Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

Additional Broadridge resource:

View our Contact Us page for additional information.

One of our sales representatives will contact you about your submission.

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.

Want to speak with a sales representative?

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Nos représentants et nos spécialistes sont prêts à vous apporter les solutions dont vous avez besoin pour faire progresser votre entreprise.

Vous voulez parler à un représentant commercial?

| Table Heading | |

|---|---|

| +1 800 353 0103 | Amérique du Nord |

| +1 905 470 2000 | Canada Markham |

| +1 416 350 0999 | Canada Toronto |

Votre soumission a été reçue. Nous communiquerons avec vous sous peu.

Vous souhaitez parler à un commercial ?

| Table Heading | |

|---|---|

| +1 800 353 0103 | Amérique du Nord |

| +1 905 470 2000 | Canada Markham |

| +1 416 350 0999 | Canada Toronto |

As fees become more complex, an intelligent approach to fee and expense management is required for success.

The asset management industry’s traditional fee model and pricing structure is facing enormous pressure from investors, market regulators and low-fee passive investment funds. Consequentially, fees are becoming less standardized and increasingly complex. An intelligent and thoughtful approach to fee and expense management is therefore required if investment firms are to successfully navigate these challenges.

Across the board, active fund managers are being squeezed on fees by investors. Data from Broadridge’s Global Market Intelligence (GMI) fees module – a consortium of more than 50 asset managers providing net negotiated fees for their institutional clients across pooled funds and separately managed accounts – corroborates this.

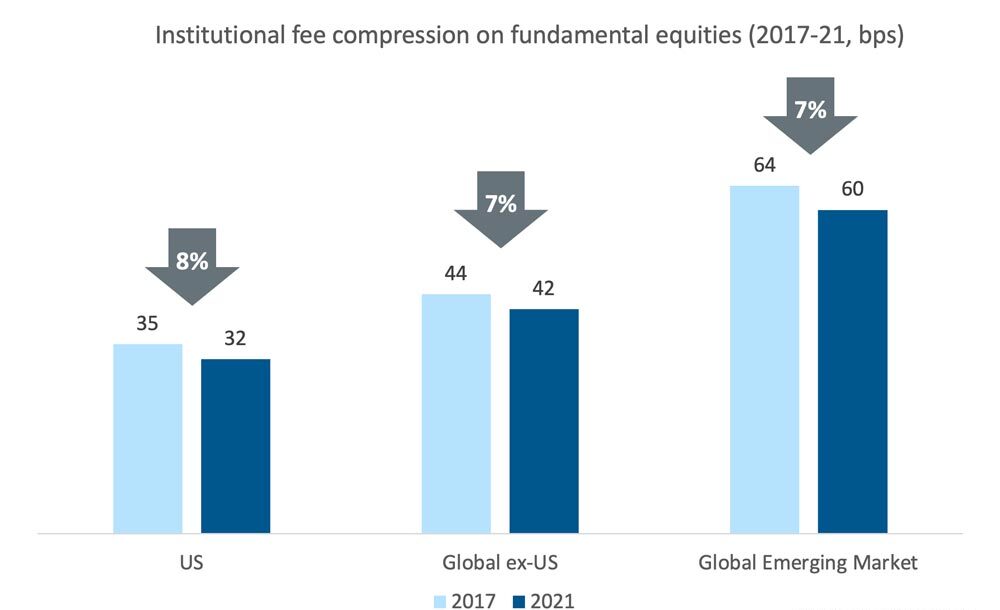

Investment management (IM) fees for active fundamental equities are falling by approximately 2% per annum. Between 2017 and 2021, the weighted average fee on US equities has reduced by 8% and on global ex-US equities by 7%. This trend has also affected higher fee strategies. Fees for global emerging equities have fallen by 7% during the same period1.

Source: Broadridge, GMI Fees Module

These declines have been driven by heightened fee pressure from low-cost passive alternative investment products. The weighted average IM fee that institutions pay for passive US equities has fallen below 2bps (basis points), below 3bps for global equities, and below 5bps for global emerging markets. By delivering market returns at a fraction of the cost of active managers, passive managers have been luring in investors’ assets. Broadridge’s GMI Institutional now tracks $7.9T of passive equity assets versus only $6.6T of active fundamental equity assets. From a vehicle perspective, Broadridge tracks $9.4T of passive ETF assets, the US being the largest, most mature market with AUM of $6.5T. Globally, these products continue to see strong asset growth, new investor assets driving annualized organic growth to almost 11% for the three years to Q3’21.

Regulators are also scrutinizing management fees, resulting in added complexities for investment firms when calculating their costs and charges. In the US, the Securities and Exchange Commission’s Regulation Best Interest (Reg BI) imposes tough fiduciary standards on brokers to ensure they are fully aligned with their clients’ interests. As a result, managers need to make sure they can provide open and transparent evidence of their funds’ value-for-money. The UK has severely criticized active fund managers for not only having weak price competition and excessive profits but also for mirroring indexes while still charging active management fees. The EU is similarly taking a firm line on fees and expense management with multiple new rules, including provisions around cost transparency. The end result for asset managers is that they need to be able to accurately calculate, analyze and publish the details of their trading costs, fees and charges at any given time.

Aside from charging lower fees, some active firms – following demands from large institutional investors - are eschewing the traditional flat-rate management fee structure. For example, three years ago, Japan’s $1.7 T Government Pension Investment Fund (GPIF) shifted away from an AUM-based remuneration model to a performance-based system for its external fund managers. As a result, managers that deliver strong returns receive higher performance fees, whereas those that fail to beat their benchmarks are given passive-equivalent pay-outs.2 According to GPIF, the move is designed to stimulate alpha rather than being a cost-cutting exercise.3

Similar efforts to align fees with performance are underway in the hedge fund industry. For example, Albourne Partners – a consultancy that has allocated more than $550 B to alternative investments – is making the case for a new and more equitable fee structure.4Albourne Partners is pushing hedge funds to adopt a “1 or 30” model, whereby managers would collect a 30% performance fee and no management fee in a good year. However, if returns are poor, managers can charge a 1% management fee which will be deducted from the following year’s performance pay-out.5 To date, 77 managers have acquiesced to charging 1 and 30, although 63% of firms surveyed stated they offer or are willing to implement such an arrangement.6

As product line-ups, fund structures, investor bases and geographies expand, and variations in fee schedules and structures continue to evolve, active fund managers must look beyond the shop window. They must consider which solutions they will need to ensure they have the flexibility to respond to these innovative and complex structures and fee schedules. At a technology infrastructure level, a high degree of flexibility is necessitated to support these changing requirements and ensure regulatory compliance.

Some firms may end up with multiple finance systems, trading platforms and data warehouses that they must reconcile at an ever-increasing cost. In this quest to become more nimble and cost-effective, Heads of Technology and Operations are looking to consolidate their technology infrastructure with highly configurable, best-of-suite solutions. The good news is that with the right fund products, and the optimal systems and processes to support them, active management is proving that it is still competitive and can continue to be an essential destination for investor capital

1. Broadridge GMI Fees Module

2. Pensions & Investments (July 26, 2021) Active managers earn their pay at Japan’s GPIF

3. Pensions & Investments (July 26, 2021) Active managers earn their pay at Japan’s GPIF

4. Bloomberg (July 27, 2020) Hedge fund fees in free fall is the new reality for a humbled industry

5. Bloomberg (July 27, 2020) Hedge fund fees in free fall is the new reality for a humbled industry

6. Bloomberg (July 27, 2020) Hedge fund fees in free fall is the new reality for a humbled industry

Contact Us about what’s next for you

Contact UsOur representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |