Technology is rapidly transforming wealth management. New fintech startups are surging, saturating the market and capturing investor business.

In order to compete, traditional firms need to fully optimize their most valuable asset: a wealth of data around every advisor, investor, transaction, position and outcome.

Data feeds artificial intelligence (AI) and the race to deliver AI capabilities has never been more intense. While it’s true that 85% of AI projects fail to deliver business results, market leaders have uncovered what it takes to succeed—and the results are paying off. Today, firms are going from proof-of-concept to quantifiable ROI in as little as 90 days.

THE PROMISE OF AI AND PREDICTIVE ANALYTICS

Next-gen technologies enhance performance and drive profitability, and AI is no exception. In 2020, leading firms adopting these technologies achieved a 51% increase in revenue 1.

AI powers predictive analytics, a class of capabilities that uses historical data to predict future events. In practice, historical data is used to generate a mathematical model that can be applied to current data. The model is then able to recommend actions that are most likely to produce optimal outcomes.

AI learns from massive datasets and uncovers trends that are otherwise imperceptible. Together, predictive analytics and AI can transform the advisor-client dynamic in many ways, from accelerating client onboarding to boosting portfolio management efficiency.

These next-gen technologies enable deeper understanding of investor behavior and preferences—essential if you want to personalize the client experience. For example, with the growing focus on Environmental, Social and Corporate Governance (ESG), understanding the unique concerns of the environmentally and socially conscious investor enables advisors to identify the best opportunities to upsell or cross-sell based on product fit. Advisors equipped with actionable insights are better positioned to deepen client loyalty and improve satisfaction.

KEY BARRIERS TO EFFECTIVE IMPLEMENTATION

Firms face complex challenges in an increasingly data-driven industry. Investor expectations are rapidly evolving, intensifying the pressure on advisors to consistently deliver an exceptional client experience. The competitive set is also changing. New threats from startups and established competitors on a daily basis are forcing firms to review operating models and workflows.

Wealth firms need to innovate to stay ahead, and one way is through AI. But most attempts to implement AI lack two critical elements: robust data and expertise in data science.

ESSENTIAL COMPONENTS OF A QUALITY DATA STRATEGY

Effective AI depends on a high volume of quality data—and accessing the right data remains a major challenge for firms across the wealth industry. Ensuring that data is efficiently stored and maintained is critical. Firms often struggle to execute a data strategy that streamlines access without sacrificing data security.

The challenge? It takes significant time to organize these massive datasets, train the machine learning models that drive AI, and ensure seamless integration with a firm’s existing back-end infrastructure. Most firms find it costly or impractical to dedicate the in-house time and talent required to deploy AI. Defining a use case that delivers ROI and is feasible based on available data is complex. For successful adoption of AI it’s essential to obtain cross-functional buy-in from key stakeholders across the firm.

THE WAR FOR DATA SCIENCE TALENT

Wealth firms find it increasingly challenging to find data science experts as they are in high demand across multiple industries. Companies that are solely focused on AI design each component of their business to excel in this sector. They attract top talent, who develop the most advanced technologies, which then attracts more top talent, and so on. It’s an ecosystem in which wealth firms find it difficult to compete.

THE BROADRIDGE ADVANTAGE

The path from proof-of-concept to tangible ROI is perhaps the most difficult. Choosing the right partner with deep domain experience will accelerate your firm’s implementation of AI and ability to achieve transformative results.

The Broadridge-Fligoo partnership leverages technology refined over seven years and is uniquely positioned to deliver transformative results. Fligoo is one of the fastest growing artificial intelligence companies in the world. With extensive expertise in advanced analytics and decision science, Fligoo develops intelligent solutions based on a proprietary algorithm framework. Developed in collaboration with MIT artificial intelligence researchers, Fligoo elevates the performance of Fortune 500 companies—delivering quantifiable results.

Broadridge’s extensive proficiency in investor trends and decision-making fuels our proprietary predictive analytics solution. By analyzing hidden patterns in the data, our solution surfaces insights that provide transparency to branch supervisors and compliance personnel. Advisors are equipped with actionable insights to take their next best action with confidence.

CRACKING THE CODE—THE THREE-STEP APPROACH TO TRANSFORMATIVE AI APPLICATIONS

1. EXPLOIT YOUR DATA TO CONQUER THE COMPETITION: The “flywheel” nature of AI causes the technology to gain more accuracy with every new user. So as fintechs grow in scale, so too does their ability to compete. However, their data-driven tools and acquisition techniques are no threat to proactive established firms. Accurate and accessible data will position you to outperform the competition—if you can leverage your extensive data advantage with the right tools and expertise.

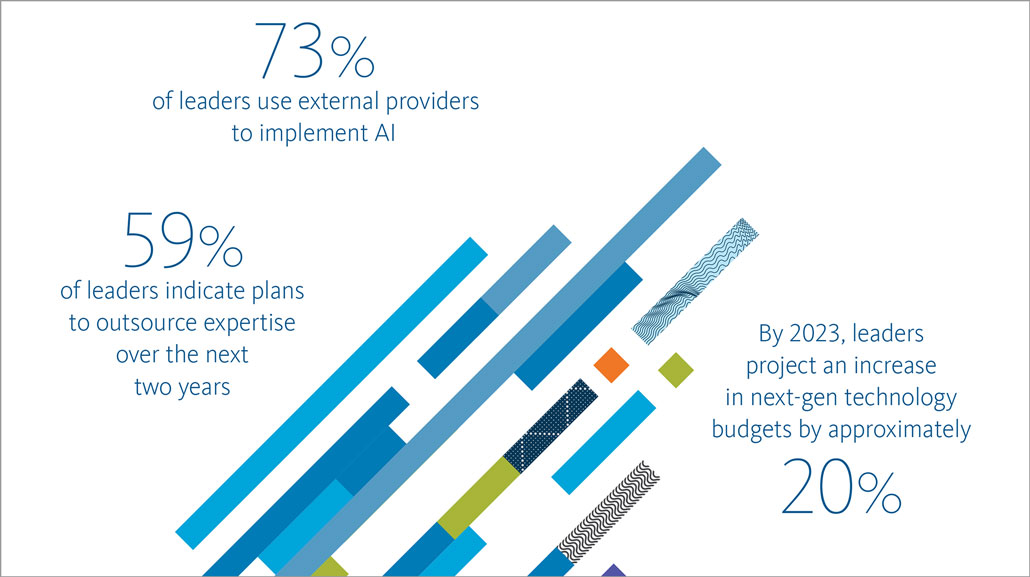

When it comes to emerging technologies, firms increasingly rely on external providers to manage access to large volumes of data and network effects. Our research indicates that 73% of leaders use external providers to implement AI.2 When selecting an external provider, firms should consider a comprehensive solution as opposed to disparate tools and costly consultants. Most importantly, an effective partnership relies not only on strong skills, but on proven experience.

2. IDENTIFY YOUR AI EXPERTS: Industry leaders recognize the complexity of AI. Likewise, they recognize their own limitations when it comes to time, expertise and infrastructure. Not surprisingly, few choose to execute alone. Leaders project increasing next-gen technology spend for AI and Blockchain by nearly 20% by 2023 3 . Future-proof your growth strategy by partnering with the right experts to advance your goals. Effective use of AI requires identifying the best applications for tangible ROI.

Initiate the process by identifying an AI business champion who understands—and can effectively communicate—how AI will advance your firm’s unique business objectives. It is also important to consider the extensiveness of the team required to execute the work. Team members may include data engineers, data scientists and product development experts, among other roles.

To mutualize the costs and risks of technology innovation, industry leaders are more likely to outsource expertise and invest in solutions from third-party providers. In fact, 59% of leaders indicate plans to outsource expertise over the next two years compared to 37% of non-leaders.4 Identifying the right partner to accelerate your business goals is critical for maintaining 73% competitiveness going forward.

3. ACCELERATE FROM PROOF-OF-CONCEPT TO RESULTS: Most firms struggle to advance beyond proof-of-concept. To achieve business value, firms must bridge the gap between their desired outcome(s) and measurable results. While daunting, it is possible to conceive and execute in 90 days or less. However, this is only possible through an effective partnership and data preparedness.

Wealth management firms become better positioned to accelerate client engagement by increasing their marketing ROI. One way to achieve this is by licensing advisor marketing content from an expert, trusted provider. For example, Broadridge trained its engagement model using hundreds of millions of engagement data points analyzing which marketing content (e.g., articles and newsletters) is most engaging to which recipients. This model has been used to successfully generate prospect and client engagement—increasing article recipient engagement by 300%.

CASE STUDY 1 A top-10 North American bank successfully increased credit card penetration in their 20 million+ customer base—achieving ROI in 90 days.

- 44% increase in sales for premium cards over bank baseline.

- 50% cost reduction in customer contact activities (call center, direct mail, etc.).

CASE STUDY 2 Client attrition pilot in a Wealth Management firm successfully predicted 9 out of 10 account closures and large money withdrawals before they occurred.

- Investors were identified as high risk more than 90 days in advance.

- Automatically suggested actions to address investors’ particular needs and retain the AUM.

INTELLIGENT AUTOMATION ACCELERATES BUSINESS GROWTH

AI adapts and learns from every client interaction. These agile algorithms increase the understanding of where your clients are now and the factors impacting their behavior. By combining AI with predictive analytics, you will be prepared to respond to investor needs at any moment. Advisors can easily determine which actions and personalized communications will boost client loyalty—and execute automatically.

Firms often rely on a limited selection of data sources to meet investor demands, such as investor profiles or available securities and investment products. AI enables smarter personalization and prospecting by analyzing thousands of behavioral variables that impact revenue, including:

- Demographics

- Current and past products

- Last contact

- Contact channel

- Transaction data

Recommended actions may include sharing content relevant to client needs, customizing product recommendations or making essential portfolio adjustments. Equip your team with the knowledge to retain and expand your clientele. Unleash your ability to achieve boundless gains.

DEFINING THE PATH FORWARD

The pandemic accelerated industry trends that were already in motion, increasing the urgency for innovation that delivers results. Leading firms are accelerating their focus on next-gen technology in alignment with their business goals. In fact, leaders indicate moving 58% faster in response to the pandemic and project making increases in IT budget allocations, particularly for AI and Blockchain, by nearly 20% by 2023 5 . Bottom line: Firms opting to delay or decelerate their implementation of AI risk falling behind the competition.

The Broadridge-Fligoo partnership combines unparalleled expertise to help firms make the shift to an innovative, predictive analytics platform for data-driven advisors. Artificial intelligence is only as smart as the data it consumes.

Our extensive expertise in investor trends and decision-making fuels our robust suite of proprietary predictive analytics tools.

The three-step approach outlined in this report will help proactive wealth management firms disrupt the fintech startups fighting to capture their core business. Advancing AI and predictive analytics from proof-of-concept to results begins with a thorough evaluation of your data. Assess your technological limitations and outsourcing needs, and use that to inform the business value that AI will bring to your operating model. This report emphasizes the speed in which firms can test, adopt and employ AI, highlighting the major ways predictive analytics is transforming wealth management.

Ready to achieve transformative results?

Our suite of AI-driven solutions helps firms and advisors optimize and enhance relationships—identifying ways to boost retention, increase revenue and find the perfect client-investor match. Let’s get started. Contact your Broadridge representative today.