Future of Operations: Finding a Home for Fintech

Could new Fintech technologies free your workforce from ‘soulless business processes’ and allow them to focus on value-added client engagement?

Menu

When it comes to implementing new technology and properly utilizing Fintech, it appears that the operations functions of asset management firms are often dipping their toes in the water, rather than taking the plunge.

Fintech, if correctly deployed, is a proven alpha-generator in everything from debt and equity issuance to trade finance and commercial insurance.

In this white paper we will explore:

- Use cases for RPA technology

- Artificial Intelligence (AI) and Distributed Ledger Technology (DLT)

- Roadblocks to adoption

- Managing future expectations

- Industry Collaboration

To an outsider, it might look like the financial industry is flourishing: asset managers continue to generate healthy returns, win and retain clients and innovate along the way. We are also safer and sounder after the implementation of new regulation over the last decade. But insiders will know that not everything is rosy. Asset managers continue to grapple with lower fees. New regulation may have shored up the ship, but it continues to make demands on our time, energy and resources.

Despite the various challenges, there is cause for cautious optimism. One bright spot is the increasing sophistication and agility of the operations function—the middle and back offices that manage risk and keep the information, cash and products flowing. Today, information technology advances such as Artificial Intelligence (AI), Cloud Computing, Distributed Ledger Technology (DLT) and Robotic Process Automation (RPA) have the potential to further transform operations, reducing the human workload, squeezing new efficiencies out of processes, and lowering costs. Can the industry find a home for Fintech?

Small, nimble technology players and Big Data companies alike are enjoying what Oliver Wyman has termed “flywheel momentum”1. This flywheel momentum has a virtuous cycle. Technology companies continually gather and analyze data in ways that enable them to better understand their customers. This allows them to offer their customers more value-added services, which in turn brings in even more data. The biggest players have only scratched the surface in terms of what they might go on to do in financial services.

The overall business case for new technology is clear—but the ability of financial services to harness the power of fintech in their operations to exploit the current boom and any future potential upside—is not. Fortunately, the will is there. The 2019 SIFMA Operations Conference and Exhibition demonstrated that financial services firms already understand the link between technology and productivity gains. There is a strong and clear consensus within operations functions around the need to automate and take processes to the next level in an industry where humans still work in Excel sheets to gather information from one system and transfer it to another.

Despite the consensus, it appears that the operations functions of asset management firms are dipping their toes in the water, rather than taking the plunge, when it comes to new technology. Can the industry find a home for fintech?

Fintech Opportunities

Some common fintech opportunities that financial institutions are analyzing, preparing to deploy or currently utilizing include:

- Artificial Intelligence (AI): AI simulates human intelligence and can be used to increase efficiencies and lower costs in what would normally be manual tasks such as market surveillance, anti-money laundering (AML) and know your customer (KYC).

- Cloud Computing: Cloud involves moving from on-site IT systems to software residing in a separate data center.

- Distributed Ledger Technology (DLT): DLT, of which blockchain is one type, is a consensus of replicated, shared, and synchronized digital data that can be geographically spread across multiple sites.

- Machine Learning (ML): ML is a subset of AI where computer algorithms can learn from data without specifically being programmed, and autonomously learn over time at identifying issues or options.

- Regulatory Technology (Regtech): Regtech is the utilization of technology, such as advanced analytics or ML, to aid in compliance, reporting and other regulatory requirements.

- Robotic Process Automation (RPA): RPA is a type of process automation technology based on the notion of software robots mimicking the actions of humans in carrying out a specific task. It is meant to take the repetition out of routine tasks, freeing up employees to focus on higher value assignments, such as those involving client interactions.

The Rise of the Robots

Operations functions have found several use cases for RPA technology—or software robots that mimic human actions— over the last year to 18 months, but they have been slower to implement other fintech such as AI, or the simulation of human intelligence by machines. There is some excitement about the potential of DLT, or blockchain technology, but market participants are struggling to define a use case and justify the costs of investment.

Czech science fiction writer Karel Capek introduced the word ‘robot’ in 1920 in a play about the technological creation of artificial human bodies without souls2. It is a good description of the kind of work performed by RPA technology, which configures software to mimic the actions of humans in carrying out repetitive—and some might argue—soulless business processes.

