Simpler data, innovative approaches

Of course, the new disclosure rules do set some baseline minimum requirements for new Product Summary Documents (PSDs) in the areas of cost, risk and performance. But in all three topics, the FCA has consulted with industry to simplify and enhance data and it's presentation to make the information easier for retail investors to understand and use.

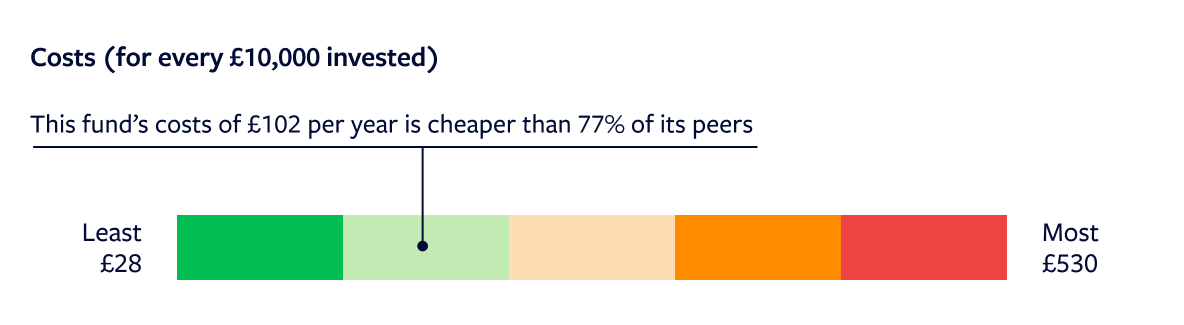

For costs, the new CCI format will strip out transaction costs and show headline ongoing costs represented in both percentage and monetary form, making it easier for retail investors to grasp how much will be charged and to compare costs with other investment alternatives.

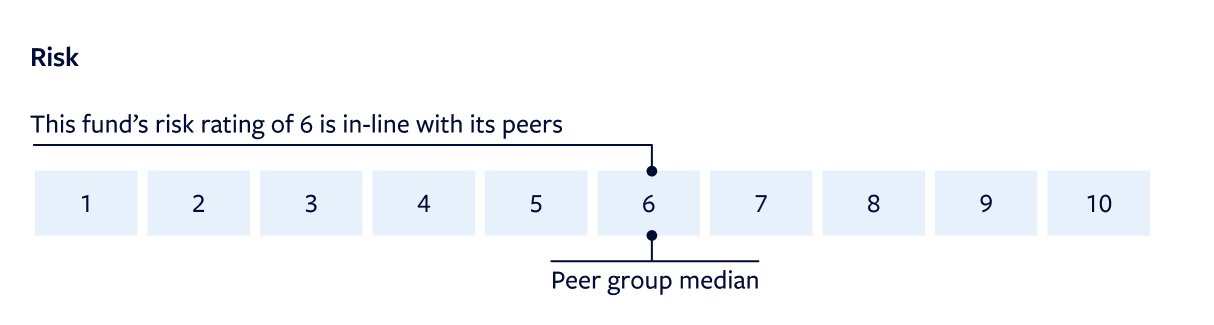

For risk, the CCI will change from the prior seven-point scale to a new and more intuitive 10-point scale based on 10 years of data, up from the five-year data set used in UCITS. The new metric will be dubbed the Risk Return Score (RRS).

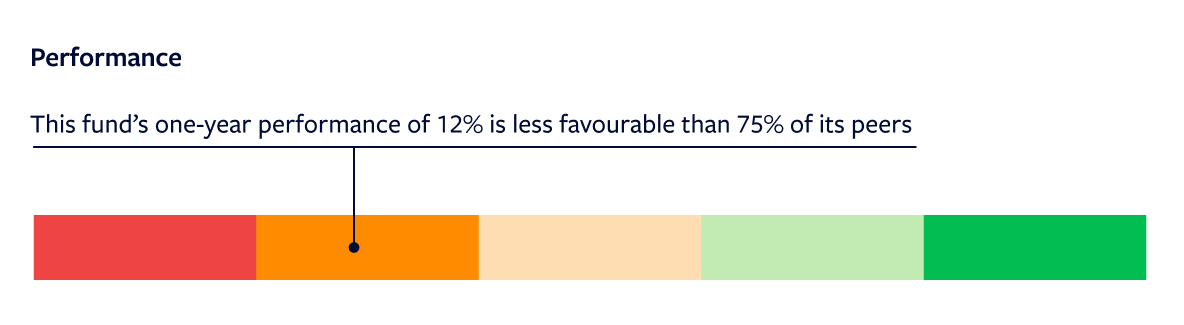

For performance, the CCI abandons past bar charts and tables based on quarterly performance data in favor of line graphs using monthly data. Line graphs should include relevant benchmarks for easy comparison. The CCI preserves accompanying narratives that explain performance, but the FCA has adjusted guidelines to prevent these sections from becoming overly focused on risk and instead present a better balance of risk and return.

Mark Walter, Head of Partnerships at Hargreaves Lansdown, said these changes will improve the quality of disclosures by making it easier for investors “to compare like with like.” However, he says the industry is most excited about the innovation the CCI will allow above and beyond these prescriptive elements.

What will that innovation look like? Manufacturers have wide leeway to experiment with ways to engage consumers. For example, a manufacturer might try to better contextualize costs by showing comparisons to the cost of funds in a similar peer group. On risk, a manufacturer might decide to illustrate the maximum drawdowns that have occurred over a five-year period to help put some context around the risk score. For performance, manufacturers might again turn to peer comparison as a useful gauge for potential investors.

Throughout the new disclosure documents, manufacturers are encouraged to use “nesting” techniques that allow investors to drill down for more detailed information on sustainability or any other topic.