Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

One of our sales representatives will email you about your submission.

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.

Want to speak with a sales representative?

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Managing a new settlement regime

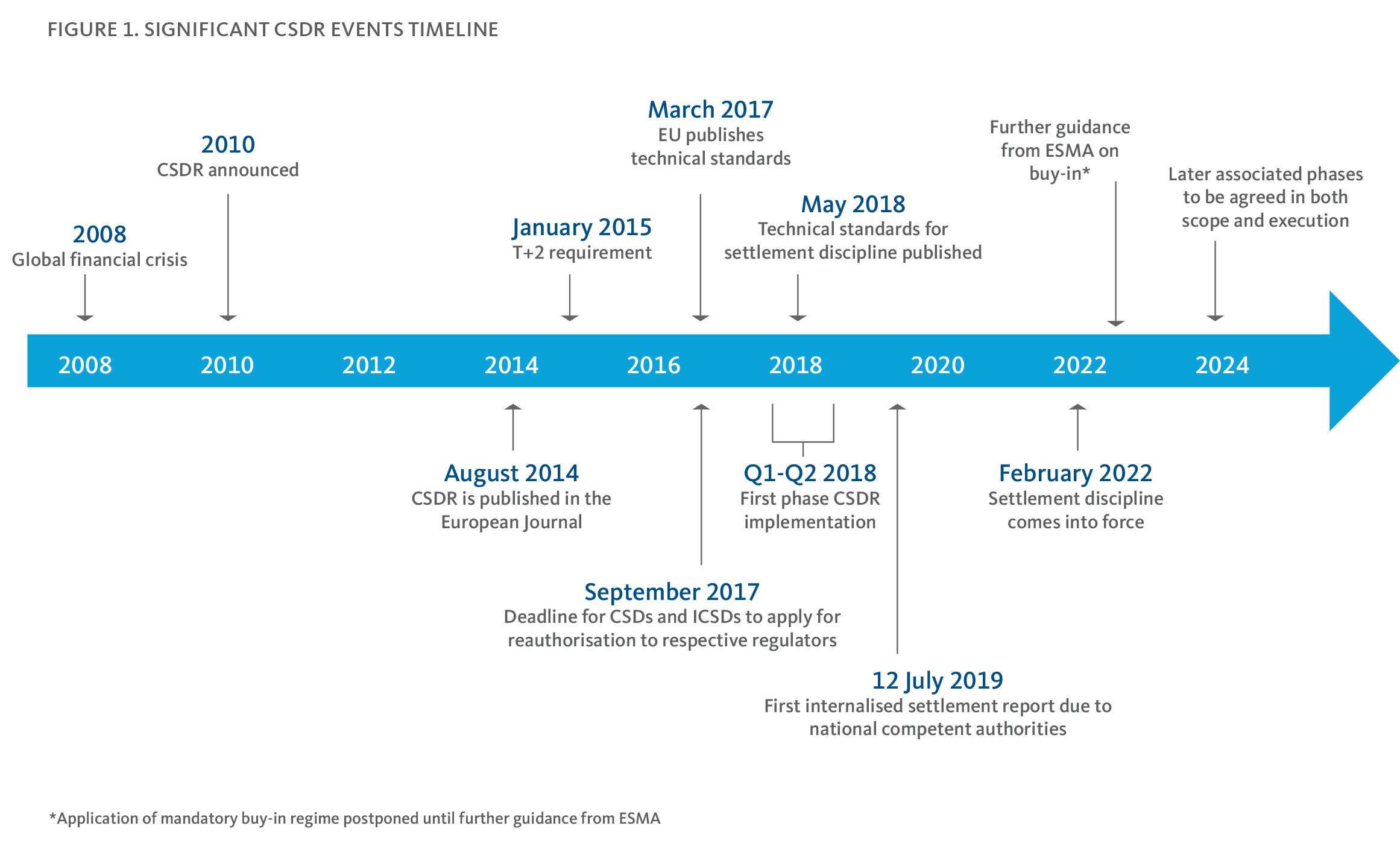

Since its initial publication in the European Journal in 2014, the Central Securities Depositories Regulation (CSDR) has faced a variety of hurdles and challenges, but with its latest milestone – the Settlement Discipline Regime (SDR) – which came into force on 1 February 2022, the EU has taken a major step forward in harmonising securities settlement across all market participants in the region.

