The Product Summary much be; technology neutral, outcomes focused, adopt standardisation only when necessary, and enable consumers to access the right information at the right time.

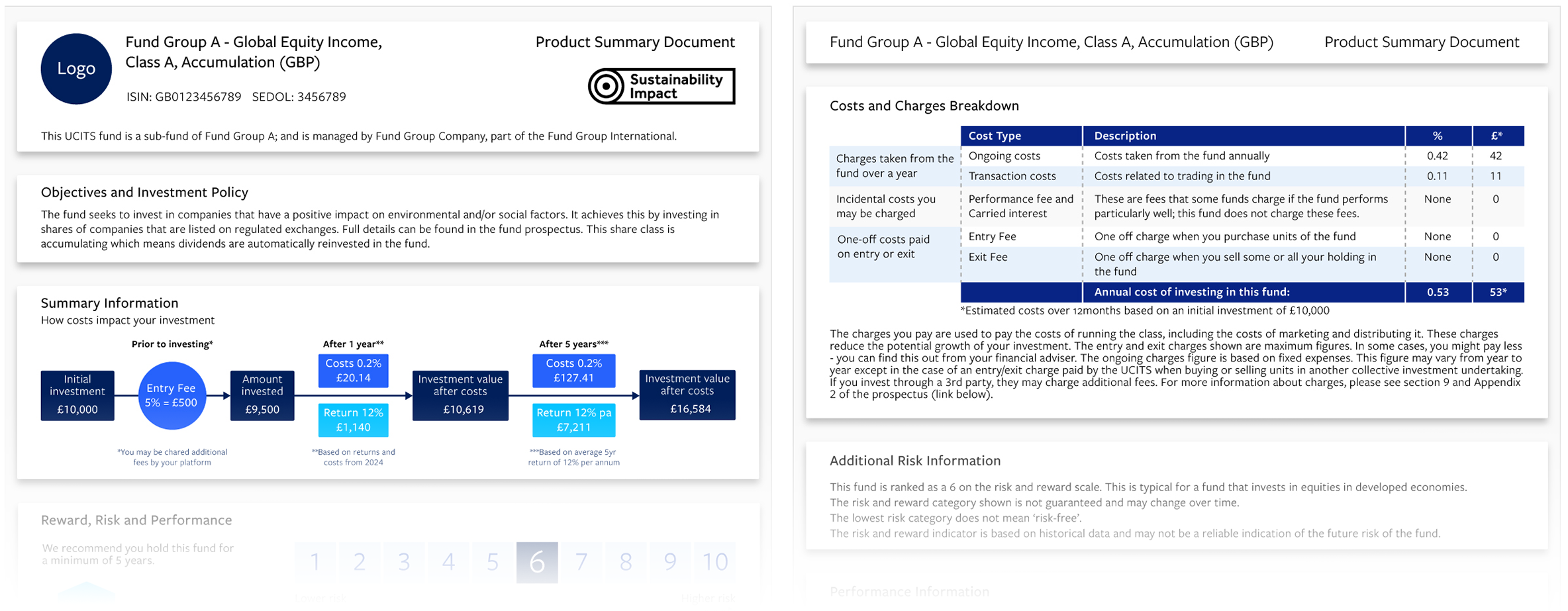

Any document being distributed to prospective retail investors needs to be simple, concise, easy to use - both digitally and physically, and formatted in a way that allows people to accurately benchmark and visualise the relationship (s) between returns, costs, and risk.

For example, asset managers might find it useful incorporating the FCA’s Assessment of Value (AOV) into the Product Summary. The AOV, introduced in 2019, is an annual self-assessment which requires managers to ask themselves whether they are delivering value to investors, taking into account a number of measurables, including cost, quality of service and performance.

If the funds industry is to continue on its current growth trajectory, it needs to convince savers – some of whom will either have a limited understanding or a negative perception about finance generally – on the benefits of investing.

A well-articulated Product Summary document could make a material difference here.

A preview of the Broadridge proposal for what this could look like can be seen below. For a complete view of the PDF please click HERE