Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

Additional Broadridge resource:

View our Contact Us page for additional information.

One of our sales representatives will contact you about your submission.

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.

Want to speak with a sales representative?

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Nos représentants et nos spécialistes sont prêts à vous apporter les solutions dont vous avez besoin pour faire progresser votre entreprise.

Vous voulez parler à un représentant commercial?

| Table Heading | |

|---|---|

| +1 800 353 0103 | Amérique du Nord |

| +1 905 470 2000 | Canada Markham |

| +1 416 350 0999 | Canada Toronto |

Votre soumission a été reçue. Nous communiquerons avec vous sous peu.

Vous souhaitez parler à un commercial ?

| Table Heading | |

|---|---|

| +1 800 353 0103 | Amérique du Nord |

| +1 905 470 2000 | Canada Markham |

| +1 416 350 0999 | Canada Toronto |

Broadridge’s new Canadian Account Transfer Solution solves an emerging problem for Canada’s dealer community and demonstrates its proactive commitment to enabling a better advisor experience, Opex efficiency and platform modernization.

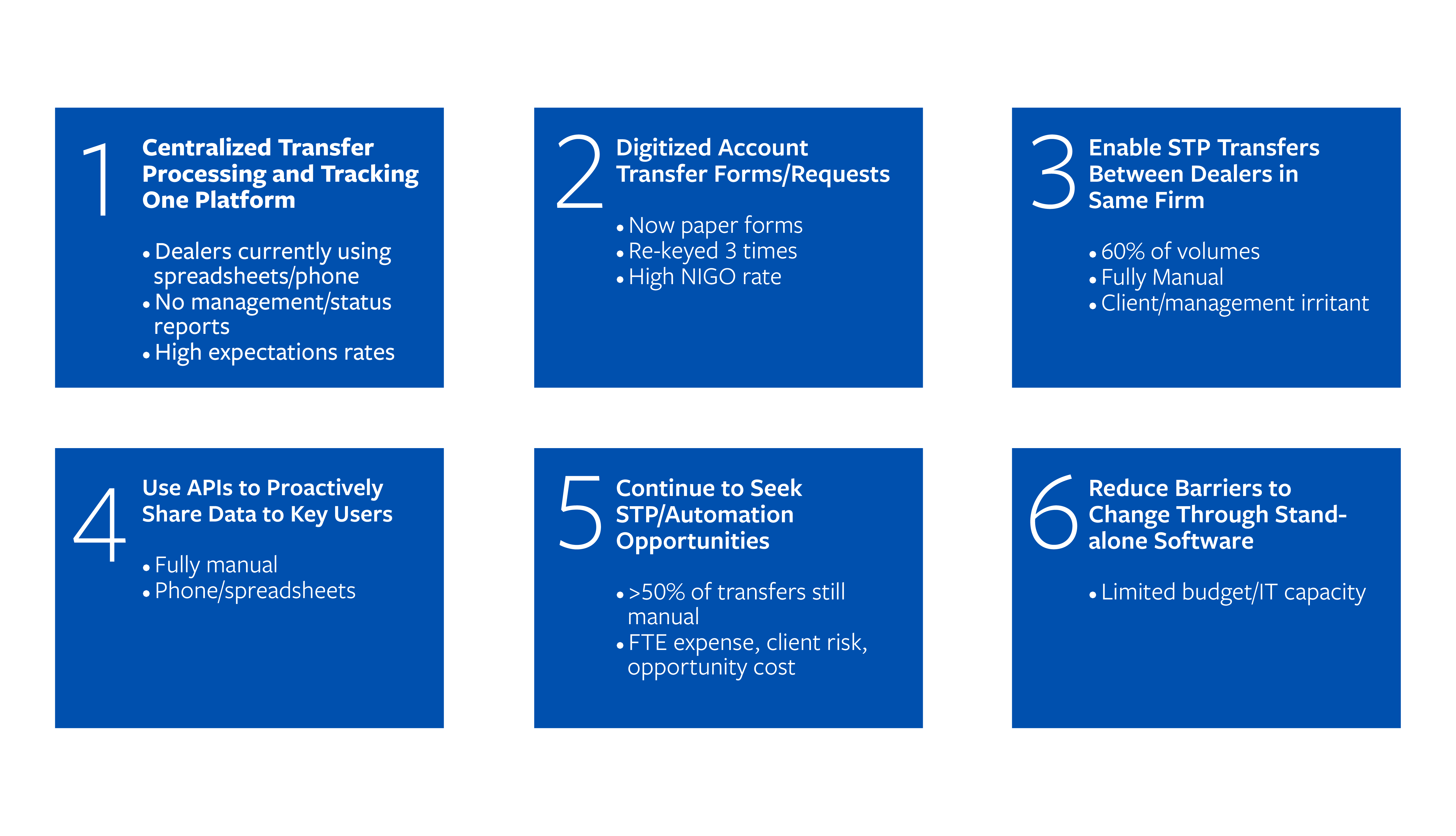

Automating end-to-end account transfers between the internal lines of business of financial institutions and between institutions themselves has been a persistent hurdle for the industry. And yet, this task has been easy for financial institutions to put off. Until now.

In June 2023, the Canadian Investment Regulatory Organization (CIRO) identified account transfer automation as an important future priority —elevating the need to modernize technology systems. And for good reason. In Canada, the high volume of account transfers and a significant lack of automation have been persistent obstacles to straight-through processing. Of the 4 to 8 million inbound and outbound transfers processed in Canada annually, more than 60% are done with little to no automation.*

More importantly, today’s account transfer process is often a frustrating experience across the entire journey — whether you’re an investor, advisor, or operations professional. Financial institutions that want to move clients from branch-registered investment accounts to their dealer accounts have to do so manually and face two- to four-week delays, lost records, and broken investment costs as underlying investments are often cashed out rather than moved in-kind. It is typical for processing Not in Good Order (NIGO) errors at each step to reach over 10% of volumes.* Some automation exists, such as CDS’ Account Transfer Online Notification (ATON), but the automation comes at the end of an astonishingly manual process.

A single, consolidated end-to-end digital workflow solution can simplify the account transfer process and represents an exciting path forward for institutions struggling with the status quo. But where to start, and is your tech stack up for the challenge?

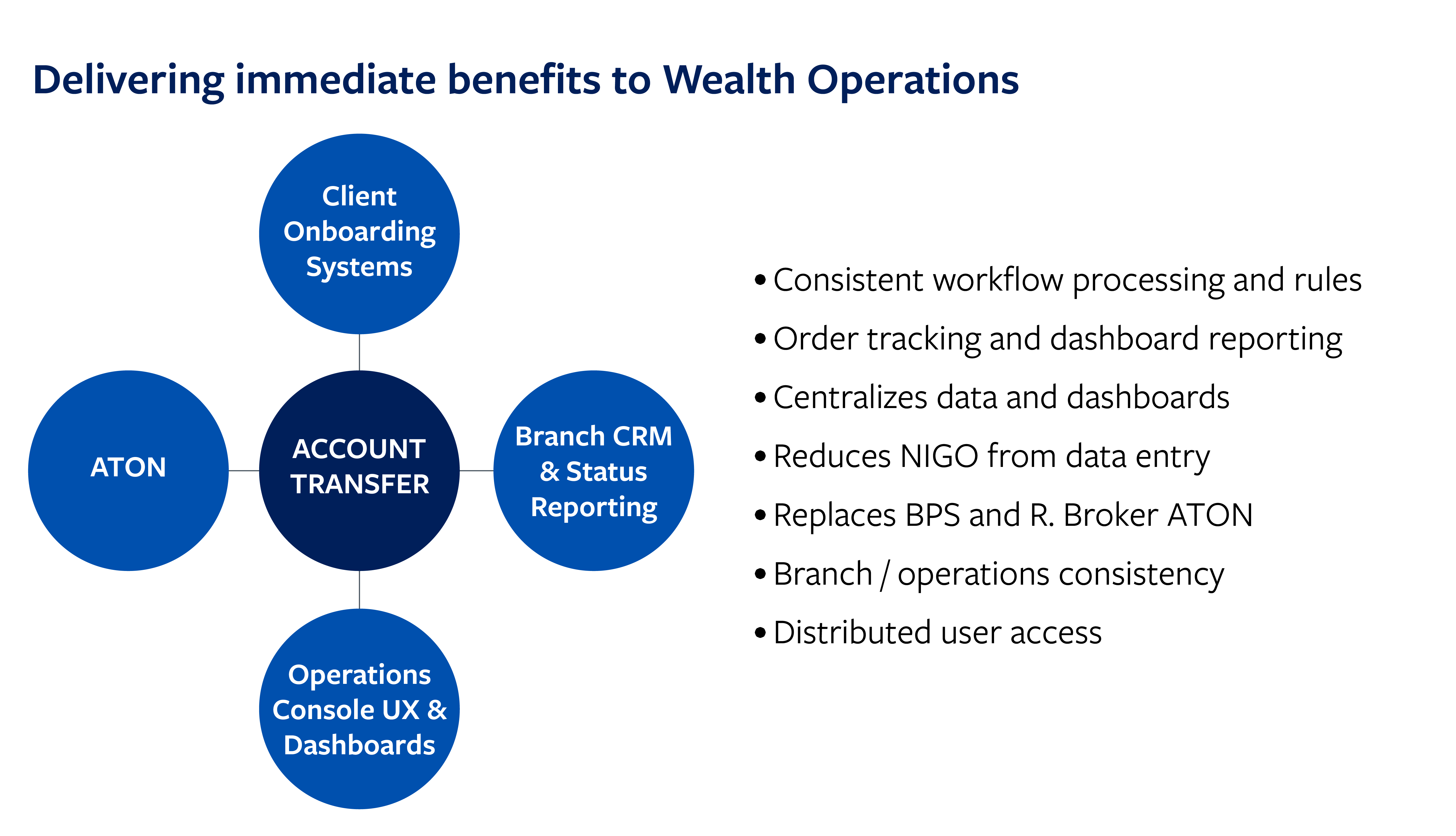

Broadridge’s Account Transfer Solution can solve the challenges of managing internal and external transfers on one platform by using consistent workflow and queue management to drive process visibility. The solution does not replace ATON; rather, it enables firms to automate in-house transfers further, and sets the stage to automate external transfers that ATON cannot process.

The inherent value of the Account Transfer Solution is its ability to integrate with dealer account record solutions, automatically interacting with them through APIs. The Broadridge solution:

Automating transfers reduces the need for manual front-office and back-office interventions, as you can establish, verify, and automate transfers through a single platform: the transfer agency platform.

With the help of stand-alone open architecture technology, financial institutions can streamline front and back offices by leveraging APIs to connect existing book of record (BOR) systems. Benefits of automation include:

“Automatically transferring from financial institution to financial institution is just the icing on the cake,” said Allan Grossman, Vice President of Product Management at Broadridge. “The first step is fixing the points of friction between channels within institutions.”

For financial institutions and independent dealers ready to act today, there is an opportunity to modernize legacy systems, gain a competitive edge, reduce costs, and increase workplace productivity. On the flipside, significant opportunity costs and risks lie in store for those who do not act.

“There are a lot of operational inconsistencies and manual tasks needed to transfer assets from account to account within a bank. ” “The time and human capital required to resolve errors manually are taxing on our resources. There are tremendous efficiencies we could unlock by leveraging our tech stack, but the challenge is where to begin.”

To help financial leaders move forward with automation, here are important considerations when selecting a solution and a partner:

In the face of declining IT budgets, an STP, API-enabled automation solution can be scaled to your needs and prime your enterprise for future innovation. While full automation is the goal, this complex undertaking can be broken down into manageable steps to accommodate your institution’s needs.

Broadridge’s new Account Transfer Solution for the Canadian market builds on the strength of transfers between intra-company investment systems, as well as a proven workflow and open-API strategy.

“Broadridge has been an important partner in helping us modernize our legacy systems. As they are already a partner who is familiar with our back office, they are ideally positioned to help us with this transformation,” said one Broadridge client.

As new CIRO regulations take shape and platform modernization becomes a greater priority, now is the time to act. Get ahead of regulations and give yourself an edge by learning more about automation and connecting with Broadridge. As the largest supplier of wealth management systems in Canada, Broadridge is often the BOR relinquishing and receiving requests for dealers. Broadridge’s experience, reputation, and reach across Canadian financial services make it uniquely positioned to bring automation to the marketplace.

It is time to end the errors and inefficiencies of today’s manual account transfer processes. Contact us today to modernize your tech stack and gain a competitive edge with Broadridge’s Account Transfer Solution.

*Sources: Broadridge, Stats Canada and Ernst & Young

Other Possible quotes to integrate:

“The vision of straight-through processing with little need for exception processing and manual intervention is our goal. It is within reach.” – Darren McNaughton, Vice President of Strategy

“Automating account transfers is an important first step in the convergence of the retail bank and wealth management to offer clients the simple, omnichannel experience they expect.” – Allan Grossman, Vice President of Product Management

Contact Us about what’s next for you

Contact UsOur representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |