Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

One of our sales representatives will email you about your submission.

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.

Want to speak with a sales representative?

Your sales rep submission has been received. One of our sales representatives will contact you soon.

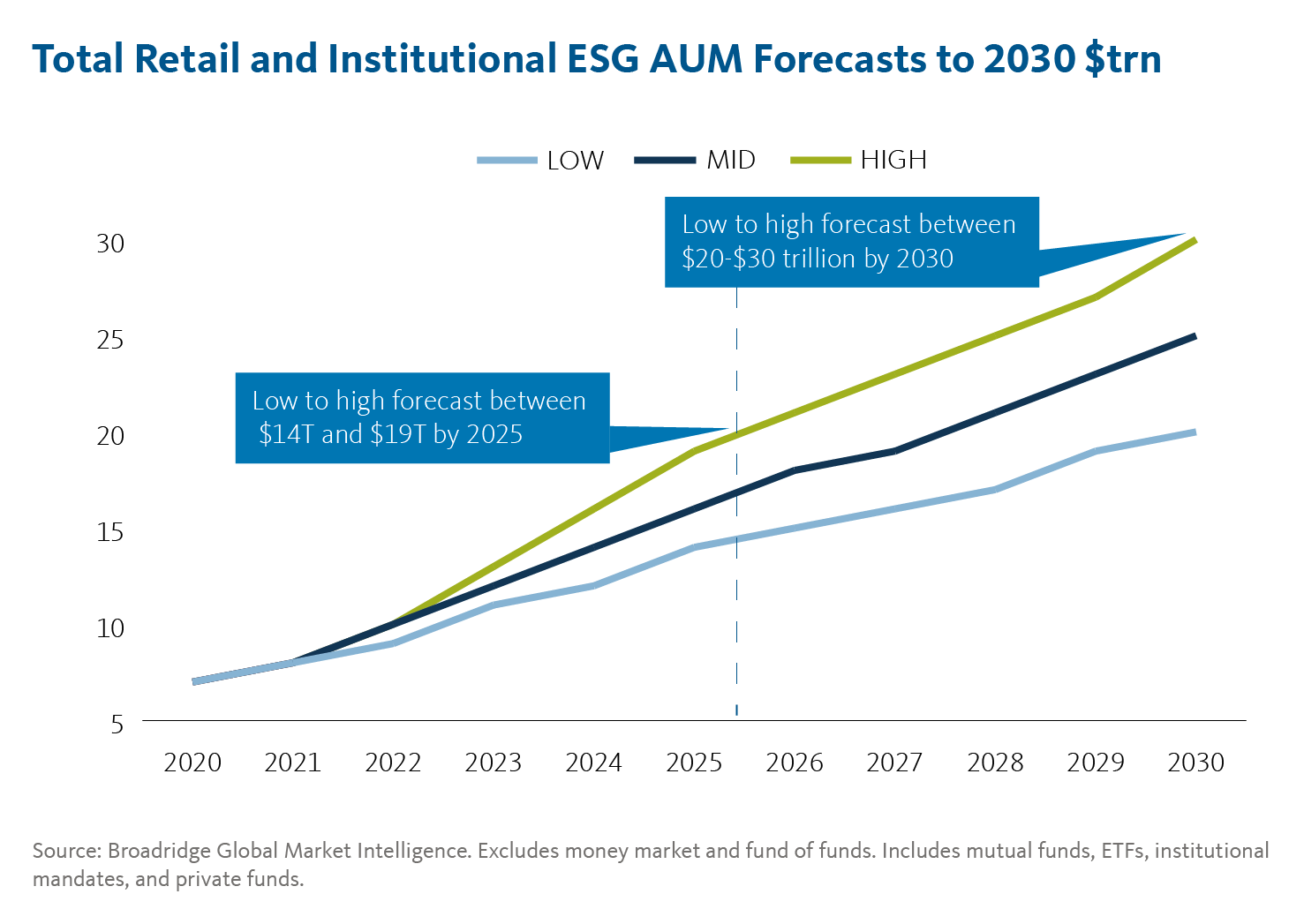

London and New York – November 30, 2021 – A new report from Broadridge Financial Solutions, Inc. (NYSE: BR), a global Fintech leader, reveals assets in dedicated environmental, social, and governance (ESG) mutual funds, ETFs, institutional mandates, and private funds are on track to grow from $8 trillion today to as much as $30 trillion by the end of this decade. Asset managers stand to win up to $9 trillion of net new flows, with expanding opportunities through thematic strategies, climate transition and net zero solutions, and investments offering measurable sustainability impacts.

Net flows into ESG mutual funds and ETFs have risen dramatically this year to $577 billion in the nine months through September 2021, far surpassing the full-year total of $355 billion for 2020. The center of gravity in ESG investing continues to evolve from value and risk considerations towards sustainability impacts, putting greater demands on asset managers to show evidence of the results achieved.

“ESG strategies accounted for just 11% of overall mutual fund and ETF assets but captured 30% of inflows during the twelve months through September 2021” says Jag Alexeyev, Head of ESG Insights at Broadridge Financial Solutions. “While growth remains strong, the complexities and costs of ESG implementation have risen, and fund selectors have begun to ask harder questions, In addition, greenwashing has emerged as a key reputational risk that firms must address. Improving a manager’s sustainable investment capabilities, enhancing transparency, and amplifying communication of results can help establish credibility and strengthen client relationships.”

ESG driving impact and other key findings from the report show:

Visit this link to download Broadridge’s ESG and Sustainable Investment Outlook Report.

Methodology

This report was conducted using Broadridge’s Global Market Intelligence platform. Broadridge’s proprietary Global Market Intelligence platform provides an integrated analytics solution for the asset management market tracking institutional and retail products globally. Broadridge provides insights into more than $100 trillion of tracked assets, covering every market in every region, and 80,000 globally tracked funds.

About Broadridge

Broadridge Financial Solutions (NYSE: BR) is a global technology leader with trusted expertise and transformative technology, helping clients and the financial services industry operate, innovate, and grow. We power investing, governance, and communications for our clients – driving operational resiliency, elevating business performance, and transforming investor experiences.

Our technology and operations platforms process and generate over 7 billion communications annually and underpin the daily average trading of over $15 trillion in equities, fixed income, and other securities globally. A certified Great Place to Work®, Broadridge is part of the S&P 500® Index, employing over 15,000 associates in 21 countries.

For more information about us, please visit www.broadridge.com.

To contact media relations, please email us at mediarelations@broadridge.com.