Put another way, RPA takes the robot out of the human, freeing them up to focus on higher value and more intellectual tasks, as well as enabling more time for value-added client interactions. RPA utilizes the user interface to capture data and manipulate applications, while interpreting, triggering responses and communicating with other systems in the same way as humans do. This capability allows companies to automate at a fraction of their previous costs and time, and RPA can leverage existing infrastructure with minimum disruption.

The biggest use case of RPA appears to be transaction processing. For example, SIFMA members have implemented the technology in various stages of the trade management cycle, allowing them to squeeze efficiencies from individual processes such confirmation, settlement, reconciliation, valuation, accounting, net asset value calculation, reporting, performance management and risk management.

A large majority of SIFMA AMG members have reported the successful implementation of a form of RPA in their operations functions during the previous 12-18 months. According to respondents of a recent SIFMA survey3:

In the largest use case, members reported using RPA technology as they develop their own applications and workflow chatbots that connect to Symphony, the messaging platform. RPA can underpin a range of projects from simple applications that automate a specific workflow to complex bots and chatbots, which combine multiple functions, such as enhancing conversations about market data, or ironing out human errors in the workflow process. “For example, it might spot a mismatched FX trade communicated by a human, correct that price, and move it back into the workflow,” stated an asset management operations executive.

The second-largest use case for RPA appears to be for data tasks including extraction, aggregation entry, transformation and reporting, as well as lower-value work such as saving files, transferring data and sending e-mails. For example, members reported using RPA for the testing and implementation of Extract, Transform and Load (ETL) tools within their operations processes, the three database functions that are combined into one tool to pull data out of one database—such as custodian files—and placing it into another database.

“We want RPA to pull data that was previously gathered manually—whether it’s websites, files, emails—and bring it into our environment,” stated an asset management operations executive from a large asset management firm.

Market participants have also used RPA to create in-house smart workflows, which send ‘ticklers’ to employees when actions are required. “It will tell people when our deals get approved and are ready to be funded,” says Joe Haddock from Annaly Capital Management, Inc. “That used to be done by email and spreadsheet.”

Companies reported using RPA to share so-called ‘static data’ such as instrument, product, client, counterparty, book, corporate actions, calendars across their organizations. Firms are also using web-based RPA tools such as Blue Prism for identifying potential processes for automation and also building their own RPA models on desktop software such as UiPath.

Executives also reported using RPA to enhance JIRA service desks, which provide a single point of contact between a company and its customers, employees and business partners. The technology smooths workflows such as the desk’s ticketing systems.

RPA in Action

“We’ve moved from humans working manually to using robots for several processes - the reconciliation of accounts and software systems, simplifying manual processes, exceptions processing and so on. This opens up our associates to do more value-added work and allows us to gain greater efficiencies in our processes.”

“We run a robot to log onto custodian sites, download files and save them in a drive. That used to be a manual task from file transfer protocol (FTP) sites. We’re also developing a smart RPA builder, to be managed by our IT staff. We plan to roll it out so other areas of the business can create their own RPAs.”

“We are doing pilot work with RPA, using them as anomaly detection tools in chatbots seems like a fruitful place to start.”

“We’ve just put together new systems for portfolio management, which are reliant on the data in broker’s statements. RPA can just grab the data from emails and works well for these upstream processes that are very manual. Leveraging the technology saves on grinding the data into readable format for downstream system records.”

AI and DLT wait their turn

RPA seems to have found a home at several companies for winning efficiencies from specific processes, but AI is a different story. Anecdotal evidence suggests that adoption of AI in the operations functions of asset managers over the last 12-18 months has been very modest, and that a minority of SIFMA AMG members have plans to implement the technology. There is also widespread skepticism about future uptake.

