Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

Additional Broadridge resource:

View our Contact Us page for additional information.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

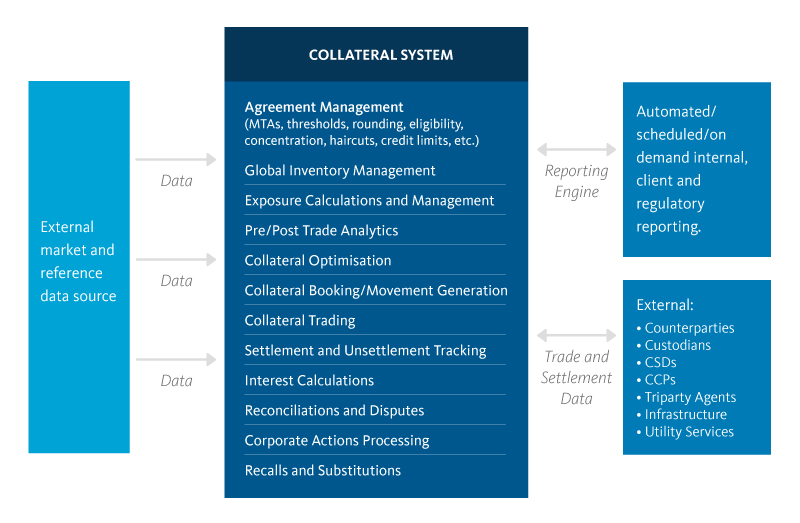

Gain a real-time view of global inventory and exposures through intuitive dashboards. Generate efficiencies through margin automation, collateral optimization, life cycle management, settlement and connectivity with market infrastructure.

Learn more about collateral management

Global inventory and exposure management

Trade life cycle processing

Connectivity

Reporting