Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

Additional Broadridge resource:

View our Contact Us page for additional information.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

The era of client portals, cloud mobility and self-serve models for client management is upon us. While this may be good for the operational bottom line, it is having a domino effect on customer retention. Given that the issue of the “slippery client” is on the rise, many financial firms have shifted priorities from increasing their books of business to keeping the clients they have. If there is one word that defines trending business goals of financial services firms, it is “stickiness.” All financial services firms are looking for ways to entice clients to remain loyal customers. For buy-side, sell-side and wealth-focused firms, there is increased momentum behind fully paid lending (FPL) programs to help achieve this goal.

While FPL will be new to many, the business model is not. Formerly the bastion of institutional books of business in a securities-lending role, the FPL concept is now being employed on other long-only portfolios, such as high-net-worth books of business.

The concept and business goals behind traditional securities lending practices are relatively simple. Historically, it has been a practice adopted by banks and brokerage firms to leverage additional income on books of business, particularly long-only positions. It has provided market makers an avenue to generate fees for institutional portfolios through borrowing and lending securities in demand as collateral and for other purposes.

The institutional investor (the lender) offers a temporary loan of a position/group of securities to a borrower (a financial institution, such as a brokerage firm, bank or hedge fund). The loan generally has an intermediary who facilitates the transaction (broker/lending agent). Agreement on the terms of the loan, how the lender is paid and the revenue are all shared, as well as any other relevant details, and captured into a loan agreement.

The short answer is yes. FPL is trending. But the factors shaping its increased usage help clarify why. Given the advantages of FPL a decade past the subprime crisis environment, securities lending is going through a metamorphosis.

Trend #1: The buy side is getting more self-sufficient in this area after decades of handing their books to custodians as lending agents for a cut of the fees. Looking for increased revenue opportunities, many buy-side firms are eliminating the third-party lending agent and dealing with brokers directly. This buy-side trend to pull securities lending in-house is subtle but impactful to the industry. However, it is only noticeable to those on both sides of the former revenue stream, so this is a very quiet revolution.

Trend #2: The sell-side and remainder of the traditional borrower markets in securities lending (banks, hedge funds) are looking to target pools of securities to help expand their desk activities in securities lending. As baby boomer retirement pools are growing, it has become an area of increasing interest for sell-side firms to establish securities lending relationships with sophisticated investors.

Happenstance trend #3: As the sell-side pushes the envelope a bit further into the high-net worth of boomers and retail pools looking for sophisticated investors (especially for pools like hard-to-borrow stocks), the wealth sides of the financial services business are looking for ways to keep their clients happy.

In the era of disruptive technology, repapering with another firm has become easier. Loyalty is being tested by wooing business with client portals offering analytical tools, transparency and the ability to drill down into portfolio activity for a more enticing client investing experience. As wealth businesses are looking for ways to keep clients sticky and brokerage firms are looking to penetrate further into retail books, FPL programs are beginning to emerge.

FPL programs are attractive because they can service a multitude of business goals across diverse business groups in a financial services firm. However, they have some distinctions from traditional securities lending that firms need to address. Similar to any other securities initiative that migrates from institutionalonly to retail investors, hurdles of dealing with potentially less sophisticated investors get a little higher as the footprint to include the average investor firm expands. Regulatory scrutiny on this area is growing in line with the number of firms launching FPL programs.

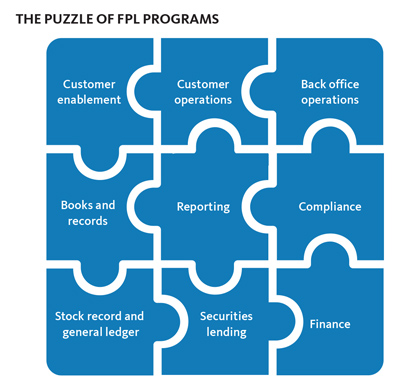

At first glance, establishing an FPL program appears to be a securities-lending business initiative. However, the mechanics to enable all the working pieces lie in other areas, including onboarding, client management, accounting, tax, reporting, compliance and legal. Any enterprise-wide initiative can be daunting to take on. FPL is no different.

The hurdles for clients of a firm contemplating FPL include:

Apart from these two core elements, a key component is raising awareness on the compensation structure for securities on loan. The legal and potential risk disclaimers and managing expectations of clients are also critical to get new FPL participants on the right track from the start.

Clients must understand the important differences between being in the program (having securities available to loan) and actually having securities on loan out of the program.