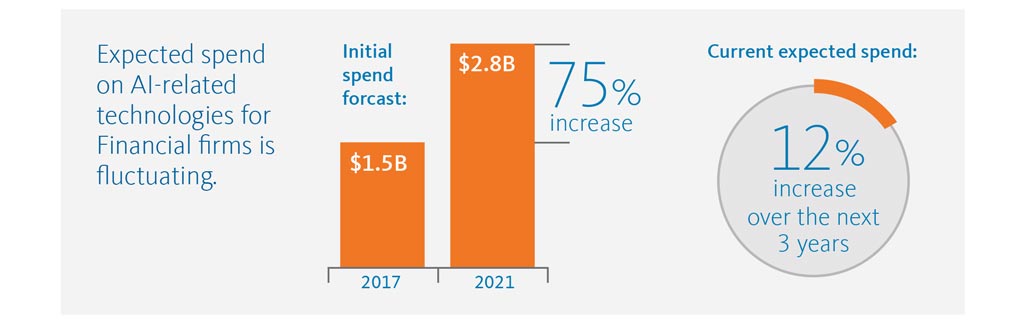

This is despite forecasts of increased spending. In 2017, consultancy Opimas expected financial firms to spend more than $1.5 billion on AI-related technologies. By 2021, this will rise to $2.8 billion, representing an increase of 75%.

Participants appear to agree that the technology could have a potential role in increasing efficiencies and lowering costs in what would normally be human tasks such as market surveillance, Anti-Money Laundering (AML), and Know Your Customer compliance (KYC). This is because the technology can ‘think and learn’4 as it uses deductive analytics to read and extract pertinent information. However, SIFMA AMG members are still skeptical that AI can replicate the value judgement and sophisticated thought processes of human beings.

An anecdote about a train trip through Swiss countryside told at last year’s 2019 SIFMA Operations Conference and Exhibition illustrates one perceived weakness of AI. Hans-Juergen Rieder of UBS explained that the technology can certainly calculate the most efficient route, but it would fail to notice that the sun was shining and that travelers might prefer to take the scenic route and enjoy each other’s company. The moral of the tale is that companies should not confuse information with knowledge. A Deloitte survey notes that market participants expect industry spend on AI to increase by just 12% over the next three years and that RPA is the next evolution in the greater financial services industry.

However, there are some bright spots. Broadridge’s Christopher Fedele, Senior Director, explains that in testing, it appears AI technology can efficiently assist the population of legal entity identifiers (LEIs) for clients who are reporting transactions. “We’re happy with preliminary results when we compare our LEI database alongside client data because AI successfully grabs data and populates fields. Although we’re learning very quickly.”

“We’re using rudimentary AI—machine learning—to automate and accelerate some of the underlying processes of client onboarding, which is emerging as a major focal point for banks and financial institutions,” says Bolusani. “This will allow us to have our people spend more time analyzing complex regulations in the AML/KYC space and determine how to best manage regulatory and franchise risk.”

He explains that a combination of tighter margins, stiff competition and regulatory scrutiny—stemming from the Foreign Account Tax Compliance Act (FATCA) and Europe’s Markets in Financial Instruments Directive II (MiFID-II)—has increased the costs of trade processing and operations. This means that banks and brokers need to focus more on how they onboard, understand and treat their clients.

Participants also weighed the use of AI in loans, saying the technology could review loan documents in place of lawyers, and make better decisions when there is a scarcity of market data. However, these appear to be the exceptions among participants. “AI is finding an increasing number of use cases, but we don’t see many practical applications for it yet in the mortgage and fixed income asset management space,” says Haddock.

Several participants claimed that the costs of implementing AI were unjustifiable. AI might be able to streamline a process— such as reducing the number of trade exceptions throughout the lifecycle—but the investments in the technology might be larger than paying full-time equivalents (FTEs) to resolve exceptions.

Similar concerns plague DLT, or blockchain technology. Panelists estimated at SIFMA’s 2018 Ops conference that around 75% of US financial institutions have tried a type of blockchain but noted that there are still very few business cases.

Several market participants noted that blockchain is currently being tested by the ASX Group in its clearing and settlement infrastructure and platform transformation—and acknowledged the utility of the technology—but could not identify additional business cases in the asset management industry.

SIFMA members agreed that DLT could improve a narrow range of specific processes, such as confirming and reconciling bilateral swaps, or underpinning a repurchase rate. The failure of the industry to rally round a larger use case for DLT surprised some market participants. “Everyone has disparate data and domains,” says Jesse Robinson, Managing Director, State Street Global Advisors. “It currently takes two days to settle an electronic stock—there’s no reason why we can’t be more real-time in record management,” he adds.

“We haven’t seen the take-up yet of DLT yet, beyond prototyping.”

