In July 2025, Hong Kong Exchanges and Clearing Limited (HKEX) released a consultation paper proposing to shorten the cash market settlement cycle from T+2 to T+1. This move would align Hong Kong with global leaders like the US and India—which have already adopted T+1—and with Europe and the UK, who are preparing to transition by 2027. Soon, nearly 90% of global equity turnover will operate on T+1 or faster.

The proposal covers secondary market transactions, for all listed products including equities, ETFs, structured products, REITs, SEHK-traded debt securities, and stock option settlements, while excluding primary market activities and Northbound Stock Connect trades. Existing core processes such as Delivery versus Payment (DVP) Model 2 and batch-based settlement would remain, but all post-trade operations would need to accelerate. HKEX is engaging stakeholders to assess whether current batch systems should adapt to the new timelines. HKEX is planning make a number of future improvements post technical readiness, expected to be in 2026/2027, such as adding real-time settlement instruction (SI) matching processes, to improve overall capabilities

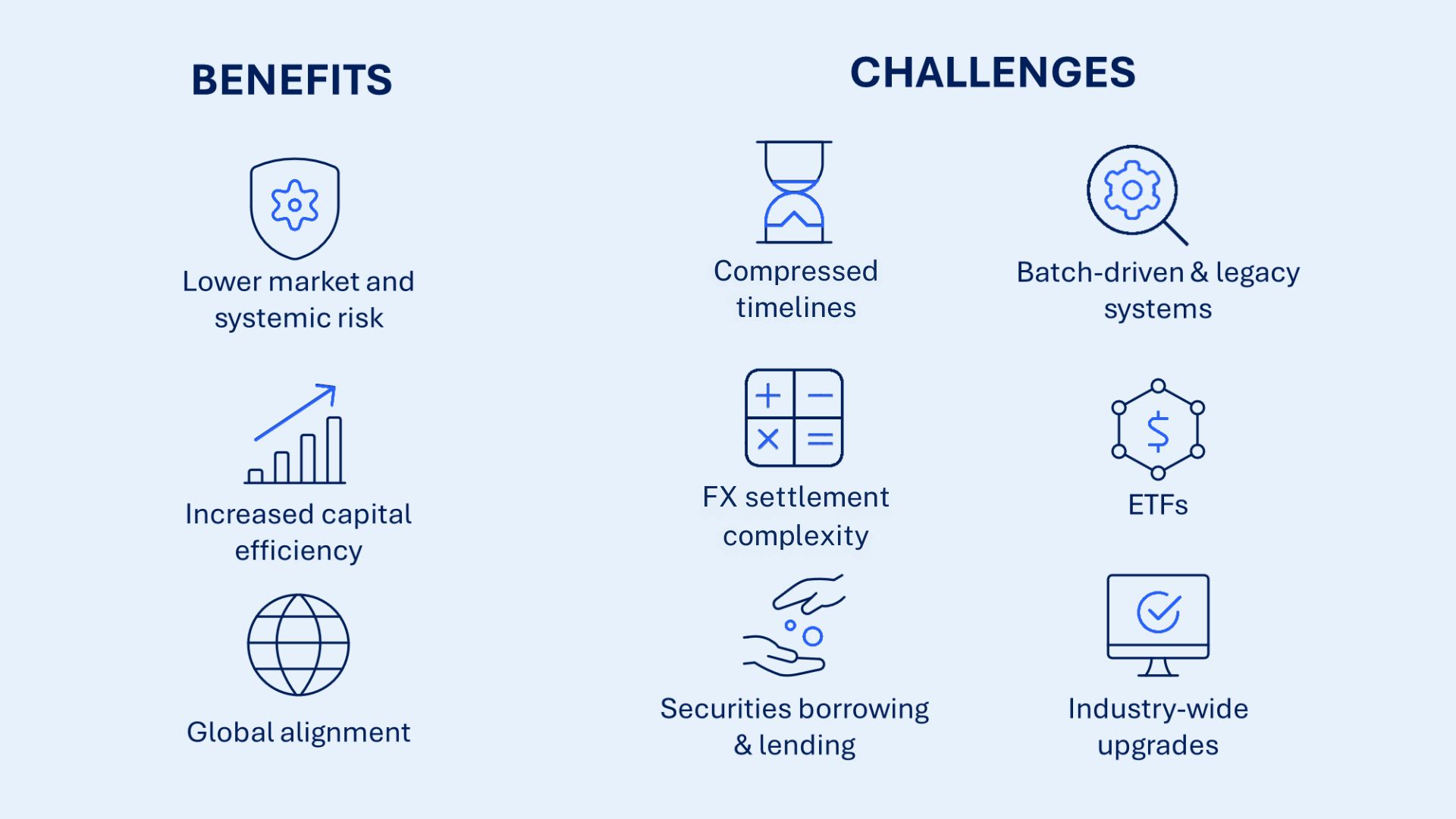

As the consultation moves forward, several core benefits and challenges come into focus.

Benefits of a Hong Kong T+1 Settlement Cycle

- Lower Market and Systemic Risk: T+1 means settlement positions are resolved within one day, sharply reducing the risk of trade defaults and operational failures. Faster settlement lowers overall systemic risk and boosts investor confidence.

- Increased Capital Efficiency: Shorter cycles enable faster access to sale proceeds and earlier release of capital, benefiting both investors and intermediaries. Mainland investors using Southbound Stock Connect will also see more efficient, next-day settlement that is better aligned with onshore A-share market practices.

- Global Alignment and Market Coherence: Keeping pace with other major financial centres is crucial for Hong Kong’s future. Harmonized settlement timetables simplify cross-border trading and post-trade operations and meet growing demands from global investors. As Europe and the UK join T+1 by 2027, this will form the baseline expectation for international flows.

These collective advantages underscore why Hong Kong and market participants are mobilizing toward accelerated settlement.

Challenges and Hong Kong-Specific Considerations

While the benefits are compelling, HKEX’s paper makes clear this change involves significant operational, technical, and structural challenges—many arising from Hong Kong's position as a global financial hub.

- Compressed Timelines: All trade confirmation, allocation, and funding must be completed more quickly. For investors in the US or Europe, T+1 in Hong Kong effectively creates a T+0 (overnight) processing requirement, demanding robust overnight or continuous operations to avoid settlement failures. Mainland investors trading via Southbound Stock Connect and global custodians serving international clients will also need to adapt, as settlement cycles accelerate and require tighter cross-border coordination.

- FX Settlement Complexity: Most FX in Hong Kong operates on T+2. Transitioning to T+1 for equities means investors without HKD or RMB must pre-fund or secure same-day FX, adding complexity to liquidity management and elevating operational risk, particularly for cross-border participants.

- Securities Borrowing and Lending (SBL): With shorter settlement cycles, SBL becomes even more critical. The recall window is halved, so efficient, real-time monitoring and automation are needed to avoid mismatches or delays in Hong Kong’s bilateral SBL environment, preventing settlement fails or increased costs.

- Batch-Driven and Legacy Systems: Hong Kong’s batch settlement process may need reworking or shifting to more real-time or overnight processing. Adapting legacy systems to new requirements can present a significant challenge, and upcoming features like the Uncertificated Securities Market (USM) must also fit accelerated timelines.

- ETPs and ETFs: Creation and redemption processes for ETPs/ETFs must align with the faster cycle, requiring tight coordination across asset classes and infrastructure. Any misalignment could result in operational bottlenecks and settlement delays. The HKEx is introducing more automation around this process.

- Industry-Wide Upgrades: Meeting these challenges will require market-wide investments in automation, real-time workflows, better data connectivity, and potentially new staffing approaches or training. Early and strategic preparation will be essential for a smooth transition.

Technology, Automation, and Streamlining the Post-Trade Process

Technology is the backbone of a successful T+1 transition—not only for compliance but for operational resilience and market stability. Manual or fragmented post-trade processing cannot keep up; straight-through processing, workflow automation, and real-time data are essential. As part of the HKEx work, the Orion Cash Platform will provide more real-time and streamlined access to the CCASS platform for participants via APIs or SFTP. This underlines HKEx ambition for greater automation, efficiency and real-time capabilities. Participants will need to think about modernization as part of their transition to be able to take advantage of these changes.

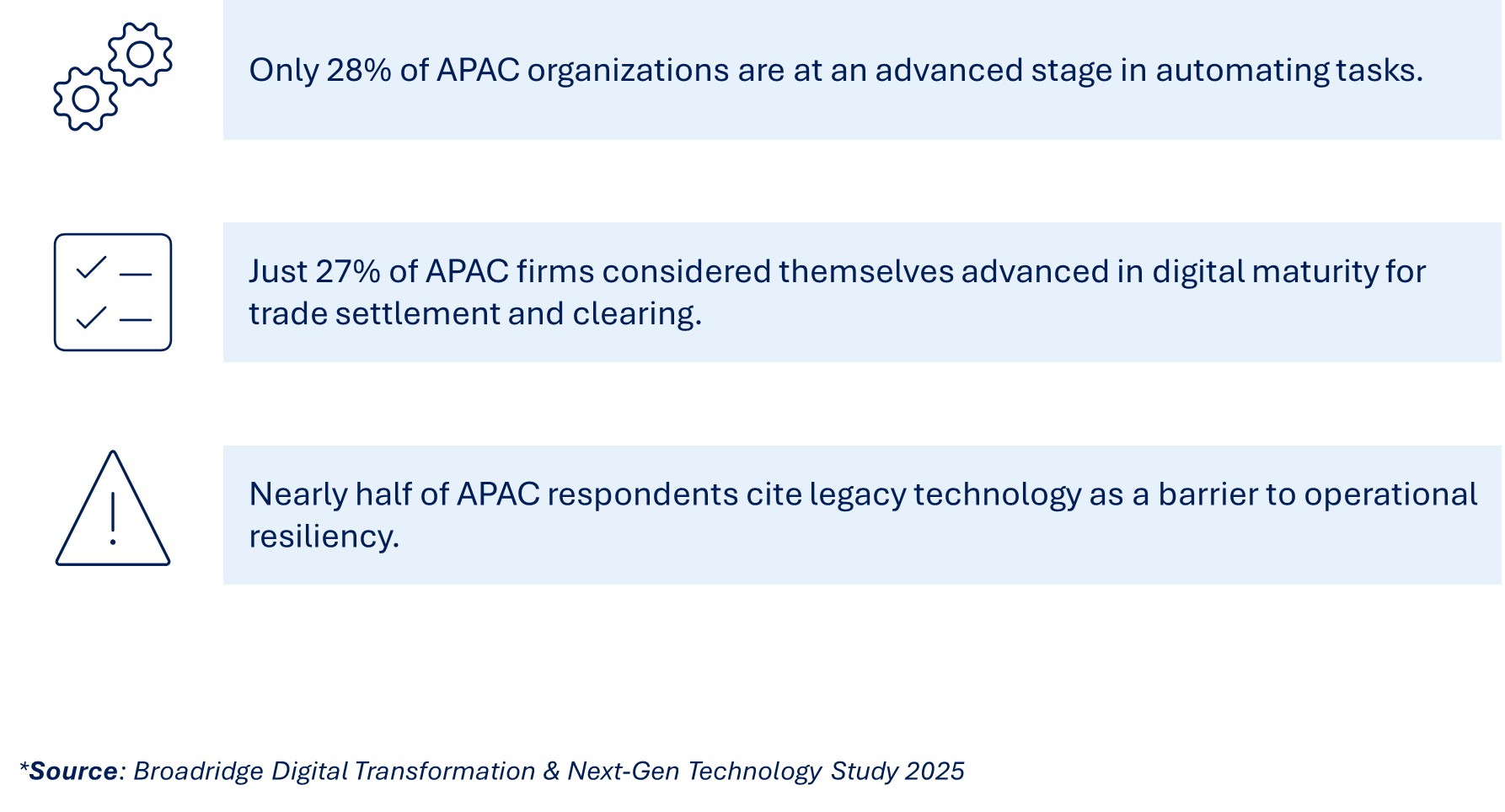

According to Broadridge’s Digital Transformation & Next-Gen Technology Study 2025, only 28% of APAC organizations are at an advanced stage in automating tasks, and just 27% are advanced in digital maturity for trade settlement and clearing. The shift to T+1 settlement will place unprecedented pressure on these systems and processes.

To meet these demands, automated trade matching—such as NYFIX Matching, already used in global T+1 markets—enables quick affirmation and exception resolution, both vital under tighter settlement windows. Modern post-trade processing solutions also automate allocations, settlement, and exception handling, support faster SBL recalls, and keep ETP creation and redemption on track.

At the market level, participants must prepare for real-time settlement instructions, improved connectivity with custodians, brokers, and infrastructure providers, and investment in robust exception and risk management tools. Early engagement and close collaboration with technology partners and vendors will be central to avoiding disruption.

“T+1 settlement can only be achieved with true end-to-end automation and seamless post-trade integration. Firms still depending on manual intervention, legacy systems, or siloed workflows will struggle to meet the new demands. Success will depend on adopting advanced technology and investing in streamlined, resilient processes—ensuring operational continuity and reduced risk as the industry shifts to a faster settlement environment,” said James Marsden, Head of Post-Trade APAC at Broadridge.

The Road Ahead

While the shift to T+1 settlement will be a multi-year journey, it is clear that early preparation and planning are critical. HKEX is signalling a careful, phased approach—incorporating broad-based consultation, industry-wide testing, and alignment with global peers—to ensure stability and limit disruption.

This transition presents a major opportunity to reinforce Hong Kong’s role as the leading financial hub in Asia-Pacific. However, achieving a smooth and successful move to T+1 will require strong commitment and close collaboration across the industry. Firms are encouraged to assess their operational readiness, invest early in automation and technology, and engage actively in the ongoing industry dialogue. With coordinated effort and decisive action, Hong Kong is well-positioned to lead the next phase of capital markets modernization in the region.

“Hong Kong’s move to T+1 settlement will be a landmark moment for the region and global investors. As a leading equity hub, this transition will give Hong Kong the opportunity to drive even higher standards across Asia-Pacific’s financial markets,” said Wout Kalis, Head of Asset Management Solutions APAC and Senior Country Officer of Hong Kong at Broadridge. “Success will depend on early engagement and close collaboration across all parts of the industry, supported by the right post-trade technology. By working together, we can ensure Hong Kong not only retains its position as the gold standard for financial infrastructure in the region, but helps raise the bar for everyone.”

For a discussion on how to prepare your post-trade operations for T+1, market participants are encouraged to consult the full HKEX discussion paper and engage with experienced technology and service providers.