The Future of Operations:

Your Next Hire is Digital

How financial institutions can prepare for implementing and managing a digital workforce with the latest RPA solutions.

Investments in AI and RPA technologies have been growing across the board in every industry, including financial services. While solving a range of problems for financial institutions, digital labor also creates new issues around ongoing governance, maintenance, and management of exceptions. In addition, digital labor results in new risks that financial institutions must manage as adoption grows and regulatory scrutiny of next generation technology increases.

There is growing adoption of digital labor1 in financial services through the use of technologies such as Robotic Process Automation (RPA). Following an initial wave of interest, the use of more sophisticated cognitive automation tools employing Artificial Intelligence and Machine Learning is also starting to drive business benefits.

This paper discusses current trends and the future outlook for digital labor as technology evolves and adoption becomes more widespread. It leverages Broadridge’s experience and best practices when implementing digital labor, including monitoring and managing a digital workforce, and tools to identify and control risks as the scale and complexity of digital labor increases. It also covers the importance of an effective change management plan as a human workforce adapts to the rise of digital labor.

Trends Driving Adoption of Digital Labor

Recent years have seen strong growth in the use of Robotic Process Automation (RPA) tools, with the RPA market growing over 60% in 2018 according to Gartner2 . A number of factors have driven the growth in digital labor adoption and its application in financial services.

Technological Advances

The latest generation of RPA solutions are now starting to incorporate complementary technologies such as Optical Character Recognition and elements of Machine Learning. This allows users to leverage more advanced tools that can distinguish text characters and make data-driven decisions. These cognitive solutions can further increase the level of process automation and perform a wider range of tasks typically carried out by humans.

Democratization of Process Automation

Recent years have seen a democratization of the ability to automate processes. For example, RPA differs from traditional automation algorithms coded by software developers in that it involves lower levels of coding and programming skills. Nontechnical users can drag and drop icons to automate a process. The application then generates code automatically. Additionally, RPA solutions sit on top of existing technology systems, meaning they do not require complex IT projects to implement them.

As a result of these benefits, RPA has often been seen as a panacea for the difficulties financial institutions have faced in creating interfaces and feeds between existing systems.

In theory, RPA can be used to implement connectivity and automation without the need for a major IT project or specialist coding skills. This makes it different from the Application Programming Interfaces (“APIs”) used in the past to allow systems to communicate with each other. As Martin Walker states in his book, Front to Back3 , “APIs allow systems to talk to each other in the language of computers, while RPA is about computers interacting with other computers as if they were human.”

A Difficult Operating Environment

These advances in technology are occurring in tandem with an increasingly difficult operating environment for financial firms. Regulatory cost pressures, economic uncertainty and intense competition are resulting in low return on equity and squeezed margins. While cost benefits can be gained from offshoring work to lower cost locations, there are large upfront costs in creating offshore centers and ongoing complexity in managing offshore labor.

Financial firms are therefore looking at how they can unlock the next wave of efficiency gains and cost savings while optimizing processes and mitigating operational risk. As such, there has been a strong focus on mutualizing non-differentiating functions and increasing the use of automation tools to boost the bottom line. In particular, post-trade operations, which are highly manual and labor intensive, offer huge potential for both outsourcing and automation. Other functions, such as Finance, Human Resources and Compliance also provide opportunities to apply digital labor and automation tools.

Robotic Process Automation Explained

Robotic Process Automation allows users to automate processes typically carried out by humans in IT systems. The software sits on top of existing IT applications and processes can be automated by less tech-savvy users who are able to work with low code solutions.

RPA can replicate keystrokes, perform specific actions or trigger process activities downstream from a given event. RPA can also communicate across multiple underlying applications, allowing the automation of ‘swivel chair’ processes where data is entered into more than one system.

This digital labor can be attended, unattended or a hybrid of the two. RPA is increasingly being augmented with technologies such as natural language processing and machine learning to create a deeper level of automation.