“Blockchain / DLT would certainly help the industry, given the size of some client bases. Add in buy-side, sell-side, clearing organizations, custodians, regulators, and you have a multitude of parties and relationships that would benefit from being across something like a repurchasing trade. But all the above parties would have to make the business case for implementing such new technology,” said Fedele.

Broadridge Chief Executive Tim Gokey said at the SIFMA Operations & Technology conference in May 2019 that the industry could innovate, gain scale and decrease their costs in this respect via mutualization. “It’s an industry model where the more people that come into it, the better it works,” he told delegates. Companies working independently of one another would result in “a lot of work,” he added. “When you think about the broad portfolio of applications that we all have, and the work we need to do to get them to the next generation…can we mutualize that?”

Roadblocks to Adoption

McKinsey indicates RPA “offers a potential 30%–200% ROI in the first year, and employees may like it too.”5 It’s unclear if this has been the case for all market participants, but SIFMA AMG members are overwhelmingly satisfied with the results that RPA has delivered to date. They report that they have successfully used RPA to win efficiencies, improve key performance indicators (KPIs) from mature processes, lower the cost of labor needed for what were formerly manual tasks, and free up personnel for value-add projects. Participants have plans to expand RPA’s deployment within existing use cases such as transaction processing, data tasks and client servicing.

“We’re happy with RPA so far in comparison to our previous manual processes, and we’re continuing to expand its use,” says Haddock. “RPA is saving us thousands of man hours,” says Bolusani.

Participants are pleased that RPA has proven to be relatively IT-light and can be implemented in short timeframes, which differentiates it from other emerging technologies like blockchain or AI. Firms report that they have easily layered RPA on top of legacy technology systems to interact with them more efficiently or connect them with other systems or technologies. IT departments no longer need to create code ‘from scratch’ to streamline certain processes, says Montgomery. "They are very keen on promoting RPA, it’s a very big benefit to the business."

However, participants have identified some shortcomings with the technology. Participants agree that RPA has so far been limited to ‘low-hanging fruit’. The technology is a successful workflow tool that can read documents, carve out unstructured data, restructure the information and move it along to other groups.

“It’s delivered for some specific use cases such as reconciliations, client on-boarding and trade processing,” says Robinson. “Now it’s about looking for opportunities that can have a wide impact across an organization and not deliver results just for one team. For instance, can we extend the on-boarding processing into billing? Then you build that lifecycle further and further, using technology that can keep growing with the business, rather than being spot orientated, which adds less value.”

“RPA has worked well, but we haven’t applied it to anything really complex like derivatives, or transformation. There are questions about RPA - not so much regarding the delivery and consumption of data but whether it can transform and enrich that data.”

This exposes one of the possible obstacles to rapid RPA rollout. The technology can handle back office tasks such as trade processing, transaction duplication, or account opening automation, but may struggle in automating tasks that are constantly changing, non-standardized, and unstable because they cannot be easily defined6. This would present problems for the technology’s potential deployment in front office work that involves sophisticated thinking, judgement, and decision-making.

There are also concerns about the resourcing capacity to drive such technological advances such as RPA, because firms have been cost-cutting and downsizing in recent years. Several candidates said that simplicity and versatility were key to maximizing RPA deployment.

And one of the biggest obstacles to swift RPA implementation is compliance with regulation, most notably audits of internal controls. “There is the Sarbanes-Oxley Act (SOX) and all the associated legal regulatory requirements, which goes across multiple systems, upstream, downstream—and involves external auditors,” says Haddock. Such strict rules are a deterrent to quick decisions on investment, agreed participants.

Despite a seeming lack of confidence over the widespread deployment of AI, participants who have adopted the technology have reported good results. “It’s showing a lot of promise in solving some of the asset managers’ challenges, such as reducing errors and squeezing out new efficiencies,” says Fedele.

“For AI, the limit is human psychology itself,” says Bolusani. “It’s very easy to take a step back and identify what needs to be done, but then you need to reengineer it, ensuring that the data is accurate, and that is evolving properly in terms of its ultimate purpose.”

Market participants were not surprised by the slow progress made around DLT. Several cited a benchmarking study7, which identified legal risks, DLT’s relative immaturity, and the reluctance of end-users to disturb established business processes as the main obstacles to further adoption of the technology.

