of working with an experienced service provider have evolved beyond cost-savings to include expertise and best practices without the costs of capital investments or staff expansion and expertise. The optimal partnership offers greater control and process standardization while enabling financial services firms to focus on current business needs including increased regulations, risk management requirements and cost pressures. As a result, leading firms are embracing the outsourcing of their reconciliation operations and technologies to attain the operational efficiency and transparency provided by a state-of-the-art utility.

Firms should select a reconciliation solution that is expandable – capable of enabling the addition of new reconciliation and global trading instruments and volume, in response to emerging issues and opportunities.

Finding the right partner in this area is essential to achieving the end-to-end operational controls your firm needs to grow business, reduce operational risk and realize cost savings. Be sure to seek a partner with proven functional expertise and deep understanding of your business based on an indepth assessment, plus the flexibility to operate within your environment.

This is where Broadridge comes in.

For more information about Broadridge products and solutions, please contact us at marketing@broadridge.com or +1 844 836 6773.