Challenges in Adopting Digital Labor

Automation tools and cognitive labor have often been seen by financial firms as a quick fix to solve long-standing problems. As a result, the technology has sometimes been used to fill in the cracks of an ageing technology infrastructure consisting of a patchwork of fragmented legacy systems across the firm. In many instances, attempts by firms to implement automation tools to fill these gaps, especially in the support functions, have resulted in expensive and time-consuming failures.

Typical Reasons Digital Labor Projects Fail

- Automation projects tend to fail for a number of reasons. These can include:

- Trying to fix a broken process with technology rather than addressing the deficient process.

- Applying the technology to the wrong types of process.

- Neglecting to take people factors and managing the interplay between human and digital labor into account.

- Failing to involve the IT department.

- Not considering the security, governance, and access rights needed for digital labor.

- Implementing point solutions without thinking through the wider strategic design of the firm’s overall automation architecture.

- Focusing on getting the newest technology in place rather than the business outcome that is desired as a result of the technology. For example, improving throughput times for a specific process, or improving end client satisfaction.

- Failing to anticipate the effort required to maintain automation solutions. Robots depend on the data structure, design and screen layout of the applications beneath them. When these underlying systems change, automations must be updated to adjust for these changes, or they will stop working.

- Overstating the business case (i.e., expectations defined at the onset of the project are often too optimistic).

- Failing to define a business continuity and knowledge retention program for when digital labor is halted.

Benefits of Digital Labor

When implemented properly, digital labor offers a range of operational benefits for financial firms, including the ability to:

- Operationally process a higher volume of transactions and create scale.

- Reduce manual touchpoints, ultimately mitigating operational risk.

- Manage peaks and troughs in volume during volatile markets.

- Ease process bottlenecks.

- Work overnight when humans are sleeping and at weekends.

- Allow human workers to focus efforts on higher order tasks.

- Improve the productivity of human workers.

- Add a secondary level of controls to enhance a firm’s control framework.

Managing Digital Labor – Key Risks

In addition to difficulties implementing these technologies, maintaining and governing them can create new issues and expanded workload. Automating multiple processes can result in a complex set of dependencies and interactions. Firms must manage various risk factors and develop appropriate governance structures, while also upholding regulatory and compliance requirements. Some of these risks and strategies to manage them are described below.

Operational Risk

As the digital workforce automates more front to back-office processes, it becomes more complex to manage the new risks digital labor creates related to procedures and systems.

This is further amplified when combining cognitive technologies like machine learning with the use of RPA. It becomes more difficult to assess the impact of these technologies and to understand the upstream and downstream impact of exceptions when they occur.

Having a clear inventory of digital labor across the firm is a critical starting point in assessing the level of operational risk exposure. In the event of exceptions, being able to quickly perform root-cause analysis is also essential. Human managers can then determine which bots to halt, when to halt them and what the impact on operational processes will be when they are stopped.

Cyber Risk

Firms need a robust cybersecurity framework to monitor and mitigate cyber threats as they evolve. If working with a third-party fintech firm or business process outsourcing provider, it is vital that financial firms perform sufficient due diligence to manage their vendor/outsourcing risk. Any external providers should have mature cybersecurity and information security procedures in place and be able to provide timely audits of underlying digital labor.

As a provider of business process outsourcing services for financial institutions, Broadridge has comprehensive cybersecurity and information security controls. This gives clients confidence that they are performing appropriate due diligence and managing outsourcing risk when working with Broadridge.

Systemic Risk

When a large number of firms are automating processes, there is potential to introduce systemic risk. For example, in recent years several flash crashes have resulted from black box automated trading algorithms in financial markets.

It should be pointed out that the use of digital labor and automation in areas such as post-trade operations do not have as much potential to unleash a similar degree of havoc. However, if a large proportion of counterparties are all using digital labor and these agents are interacting with each other in mission critical areas such as collateral margining, then systemic risks could arise.

This is particularly relevant in the event of a black swan event similar to the collapse of Lehman Brothers or the recent Coronavirus (COVID-19) outbreak. In these kinds of stress events, settlement volumes typically spike significantly due to heavy trade volume.

The ability to automate areas such as settlements, reconciliations, corporate actions processing and other trade lifecycle events and for digital labor to work when human workers are asleep or unwell, can help to increase the stability of the wider system during stress events. But, careful thought should be given to stress testing how a digital workforce will behave in these types of unexpected tail risk scenarios.

Another area for consideration is whether a large number of market participants are all using automation solutions provided by a single vendor or small number of technology providers. This could result in the potential for key vendor dependencies and concentration risks.

Regulatory Risk

Regulators globally are supportive of the need for market participants to innovate and improve operational efficiency. However, they are paying closer attention to the use of digital labor and artificial intelligence. There is a trend for regulators to expect ‘explainable AI’. This means that the models used to automate a particular process need to be transparent and easy to understand rather than using opaque black box algorithms.

It is therefore important that firms employing digital labor can easily audit their digital workforce. This allows them to quickly provide an inventory of digital labor across the firm and demonstrate to regulators they have appropriate operational and risk controls in place.

In addition to regulators, securities depositories such as Depository Trust and Clearing Corporation (DTCC), BNY Mellon and Options Clearing Corporation have implemented rules on the use of digital labor. These rules provide guidance on the proper usage of bots when interacting with their depot. For instance, DTCC regulates the speed at which a bot can process events and limits the hours a bot can access the depot. Digital workers must be registered with DTCC and have naming conventions that distinguish digital workers from staff workers, as well as an accountable human contact person in the event of outages4.