Costs were also cited. “Overall, the question is whether DLT’s worth it, given the costs of technology versus the potential incremental revenues, savings and risk reduction it can deliver. New technology takes time and experience to develop; you have to have patience and persistence. We’re working in a results-orientated industry, so new technology needs to add to the bottom line quickly,” says Fedele.

Market participants said that the industry would continue to pursue new technology such as DLT, but noted that its adoption could be slower than originally anticipated. Several participants suggested that this should not be read as a value judgment on the technology itself, but as a reflection of the industry’s tendency to prioritize topical concerns over the implementation of new technology. Some cited preparations for a ‘Hard Brexit’ and cybersecurity as current business priorities in the industry8. That can divert a company’s finite resources and attention away from new technology, irrespective of its utility.

Challenges to Broad DLT Adoption in Order from Highest to Lowest

- Legal risks/regulatory framework

- Confidentiality issues

- Reluctance to change established business prosses

- Immature technology

- Difficulty of building business network

- Potential issues with data protection laws

- Scalability/performance concerns

- Reluctance to give up some control

- Security concerns

- Unknown costs/benefits

- Lack of suitable use/business case

Source: Cambridge Centre for Alternative Finance and Visa

Managing Future Expectations

Looking ahead, participants conceded that the pace of change is glacial, but attribute this to the conservatism of the highly regulated financial services industry and its significant legacy technology.

“You have to remember that today’s tech was not built overnight. So it’s a marathon not a sprint, and in the process we’re breaking a lot of new ground. This is a multi-trillion-dollar industry so it’s wise to move slowly and deliberately with defined goals.”

Others are less hopeful. “The pace is deathly slow, and we don’t move unless we’re forced to by a regulator or by an opportunity,” says Robinson.

Many agreed that the pace of technology adoption should be governed by the industry’s fiduciary responsibility to its clients, rather than self-interest. “We should show our clients that we’re taking the lead and driving outcomes that are in their interests— that’s why we’re here, “ says Robinson.

“What we are ultimately trying to do with technology is improve the overall experience for clients,” agrees Fedele. Several participants stated a variant of the sentiment that “technology is not the destination; the destination is the client,” with technology merely a means of serving the client better.

However, use cases for RPA are expected to proliferate. “I think RPA will become even more mainstream [because it offers] quick wins in terms of efficiency,” says Montgomery. “RPA is here to stay.” Participants says that they will continue to use RPA to drives cost reductions, increase oversight and decrease risk within specific processes, especially transaction processing and data tasks.

However, the industry is well aware of RPA’s limits. The technology will not be applied to more complex processes where multiple decision points exist, or as a ‘band-aid’ where wholesale system and process redesign are required.

There is also a realization that firms need a company-wide approach to implementing RPA, rather than deploying various technologies to squeeze efficiencies from individual operational processes. This means incorporating the technology into the supervision, risk management and regulatory frameworks that govern financial institutions. If not implemented within a proper governance structure, or deployed without suitable quality controls, there is a risk that RPA can create and multiply issues at a faster rate than manual processes, as with any other software.

There is room for fresh thinking in this respect. “How else should we think about robots within our governance frameworks? Should they be considered employees with org-chart designated managers responsible for their performance?” asks Haddock.

There is optimism in some quarters that use cases will be found for AI and DLT / blockchain that will lessen the operational burden. “AI should become more mainstream—although as is the case with many new technologies, the jury is still out on if it will become that,” says Fedele.

Although some participants struggle to envisage use cases for the technology, Broadridge says that recent advances in natural language processing lend themselves to “significant automation” of a variety of currently manual tasks such as legal agreement electronification, regulatory analysis, reconciliations and disputes, client and counterparty communications, as well as voice-based control and use of virtual assistants.

It concludes that market participants will finish implementing the recent round of regulatory initiatives in coming years. We will then begin to see more rapid and widespread uptake of AI technologies to achieve competitive advantage. This will also coincide with the maturing of AI tools for a wider range of business applications. While this will entail changes for human traders, collateral managers and operations personnel, it is important to note that ML systems rarely replace a person’s entire job.

“We used to say we desire to be a fintech company. However, a financial institution is very different from a fintech as: (1) it has strict regulations to adhere to and a great responsibility to protect the movement of money and sensitive customer data; and (2) shareholders do not have a fail fast and fail often mentality.”

The implementation of DLT / blockchain will be similarly cautious. Participants say that the imperative of keeping customer data safe takes precedence over ‘bragging rights’ on the technology. In any case, deep and broad collaboration is necessary if the technology is to achieve critical mass adoption. The lack of interoperability—a DLT platform working across offices, banks and various infrastructures—is still cited as an issue by participants, but that does not mean a single ledger for the industry is either realistic nor desirable.

Some market participants pointed to the efforts of industry groups such as Hyperledger, who are working to build standards to enable interoperability. Even if this is realized, the question of future regulation around the technology is causing headaches. Participants perceive US regulators to be more focused on other technologies, and little prospect of this changing in the short-term.

Participants generally accept the utility of fintech in operations but are keen to manage the industry’s expectations around deployment. For instance, several note the false dilemma over whether companies should build technology themselves—those fostering the entrepreneurial spirit of a fintech—or ‘go outside’, by partnering with, or buying, fintech firms.

Collaboration

Participants are strongly supportive of increased collaboration, and there is a consensus that firms should come together at all levels. There were calls for trade associations such as SIFMA—that brings together the shared interests of brokers, investment banks and asset managers—to broaden the scope of conversations around technology to improve advocacy efforts.

“That [breadth of conversation] would help us to better interact with vendors, meaning we can transform their technology into a product we can leverage,” says Montgomery. However, Bolusani cautions that such conversations can be difficult to navigate in the competitive environment of financial services.

Executives were pleased with collaboration over the development of RPA technology. They pointed to several industry-wide formal discussions on firm experiences and good practices for supervising RPA bots and integrating RPA into technology risk management and oversight frameworks. The conversations have been fruitful, and the industry is seeking to engage regulators and supervisors in dialogue to explore how to accommodate digital labor into regulations designed for human labor practices.

In this vein, participants were strongly in favor of working groups within SIFMA that have a particular focus. Several suggested the formation of special groups to work on business use cases for AI and DLT / blockchain within operations.

Almost every executive polled said that the industry continued to suffer from the lack of standardized data. With every firm having different database input fields in their in-house systems, even routine processes as reconciliations and margin calls can be onerous.

Market participants also called for developers to open application programming interfaces (APIs) to boost interoperability. “Doing so provides a better opportunity to connect workflow to the technology,” says one asset management operations executive. “The biggest thing that could happen in terms of collaboration is open source solutions—take portfolio accounting, which only has very expensive legacy systems,” says Haddock. “There’s an opportunity for an open source tool to disrupt that.”

However, some participants warned that the industry should move beyond tactical collaborations that solve a single problem, instead building a culture based on a shared strategic view of the future. A better way of identifying common ground would be for representatives of the leading firms to share their top specific pain points and solutions to solve them, leveraging service providers as needed to develop those fixes.

Such efforts could lead to the use of sandboxes in the US. In such environments, all parties can learn together and assess potential opportunities and risks as technologies are being developed and tested. A sandbox provides a favorable regulatory environment for small-scale experimentation and is a safe way for market participants to realize a bona fide business case. However, there are still question marks over the regulation of such enterprises. SIFMA’s white paper “Promoting Innovation in Financial Services” has made recommendations for balancing financial regulation and innovation.

“Organizations that expect to benefit from a digital transformation or a promising new strategy won’t get very far if they lack the people to bring the plans to life. What might seem like an irritating talent gap today could prove a fatal competitive liability in the not-too-distant future.”

“We have recent employees and interns who have come straight out of school and understand coding and RPA. We just have to help them to understand the business. We’ve also hired internally - for example, a paralegal came over from another team to help centralise the operations function. We also have an internal talent pool that is hungry to expand their talents into this growing role of operations.”

People and Skill Sets

Operations executives accepted that hiring strategies needed to change to confront disruptive technologies such as digitization, automation, and AI. Such technologies continue to transform the nature of work.

88 percent of global executives expect that at least half of their organization’s workforce will need retraining or replacing within five years according to a recent McKinsey survey. Additionally, around one-third of the survey’s respondents claimed their organizations were poorly prepared to address the skill gaps they anticipate.

Participants agreed that their industry would benefit from people who understand both technology and the asset management business itself. “It’s not about core operations —it’s about [finding people] with that combination of operations, tech and data science backgrounds or building those capabilities. They need to understand data and apply it to the business in ways to impact change,” says Robinson. “Leverage the capabilities of great programmers and add in business experts to bridge the gap, or encourage operational experts to develop their technical skills.”

“We need individuals that know how to work with data, have a good understanding of how relationships work between data, and who are already able to speak the language,” says Montgomery.

Executives said that companies implementing new technology might lean towards hiring people with specific experience in those stacks. “We recently hired someone for a model risk management role, in part because they had an understanding of specific technologies,” says Haddock.

The asset management industry also needed to offer opportunities for people to retool to take the next stage in their careers. This could mean allowing people to return to higher education where appropriate. “Organizations should be helpful and responsive to that,” says Robinson.

“We have rotation programs for recent graduates, which means they will be rotated through our data science teams,” says Herskowitz. “That will stand them in good stead.”

Conclusion

There is no doubt that new technology is and will continue to improve the overall experience for clients, which augurs well for the future ability of operations departments. Companies have found a multitude of business uses for RPA technology, which has freed them up to focus on higher value tasks. However, the industry has not yet unleashed the technology on complex work or across organizations.

The industry believes that AI has a potential role in increasing efficiencies and lowering costs in what would normally be human tasks, but it has yet to thoroughly define this role. There are no doubts about the technological utility of DLT / blockchains, but like AI, it remains a solution in search of an application. There is a lingering dissatisfaction with the pace of progress, which participants generally attribute to a conservative culture in the heavily-regulated financial services industry. However, there is a healthy appetite for collaboration enthusiasm around the workforce’s expanding skill set, and a continued optimism to work together to find use cases for new technology.

These topics and more were discussed at SIFMA’s 2019 Operations Conference & Exhibition, which took place from May 6-9 in Boca Raton, Florida and for which Broadridge was a Presidential Sponsor. For more from the event, visit Sifma.org/ops

Footnotes

1 Oliver Wyman, The State of Financial Services 2019, https://www.oliverwyman.com/content/dam/oliver-wyman/v2/publications/2019/January/TheState-Of-Financial-Services-2019-Time-to-start-again.pdf

2 SIFMA Insights: RPA, Not Your Science Fiction Movie Robots, May 7, 2018, https://www.sifma.org/wp-content/uploads/2018/05/SIFMA-InsightsRPA-Not-Your-Science-Fiction-Movie-Robots.pdf

4 Broadridge, What are the Applications for Artificial Intelligence in Securities Finance and Collateral Management?, 2017, https://www.broadridge.com/white-paper/what-are-the-applications-for-artificial-intelligence-in-securities-finance-and-collateral-management

5 McKinsey, The next acronym you need to know about: RPA (robotic process automation), December 2016, https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/the-next-acronym-you-need-to-know-about-rpa

6 UiPath, 5 Factors In Choosing Which Processes to Automate, https://www.uipath.com/blog/5-factors-in-choosing-which-processes-to-automate

7 EY, the Cambridge Centre for Alternative Finance and Visa, Global blockchain benchmarking study 2017, September 2017, https://www.ey.com/gl/en/industries/financial-services/fso-insights-global-blockchain-benchmarking-study-2017

8 BackBay Communications, Asset managers beef up cyber defences as a priority new industry survey reveals, 2018, http://www.backbaycommunications.com/?s=private+equity+brand+survey

9 McKinsey Quarterly, Are we long—or short—on talent? January 2019, https://www.mckinsey.com/business-functions/organization/our-insights/arewe-long-or-short-on-talent

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

The ABCDs of Innovation®

Leverage next-gen technology. Turn tech disruption into opportunity.

Innovation

Explore the next generation of AI-driven, platform-agnostic reconciliations to eradicate breaks, enhance system performance and drive ROE.

Report

6 in 10 consumers want to go paperless with new providers, but most aren’t being asked at signup. Learn how to drive your digital transformation.

Article

Broadridge now offers services through a private cloud powered by IBM. Discover how the hybrid strategy can get you ready for what’s next.

Innovation