Access the latest news, analysis and trends impacting your business.

Explore our insights by topic:

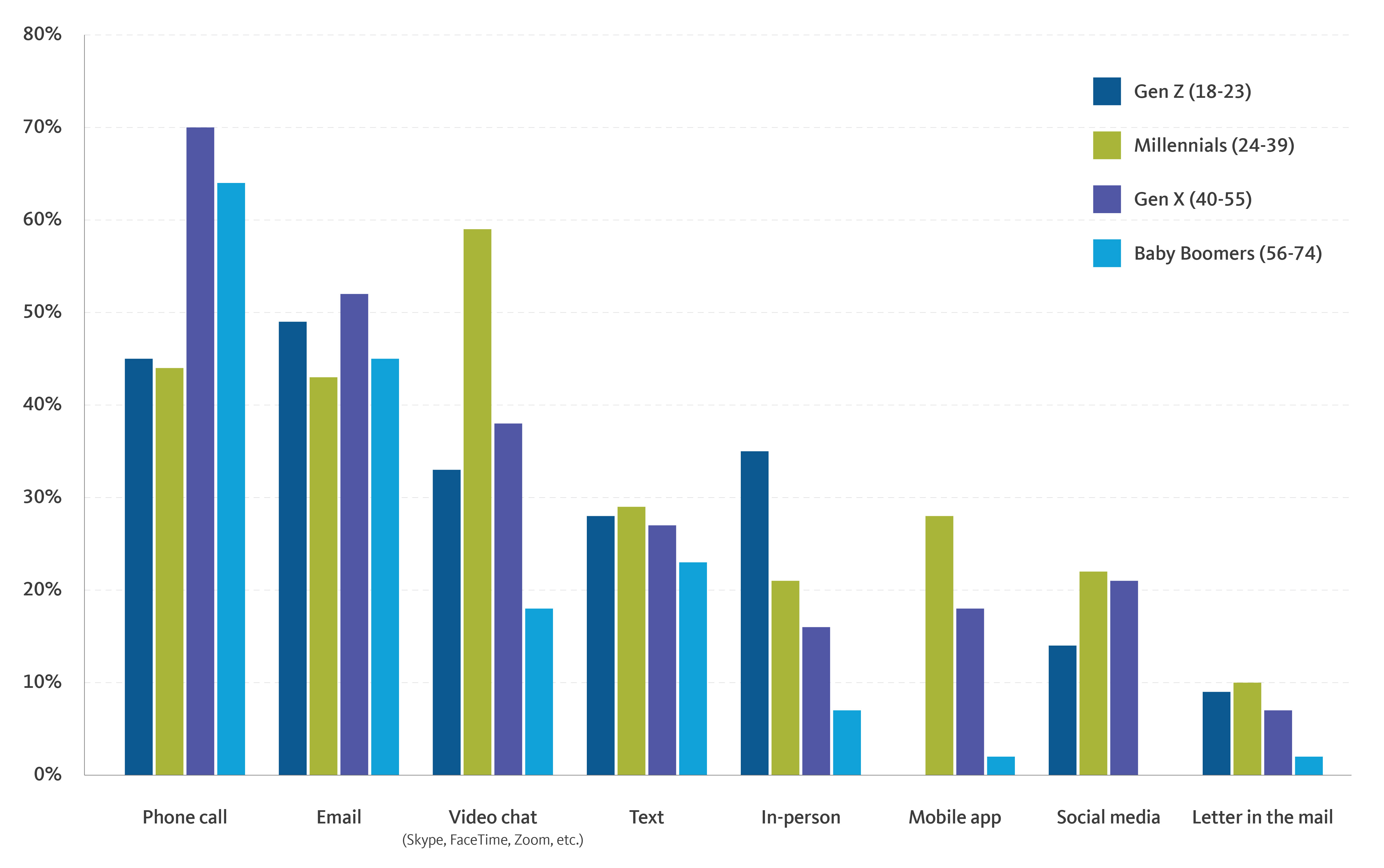

NEW YORK, New York – July 27, 2020 – Changes in how investors and financial advisors collaborate, at first caused by Covid-19, are likely to remain long after the pandemic, according to a new survey from Broadridge Financial Solutions, Inc. (NYSE:BR), a global Fintech leader. Over half (57%) of investors surveyed said communications with their advisor had changed in some way in light of new stay-at-home mandates. Sixty-two percent of those who reported a change in mode of communication said they would entirely or partially maintain their new methods after the pandemic ends. Fifty-eight percent cited phone calls and 46% cited emails as new ways that they communicated with their advisor during the pandemic. More than a third (36%) used video chat, even though only 9% prefer the method above all others. Millennial investors were most likely to use video chat with their advisor (59%).

“We are seeing an accelerated adoption of digitalization and personalization from investors, financial advisors, and wealth firms as a result of the pandemic,” said Michael Alexander, President of Wealth Management at Broadridge. “Advisors and investors adapted their behaviors to comply with stay-at-home mandates and social distancing rules, which led to an increase in digital communications and video conferencing, more personalized emails, and more frequent phone calls. These behaviors are broadening, deepening and changing the client-advisor relationship. As a result, investors don’t want a return to the past. They largely prefer this new normal.”

Personalized and Individualized Advisor Communications

When asked what they like to see in communications from their advisor, respondents preferred information that is individualized to them:

Social Media Remains Key to Connecting with Younger Clients

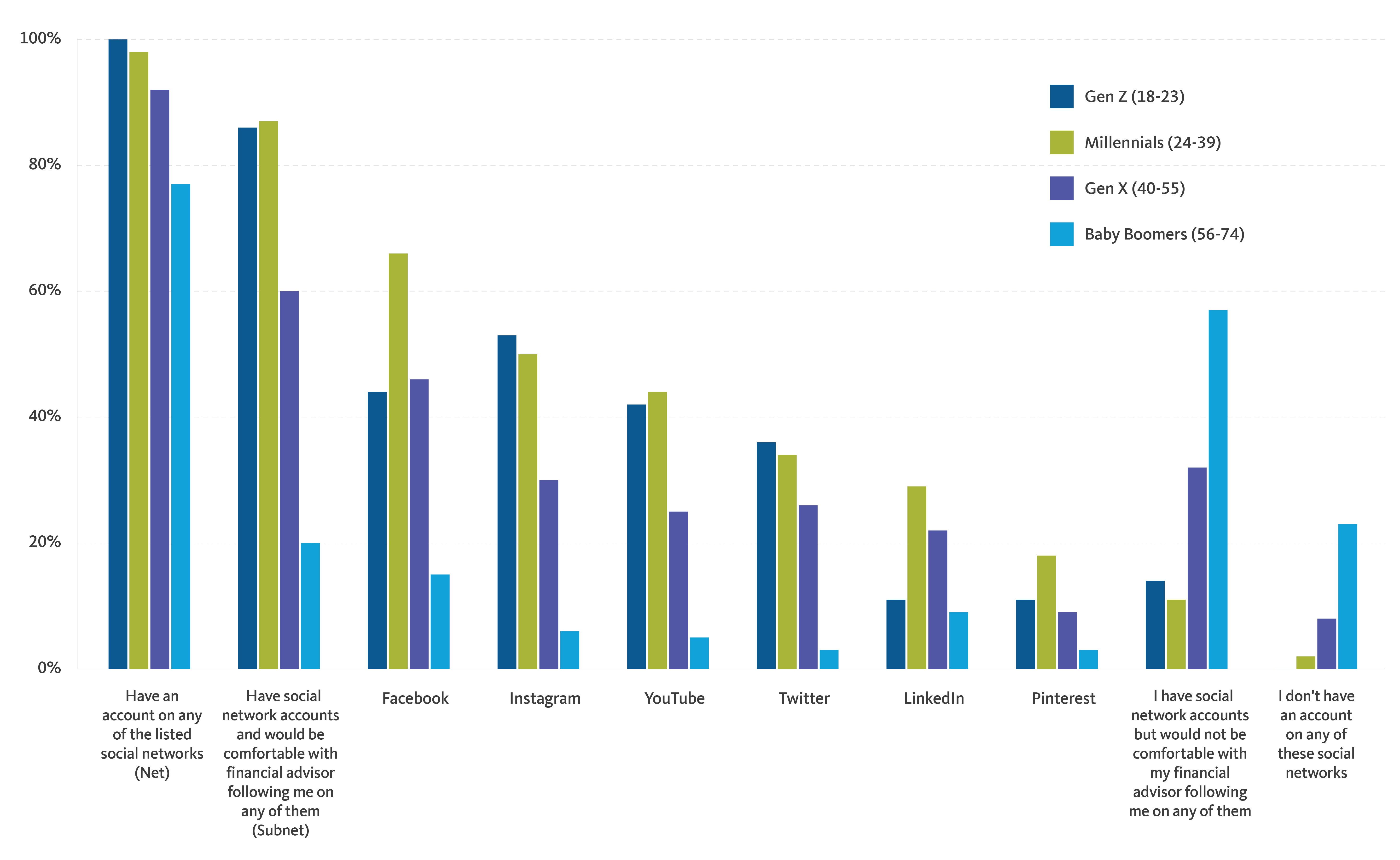

An overwhelming majority of Gen Z (86%) and Millennials (87%) said they are comfortable having an advisor follow them on social media to offer a more customized experience. Meanwhile, only 60% of Gen X and 20% of Baby Boomers are comfortable.

Facebook is the top social media platform where Millennials (66%), Gen X (46%) and Baby Boomers (15%) would feel comfortable with their FA following them, while Gen Z is most comfortable with advisors following them on Instagram (53%). Fifty percent of Millennials are also comfortable with advisors following them on Instagram.

Millennials (87%) and Gen Z (86%) are most likely to be receptive to reading adviser communications on social media as opposed to Gen X (59%) and Baby Boomers (18%).

Advisors Missing Key Family Relationships

Despite 44% of respondents stating that they discovered their financial advisor through a personal referral, nearly half (44%) reported that their advisor has not communicated with their spouse, partner, children, grandchildren or heir.

“With clients spending more time at home due to the pandemic, advisors have a once-in-a-lifetime opportunity to develop a deeper relationship with their client’s entire family,” said Alexander. “It doesn’t have to be more complicated than a video conference. This is a natural moment to engage, educate and communicate with spouses, partners and children.”

Methodology

The survey of 1000 individuals who currently use a financial advisor in the United States and Canada was fielded in June 2020 by Engine, a market research firm.

About Broadridge

Broadridge Financial Solutions (NYSE: BR) is a global technology leader with trusted expertise and transformative technology, helping clients and the financial services industry operate, innovate, and grow. We power investing, governance, and communications for our clients – driving operational resiliency, elevating business performance, and transforming investor experiences.

Our technology and operations platforms process and generate over 7 billion communications annually and underpin the daily average trading of over $15 trillion in equities, fixed income, and other securities globally. A certified Great Place to Work®, Broadridge is part of the S&P 500® Index, employing over 15,000 associates in 21 countries.

For more information about us, please visit www.broadridge.com.

To contact media relations, please email us at mediarelations@broadridge.com.