It is also important to discuss key aspects of the program, such as:

– Cause tax ramifications (i.e., payment in lieu, or PIL)

– Result in dividend income changing to cash payment and trigger tax impacts)

These components should be clarified so there are no surprises for anyone – and this discussion can vary depending on the jurisdiction in which the program is established, along with other factors.

Given that FPL programs move securities lending to the retail domain, this activity is coming under increased regulatory scrutiny. Regulators are looking to ensure retail investors have reasonable financial protections and treated as fairly as possible for allocation and execution. The rules governing FPL in various jurisdictions reflect that focus. Key examples of regulatory policy emerging for FPL programs include:

– Corporate action/tax impacts

– Whether investors who lend their shares are allowed to continue to trade as usual and sell them at any time without prior notice

– The stipulations and issues surrounding unwinding from an FPL program in whole or in part

Like any securities-industry initiative in its early stages, FPL is ramping up for competitiveness. Firms are starting with entrylevel programs for FPL, but will evolve in the coming years. More entrants will push existing players to create options to further entice existing clients to stay sticky. Hand in hand with this revolution will be the evolution of regulatory readiness threshold. These thresholds are likely to have different flavors across jurisdictional boundaries that must be incorporated for robust, global FPL offerings.

Early adopters of FPL programs may benefit from less onerous scrutiny for approvals to start a program, but the rules will evolve with more entrants. While this may give some firms a competitive edge in the early days of mainstream FPL, neither entrants nor participants in FPL programs anticipate these early-adopter approvals will be grandfathered. While movements on this front to retrofit the first firms into this space are still pending, some alignment should be anticipated at a future date.

While these may seem like high barriers to entry for firms bullish on setting up an FPL program, the good news is it is not an uphill struggle to sell FPL to clients. For many retail investors with long-only strategies, FPL programs provide an opportunity to earn additional income on positions in their portfolios without any action on their part other than signing up for the program. This makes the conversation on signing up much easier. We are unsure the members of Dire Straits had this concept in mind when they penned the song “Money for Nothing” in 1985, but it seems a quite fitting analogy for many long-only portfolio strategy participants who understand the business risks.

Any time an initiative can demonstrate it can service opportunities in multiple areas of the business from a single spend, it ascends the priority list for approvals. While business cases for FPL initiatives are complex to assemble, alignment on approvals is easier to obtain with a cohesive end-to-end picture and story. The program may be rolled out in increments over a longer period of time. However, assembling the planning pieces up front with a combination of current and sequential activities for the rollout are the most common and successful approaches to establishing FPL programs, while minimizing risk.

The short answer is that it depends on the marketplace where you plan to initiate an FPL program. Canada is on the verge of a major launch in the FPL marketplace and the U.S. is entering the second generation of FPL. Multi-jurisdictional offerings are anticipated as a next major step, but this area is still in its early stages.

Regardless of jurisdiction of origin (which is primarily Canada, the U.S. and U.K.), FPL programs are extending into client portfolios and searching for revenue-generating opportunities and attractive client offerings across local and international jurisdictions. As these programs continue to expand cross-border, regulatory bodies in impacted regions will assess effects on investors and retail participants in their own regional markets for this global exposure.

While we are in early days of a large competitive market for FPL programs, a shift in gears to the next level of sophistication is on the horizon. Fee structures are the obvious target for keeping clients sticky, but the nature of FPL programs themselves facilitates other options for competitive offerings:

While early adopters of FPL programs are in the U.S. and Canada, and the marketplace is a little more established in the U.K., many new entrants are ramping up to enter the business. Much like solving the famous Rubik’s Cube puzzle, assembling the technology and operational work flows to develop a competitive offering that also meets regulatory concerns can be daunting. This complexity is heightened as firms begin adopting a multijurisdictional model for global rollout.

As mentioned previously, many of those charged with the task of adopting an FPL program in firms often have an operational or securities-lending desk role. Before a firm seeks approvals externally with regulatory bodies to enter into a program, it must build its capabilities (and often approvals) from business units up and down the food chain. This includes those responsible for managing clients and the books of business in the firm. Legal counsel often represents the first gauntlet that must be passed as lawyers strive to protect the firms’ exposure and that of its underlying clients.

Achieving internal buy in for an FPL program involves a clear assessment of the potential market size from the firm’s existing clients. The number of potential new clients that could be attracted by the program can then be added to the assessment. This calculation helps to persuade internal stakeholders that the investment in an FPL program could be profitable for the firm and under what conditions.