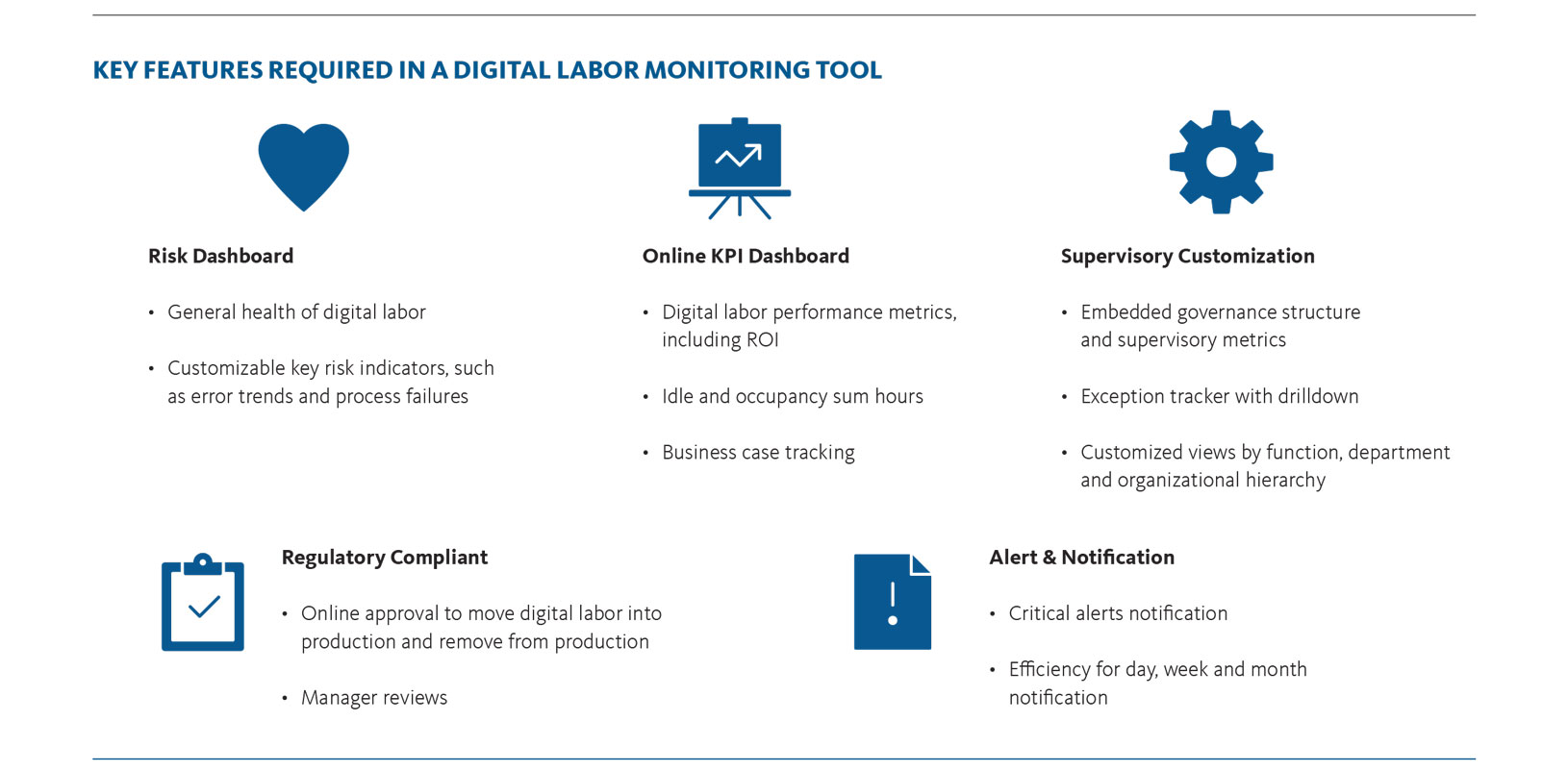

The Next Generation of Supervisory Tools

In response to the challenges described above around managing a digital workforce in mission critical operations, Broadridge has developed AIVision — a supervisory tool for monitoring and governing digital labor — as part of its suite of business process outsourcing (BPO) solutions and services.

While Broadridge currently uses AIVision to monitor its own digital labor, the solution can also be used by clients as an off the shelf, or customizable supervisory tool for their own internal digital workforces.

AIVision provides clear, centralized insights into the performance of the digital workforce across key areas of a firm’s operations function. It allows human supervisors to view and manage exceptions generated by both attended and unattended labor through embedded controls. This enables managers to quickly resolve issues by providing visibility into the part of a process that is resulting in exceptions.

Furthermore, the solution can provide detailed metrics on the performance of digital labor and data analysis to determine how a given process can be further optimized. The tool also makes it easier to see the wider picture of where human expertise can be directed to maximize productivity.

Through the use of AIVision, Broadridge has a clear, holistic and strategic view of the general health of both its digital workforce and specific processes. It allows human supervisors of digital labor to respond quickly to issues that may arise during normal operations, or at times when financial markets are under stress and operational workload increases.

The solution can help managers to understand the impact of exceptions. Knowing which bots to halt, when to do so and what the impact on upstream and downstream operational processes will be in the event they are stopped, can provide huge benefits when managing digital labor.

An advanced monitoring system like AIVision also makes it quick and easy to perform both internal and external audits. This allows Broadridge to satisfy clients and regulators that robust operational controls are in place to support the digital workforce.

Broadridge has also developed an “AI Readiness Index,” to help firms evaluate how ready they are to adapt AI, ML, and RPA to their operations. At a high-level, the Index helps to assess the preparedness of a firm’s operations and technology functions to adopt and scale AI. Assess your firm’s level of AI Readiness.

People Factors: The Interplay Between Human and Digital Labor

In Broadridge’s experience, one of the biggest mistakes firms make when implementing digital labor is ignoring people factors. It is critical that firms think through the interplay between human and digital labor and establish a comprehensive change management plan.

According to a 2017 McKinsey paper, an estimated 50-70% of business processes can be automated, which will allow workers to focus on higher-value work instead of repeating timeconsuming administrative tasks5.

But we should not assume right away that AI/RPA will lead to massive job losses. In fact, Gartner estimated that AI would create more jobs than it would replace and that, by 2025, the net gain of jobs would be around 2 million6.

When implementing its own digital workforce, Broadridge encourages human employees to think of digital workers as colleagues that will help to augment their skills and day to day roles. Employees also benefit from upskilling programs and redeployment to higher value work that helps to increase their productivity levels and role satisfaction.

As part of the ongoing optimization of a digital workforce, human employees can often play a key role in helping to identify ways to further automate repetitive and high-volume parts of their work. This sees humans evolving from task performers to process optimizers. It empowers them to spend less time thinking about work and more time thinking about how they work.

Human supervision of digital labor will also remain vital well into the future. Most experts expect that it will be many years before artificial intelligence has the kind of general intelligence that allows humans to perform a wide range of tasks very well and to make abstract connections between concepts7 . Additionally, in an interconnected and heavily regulated industry such as financial services, human oversight and the ability for humans to make common sense decisions about when to halt digital labor in certain situations will remain a key part of the governance process.

Furthermore, if human labor is redeployed and an automation fails, then human supervisors need to be able to step in and manually manage exceptions, or even take over the process completely. It is therefore important that knowledge of operational processes is retained as a backup to digital labor

“Currently, our digital labor is developed and deployed in attended mode, working alongside and continuously monitored by our subject matter experts,” says Kevin Moran, Global Head of Broadridge Business Process Outsourcing. “As our expertise in developing digital labor continues to grow and our managers build their digital labor management skillset with the investment of AIVision, our model will gradually evolve to deploying more complex, unattended digital labor. At that time, we will leap from optimizing the operations industry to transforming it.”

Future Trends: How Could Digital Labor Evolve?

Digital labor continues to evolve in a number of ways. When combined with other next-gen technologies such as machine learning, it’s possible to automate a wider range of more complex tasks that have greater potential for exceptions.

It is also possible to make use of the increasing volumes of data that a digital workforce generates – known as the ‘digital exhaust’. This data can drive new levels of more sophisticated and intelligent automation. For example, process mining can mine data from system logs to gain a deeper understanding of process workflows. This allows intelligent automation tools to identify bottlenecks and other process inefficiencies.

From there, digital labor could use machine learning to suggest ways to generate new automations, or to optimize its own efficiency. Cognitive automation could even suggest ways to re-engineer entire process workflows to improve throughput or other key metrics. Digital labor could then continually adapt itself automatically with limited human supervision, although some level of human validation would still be required.

Best Practices In Managing Digital Labor - Key Considerations

- Has my firm assessed the risks of employing a digital workforce?

- Has the digital workforce been stress tested to plan for black swan/tail risk events?

- Is there an up to date inventory of digital labor across the organization?

- Has every component of digital labor been associated with its human counterpart (owner) to ensure effective control and proper access rights?

- Are appropriate exception management and governance solutions in place to monitor digital labor?

- Is there a clear enterprise-wide strategy for automation rather than a siloed approach with multiple point solutions?

- Has the IT department been involved from the outset, rather than seeing digital labor as a way to automate processes without lengthy IT projects?

- Has an appropriate change management plan been put in place to ensure people and political factors are considered when adopting digital labor?

- Are suitable policies in place for upskilling and reallocating staff to higher value work?

- Is it optimal to build in house solutions for automation, use vendor products or to outsource the process to service providers who employ digital labor?

- When using external vendors for process outsourcing or automation technology, have they been assessed for vendor risk to ensure robust governance and cyber security protocols are in place?

Conclusion

The next generation of digital labor may hold significant benefits for individual financial institutions and for the efficiency of the financial system as a whole. As with any new and complex technology, it is important to think carefully about the risks that digital labor will create and to put appropriate governance structures in place before you make your first/next digital hire.

Using state of the art tools for monitoring and managing digital labor can allow financial firms to take advantage of a digital workforce while managing the complexity created by these new tools as they evolve.

As advances in digital labor drive a new wave of adoption, defining a clear automation strategy at the outset and working with a third party or business process outsourcing provider can help firms adapt to a demanding operating environment while remaining competitive in a world where technology continues to disrupt business models.

Related Content

Contact Us

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.