It is however important to recognise that there is still a significant amount of effort needed to resolve some of the most contentious topics in this regulation, especially regarding the mandatory buy-in process. It is likely that the latest postponement proposed by European Securities and Markets Authority (ESMA) and its approval by the EU legislators will push back the overall timeline.

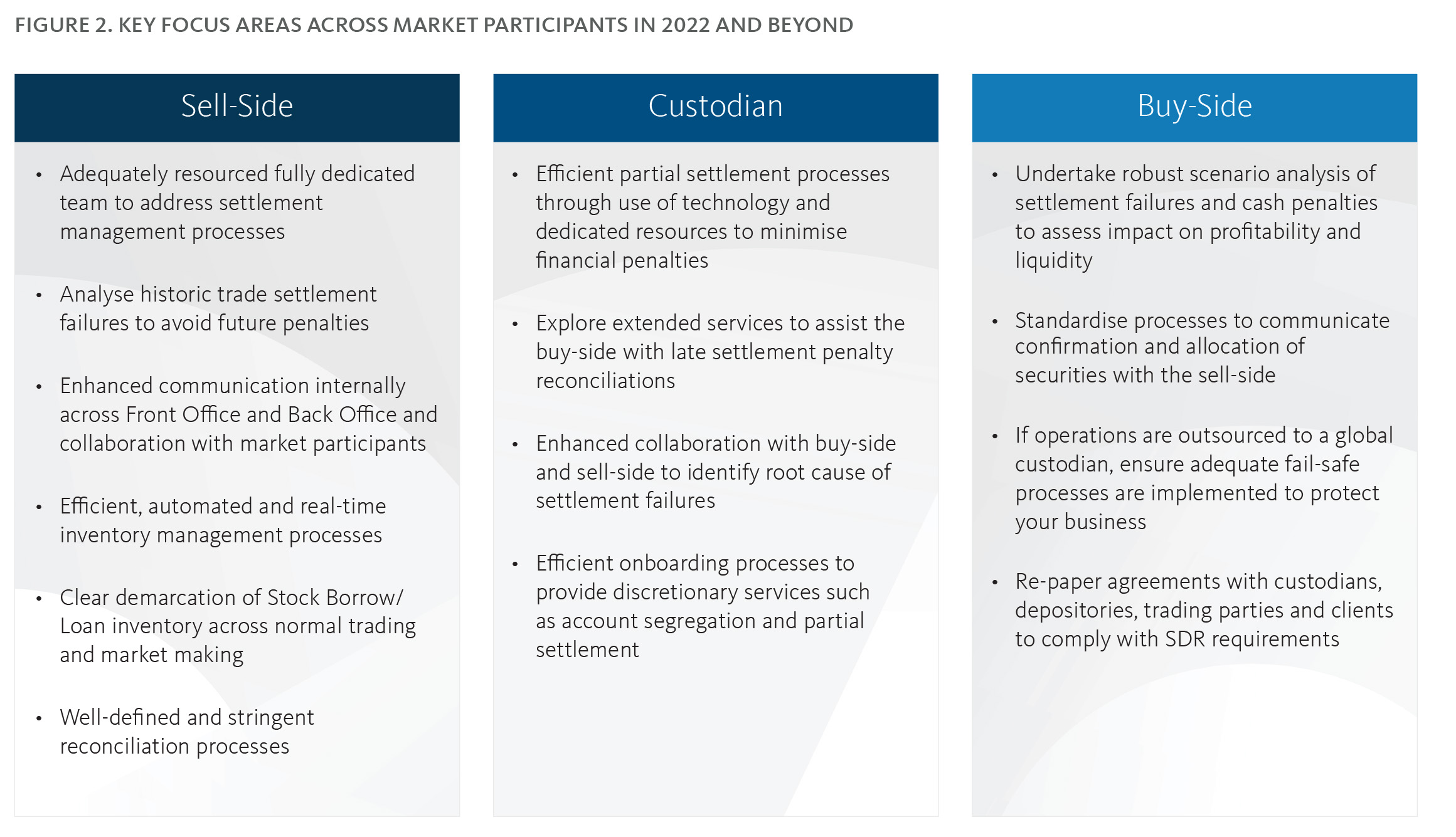

This is an opportunity for market participants to recommit their efforts to achieving industry best practices, streamlining functions and processes impacted by the CSDR regulation and supporting their clients throughout the journey.

The CSDR aims to harmonise the authorisation and supervision of CSDs across the EU. It establishes both uniform requirements for the settlement of financial instruments in the EU and rules on the organisation and conduct of CSDs to promote safe and efficient settlement.

The regulation applies to EU CSDs (and ICSDs), issuers that issue securities in EU CSDs, participants and indirect participants at CSDs, and banks offering services to EU CSDs in the EU.

Settlement Discipline Regime Goes Live

Originally introduced in 2014 along with MiFID II and EMIR, the CSDR regulation has achieved a significant milestone with the SDR which went live on 1 February 2022.

While viewed as contentious by some, the SDR has always been a central component to achieving the overarching objective of the regulation – to provide a set of common requirements for CSDs and their interaction with market participants across the EU, harmonise aspects of the settlement cycle and mitigate settlement risks.

In December 2021, the EU’s securities markets regulator, ESMA, published a public statement calling for, “…an urgent change in CSDR to allow postponing the application date of the buy-in regime, while noting the importance of the entry into of force of the rest of the settlement discipline regime measures (settlement fails reporting and cash penalties) on 1st February 2022 as planned.”

This amendment to CSDR by co-legislators paved the way for the de-coupling of the applicable date for the provisions dealing with the buy-in regime from the provisions dealing with penalties and reporting.

As a result of these developments, ESMA does not now expect National Competent Authorities (NCAs) to prioritise supervisory actions in relation to the application of the CSDR buy-in regime.

The postponement of mandatory buy-ins came perhaps as a relief to many market participants, as the delay allowed a further review of the scope of the rules. Nevertheless, it may have left some participants in a state of ambiguity on how to move forward today.

The amendment is expected to allow ESMA to develop draft technical standards addressing design challenges as well as reduce ambiguity around scope and process, not only from an implementation and operational perspective, but also with respect to the potential implications for EU bond market liquidity in general.

In March 2022, the EU Commission published a series of proposals aimed at improving the EU settlement market without compromising its financial stability.

Following an impact assessment and comparison of all policy options, the proposals are intended to lower the regulatory burden on CSDs whilst improving their ability to offer a wider range of cross-border services. The proposals involve:

• Simplifying the passporting process by removing the possibility for the host supervisors to refuse the passport, and instead replacing it with a single EU-wide licence

• Enhancing cooperation between national supervisors by establishing colleges of supervisors and providing more powers to monitor risks

• Allowing CSDs with a banking licence to offer banking-type ancillary services to other CSDs within certain thresholds

• Modifying the timeline for implementation of mandatory buy-ins (two-step approach)

• Introducing an end-date for the grandfathering clause for EU and 3rd country CSDs

Any implementation of mandatory buy-ins could take the “wait and see” approach. Whilst preliminary, there is evidence suggesting cash penalties will incentivise improvements in settlement efficiency, without endangering stability and liquidity across markets and financial instruments. After cash penalties have applied, the EU is likely to assess how to best apply the mandatory buy-in in light of the evolution of settlement efficiency.

Market participants’ ability to implement the SDR will be directly impacted by these proposed changes, and they are likely to face increased costs as they align with the potential amendment of buy-in rules, which will most likely require additional changes to their systems and processes.

We believe a considerable amount of effort by all market participants is still necessary to define a streamlined value chain that clearly identifies trades that are in scope, agree on the expected buy-in costs, and the overall process of claiming, tracking, and processing those costs with the buy-in agents or counterparties.

Although the de-coupling of the buy-in regime with the rest of the SDR has certainly added an extra layer of ambiguity and complexity, we believe this is an opportunity for market participants to take stock of the progress made to date and re-commit efforts towards successful implementation.

Broadridge has held workshops with Special Interest Groups to continuously understand clients’ CSDR needs. Our settlement products and services have been developed with core enhancements to support these needs.

We welcome the opportunity to discuss these services with our clients to address their settlement discipline requirements. To join this dialogue, or seek additional guidance on CSDR and its impacts, please fill out the contact us form below to speak to a member of our team.

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |