T+1 in Japan: Forging a new industry model

What does accelerated settlement look like in Japan’s divided market?

Following the transition of leading global markets to T+1 settlement cycles in 2024, the theme of accelerated settlement has begun to attract growing momentum across Asia-Pacific. Late last year, the ASX led the region with their own “Key Considerations ” whitepaper, followed by market outreach initiatives in Hong Kong, Taiwan and Singapore. In Japan, the JFSA (Japan’s financial services regulator) and industry bodies have also now begun informal discussions on the potential impacts of a shift for Japanese securities to T+1 – as a first step in preparing for the wave of global market transitions that lie ahead.

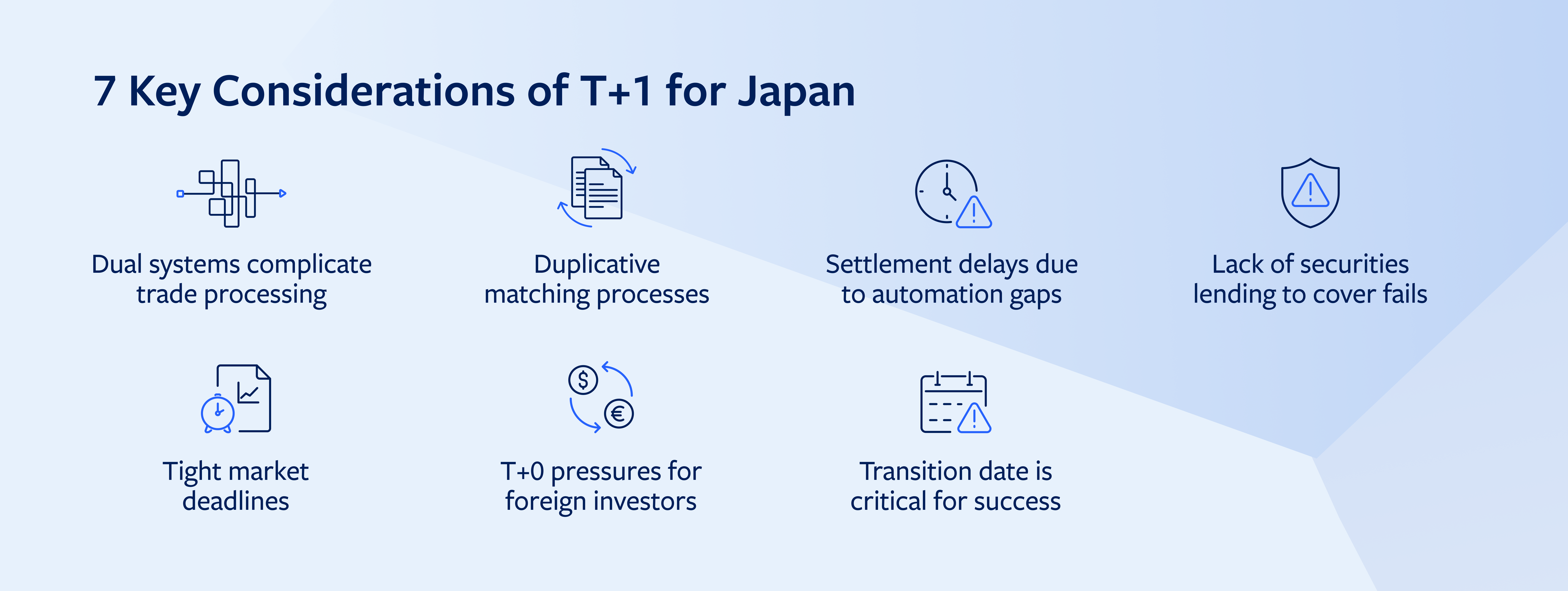

This article, leveraging research from the ValueExchange, highlights seven key considerations for global firms as they navigate the implications of T+1 for Japan:

1.A split market model

Japan’s post-trade landscape and processing is currently divided into two parallel structures. Today, Japanese onshore institutions match trades using their own messaging (or emails) and then proceed automatically to settle trades. At the same time, foreign institutions rely on SWIFT messages (MT564s) to match and settle trades, relying on JASDEC (the central securities depository) to bridge the gap between these two entirely different worlds during the two days available between trade matching and settlement. Whilst manageable today, it is highly unlikely that this model could survive a move to T+1, given the significant gaps that it creates in messaging, funding and reconciliation across the industry – meaning that fundamental market structure change is likely to be a core part of Japan’s T+1 journey.

2.Duplicative matching processes

This split model not only creates gaps, it also creates duplication, with two matching processes in action today for all trades (at middle office and then settlement levels). With 86% of T+1 project work in North America focused on process refinement, accelerating settlement is, at its core, an exercise in removing duplicative processes that can consume critical time. As we look towards a T+1 environment in Japan, this duplicative matching process will inevitably come under scrutiny as firms look to consolidate their trade matching into a single process that can provide golden-copy settlement information across all stages of the post-trade cycle.

3. “The trade settles eventually”…even in T+2

With limited use of standards (such as FIX and SWIFT) and limited automation by leading market participants, the above challenges and processes have one core consequence: time. Today, 50% of fails in Japan are reported to be due to late instructions, meaning that T+2 is already not enough time for many. Removing one day from the settlement cycle will inevitably create new pressures for the processes that support Japanese trades today, driving a pressing need for automation, standardisation and acceleration across the trade cycle. Capital expenditure in the back-office is an inevitable consequence of T+1 for all firms that today use non-standard and batch processing platforms for their Japanese settlements.

4. Lack of securities lending to cover fails

Given the inevitable increase in potentially failing trades in a T+1 environment, the availability of robust and readily available channels for securities borrowing is likely to be a key consequence of accelerated settlements (as a means of covering potentially failing trades). Today, limited demand means that this critical mitigant and pressure valve in the settlements process lacks the scale and coverage needed to provide market participants with the assurance that all settlement risks can be safely provided for as a last resort. Borrowing securities for same-day delivery is “a terrible process” for many in Japan, giving rise to potentially avoidable settlement risks and additional resourcing in an accelerated settlement environment. To manage this, firms will either have to develop their own borrowing channels and / or rely on a potentially expanded, lender-of-last-resort facility from a leading market infrastructure.

5. Tight market deadlines

The challenge is that a transition to T+1 settlements simply cannot lead to delays in daily processing, given the number of downstream processes that are contingent on timely securities settlements. With the majority of fund valuations (NAVs) published between 17:00 and 18:00 JST, there is not enough time in the day for the above delays and additional processes, as part of the daily processing cycle. Given these fund valuation deadlines, it is critical that all settlements be processed with enough time for ancillary processes (such as the calculation of bulk discounts on commissions at 15:30) to be completed – as failure to do so would have a visible and direct impact on individual fund holders in Japan and overseas. The industry has little room for manoeuvre.

6. T+0 pressures for foreign investors

Further afield, foreign investors look set to find themselves in what resembles a T+0 environment for Japanese securities, even when domestic trades are settling on T+1. With 13 hours time difference against New York and Boston, all middle- and back-office activities (including FX, funding and pre-trade matching) will need to be completed by foreign investors on trade-date – essentially driving them to close out all trade processing within hours. As we have seen with the North American transitions, this accelerated time pressure can lead to significant escalations in headcount costs (of up to 14%), FX costs and funding costs. Foreign investors into Japan will need to rely more heavily on automated processing than ever.

7. Timing is key

A critical point in the execution of a transition to T+1 in Japan is the scheduled transition date. Given the evident costs of dislocation between T+2 and T+1 markets (approximately 2 basis points per day), there is a clear desire for Japan to coordinate its transition with other leading markets. Whilst there is a desire amongst many participants to move to T+1 in Japan ‘not long after the UK’, it is likely that Asian markets will need to find their own transition date that avoids unnecessary concentration of risk, whilst also minimising regional disparities in settlement cycles. Japan will need to move as part of a wider transition if at all possible, if it is to avoid unnecessary costs to the investor.

Even with all the challenges outlined previously, as the North American T+1 transitions demonstrated in 2024, the potential short- and long-term benefits of accelerated settlement are significant. Those who invest in automation and streamlined processes have seen reductions of up to 4% in their trade fail rates – in addition to significant balance sheet and capital efficiencies. "Managed well, a transition to T+1 in Japan stands to deliver substantial benefits to market participants by driving widespread automation and standardisation,” according to David Runacres, APAC President at Broadridge. “Rather than being viewed with apprehension, this shift can enhance Japan’s global competitiveness, ultimately benefiting investors worldwide. The time to prepare is now."

This article was produced in collaboration with The ValueExchange.

Explore more about Broadridge post-trade processing and JASDEC Processing System

Work with a trusted,

award-winning partner

WINNER 2023

Lending Transformation & Overall Winner

IDC FinTech Real Results

LEADER 2023

Digital Experience Platforms

Everest Group PEAK Matrix

WINNER 2023

Best Overall US WealthTech Provider

WealthTechAmericas

WINNER 2023

Best Innovative Client Solution (Canada)

WealthTechAmericas

LEADER 2022

Credit Lending Operations

Chartis RiskTech Quadrant

LEADER 2022

Wealth Management Products

Everest Group PEAK Matrix

Connect with our experts about the future of wealth management

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |