EXECUTIVE SUMMARY

Despite an improving financial outlook, many capital markets institutions are struggling to increase profitability. Regulatory compliance requirements have forced sell-side banks to scale back market-making activities, resulting in loss of trading revenue. Buy-side firms face their own challenges: active management continues to lose market share to passive and managers have to differentiate beyond simply beating performance benchmarks. Providing vanilla execution services or generating alpha is no longer enough in this market, and forward-looking firms are prioritizing cost control, transparency, and enhanced client service.

Providing Liquidity No Longer Translates into Profits

Five years into the Dodd-Frank Act, less than 60% of its rules have been finalized. Simply put, firms are still not reaping any dividend from their spending on systemic risk. As a result of implementing Basel III, EMIR, Volcker Rule, and other regulations, margins continue to be squeezed by mandatory compliance projects. Some of the SIFI-designated banks have lost as much as 15 percentage points of return on equity and have struggled to gain back lost ground (Figure 1). Macro-prudential regulation, designed to reduce systemic risk, has had the unintended consequence of pummeling profitability.

With profitability levels flatlining, many banks have been forced to scale back market-making activities, contributing to a structural lack of liquidity. This will only become more acute as volatility increases. As banks retreat from market making, liquidity will further fragment or even evaporate. Lacking access to the pools of liquidity they need, investors are consequently turning to technology to squeeze additional liquidity from shrinking inventory. In doing so, investors hope to complement traditional “brokerguided” liquidity with “technology-enabled” liquidity.

Cost cutting and efficiency drivers are moving to center stage as banks, brokers, and managers reinvent their operating models to realign with a business environment in which traditional high-margin products and services have disappeared. Firms need to maximize insight into these new cost and revenue patterns in order to survive and eventually thrive.

Global Fragmentation Is Driving Complexity of Trade Expense Management

The changing nature of trade execution is not just a challenge to front-office business models. Global fragmentation of the trading and clearing landscape has increased the complexity of trade execution and reduced the transparency of trade expense management. Triggered by monetary policy and geopolitical tremors, volatility in bond markets has upset the post-crisis calm and exposed the weakness of market liquidity. In the past two years, the fixed income market has seen large yield swings and bond fund outflows in response to geopolitics and central bank policy. As a result, primary dealers, who typically maintain an inventory of securities and supply liquidity to investors in a quote-driven market, have cut their bond positions to one-fifth of 2008 levels. The net result is that trades have been fragmented into smaller pieces, resulting in lower overall trading volume, smaller bid/ask sizes, and higher spreads, none of which bodes well for the future health of the market (Figure 2).

This also impacts the complexity required to monitor the cost of trading and settlement, as trading strategies are more fragmented and dispersed across multiple venues, global markets, and alternative products. Maintaining the right quality and granularity of data to service customers is becoming more difficult, and measuring KPIs, SLA, and P&L is a growing challenge for analysts and BI teams.

Enable Low-Cost and Transparent Investment Products

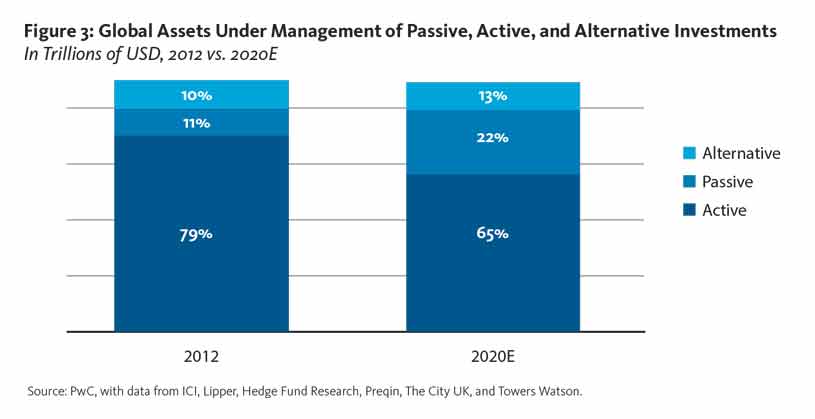

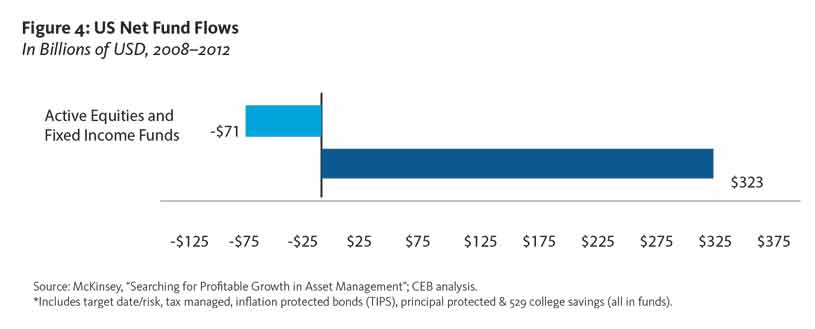

Traditional investing—active management supported by autonomous, specialized teams— is quickly losing ground. As noted in Figure 3, passives and alternatives will form one-third of global assets by 2020, up from one-fifth in 2012. Additionally, investor appetite for outcomesbased investment solutions vastly outstripped tepid growth in traditional equity and bond funds after the 2008 financial crisis and these solutions continue to grow quickly (Figure 4). Standing out by beating benchmarks is no longer enough. Asset managers need to reinvest and adapt to a world in which alpha no longer rules.

Historically, investment teams have been divided into separate regions, asset classes, and products. However, this structure makes analysis and transparency more difficult because it encourages operational and information silos. Subdivisions within asset classes further exacerbate the problem and create more data discrepancies across operations, investment, and distribution. One of the biggest obstacles to scalable process optimization is the fragmented nature of the IT landscape in capital markets. As trading and investment desks require niche solutions that understand the nuances of asset class and domain specialization, the result is a patchwork of operational data stores with their own metrics, logs, and audit capabilities. The expensive and painful data integration effort required to aggregate and analyze these data sets has meant KPI management and operational optimization has been a patchwork of inconsistent reporting and business intelligence tools. In this environment, investors’ and regulators’ push for transparent and low-cost investment products is a fundamental challenge. In order to remain competitive, all funds must harvest and publish more detailed analytics around cost structure, tariffs, and other drivers of transparency to effectively support low-cost investment products.

Balance Multi-Asset Investment and Single View of the Customer Priorities

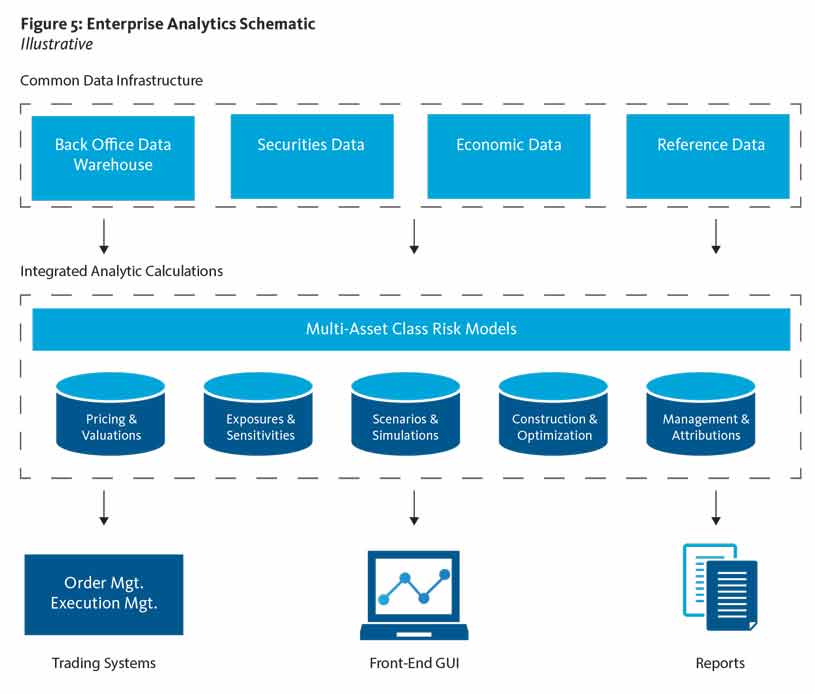

With rates of return on vanilla portfolios at all-time lows, investors are increasingly moving into emerging markets and non-traditional asset classes. This diversification of trading involves breaking through asset-class and business-line silos to support multi-asset risk and return strategies. The process begins at the back end, where access to accurate, standardized, and complete client data has the potential to improve risk and compliance management as well as service delivery (Figure 5). By making data usability a top priority, firms can then equip clientfacing staff with the means to accelerate service cycles and produce better analytic outcomes that drive efficient business decisions. The prevalence of multi-asset trading is a net positive as product silos have historically obstructed the data needed to track profitability, liquidity, and risk. Moving to strategies that cut across asset classes will encourage a shift toward consolidating back-office client data in order to execute trades and properly asset allocate—activities that filter up into the front-office. Creating a single view of client exposure in this interconnected product landscape is critical to optimized position management. Without credible global multi-asset capabilities, firms cannot capitalize on clients’ appetite for trading these products.

Conclusion

Driven by markets and regulators, financial institutions face structural changes to their business, reengineering of operations, and increasing threats to profits. Regulators are creating a capital and liquidity roadmap that will dictate the structure of the industry and place added pressure on corporate balance sheets. Since margins, volumes, and revenue growth will remain under pressure, firms must be operationally efficient, more focused on transparency, and agile enough to capitalize on the new opportunities this market environment brings.