Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

New York, N.Y., April 11, 2018 - An industry working group comprised of 17 executives representing retail and institutional investors, public companies, and proxy and legal service providers, today released “Principles and Best Practices for Virtual Annual Shareowner Meetings.” The Virtual Annual Shareowner Meetings Study Group identified five principles and 12 best practices companies should consider when managing annual shareowner meetings.

Advances in technology have enabled companies to consider the option of hosting shareowner meetings online. Virtual shareowner meetings expand the number of shareowners that can view and participate in a company’s annual meeting.

“Using technology to conduct virtual annual meetings is a positive development designed to further enhance shareowner attendance and participation,” said Anne Sheehan, study group co-chair and a recently retired director, corporate governance, California State Teachers' Retirement System (CalSTRS) and chair, Securities and Exchange Commission’s Investor Advisory Committee. “These principles and best practices should guide companies in how to use this new technology, which is important.”

Five Principles

The Virtual Annual Shareowner Meetings Study Group outlined five guiding principles that every company should consider before undertaking a virtual shareowner meeting:

12 Best Practices

“The principles and best practices the Virtual Annual Shareowner Meetings Study Group outlined represents the consensus of a diverse study group, after robust discussion, that accommodates evolving technologies in a way that expands and enhances opportunities for meeting participation by all shareowners in a fair and balanced way,” said Darla Stuckey, study group co-chair and president & CEO, Society for Corporate Governance. “Companies should consider these practices as a guide to ensure a successful outcome.”

In addition, state laws can affect company decisions. Specifically, 30 states allow virtual only meetings, 42 states allow hybrid meetings—i.e. both physical and virtual—and nine states require in-person only format. The report can be viewed here: Principles and Best Practices for Virtual Annual Shareowner Meetings.

Growth in Virtual Shareowner Meetings (VSMs)

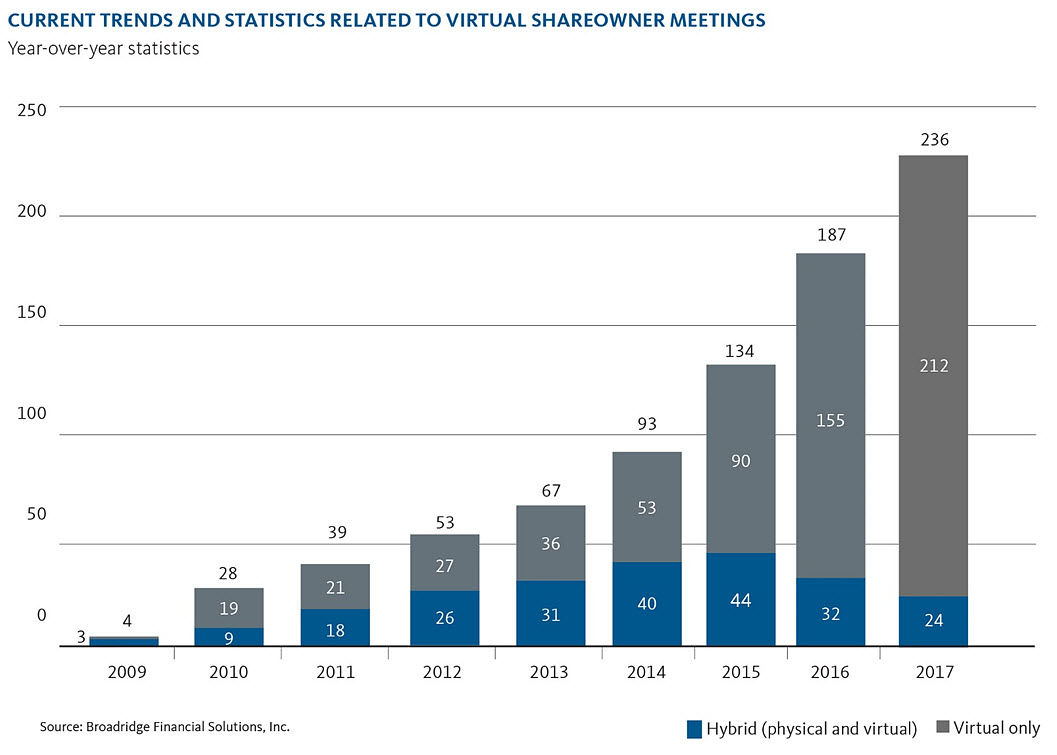

In 2017, 212 companies held virtual only annual meetings and 24 companies conducted hybrid meetings, combining a physical meeting with a virtual one.

While this still represents a small percentage of the over 4,400 U.S. annual shareowner meetings each year, the growth trend is clear. Adoption of virtual shareowner meetings has been on the rise, with 236 companies having a virtual component to their meeting, as shown in the chart following:

“This virtual annual meeting report is an important accomplishment. It provides companies with guidelines they can use in enhancing virtual meetings in a way that encourages participation and engages shareowners. Virtual technology is here to stay, and when companies choose to use this capability, they can and should use it to its fullest capacity,” said Cathy Conlon, study group member and vice president, issuer-strategy for Broadridge Financial Solutions, Inc. Broadridge is the leading third-party processor of shareowner communications and proxy voting. Each year, Broadridge processes the proxy voting for more than 80% of the shares of U.S. public companies.

About the Virtual Annual Shareowner Meeting Committee ─ Principles and Best Practices

The Virtual Annual Shareowner Meetings Study Group was formed in 2017 with the goal of developing principles and best practices for public companies on the topic of virtual shareowner meetings.

The 17 individuals represent a breadth of interested constituents including retail and institutional investors, public companies, and proxy and legal service providers.

The report issued today represents the results of their work.

The committee members include:

| Anne Sheehan | Formerly of California State Teachers’ Retirement System | Co-chair |

| Darla Stuckey | Society for Corporate Governance | Co-chair |

| Keir D. Gumbs | Covington & Burling | Legal Advisor |

| Maryellen Andersen | Broadridge | |

| Ken Bertsch | Council of Institutional Investors | |

| Anne T. Chapman | Joele Frank, Wilkinson Brimmer Katcher - (Formerly of Capital Group) | |

| Christopher Clark | National Association of Corporate Directors | |

| Cathy H. Conlon | Broadridge | |

| Fay Feeney | Risk for Good | |

| Carl T. Hagberg | Carl T. Hagberg Associates | |

| Suzanne Hopgood | Hopgood Group, LLC; Board of Directors, Mace Security International | |

| Stephen P. Norman | S.P. Norman & Co. LLC | |

| Brandon Rees | Office of Investment, AFL-CIO | |

| TerriJo Saarela | State of Wisconsin Investment Board | |

| John Seethoff | Formerly of Microsoft | |

| Timothy Smith | Walden Asset Management/Boston Trust | |

| Kristina Veaco | Veaco Group |

To contact media relations, please email us at mediarelations@broadridge.com.