Report

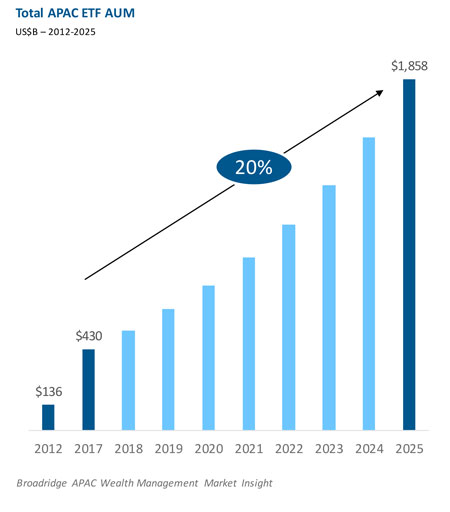

APAC ETF Assets Estimated To Reach US$1.9T By 2025

ETF assets in the Asia-Pacific region are estimated to grow, with Japan, China and Hong Kong accounting for more than 75 percent of AUM.

Japan will remain the largest ETF market in APAC, but its market share will be diminished by reduced support from the Bank of Japan as well as a rise in ETF flows in other parts of the region. We expect China (and Hong Kong due to ETF Connect) to be the two fastest-growing markets. Nearly 70 percent of projected growth is expected to come from net new flows. Asia’s growth, while still in its infancy, will be impacted by the same key drivers which propelled ETF expansion in the U.S. and Europe:

- Wider client base

- Growing fee awareness

- Regulatory support

- Broadening ETF applications

- Expansion of product strategies

Insights drawn from our APAC wealth Insight stream

An intelligence service focused on the APAC wealth segment

- Analysis of markets, products and distribution

- Current and future opportunity analysis

- 10 year forecasts of opportunity and market development

For more information about our data or insights on this topic

Please contact laura.cohen@broadridge.com