Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

One of our sales representatives will email you about your submission.

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.

Want to speak with a sales representative?

Your sales rep submission has been received. One of our sales representatives will contact you soon.

European banks have not had an easy time of late. With PSD2 and GDPR coming onto the scene, SCT Inst taking off, new and more palpable fraud threats emerging, and new geopolitical sanctions being implemented, the length of the compliance, payments, and product managers’ to-do lists has been growing faster than they can check things off.

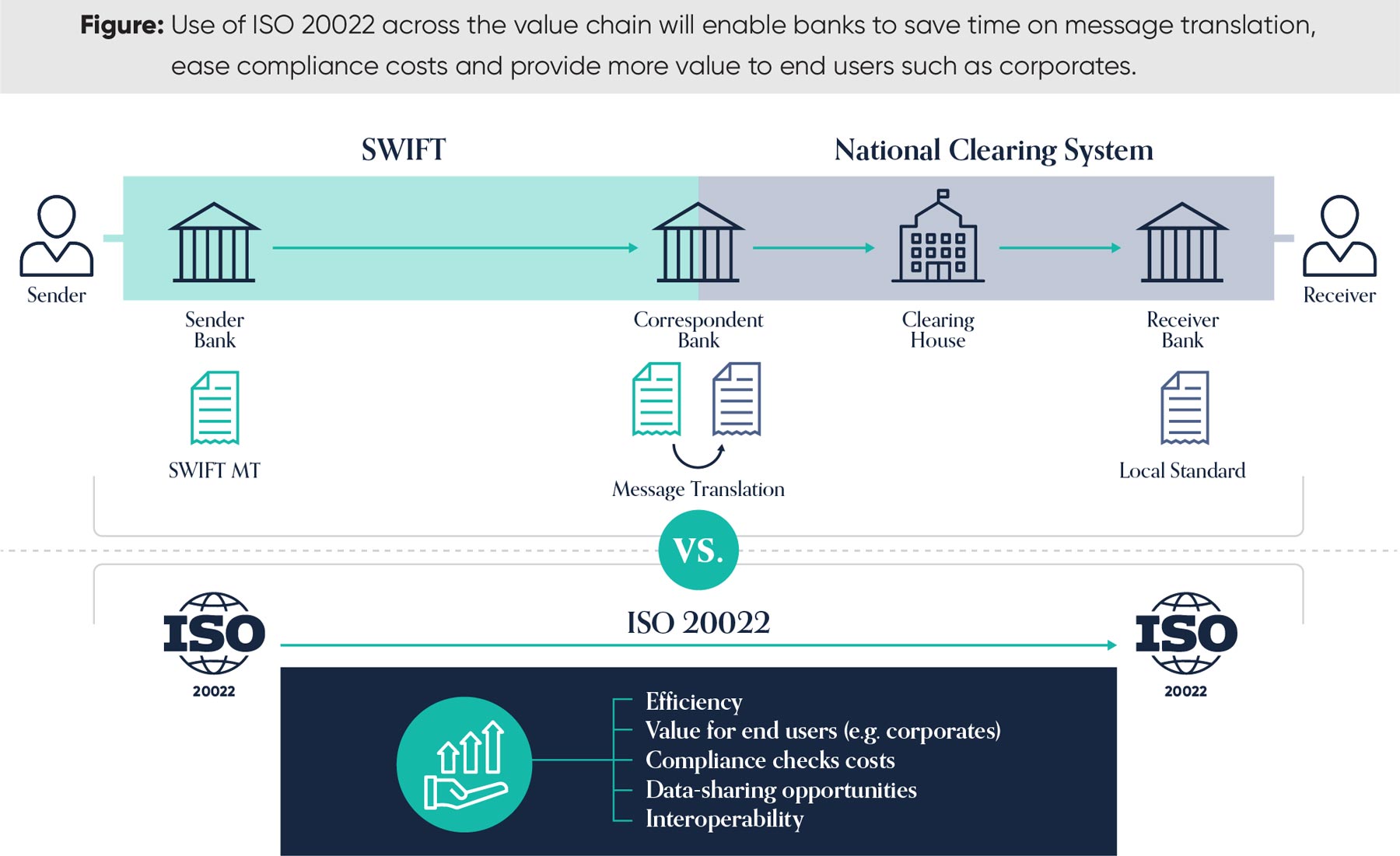

While the transition to ISO 20022 was pushed back, giving banks some much-needed breathing room, the entire European payments infrastructure will soon migrate to this message standard commencing November 2022. Most high-value payments are likely to be processed using ISO 20022 by 2025, which is looming on the horizon, so ignoring these developments would cause considerable risk for banks. While banks can opt for a complete migration of their back-office systems or even rely on conversion solutions, these too come with the risk that information is lost, mistranslated, or truncated due to old message formats. Migrating an entire back-office can be costly and complex, which potentially makes outsourcing a more cost-effective, faster, and more sustainable proposition. Banks need to evaluate where they can add value to their customers and the degree to which investing in back-office modernisation fits into that goal.

The SWIFT CBPR+ ISO migration introduces the most significant change to cross-border payments processing in many years. SWIFT CBPR+ introduces a fundamental change to validation, internal process flows, confirmation, reporting, and the processing of both outgoing and incoming international payments. Given the number of cross-border and cross-currency initiatives currently materialising (e.g. SWIFT gpi, the BIS’ Project Nexus, and IXB, a joint initiative between EBA Clearing in Europe and the Clearing House in the US), it is key for banks to formulate a long-term strategy to ensure that resources and efforts are not wasted with multiple processing areas requiring major updates. This makes the opportunity presented from TARGET2 migration to ISO 20022 well timed because ISO 20022’s rich data capabilities ease compliance matters for cross-border payments and enable corporates to utilise more data. Managing the integration of corporate customers into the cross-border space is an important aspect of ensuring that bank services and products remain customer-centric and that corporates receive more relevant information and data when working with their bank partners.

Banks have not been immune to the effects of “the great resignation”, with record numbers of workers having left their jobs since the spring of 2020. Even prior to this phenomenon, retaining skilled payments professionals had already become increasingly difficult because of the explosion of new and exciting payment offerings, whether from neobanks and Fintechs, or in the crypto space. The challenges mentioned earlier are coming at a time when banks not only have a lot on their plate but are also struggling to retain key staff. European banks therefore have to swiftly decide how they can transform and modernise their operations and technology in a way that makes them less exposed to labour movements. The ability to outsource has never been easier with cloud-based solutions reducing the dependency on in-house staff, while enabling continuity through continuous access to expertise and experience.

This article was written in collaboration with Lipis Advisors.

Lipis Advisors is a leading strategy consultancy specialising in the payment sector. Lipis Advisors staff are experts on payment systems, services, and strategy, as well as the underlying technologies that support payment infrastructures. Lipis Advisors advises on all forms of payments, including ACH payments, real-time payments, card payments, cheques, mobile payments, online payments, and RTGS/wire payments. To learn more about Lipis Advisors, please visit www.lipisadvisors.com

Contact Us about what’s next for you

Contact UsOur representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |