Taking the “Out” Out of Investment Operations Outsourcing

Today’s wealth management marketplace is all about the race for returns. As firms search for ways to cross the finish line in the face of market conditions and the rising cost of doing business, investment operations outsourcing has emerged as a marked competitive advantage. But, as they weigh the risks and rewards, retaining control is a primary concern.

Fortunately, today’s model has evolved. Firms can now realize the benefits of a complete outsourced solution without sacrificing control over people, processes and technology. It’s just a matter of taking the “out” out of outsourcing to achieve “in-servicing.”

As a presenter at Opal Family Office and Private Wealth Management Forum, I had the opportunity to discuss this topic with a large audience of family offices, investors, money managers and private wealth service providers. A quick survey showed that the majority are currently evaluating outsourcing as a business strategy. But, they want the benefits of outsourced services with the knowledge and responsiveness of a dedicated, in-house team.

This is a realistic demand with the right approach. That means first determining if outsourcing is right for your firm, then identifying a partner that can support the in-servicing model.

Is Outsourcing Right For Your Firm?

For the right firm, outsourcing can create and support healthy growth. It delivers an affordable infrastructure of cutting-edge technology, proven processes and industry expertise that can be efficiently modified and scaled. Outsourcing could be right for your firm if you are looking to:

- Improve response to changing market and regulatory conditions

- Re-allocate resources from operations to client-facing activities

- Add efficiency to operational processes

- Maximize gains after fees

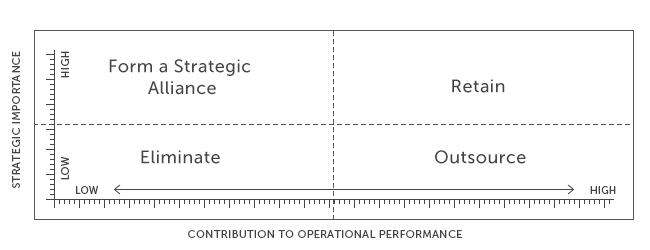

Outsourcing works best for firms trying to achieve these objectives with limited resources. It may not make sense for the largest firms with heavy investment in infrastructure, internal systems and proprietary processes, along with the dedicated, in-house staff to manage them. To determine whether specific operational activities would be best outsourced or kept in-house, use the Outsourcing Decision Matrix from Mind Tools.

Choosing a Partner That Can Support the “In-Servicing” Model

Once you’ve determine that outsourcing is right for your firm, the next step is to choose a partner. At this stage of the process it is again critical to weigh risks and rewards carefully. Potential risks include hidden supplier costs, poor service or technical and operational support, and heavy transition requirements. Rewards could include reduced costs, improved service provision and deeper expertise.

Traditionally, this decision has been based upon fixed criteria like price, quality of service, and contract flexibility. But, as competition increases and clients demand more from providers, it has become equally important that a vendor is able to enhance both operations and customer experience. That means they need the business acumen and industry knowledge to conduct applied research, offer leadership, leverage new infrastructure, and redesign services and processes.

The in-servicing distinction is made through these capabilities, as well as additional criteria around competence and accessibility. An “in-servicing” provider will have business knowledge, service capability and accessibility equal to or greater than your in-house team. They will support your control over the business by:

- Understanding the complexities of your market and business

- Executing tasks at an equal or higher level

- Meeting equal or more stringent hiring criteria

- Being directly available when needed, despite off-site location

Learn more about Investment Operations Outsourcing.