Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

Additional Broadridge resource:

View our Contact Us page for additional information.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

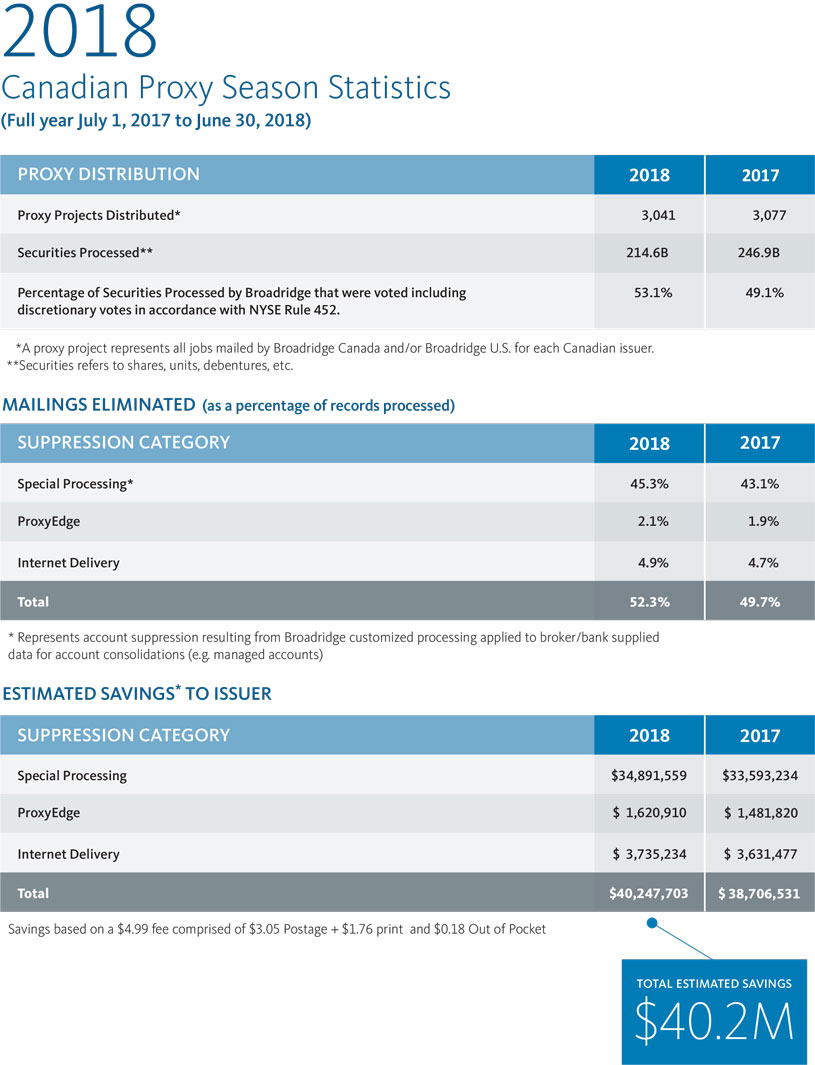

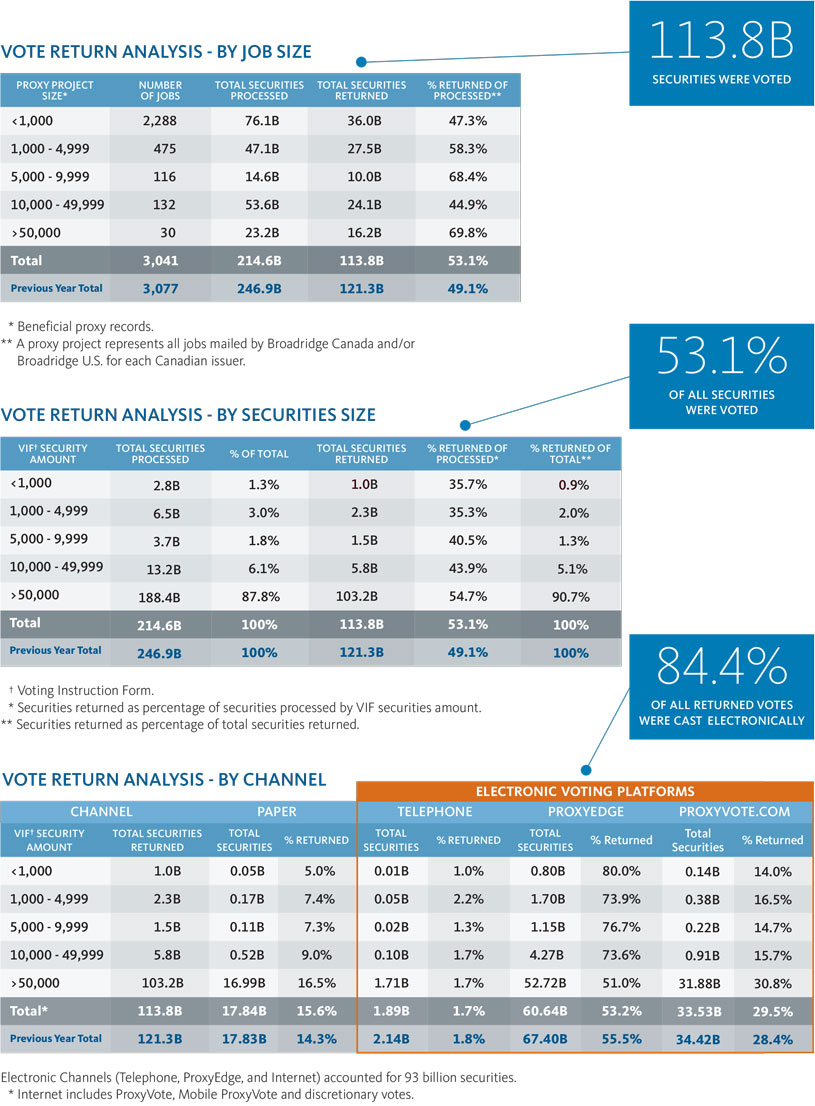

Over the past year, Broadridge delivered innovative solutions to enhance securityholder engagement and improve the effectiveness of the proxy process. This report details some of the highlights, including cost-savings and other benefits achieved by our clients, marketplace and regulatory insight, and key performance statistics.

In the past year, Broadridge delivered new and innovative solutions to drive the efficiency of the proxy process and further enhance securityholder engagement. We would like to take this opportunity to share with you some of the highlights of the 2018 proxy season:

In May 2018, Bill C-25 an Act to amend the Canada Business Corporations Act, the Canada Cooperatives Act, the Canada Not-forprofit Corporations Act and the Competitions Act received Royal Assent (now S.C. 2018, c. 28). The ability to allow CBCA corporations to use notice-and-access to distribute proxy circulars under the provincial securities rules will only be effective on a date determined by an order of the federal cabinet. According to Corporations Canada “the notice-and-access regime provides shareholders with sufficient disclosure to support applications for exemptions under both subsection 151(1) and section 156 of the CBCA.” Refer to the Corporations Canada website for more information.

Issuers can now brand the ProxyVote.com voting site and emails to better engage securityholders. New functionality allows issuers to enhance communications with video or multimedia messages or direct investors to the issuer’s investor relations site. The result is more compelling and effective communications, better securityholder engagement and enhanced brand awareness.

Advanced analytics turns historical data about securityholder voting behaviour into actionable insights. Issuers can leverage data to refine strategy, deliver persuasive securityholder communications, define benchmarks, evaluate progress and improve projections.

The popularity of virtual shareholder meetings has dramatically increased since it was first offered in 2009. With over nine years conducting VSMs Broadridge has assembled meaningful support material to assist corporate issuers plan and organize their annual meetings.

The Broadridge Virtual Shareholder Meeting (“VSM”) service offers corporate issuers the ability to conduct annual meetings online, via streaming audio or video. It is the only solution of its kind that allows validated registered and beneficial securityholders to fully participate in an online annual meeting. Broadridge’s VSM service features the ability to authenticate securityholders and allows them to ask questions and vote in real-time at the meeting facilitating English and French video and/or audio streams.

We are pleased to report that over 96% of Canadian issuers were satisfied or very satisfied with the overall service received from Broadridge, based on the responses to this year's Client Satisfaction Survey. We continue to increase our client satisfaction ratings year-over-year and your comments are important to identify opportunities for further improvements. Please email client.relations@broadridge.com if you have any questions or suggestions.

Streamline securityholder communications and managementA single-source solution helps you simplify securityholder management, efficiently navigate regulatory and compliance communication requirements and gain insights to effectively serve and engage securityholders. |