Pathways to Profit

Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

Additional Broadridge resource:

View our Contact Us page for additional information.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Accelerate your business growth and offer your clients more market choices through real-time connectivity with trading systems, exchanges, regulators, CCPs, clearing centers, custodians and network providers. Our solutions help you increase operational efficiency on a cost-effective, low-risk basis.

Learn More About Our Global Transaction Life Cycle Connectivity

Front-Office Connectivity

Seamless communication with market services

Post-trade Connectivity

Transparent communication for reporting, netting, clearance and settlement, supporting business in over 70 markets

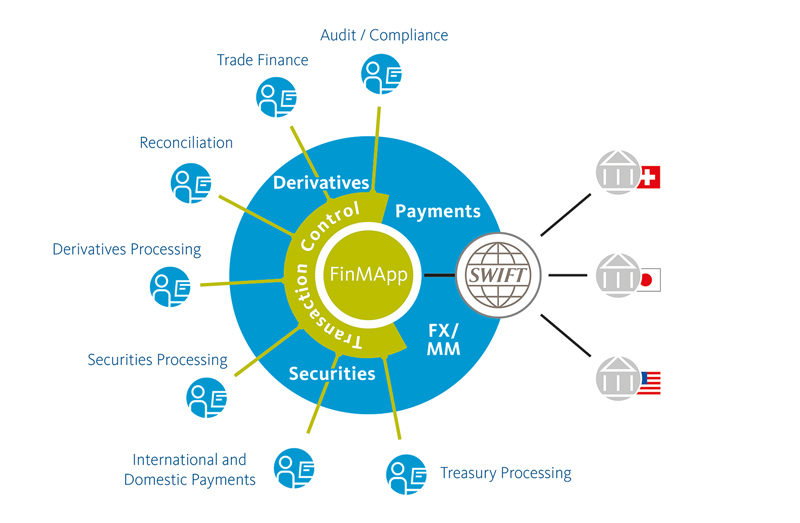

Global SWIFT Services

Reduce cost and risk and extend your service reach through our advanced SWIFT transaction processing and workflow management solution

Harmonized Inbound Clearing Reports

Efficient handling of balance and transnational data from CCPs, exchanges and clearing brokers

Industry Transformation