Chapter 3: A Smarter Data Ontology at the Core

By Larry Bajek, Vice President, Strategic Wealth Solutions

In the ever-changing asset servicing landscape, fragmentation remains a constant. Particularly as bank and broker-dealer enterprises expand across borders and businesses, the amalgamation of disparate systems, datasets, and experiences increases. Without a unified approach, tasks such as normalizing data, harmonizing workflows, and presenting insights coherently across business units and functions—especially with the integration of AI—become progressively more difficult.

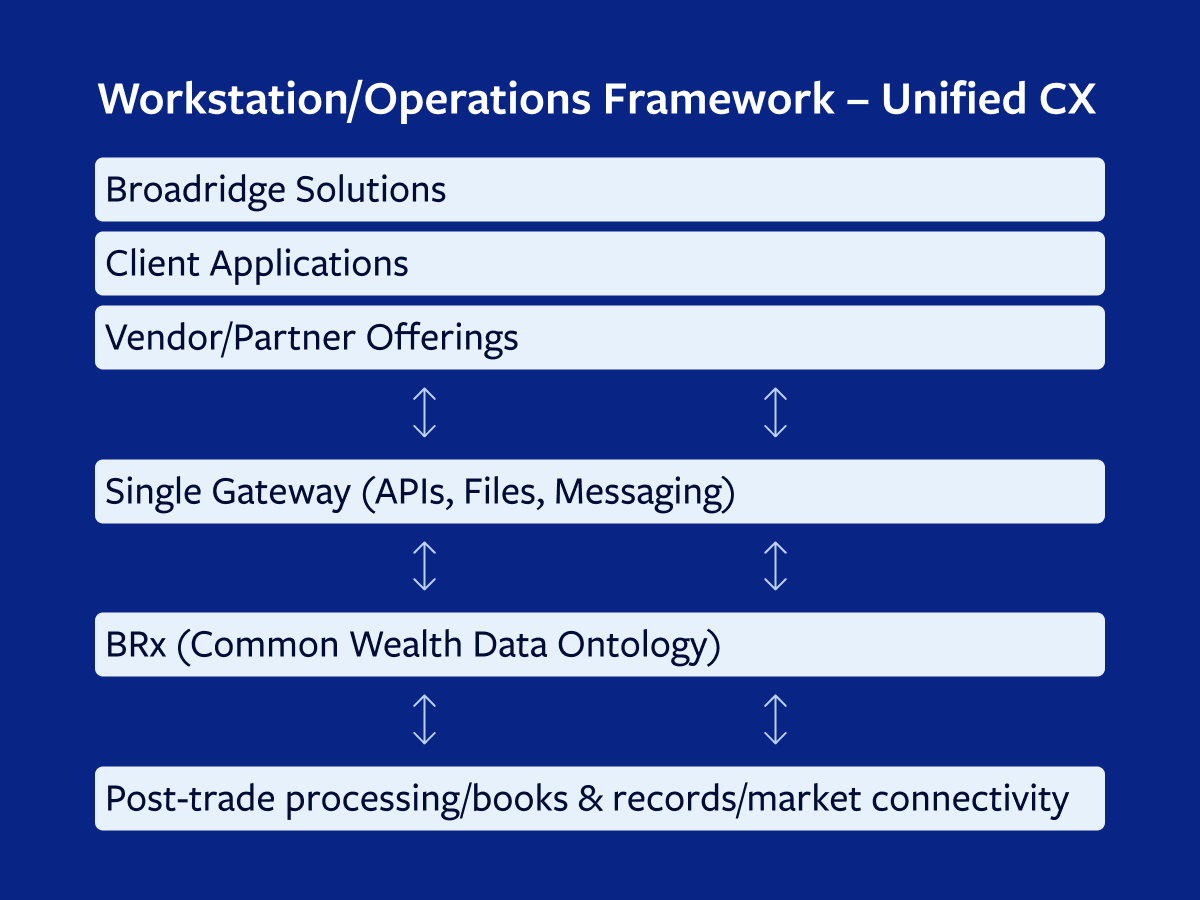

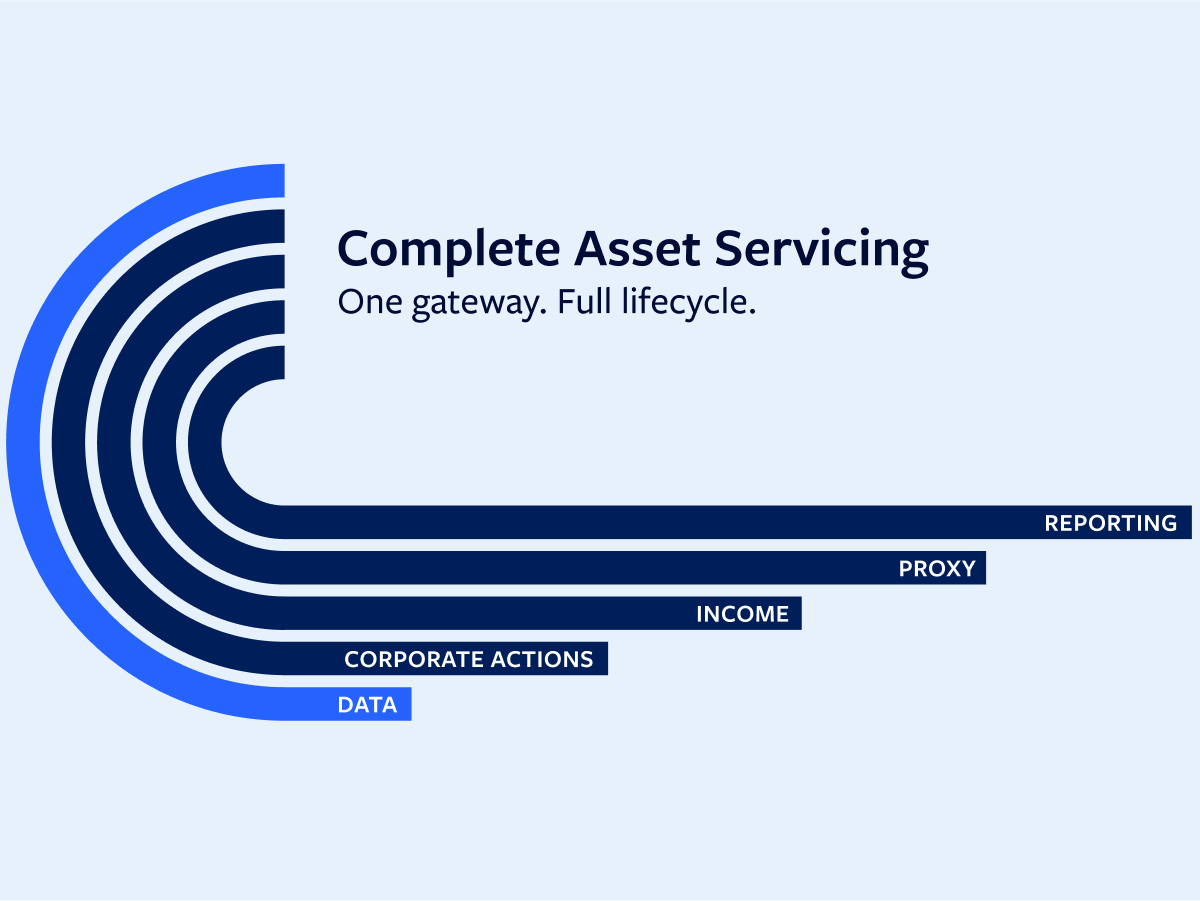

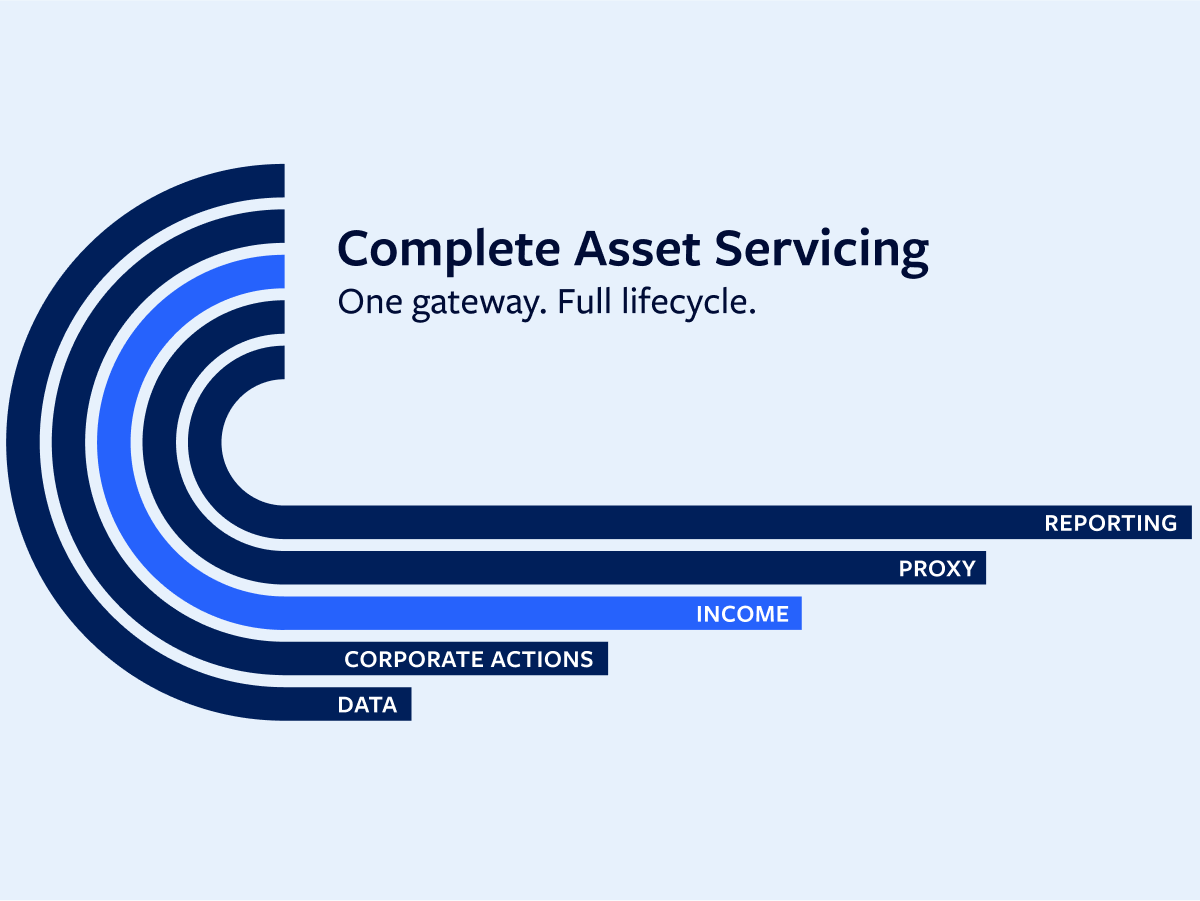

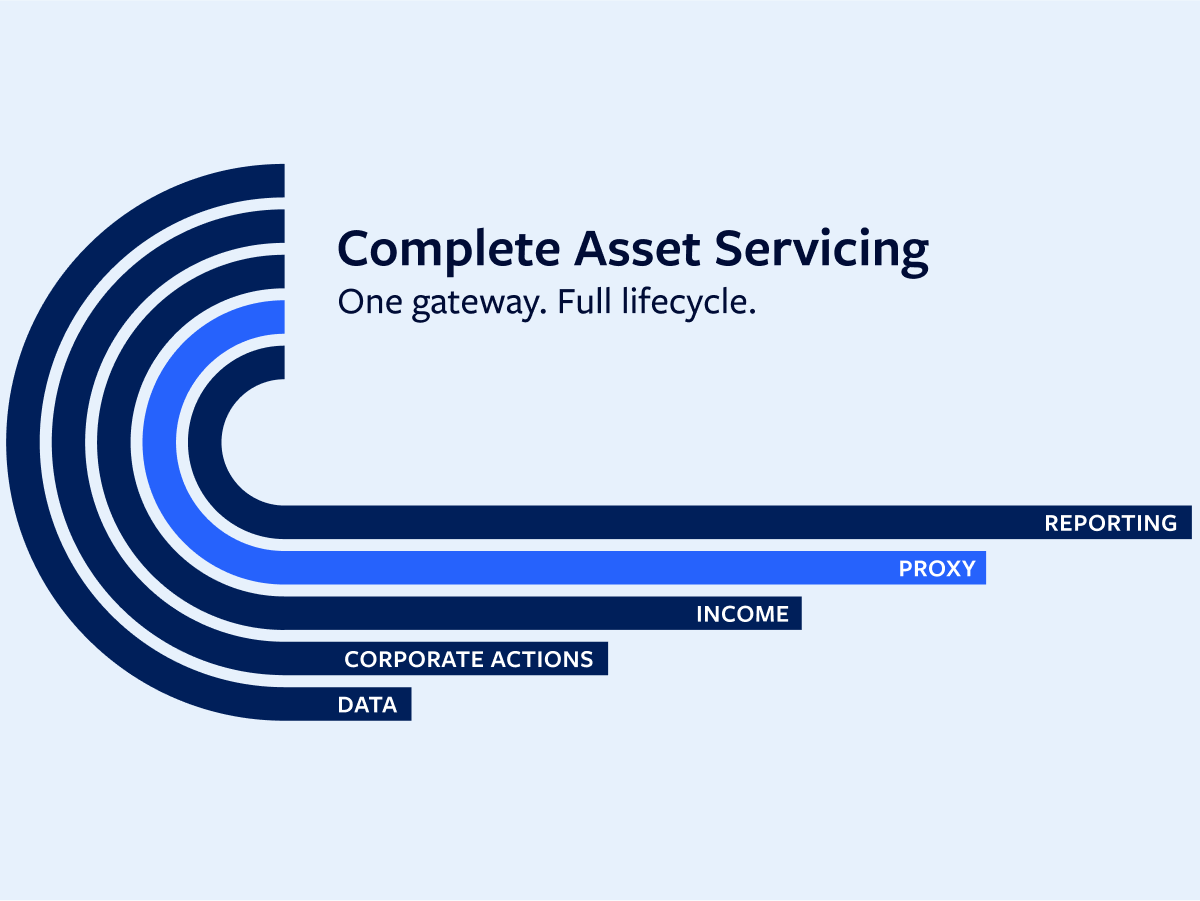

At Broadridge, we are addressing fragmentation with our Global Asset Servicing Platform, powered by a single, unified data source called BRx. This transformation goes beyond merely consolidating solutions and standardizing data patterns. The most exciting aspect is the cumulative value that emerges from uniting previously disconnected data sets.

New opportunities for interconnected intelligence

With a single platform, now we can identify how a pool of data from one function could inject a new level of intelligence or efficiency into another. For example, data on a company’s strategy and decision-making from a proxy system could enrich corporate actions communications, while tax-efficient insights could help advisors and investors optimize investment strategies. Opportunities to create value all stem from the unified data set driven by BRx’s common data ontology.

Our data ontology’s design principles

In order to unify functions and datasets across the entire asset servicing lifecycle with a single data ontology, we have embraced three key principles in designing BRx:

1. Agnostic aggregation and abstraction

2. Modular and cumulative data-banking

3. User-first views and experiences

Let’s explore each principle in more detail.