Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

One of our sales representatives will email you about your submission.

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.

Want to speak with a sales representative?

Your sales rep submission has been received. One of our sales representatives will contact you soon.

NEW YORK, December 14, 2022 – The fourth-annual financial advisor marketing survey by global Fintech leader, Broadridge Financial Solutions, Inc. (NYSE: BR), reveals that 63% of advisors are actively seeking new clients but only 43% are experiencing increases in inbound prospect requests. Market volatility, increasing compliance and regulatory pressures, and a competitive landscape for wealth management service professionals continue to challenge Independent Broker-Dealers (IBDs) and Registered Investment Advisors (RIAs) and requires them to find innovative new solutions to generate business.

“It has been a challenging year for financial advisors, with many struggling to adapt to new compliance and regulatory guidelines, increased market volatility, and ongoing hiring and talent retention challenges. Despite evidence that staying on offense with a sharp marketing strategy yields business growth, especially in volatile markets, we’ve seen advisors shift back to defense and fail to allocate the right level of time, money and effort to their marketing strategies,” said Kevin Darlington, General Manager, Head of Broadridge Advisor Solutions. “That said, digital media usage is a bright spot and continues to show upward-trending success, as advisors double down on digital strategies and maximize the use of websites, LinkedIn and Facebook to generate leads.”

Advisors With a Defined Marketing Strategy Land 2x More Clients Annually

While advisors’ average marketing spend continues to increase ($17,433 in 2022, up from $16,090 in 2021), the percentage of revenue allocated to marketing is down to an average of 3.1% in 2022, compared to 3.6% in 2021. In addition, only 10% of advisors report being very satisfied with their marketing return on investment (ROI), down from 15% in 2021. RIAs tend to allocate more to marketing, spending $27,000 annually compared to $9,7000 by IBDs.

Despite an increase in marketing spend, only 28% of advisors have a defined marketing strategy (up slightly from 26% in 2021). However, these advisors are far more likely to achieve better business outcomes than their counterparts without a defined marketing strategy. Seventy-six percent of advisors with a defined marketing strategy feel confident (somewhat or very) in meeting practice growth goals compared to those who do not (61%).

In addition, advisors with a defined marketing strategy have on-boarded more than two times the number of new clients in the past 12 months: an average of 41 new clients versus 17 for those without a defined marketing strategy. Eighty-two percent of advisors report that developing a marketing plan/strategy is the top challenge when it comes to marketing activities, followed by finding the time for marketing efforts (81%) and managing compliance (79%).

Social Media Use Successfully Yields Leads and New Clients

Advisor success in converting social media leads to clients is trending up, reaching 41% in 2022, an uptick from 34% in 2019. Fifty-seven percent of advisors with a defined marketing strategy converted a social media lead to a new client, compared to 36% of those without a strategy.

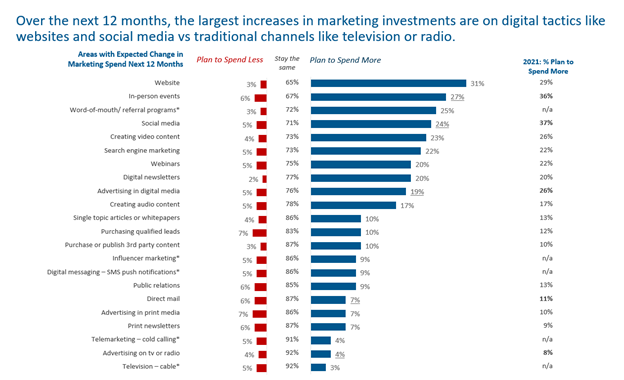

Forty-one percent of advisors with a defined marketing strategy had a social media lead convert to a client, while the majority of advisors (61%) report that they feel their websites could be more effective in generating leads. However, 31% percent of advisors plan to spend more on their websites in the year ahead – the highest spending allocation among all areas reported.

Other top tactics include using digital marketing to expand their prospect pools. The percentage of advisors growing their business outside their locale continues to increase (27% currently servicing non-local clients, up from 24% in 2021), and younger advisors are planning to take advantage of recent SEC marketing regulatory updates, leaning into the idea of featuring testimonials in their marketing (43% of advisors under the age of 45 compared to 30% generally).

Broadridge Wealth Platform

The Broadridge Wealth Platform is an open, component-based ecosystem that redefines wealth management technology. With a flexible, scalable platform powered by an aggregated data layer, it is designed to help firms drive innovation, perform more effectively at scale and deliver a digital, modernized client and advisor experience.

About Broadridge

Broadridge Financial Solutions (NYSE: BR) is a global technology leader with the trusted expertise and transformative technology to help clients and the financial services industry operate, innovate, and grow. We power investing, governance, and communications for our clients – driving operational resiliency, elevating business performance, and transforming investor experiences.

Our technology and operations platforms process and generate over 7 billion communications per year and underpin the daily trading of more than $10 trillion of securities globally. A certified Great Place to Work®, Broadridge is part of the S&P 500® Index, employing over 14,000 associates in 21 countries.

For more information about us, please visit www.broadridge.com.

To contact media relations, please email us at mediarelations@broadridge.com.