Asia-Pacific is at a turning point in the move to T+1 settlements. With major global markets (North America, EMEA, the UK) moving rapidly, APAC firms must now prepare for change both at home and abroad. This article summarises the key priorities for every APAC securities market participant—whether you trade globally or only in the region.

Current T+1 Status in Asia-Pacific

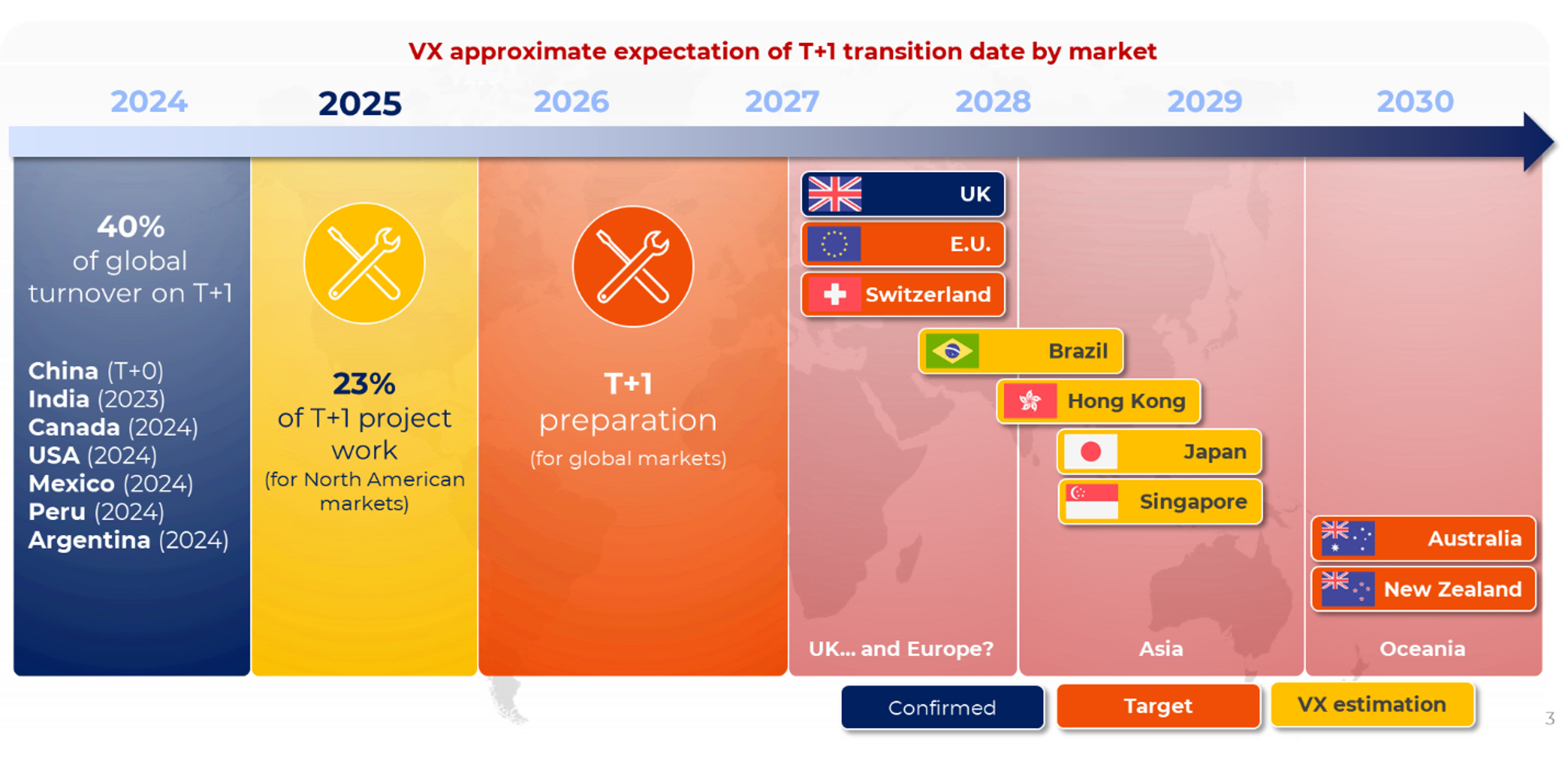

T+1 conversations are beginning to accelerate across Asia-Pacific: HKEX published its Accelerated Settlement Discussion Paper in July 2025, ASX released its Key Considerations paper in October 2024, SGX is expected to publish its T+1 report soon, and industry dialogue has begun in Japan and Malaysia. Progress is being made, but each market is setting its own pace and timeline, underscoring the complexity of regional transition. With extensive local market specifics to contend with, T+1 transition discussions will doubtless accelerate in H2 2025 with a specific focus on Asia—adding to many firms’ growing project agendas. Firms should be proactive: join consultations, analyze market- specific requirements, and plan for further change.

Why global T+1 matters for Asia

As the global shift to T+1 settlement accelerates, Asia-Pacific finds itself at a critical juncture. Last year’s transition in North America and the current focus on the UK and European Union are raising the bar for market readiness worldwide. With the pace of change set globally, APAC firms must prepare now to ensure their operational agility in this evolving landscape. As readiness deadlines loom in 2026 and beyond, it is critical that APAC firms use the time available to understand, scope, and fund the project work required for a smooth transition to T+1.

Here are the 7 things APAC firms need to know and do in the next year:

- Start scoping now – 30 months isn’t long

It is widely acknowledged that North American markets needed “30 months” to prepare for and execute T+1—covering project scoping, development, and nearly a year of testing. UK and EU markets, aiming for T+1 by October 2027, are now following the same “fast track.” For APAC, the lesson is clear: scope and size your T+1 projects now, even before concrete regional deadlines are published.

- Don’t overlook interim deadlines, especially in the UK and EMEA

Time pressure is even greater with the UK T+1 Implementation Plan targeting December 2026 for critical post-trade processes on T+0 — a deadline only 18 months away. Despite industry awareness of the 2027 migration, few firms are tracking this interim deadline, with 28% likely to miss it. If you trade UK/EMEA instruments from Asia, align your projects to both the interim and final milestones.

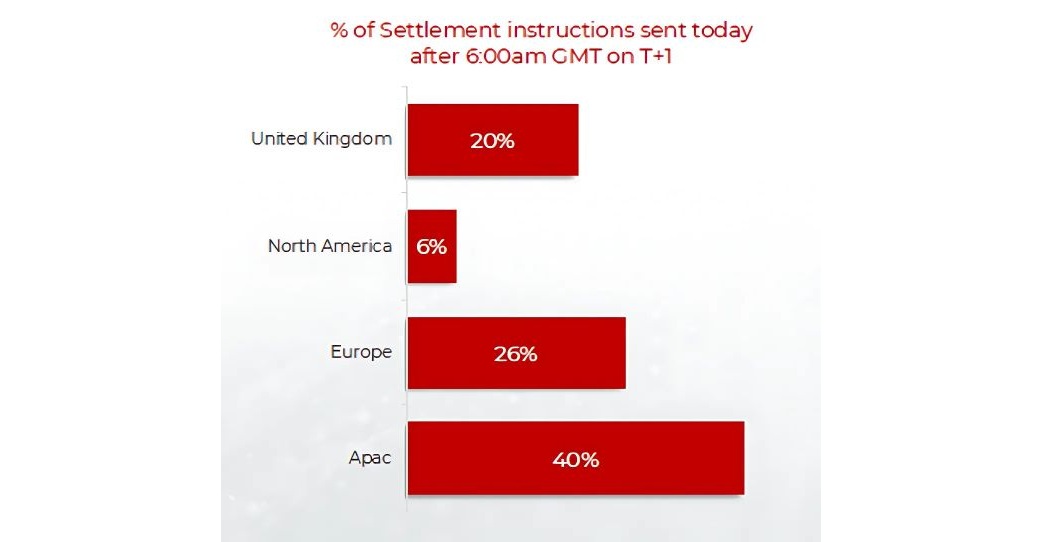

- T+1 in Europe means a 40% acceleration in Asia

How far do we have to go in Asia? According to ValueExchange research, Asian firms will need to accelerate around 40% of their settlement instructions to meet the proposed UK T+1 deadline (publishing all instructions by 05:59 GMT on T+1). Failing to close this gap could trigger extensive settlement issues and costly fails penalties. The European penalty regime is material—and creates significant downside risk for firms unable to accelerate their workflows.

- Get T+0 working today: prepare locally

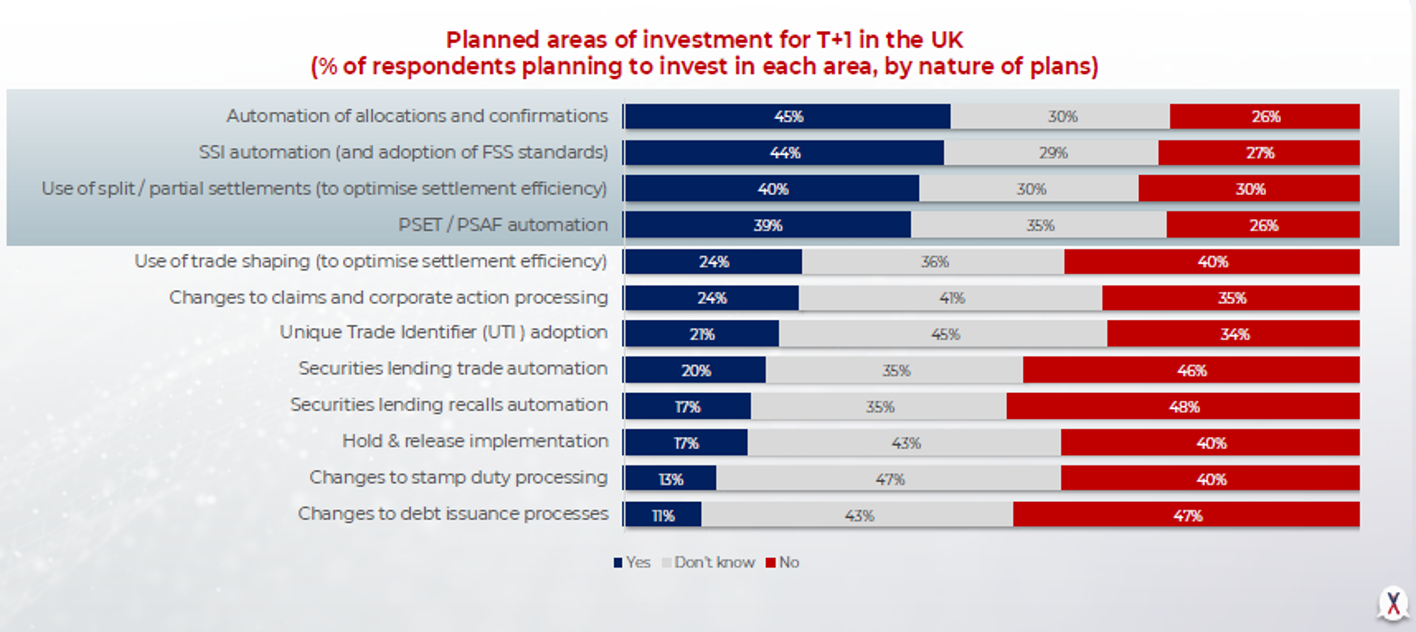

While 53% of firms are still waiting to begin T+1 preparations for Europe, pending the EU’s implementation plan, there’s much that can be done now. Asian firms should immediately begin shifting as much trade processing (allocations, confirmations, funding, and settlement instruction generation) into T+0, leaving only exception handling for T+1. Same-day FX and funding may soon become essential for local markets as well—start building capabilities now

- Don’t underestimate settlement discipline rules

A key difference between North America and Europe is the regime for settlement discipline. In Europe, CSDR penalties make late or failed settlements punitive, not merely undesirable. For Asian firms trading UK/EU, this means significantly more financial risk if underprepared. Asian markets such as Hong Kong and Singapore are also considering or already enforcing fail penalties. Now is the time to tighten your post-trade controls.

- Mind the fund gap – both regional and cross-border

As more markets move to T+1, Asian firms face increased risks in managing mismatches between T+1 and T+2 markets. For instance, a firm selling in Hong Kong (T+2) to fund a purchase in London (T+1) will need to provide an extra day of funding—at a cost—before sales proceeds are available. This cost is not trivial, and will require improved cash forecasting and management to avoid surprises.

- Monitor local implementation details

While much readiness can begin now, UK and EU implementation plans will contain local specifics Asian firms need to track, such as automated partialling, trade shaping, and PSET matching. Likewise, APAC exchanges and regulators will be rolling out their own local rules—stay close to market consultations and adjust your plans early.

A pivotal year for APAC

After the industry’s extensive efforts in 2024 to ensure a smooth T+1 transition in North America, it would be natural to expect a pause in 2025. In reality, the T+1 clock is already ticking louder—especially for UK, EMEA, and Asia-Pacific participants. Concrete action and planning must be underway now to hit readiness targets by the end of 2025 and beyond. For APAC, T+1 is not just a compliance exercise, but a strategic opportunity to modernize, improve efficiency, and better serve clients. Those who act early will benefit the most.

This article was produced in collaboration with The Value Exchange. Discover more about Broadridge’s post-trade processing solutions and NYFIX Matching for trade matching and allocation.