Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

Additional Broadridge resource:

View our Contact Us page for additional information.

One of our sales representatives will contact you about your submission.

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.

Want to speak with a sales representative?

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Nos représentants et nos spécialistes sont prêts à vous apporter les solutions dont vous avez besoin pour faire progresser votre entreprise.

Vous voulez parler à un représentant commercial?

| Table Heading | |

|---|---|

| +1 800 353 0103 | Amérique du Nord |

| +1 905 470 2000 | Canada Markham |

| +1 416 350 0999 | Canada Toronto |

Votre soumission a été reçue. Nous communiquerons avec vous sous peu.

Vous souhaitez parler à un commercial ?

| Table Heading | |

|---|---|

| +1 800 353 0103 | Amérique du Nord |

| +1 905 470 2000 | Canada Markham |

| +1 416 350 0999 | Canada Toronto |

How technology simplification can drive competitive advantage throughout the trade lifecycle.

Capital markets firms are facing more challenges and complexity than ever before — and many technology ecosystems are straining to keep up. Expansions to new markets, new asset classes and new business strategies quickly reveal when existing ecosystems are pushed beyond their capabilities. Meanwhile, the steadily growing requirements of regulatory reporting and compliance are forcing firms to prioritize transparency and traceability of data as we progress toward a T+0 future.

As business needs and strategies become more complex, success depends upon simplification. Many firms are concerned about the risks and disruption large scale simplification or “digital transformation” efforts often create. But done well, simplification takes a phased approach that is evolutionary rather than revolutionary, implemented in a series of incremental steps: a chain of wins rather than one big bang. Over time, legacy systems (and problems) phase out while new, better, modular solutions phase in, resulting in a dramatically simplified and modernized technology footprint.

The resulting benefits are well worth the investment of time and resources. We estimate that simplification across the trade lifecycle can reduce addressable costs by 20–30% in key areas such as reference data management, reconciliations, clearing and settlement, middle office, regulatory reporting and overall application footprint. It can simultaneously enhance business growth while reducing risk. Simplifying the technology that supports trading and post-trade functions can transform it from a high-maintenance cost center to a high-value competitive advantage.

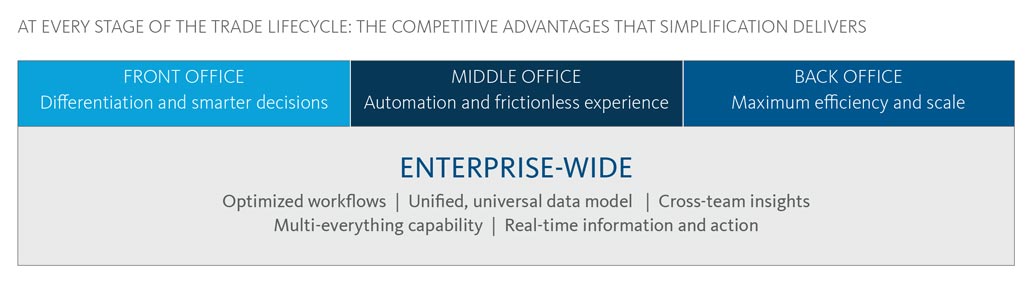

In fact, an optimized, simplified technology ecosystem becomes a force multiplier at every stage of the trade lifecycle. Competitive advantage takes different forms as you move through the stages — manifesting as differentiation in the front office and maximum efficiency and scale in the back — but what is consistent is that a strong tech foundation helps separate leaders from the rest.

In this white paper, we examine the current market context, the numerous competitive advantages that technology simplification enables, and the practical challenges and considerations to keep in mind when developing a successful action plan. Our team at Broadridge has helped guide many leading firms through the process of planning and executing their simplification roadmap. Please get in touch to find out how we can help you move your technology and business forward.

"Simplifying the technology that supports trading and post-trade functions can transform it from a high-maintenance cost center to a high-value competitive advantage."

VIJAY MAYADAS,

PRESIDENT, CAPITAL MARKETS, BROADRIDGE

DEFINING SIMPLIFICATION

By Justin Llewellyn-Jones, Head of Capital Markets, North America, Broadridge

When we talk about “simplifying” trading and post-trade technologies, what we mean is eliminating all the friction between applications, both in the back-end architecture and in the front-end user experience. The friction may arise from a multitude of issues; incompatible or redundant solutions, disparate data formats, manual workarounds, and siloed platforms that each serve a single asset class or market are some of the most common problems. By streamlining and consolidating systems, we can smooth away the friction points that slow trading and operations, cause errors and increase costs. When a firm’s technology operates more smoothly, their business is better able to thrive; they have greater ability to allocate resources and create strategies that meet client needs, drive revenue growth and preserve or even expand margins.

In case the idea of simplification conjures a vision of a generic or homogenous solution, rest assured that the simplification we are striving for will embrace specialization (of asset classes, geographies and business segments) along with a fluid common language flowing between and connecting applications. A platform- and provider-agnostic data model is a key catalyst for a frictionless architecture, and as such it is a core focus in our innovation roadmap. We’re working to facilitate the process of simplification so our clients can accelerate their success.

GROWING PRESSURES FACING CAPITAL MARKETS FIRMS

Sell-side and buy-side firms simultaneously strive to reduce costs and risks while strengthening their agility and ability to grow. Today, these commonplace challenges are exacerbated by increasing pressures from both external and internal forces.

THE EXTERNAL ENVIRONMENT REMAINS UNCERTAIN

What a difference a few months makes. By the end of 2021, global markets seemed to have recovered from the impact of COVID-19, with the S&P 500 up 26.9%, the FTSE 100 up 14.3%, and the Nikkei 225 up 4.9%. But the first quarter of 2022 has brought the Russia-Ukraine war along with rising interest rates and inflation. Moreover, looking to the US, midterm election years typically bring increased volatility and the potential for a sell-off in stocks. All of these factors make the near future highly unpredictable and highly challenging to navigate.

REGULATORY PRESSURE IS GROWING

The continued pressures of regulatory mandates such as Dodd-Frank, MiFID II, CAT, EMIR, SFTR and 10C-1 are compelling capital markets firms to prioritize transparency and traceability in their trade and transaction reporting, while CSDR in Europe commands a more efficient settlement regime. Meanwhile, in response to the global climate crisis, regulators have proposed new requirements for ESG disclosures, most notably in the European Union with the continued rollout of SFDR, and in the UK with the proposed SDR. Asian market regimes have started to issue their own ESG disclosure requirements. While the onus of disclosures is on buy-side firms, sell-side firms will need to support them with ESG data management across the trade lifecycle. New requirements create new workflows, adding to firms’ operational burdens.

MARGIN PRESSURE IS INCREASING

Increasing competition and the growth of passive management continues to squeeze buy-side margins. As buy-side firms face shrinking margins and seek greater efficiency, electronic trading has surged. In fixed income, for example, according to Coalition Greenwich, from 2017 to 2020 US investment grade and high yield bond electronic trading grew by 111% and 145%, respectively, while Europe saw 61% growth.1 As a result, sell-side firms must invest in new trading solutions to keep up. The boom in electronification delivers numerous benefits — efficiency, transparency, better risk management, and easier reporting – but the move to low-touch/no-touch flows also means brokers see compression of their commissions. Additionally, MiFID II’s mandated unbundling of research from execution puts more pressure on firms’ profitability.

EXPANSION ACROSS ASSET CLASSES, GEOGRAPHIES AND BUSINESS SEGMENTS

Firms’ growth strategies are inevitably focused on adding additional asset classes, geographies or business segments to their platform. This includes the need to add new asset classes such as cryptocurrencies. But given that many existing trading and post-trade technologies specialize in a single asset class (and often within one region), it’s historically been easier for banks and broker-dealers to just stand up a whole new system rather than struggle to extend an existing solution (from equities to futures, for example). When that process is multiplied across the many businesses of a global organization—and again across the front, middle, and back offices—the result is a veritable spaghetti-bowl of systems making up the trade lifecycle infrastructure. This fragmented, siloed approach creates complexity, inefficiency and risk—all of which further challenge teams and technology.

THE CONSTANT NEED TO AUTOMATE

Even as firms focus on maximizing efficiency and minimizing costs, they still need to deliver topline revenue growth. Additionally, the accelerating pace of industry innovation raises client expectations, demanding attention and investment. To address these increasing demands competitively, firms need to automate workflows throughout the trade lifecycle to optimize their productivity. A few key technologies can help super-charge automation efforts. Algorithmic trading, which accounts for approximately 20% of all institutional foreign exchange trading volume and half of all equity trading volume,2 is growing year-on-year due to its superhuman speed and efficiency. Artificial intelligence (AI) can accelerate many workflows, from liquidity sourcing and trade execution to flagging and resolving data breaks. Distributed ledger technology might be the epitome of automation, given that the single immutable database supports real-time visibility and eliminates the need for reconciliations altogether. As competitors embrace automation technologies, both sell-side and buy-side firms feel greater urgency to keep up — or risk being left behind.

Successfully addressing these pressures requires enterprise-wide commitment and the technology and partner strategy to match. On the following pages, we’ll explore how technology simplification can prepare firms to anticipate and respond to new pressures while also delivering competitive advantages.

Tomorrow’s capital markets leaders will reframe the way they see their technology: instead of seeing a high-maintenance cost center, they will recognize a high-value competitive advantage. Furthermore, that competitive advantage isn’t singular in nature but rather a whole host of advantages that span each stage of the trade lifecycle as well as across the enterprise. As a result, an optimized, simplified tech stack becomes a force multiplier at every step.

IN THE FRONT OFFICE: DIFFERENTIATION AND SMARTER DECISIONS

Ideally, the trading tech stack should easily handle market access, client connectivity, analytics and order management in a seamless user experience so that traders can focus on optimizing their performance and differentiating themselves. But too often, a multitude of disjointed systems prevents traders from operating at their peak, at a time when margin pressure is only increasing.

Take as an example the client onboarding process, a common area of complaint. Onboarding can take weeks or even months if teams need to manually set up client accounts in five or ten different systems; different formats and information priorities cause headaches and delay. The onboarding experience sets the tone for the overall client relationship. Simplifying and automating this process drastically speeds up the process and improves the experience for both trader and client.

For global firms with trading desks in multiple regions and distinct platforms for each, teams suffer from a lack of transparency into each other’s activities. As one trader’s workday begins, not knowing where their counterparts netted out when their days ended can be highly problematic. Differing regulatory reporting and supervisory requirements also add complexity to the global picture.

"For front-office teams, technology can be a critical accelerator for success, or a source of friction in the execution of their workflows."

RAY TIERNEY,

PRESIDENT, TRADING AND CONNECTIVITY SOLUTIONS, BROADRIDGE

As buy-side firms increasingly embrace multi-asset and multi-geography strategies, their counterparts on sell-side trading desks must jump between applications and screens, losing precious time and efficiency. That time becomes ever more valuable as the speed of trading ramps up, from milliseconds to microseconds to nanoseconds. Furthermore, without a common language connecting disparate applications, translation between systems creates an additional burden. Initially, the adoption of cross-asset technology was relatively slow due to market structure differences between asset classes, siloed business lines within banks, and legacy technology stacks across products — but cross-asset solutions are powerful in their benefits and the pace of change has accelerated.

Simplifying the sell-side trading technology stack with a modular, cross-asset, multi-geography shared services approach (rather than relying on monolithic systems) makes for easier integration with traders’ preferred workflows. A comprehensive dashboard approach can accommodate the unique requirements of each asset class while unifying them in one view, empowering traders with the data and analytics they need to make smarter decisions, faster. In addition, to stay ahead of the competition, traders need to understand the quality of their execution and the costs of their transactions — tasks that are made much easier by integrated analytics.

The advantages of front-office tech simplification are tangible and significant. According to McKinsey, for the top 12 banks, a better technology architecture could improve revenue by up to $200 million a year, driven by improved cross-selling, faster and smarter trading, more efficient allocation of credit and an enhanced ability to launch new products.3

IN THE MIDDLE OFFICE: AUTOMATION AND FRICTIONLESS EXPERIENCE

As trades are executed—and flow into the middle office for allocation, confirmation and affirmation—the beginning of that post-trade journey is often marked by fragmentation and manual intervention. The trade capture process that serves as the intersection of front-office and post-trade functions is the root of many issues because disparate processing platforms often don’t seamlessly connect to front-office or clearing and settlement systems, and each have their own ingestion specifications. Indeed, according to recent research by Firebrand, only 14% of respondent firms have a single system for processing all of their asset classes; all the rest have silos by asset class and by geography.4

"Only 14% of sell-side firms have a single system for processing all of their asset classes."

-FIREBRAND RESEARCH

REALIZING THE SELL-SIDE DREAM OF A SINGLE OEMS AND A UNIFIED UX

By Shantanu Goyal, Product Manager, Agency Trading Solutions, Broadridge

Broadridge’s innovation roadmap for the front office has an ambitious goal: to develop a truly universal OEMS that can accommodate any region and any asset class, all within a unified user experience. While this will require substantial effort and investment, we see the transformative value it will bring to our clients and know that it will be worthwhile.

We are executing this horizontal simplification in two major phases. First, we will integrate functionality across regions within each asset class, accounting for the many evolving requirements and standards in each regime. This initial development will provide shared visibility to global teams through the same unified view. Then, we will bring together all electronified asset classes globally to empower our clients with the cross-asset technology they need to stay ahead.

While our goal is ambitious, we are building from a strong foundation with a global OEMS platform that already incorporates multiple geographies and asset classes (equities, listed derivatives, FX, and ETFs). In fact, we have already helped numerous top-tier banks and brokers simplify their trading tech stacks; in one recent case, we delivered a single trading hub that replaced 13 disparate legacy systems. Overall, we are confident that our OEMS solution will serve as a futureproof accelerator for our clients’ business agility and growth.

Without API-driven and harmonized interoperability, this fragmentation forces middle office teams to navigate multiple systems and resort to using spreadsheets, emails, and manual checks, leading to incorrect or missing data and costly settlement failures down the line. The DTCC estimates that a trade settlement failure rate of just 2% costs firms up to $3 billion globally.5

That’s where technology simplification can lend a competitive advantage: by automating the ingestion of data and the processing of transactions. If trade capture can be done once and well, with an interoperable platform that produces harmonized data across asset classes and geographies, middle-office teams are empowered with a comprehensive view of post-trade processing. Trade breaks and mismatches can be identified and resolved earlier in the trade journey, saving valuable time and money in settlement operations.

Furthermore, the frictionless experience afforded by an optimized middle-office infrastructure improves interactions between the buy-side and sell-side. Today, a buy-side firm with a multi-asset trading desk might receive communications from different systems in different formats from their sell-side counterpart. This disjointed service can degrade the client experience. The smoother and faster the allocation, confirmation and affirmation processes are, the more positive client relationships can be. In the US, the need for change is even more pressing, as equities, corporate and municipal bonds, and UITs move toward T+1 settlement in 2024, requiring same-day affirmation.

IN THE BACK OFFICE: MAXIMUM EFFICIENCY AND SCALE

Competitive advantage from technology simplification in the back office manifests as total efficiency and the ability to scale, but achieving these qualities is increasingly challenging. Expanded demands on post-trade systems, increased regulatory and market change requirements, and increased volatility and volume require either new workarounds or new investments.

To operate at peak efficiency, banks and brokers must minimize manual intervention in favor of automation. Manual processes increase the risk of errors, especially if reference data is inaccurate, unstructured or procured from multiple sources. The need to automate is especially urgent in the area of settlements, given the threat of stiff fines or mandatory buy-ins from the EU’s CSDR regime. Automation and AI-driven predictive analytics make it possible for organizations to identify problems arising in the trade settlement process well in advance of them actually materializing.

MOVING TOWARD AN ALL-PURPOSE MIDDLE-OFFICE SOLUTION

By Neha Singh, Vice President, Product Strategy & Innovation, Broadridge

It’s no small task to unify disparate middle-office platforms The silos by asset class and region that exist at many global businesses have calcified over time, to the point where it somehow seems easier to let humans hop between silos rather than find a way to make the different technologies talk to each other.

Broadridge is working to solve this problem with a modular, automated solution that will normalize, harmonize and enrich all incoming and outgoing data at the point of trade capture. By creating an integrated layer that accounts for the unique specifications of every asset class, and the different requirements of global market regimes, we will dramatically ease the burden on middle-office teams. In addition, use of machine learning to process unstructured allocations (often a high proportion of the total) will significantly reduce the need for manual intervention. Building on the innovation work we’ve already done to simplify our own post-trade platform’s trade capture process, we are extending that capability with an API-driven framework to create a universally adoptable and interoperable middle-office solution. By bringing together all inputs, views and alerts into one unified interface, we can streamline exception management across the trade lifecycle and help teams concentrate on client service, risk management and other higher-value activities.

As active managers search for yield in alternative asset classes, such as commodities, real estate and even crypto assets, and expand their use of more esoteric fixed income and derivative instruments, post-trade operations are challenged to keep up. As mentioned earlier, the vast majority of sell-side firms do not have a single system for processing all of their instruments but rather have silos by asset class and geographic region.

"Even as desks and staff consolidate their coverage, the systems that support these activities remain separate. As a result, many traders must use different systems to manage orders and execute trades, and operations staff find themselves interacting with multiple and separate middle-office and back-office infrastructures."

SANTOSH VAZARKAR, PRODUCT HEAD,

GLOBAL POST-TRADE, BROADRIDGE

A multi-asset post-trade solution with a consolidated workflow and view across all asset classes optimizes processing times and exception management. It also reduces the cost, complexity and risks of running multiple operations and technology silos. With a central view of holdings, this multi-asset approach also supports a more efficient and effective financing and collateral management function while reducing exposure to costly buy-ins to cover settlement shortfalls.

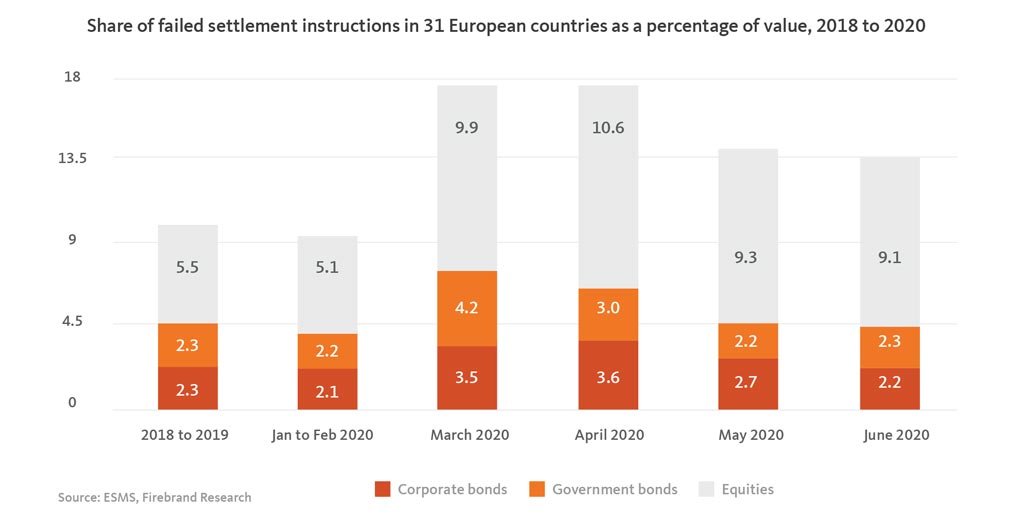

Indeed, with the increases in volatility driven by the COVID pandemic and geopolitical uncertainty, the number of settlement failures has grown as well. During the early months of the global lockdown, settlement failures increased over the usual norms for bonds and equities, as highlighted by the below statistics provided by the European Securities and Markets Authority (ESMA) and Firebrand Research.6 The chart highlights the percentage of instructions that failed as a share of the total value of settlement instructions across 31 European countries for the specific period of extreme volatility during 2020 compared to the averages over the previous two years.

According to Firebrand’s research, settlement failures tend to result from manual processes in the middle office around trade confirmation, manual dependencies elsewhere (e.g., data errors), and in the back office if systems are inefficient or lacking in required scalability to meet market volume increases.7 Outsourcing back-office processes to a mutualized solution provider like Broadridge solves the issue of scalability, as it enables a firm to scale its operations up or down depending on volume and demand. The flexibility also ensures that firms are only spending what they need to.

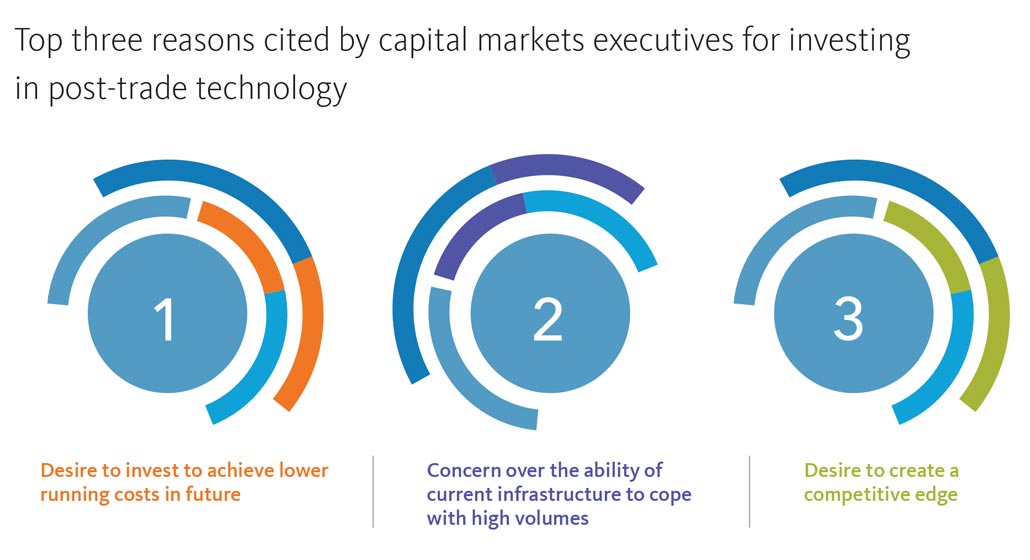

Recent research conducted by Acuiti on behalf of Broadridge confirms the appeal of the tech-driven benefits described above.8 Capital markets executives were asked which factors drove their desire to invest in post-trade technology. Overall, achieving lower running costs was the dominant motivation, followed by concern over the ability of current infrastructure to cope with high volumes as the second-ranked reason. The third most common factor driving post-trade investment was the desire to create a competitive edge. This suggests that sell-side executives are increasingly viewing spend on post-trade as a business investment rather than an operational cost, and one that will create efficiencies and enable better service for clients.

ACROSS THE ENTERPRISE: A WIDE RANGE OF POWERFUL BENEFITS

Zooming out from the individual stages of the trade lifecycle to view the capital markets enterprise as a whole, it’s clear that technology simplification delivers a range of competitive advantages that span firm-wide.

OPTIMIZED WORKFLOWS

Through componentization, interoperability and automation, a simplified tech stack optimizes workflows across teams, asset classes and geographies. Tailored, automated workflows minimize risk and maximize efficiency, while unified user experiences eliminate the jarring disruption of switching between systems. Looking at the next five to ten years, we believe synchronous multi-party workflows will become the gold standard for optimized workflows (see graph).

UNIFIED, UNIVERSAL DATA MODEL

When a firm’s tech architecture embraces a single harmonized data model, everything simply runs more smoothly. Standardizing and normalizing the data that is the lifeblood of any trading operation has tremendous value. Making that clean, structured data accessible to all the various components across the trade lifecycle means fewer breaks, less need for manual intervention and, as we’ll discuss below, valuable insights.

REAL-TIME, CROSS-TEAM INSIGHTS

Having one universal data source with intraday/real-time access helps data and insights flow not just front-to-back, but back-to-front as well. With a simplified and interconnected tech stack, capital markets firms gain significant value from the visibility into each stage of the trade lifecycle. This real-time, two-way flow of information benefits numerous areas:

MULTI-EVERYTHING READINESS

The leaders of tomorrow are ready to succeed in a “multi-everything” world — multi-asset, multi-region, multi-currency, multi-strategy. But this growth and expansion have significant implications on technology for both front-office and post-trade teams, as we’ve explored previously. It’s time for the industry to embrace simplified and consolidated cross-asset, global technology solutions that can create value throughout the trade lifecycle.

THE FUTURE OF WORKFLOWS IS SYNCHRONOUS MULTI-PARTY

By Vijay Mayadas, President, Capital Markets, Broadridge

In use cases where multiple parties are transacting in real-time—such as bilateral repo—workflows and timelines would be vastly improved by synchronous multi-party platforms enabled through smart contracts. In its most basic application, having an immutable, shared digital representation of a trade would cut down on back-and-forth communications as well as redundancies; for example, in situations where counterparties settle on an agreement but then track it in different systems.

In the repo market, Broadridge’s Distributed Ledger Repo (DLR) provides a single platform where market participants can agree, execute and settle repo transactions. Furthermore, DLR allows for the immobilization of the underlying securities in the repo transactions, while transferring ownership via smart contracts executed on the platform. The platform’s functionality significantly reduces the operating cost and risk of all repo activity, including intraday, overnight and term repos, both on a bilateral and an intracompany basis and also reduces counterparty risk while increasing auditability. Synchronous multi-party workflows will be game-changing on many fronts.

With all the competitive advantages that technology simplification delivers for capital markets firms, it would seem like an essential part of any firm’s business plan. Optimizing one’s tech infrastructure has dramatic, tangible effects on firm P&Ls, enabling higher topline revenue as well as lower operational costs. McKinsey estimates that the combined value impact of these benefits for a large bank with a technology budget of about $3 billion can be as high as $1.1 billion annually.9

But the digital transformation that is necessary is often difficult to achieve — in fact, academic research suggests that in general, 70 percent of transformation initiatives fail,10 and Accenture has found that capital markets firms struggle with digital innovation more than companies in other sectors of financial services.11

We know that digital transformation and tech simplification are necessary, but some key challenges stop some firms from embarking on their journeys to drive change.

In addition, the non-technical aspect of change management is another daunting challenge. In research conducted by Oxford Economics and Accenture among capital markets firms, “lack of change management expertise” was the top obstacle to achieving the desired results from technology investments.12

But perhaps the biggest challenge for a firm looking to simplify a tangled and complex infrastructure is just figuring out where to start. This is where an experienced technology partner can provide consultative expertise: in mapping a target operating model, finding “open windows” to prioritize and supporting an evolutionary, phased approach to execution. As the saying goes, the first step is the hardest; but with a clear map and the momentum of incremental wins, simplification is achievable.

What’s standing in the way of digital transformation?

According to capital markets senior executives from our 2022 Broadridge Digital Transformation and Next-Gen Technology Survey, the top three challenges in driving digital transformation are:

