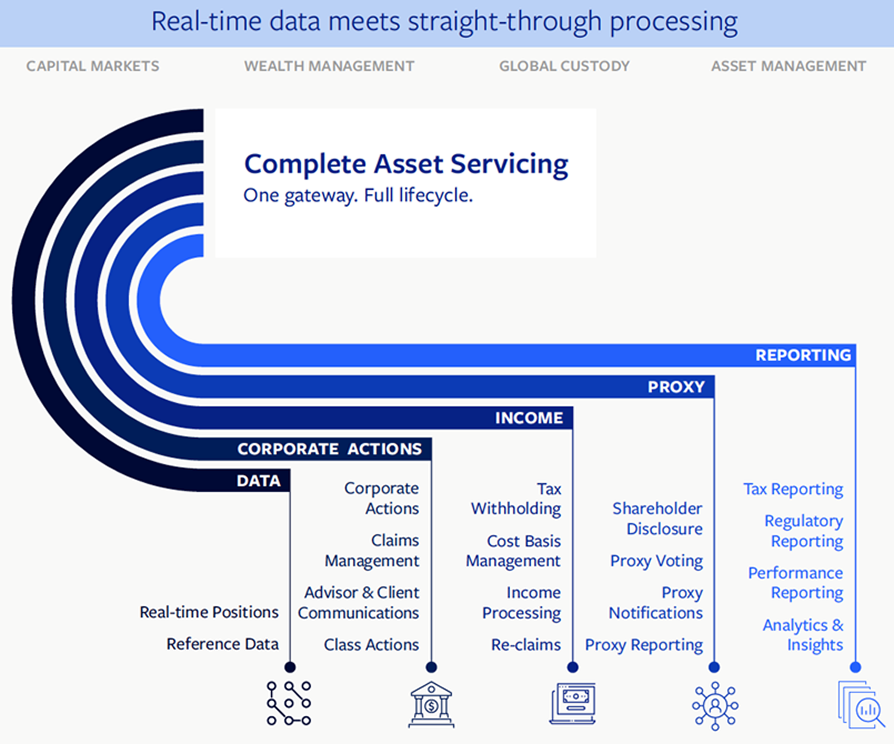

Broadridge prepares you for what’s next

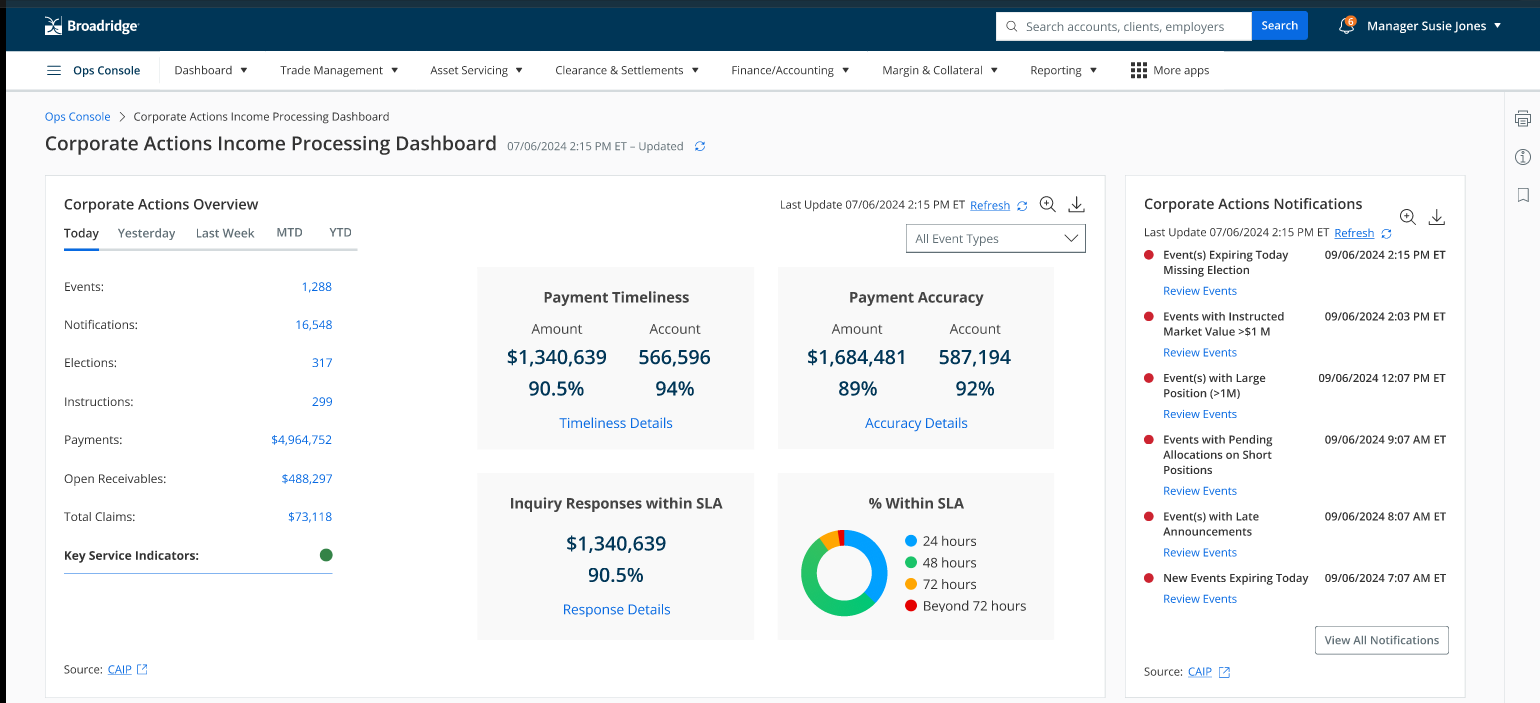

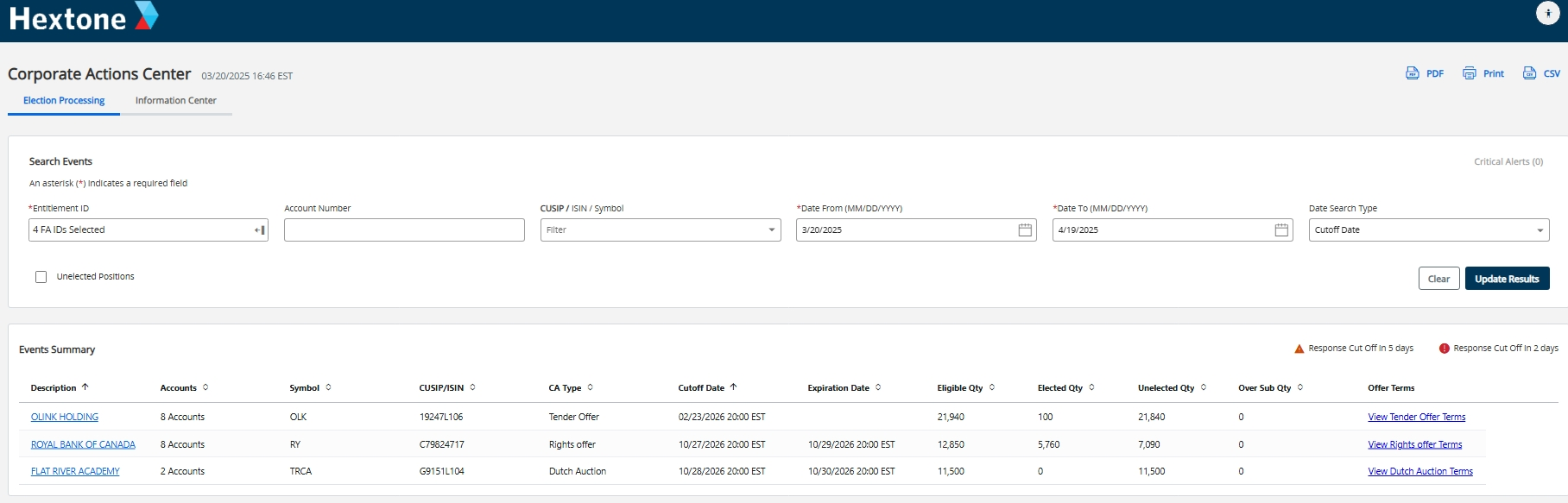

Broadridge sits at the intersection of financial services, providing the technological infrastructure for everything from trading to debt servicing, deal making, regulatory compliance, shareholder communications. We modernize platforms, digitalize communications, and offer next-gen technology and data solutions that help our clients capitalize on emerging opportunities.