Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

Additional Broadridge resource:

View our Contact Us page for additional information.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

NEW YORK, NY – December 9, 2020 – Employed Americans’ concerns over financial wellness continue to grow as two-thirds report that it is more important to them now than it was three months ago, according to a new study released today by Broadridge Financial Solutions, Inc. (NYSE: BR), a global Fintech leader. The study also found that over half of Millennial (51%) and Gen Z (60%) workers expect to postpone their retirement due to the pandemic and that nearly half (49%) of all respondents say the state of their financial wellness impacts their overall happiness.

Over one-third of workers (35%) reported that their financial wellness benefits were reduced since the beginning of the pandemic. Gen Z respondents were most impacted by the reduction of financial wellness benefits (51%), followed by Millennials (34%), Gen X (22%) and Boomers (19%). Fifty-eight percent of workers would feel confident in their financial health for three months or less after losing their job.

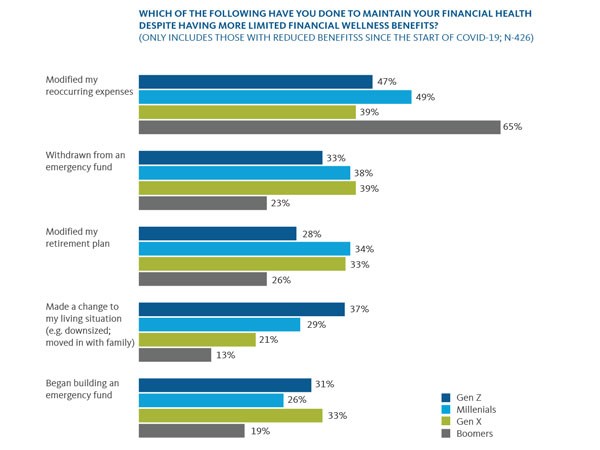

Workers who reported reduced financial wellness benefits since the beginning of the pandemic made material lifestyle adjustments in order to stay on track to maintain financial goals.

“Now more than ever employees are reliant on their employers to provide them with the proper tools and resources to meet their financial goals,” said Cindy Dash, Senior Vice President at Matrix Financial Solutions, a Broadridge company. “What’s very interesting is that two-thirds of respondents said they would leave their job if an employer took away a financial wellness benefit that is important to them. In navigating the aftermath of the pandemic, employers are going to face increased pressure to provide enhanced financial wellness benefits, especially if they reduced their offerings during the pandemic. If not, they will risk losing their valued employees.”

What American Workers Need From Employers to Achieve Financial Wellness

Two-thirds of respondents stated they would look for another job if their employer took away any of the financial wellness benefits that are important to them. Seventy-two percent of respondents say that after salary, financial wellness benefits are the most important factor for them in deciding to accept a job offer.

Sixty percent of workers say that the pandemic has caused them to look much closer at the benefits an employer offers.

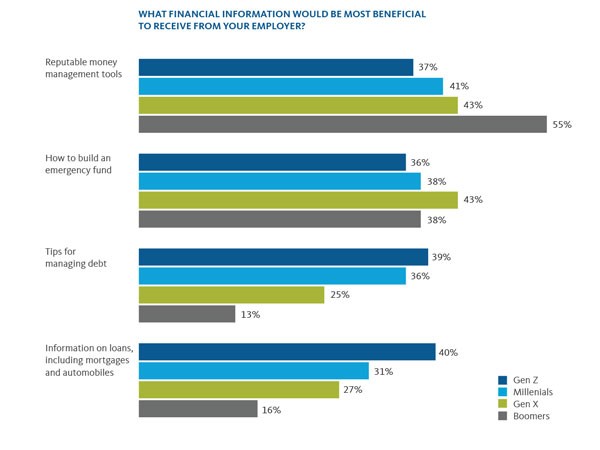

When asked about what financial information they would find beneficial from their employer, responses varied across generations.

Younger Americans Proactively Planning Their Financial Future

Despite being the furthest away from retirement, 52% of Gen Z workers already report that they expect to postpone their retirement by one to four years. Older generations are less likely to expect any delay in their retirement due to the pandemic, as 61% of Boomers and 58% of Gen X respondents do not plan to postpone their retirement.

The study finds that younger generations are more likely to believe that having a financial advisor is worth the cost (76% of Gen Z and 62% of Millennials, compared to 53% of Gen X and 54% of Boomers). Likewise, 57% of Gen Z workers report that learning about financial products and financial wellness is intimidating to them.

Methodology

The Broadridge survey was conducted by The Center for Generational Kinetics (CGK). A total of 1,250 current full-time employees completed the survey, which was fielded in September 2020.

For further details on survey methodology, please contact a Broadridge media representative.

About Broadridge

Broadridge Financial Solutions (NYSE: BR), a global Fintech leader with over $6 billion in revenues, provides the critical infrastructure that powers investing, corporate governance, and communications to enable better financial lives. We deliver technology-driven solutions that drive business transformation for banks, broker-dealers, asset and wealth managers and public companies. Broadridge's infrastructure serves as a global communications hub enabling corporate governance by linking thousands of public companies and mutual funds to tens of millions of individual and institutional investors around the world. Our technology and operations platforms underpin the daily trading of more than $10 trillion of equities, fixed income and other securities globally. A certified Great Place to Work®, Broadridge is part of the S&P 500® Index, employing over 14,000 associates in 21 countries.

For more information about us, please visit www.broadridge.com.

To contact media relations, please email us at mediarelations@broadridge.com.