Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

Additional Broadridge resource:

View our Contact Us page for additional information.

One of our sales representatives will contact you about your submission.

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.

Want to speak with a sales representative?

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Nos représentants et nos spécialistes sont prêts à vous apporter les solutions dont vous avez besoin pour faire progresser votre entreprise.

Vous voulez parler à un représentant commercial?

| Table Heading | |

|---|---|

| +1 800 353 0103 | Amérique du Nord |

| +1 905 470 2000 | Canada Markham |

| +1 416 350 0999 | Canada Toronto |

Votre soumission a été reçue. Nous communiquerons avec vous sous peu.

Vous souhaitez parler à un commercial ?

| Table Heading | |

|---|---|

| +1 800 353 0103 | Amérique du Nord |

| +1 905 470 2000 | Canada Markham |

| +1 416 350 0999 | Canada Toronto |

Financial institutions and broker dealers face operational complexities in the competitive world of collateralization. As they navigate risks in the pursuit of their objectives, different avenues of opportunities arise to help optimize their collateral utilization.

By leveraging a reliable and analytical facilitator that automatically calculates and pledges excess collateral to BNY Mellon Triparty deals, firms can manage their use of collateral strategically and generate overnight funding to support their trading and investing goals. Automatic calculations and bulk pledge and release functions improve operational efficiencies for client users.

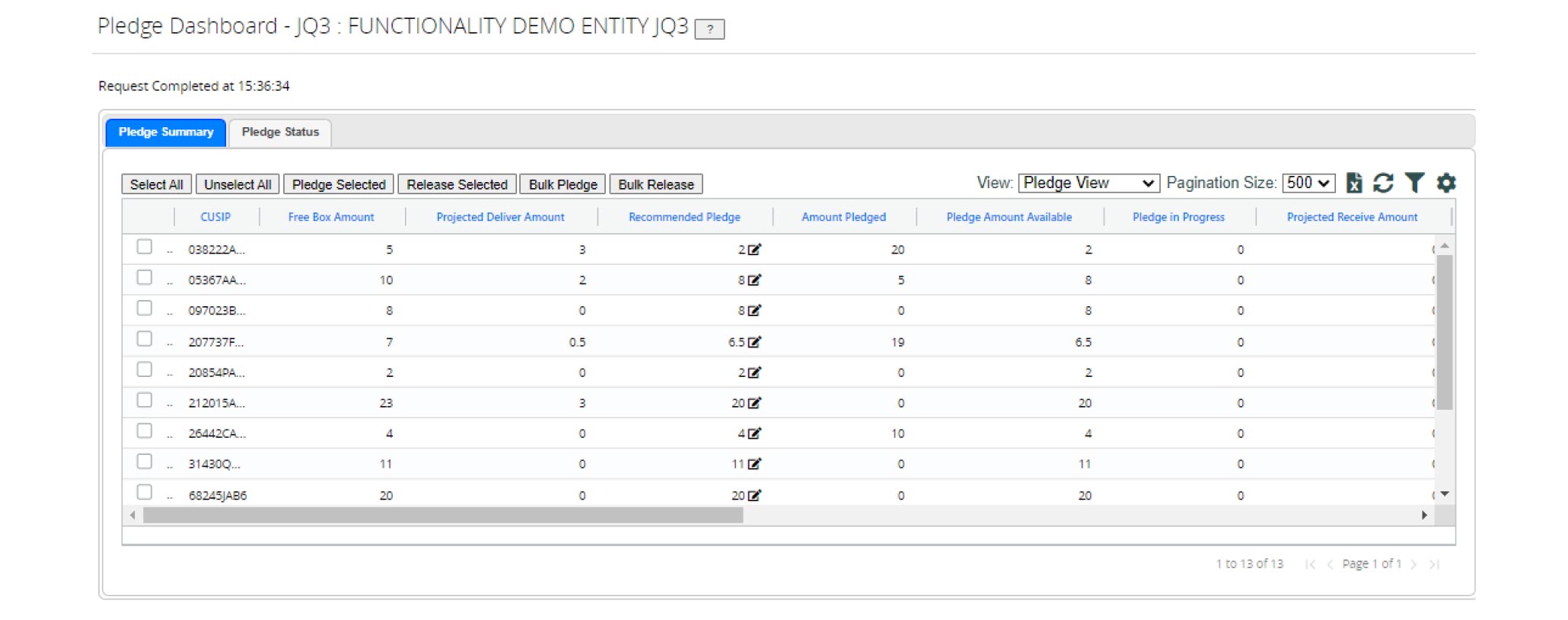

The DTC Pledge Module within impact SM offers clients the ability to streamline and automate the pledge and release of DTC collateral to the Bank of New York Mellon (BNYM) to meet industry obligations (i.e.Triparty allocations/fills).

DTC Pledge acts as a command center within impact to monitor and perform free pledge and release of collateral. Users will be able to view recommended pledge and release amounts on the pledge dashboard. Users can either submit bulk movements for all eligible securities or select individual securities to submit pledge and release requests to DTC.

DTC PLEDGE PROCESSING BENEFITS:

Pledge Dashboard Summary Tab

Pledge Dashboard Summary Tab

A highly customizable display for users to view security availability in real time, and immediately initiate collateral movements between depository accounts.

Contact Us about what’s next for you

Contact UsOur representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |