A comprehensive and flexible solution for Solvency II reporting

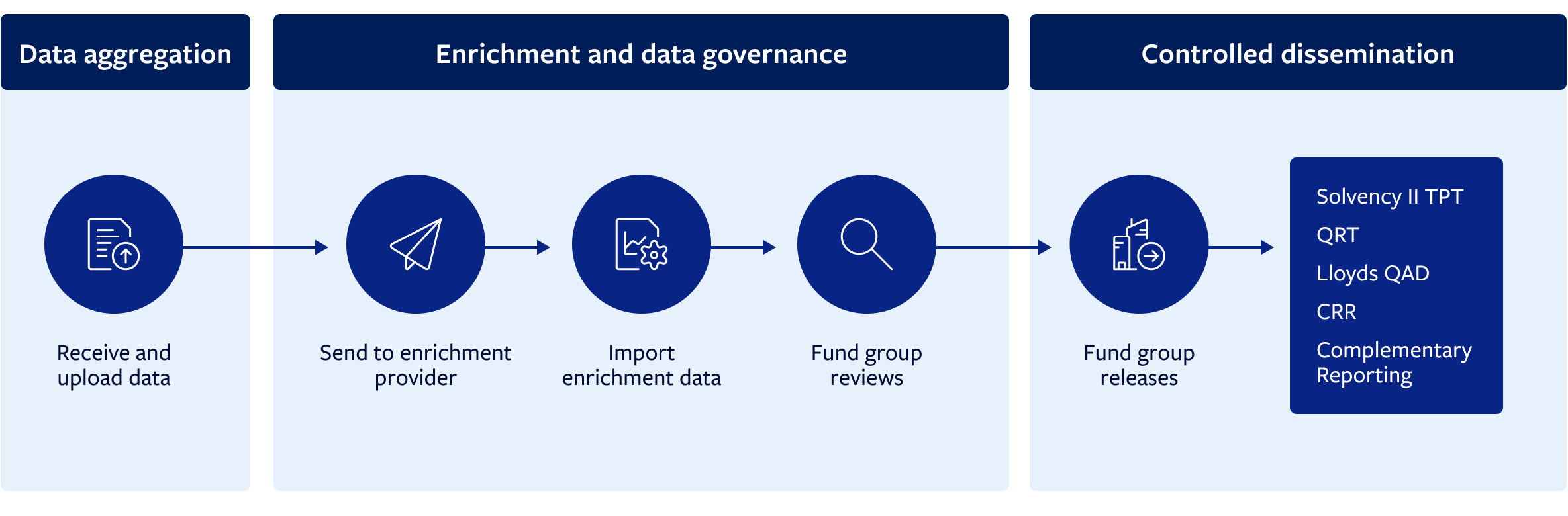

Our solution makes data aggregation, enrichment and dissemination easy and efficient. From composition through to distribution, you can meet your reporting obligations.

A growing solution developed by experts to meet your regulatory requirements

We developed our online platform in collaboration with clients and a leading global consultancy. Our experience as a leader in look-through data allowed us to design an intuitive and agile solution with a blend of automated and manual data validation that reduces risk and improves visibility across your business.

Simplified data aggregation, enrichment, and dissemination

-

Streamline TPT reporting using an online portal.

-

Set permissions to control who can view your data.

-

Access multi-layered look-through functionality at fund- and share-class levels.

-

Run SCR calculations for TPT-required fields.

-

Use asset allocation and associated risk details to support sales.

-

Adapt to future regulatory updates.

Solvency II manager

Precise and streamlined reporting

Stay ready for future changes

Rely on our extensive track record of helping 100+ European firms produce and distribute TPT reports while navigating new regulations. By promoting cross-industry dialogue between asset managers and insurers, we clarify requirements imposed by Solvency II and develop solutions that directly address your most pressing needs. Plus, we actively engage in industry working groups and forums to anticipate and plan for changes so you can adhere to ever-evolving guidelines.