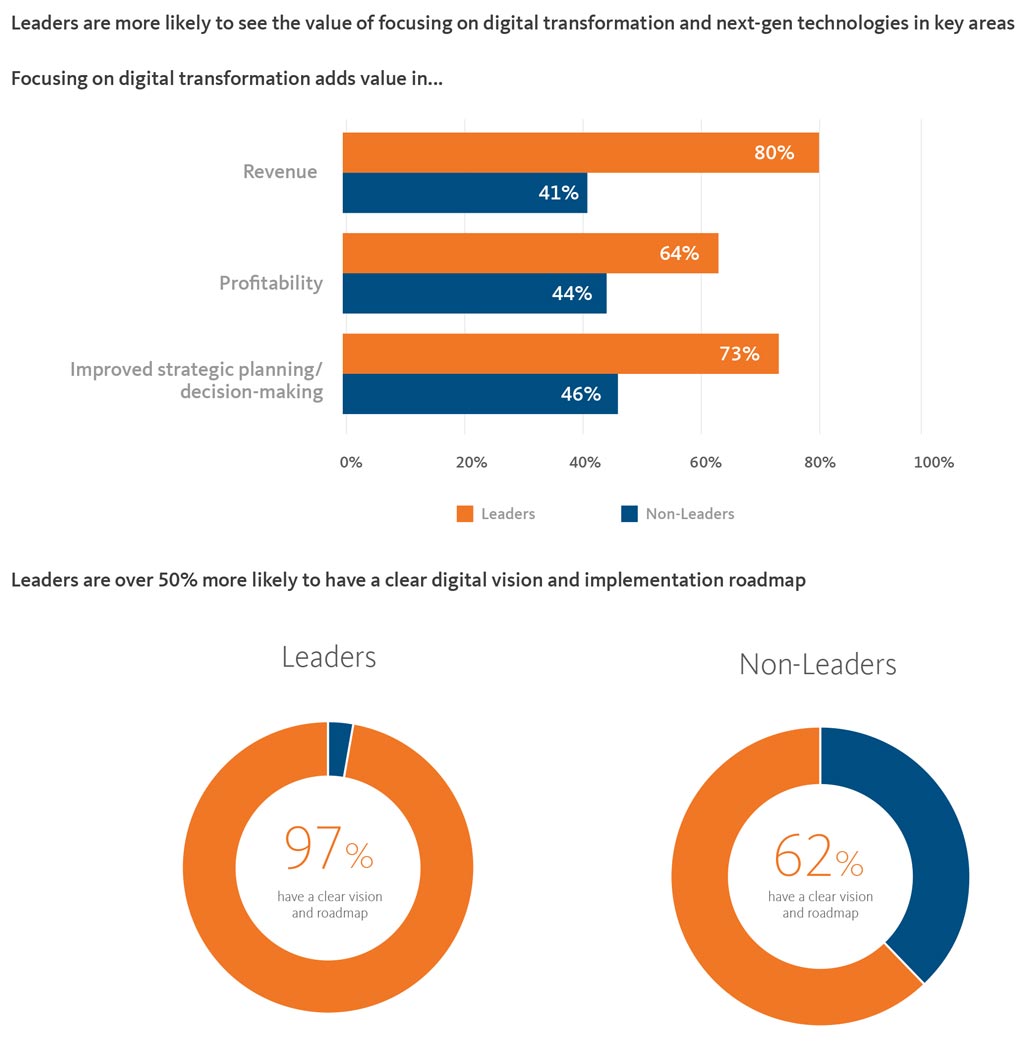

Despite the challenges in driving simplification, some firms are leading the way and offer best practices worth emulating.

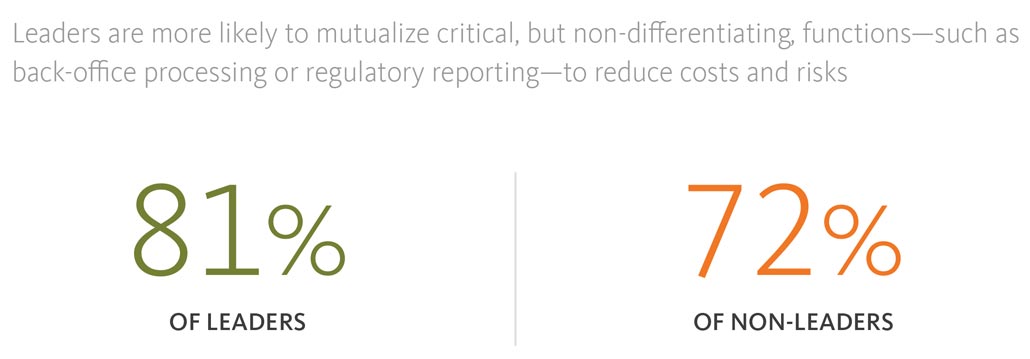

In the previously mentioned 2022 Broadridge Digital Transformation and Next-Gen Technology Survey of C-suite executives from 750 firms globally (1/3 of whom were capital markets firms), we created a scoring model for digital maturity based on firms’ digitalization and adoption of next-gen technologies as well as overall strategic and organizational factors. The top quartile of firms ranked as “Leaders” in this framework.

Among capital markets Leaders, there were some notable differences in their mindsets and actions compared to Non-Leaders.

KEY TAKEAWAYS

When we consider these differences, here’s what we can learn from these Leaders:

"Tier-1 firms are increasingly open to outsourcing non-differentiated processes. Some take a strategic approach to transform a core function, yet others adopt a ‘tactical’ outsourcing model to deal with specific pain points, such as reconciliations."

SAMIR PANDIRI, PRESIDENT,

BROADRIDGE INTERNATIONAL

After considering all the manifestations of competitive advantage that derive from simplifying trading and post-trade technologies, we have identified some universal principles for successful simplification — the principles that guide our own innovation roadmap.

COMPONENTIZATION

Many legacy technology ecosystems were formed on an ad hoc basis over time by tightly stitching together applications and workaround builds done in-house. But the resulting super-monoliths become extremely difficult to update without tearing them down completely. Building modular, standalone and discrete solutions in a service-based architecture enables firms to easily deploy and upgrade new component capabilities without impacting all the others. This is a fundamental shift that will allow for efficiency and extensibility, while ensuring ecosystems never again fall into obsolescence.

INTEROPERABILITY

If the infrastructure that supports these organizations is to be simplified, the streamlined systems that run these businesses must be able to interact seamlessly. This interoperability relies on consistency: consistency in data integrity and messaging, as well as consistency between the independent component parts. Consistency comes from well-designed back-end APIs but also front-end interfaces that allow users to jump easily from one application to the next. Creating a consistent API framework and user experience smooths workflows across independent solutions and providers.

SCALABILITY

Designing for elastic scalability, both up and down and on-demand, empowers firms to launch new products easily and adapt to changing volumes. As same-day settlement paradigms emerge for more asset classes requiring real-time transaction processing, scalability becomes non-negotiable. As a result, many firms are shifting to using scalable and distributed cloud-based environments that employ on-demand compute power, providing easily accessible capacity when required. Not only can this approach keep pace with the demands of real-time processing, it also creates invaluable flexibility, allowing firms to pay for only the compute power they need, when they need it.

DATA MASTERY

Ensuring the quality, consistency and reliability of data reduces the time and resources spent on data reconciliation.

It also facilitates the interoperability of solutions, and provides a solid platform for all other modernization and simplification initiatives. Engineering a common language and cross-team access to a consolidated pool of data ensures greater integrity and traceability, streamlines operations and unlocks new intraday insights.

SIMPLIFYING TRADE DATA WITH BRX

By Hugh Daly, General Manager, Enterprise Solutions, Head of Capital Markets Data Strategy, Broadridge

Broadridge is focused on helping the industry achieve data mastery from front-to-back, with a data ontology model called BRX. BRX structures and distills trade data across asset classes so that the most important, mutually exclusive and collectively exhaustive attributes are captured in a platform-agnostic modeling language.

The resulting repository of clean, normalized data becomes a central engine for both trading and post-trade functions, ingesting trade data, distributing it into middle- and back-office solutions, and providing unprecedented insights. The two-way flow of data across the enterprise creates new value: front-office data informs downstream functions, including regulatory reporting and reconciliations, while post-trade data informs upstream functions via insights on balance sheet optimization and client analytics.

Defining a clear technology vision and implementation roadmap is the first — and most important — step firms must take to move their businesses forward. Here are some key questions to ask for charting your own path ahead:

Once you’ve thought through these questions, it’s time to work through some action items that will inform your simplification plan:

BROADRIDGE CAN HELP YOU MOVE YOUR BUSINESS FORWARD

When internal teams and resources are constrained, you might not have the freedom or time to easily “see around the corner” to what challenges and opportunities come next.

That’s where external Fintech leaders like Broadridge can play a key role: with dedicated innovation teams, we help our clients anticipate what’s next and modernize their tech stacks to keep up.

We are committed to helping our clients optimize every stage of the trade lifecycle with a comprehensive ecosystem of modular, best-in-breed solutions and a consultative team of subject matter experts. With our recent acquisition of Itiviti, a global leader in trading and connectivity solutions, our capabilities set is now even stronger. With our teams and technology supporting you, you can embark upon your simplification journey with greater confidence and speed.

Get in touch to learn how we can help move your business forward.

ENDNOTES

1.US outpaces Europe in electronic bond trading growth, report finds,” The Trade, July 2021.

2.Algorithmic trading sees growth in the FX market,” World Finance, July 2021.

3.A Foundation for Value in Capital Markets, McKinsey, 2017.

4.The Case for a Multi-Asset Post-Trade Approach, Firebrand Research in collaboration with Broadridge, 2021.

6.The Case for a Multi-Asset Post-Trade Approach, Firebrand Research in collaboration with Broadridge, 2021.

7.Ibid.

8.The Growing Need to Invest in Derivatives Post-Trade, Acuiti, 2020.

9.A Foundation for Value in Capital Markets, McKinsey, 2017.

10.Why Do Most Transformations Fail? A Conversation with Harry Robinson, McKinsey, 2019.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |