Restructuring for Profitability

What’s next for Capital Markets? Equity analysts’ predictions through 2020.

What lies ahead for the Capital Markets industry?

To address this question, Broadridge and Institutional Investor partnered to deliver a first-of-its kind survey of 150 equity analysts covering investment banks globally.

Our study, Restructuring for Profitability, reveals equity analysts’ predictions for Global Investment Banks through 2020.

- Will they struggle to generate returns that beat cost of equity capital?

- What's the outlook on regulation?

- Where can banks find a path to greater profitability?

The report uncovers the equity analyst view on critical issues affecting the industry and profitability, and explores how adopting new technology in the back office and middle office, re-engineering processes within these functions, and similar transformational initiatives may be the key to restoring profitability.

EXECUTIVE SUMMARY

Global capital markets institutions are less at risk from a financial crisis than they were before 2008, but regulatory pressures are set to intensify dramatically over the next five years. While profits are recovering, banks will continue to struggle to beat their cost of equity capital. In order to meet the challenge, banks will need to aggressively restructure and cut costs, according to a firstof-its-kind survey of nearly 150 buy-side and sell-side equity analysts covering the capital markets industry.

The global survey of analysts, which included qualitative interviews with some of the world’s top-ranked analysts, captures the collective wisdom about an industry undergoing broad transformation. The results show that while regulations have had a significant impact to date and banks have taken great strides to improve their businesses, more aggressive action will be needed in the coming years.1

KEY FINDINGS:

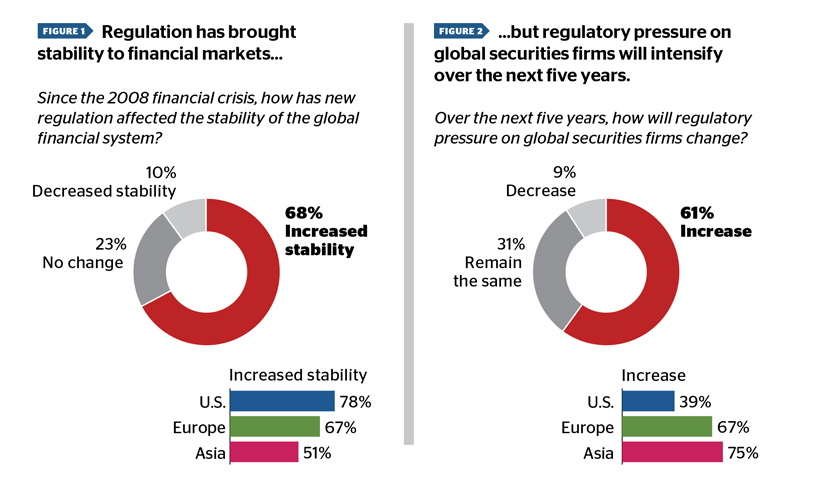

- A majority of analysts (61%) expect regulatory pressures on global securities firms to intensify between now and 2020 rather than remain steady or decline. In Europe, 67% expect regulatory pressure to increase. In the U.S., 39% of analysts expect the pressure to increase, while 43% expect it to remain the same. In Asia, three-quarters (75%) expect regulatory pressures to intensify

- Analysts believe the global financial system is safer but are concerned about the risk of creeping regulations and related uncertainty. In Europe and Asia the greatest number of analysts worry about the so-called “Basel IV” rules to standardize risk-weightings of assets. In the U.S., the main concern is that stress tests have become a wild card that will become more onerous in coming years

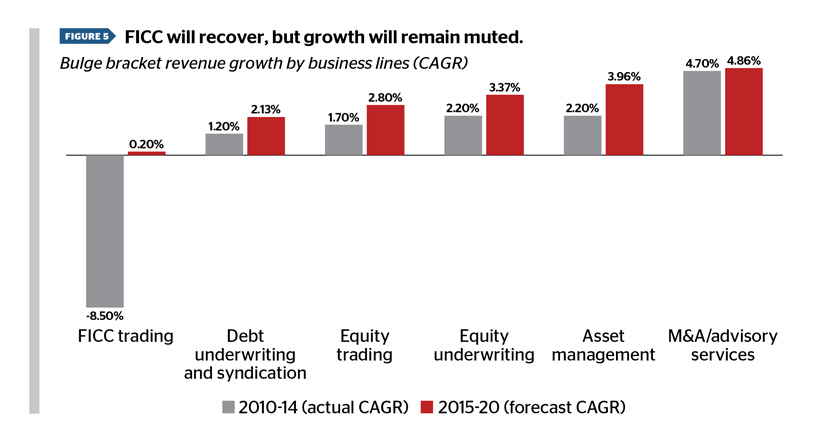

- Analysts forecast higher rates of growth across every line of business—advisory, asset management, equity trading and underwriting, debt underwriting and fixed income instruments, currencies, and commodities (FICC) trading— and significantly so in some areas between now and 2020, compared to the period between 2010 and 2014

- Over the next five years, average return on equity for bulge bracket banks is expected to increase by more than 75%—U.S. analysts expect it to double—while the cost of equity capital marginally declines. Despite these improvements, it will not be business as usual. The ever-tightening pressures of new regulation, operating prohibitions and more stringent regulatory interpretation assure continued disruption, especially to FICC trading, and will make it hard for banks to deliver satisfactory returns on equity, according to analysts

“Analysts favor restructuring and cost control to address profit pressures over the next five years.”

- The survey spotlights major differences in how analysts across the regions foresee the industry transforming. European analysts believe most banks’ RoE will still fall short of their cost of capital in five years’ time and Asian analysts hold an even more pessimistic view; but U.S. analysts predict banks’ returns will essentially meet the cost of capital in 2020

- Analysts, particularly in the U.S. and Europe, favor cost-control and restructuring—above topline growth and balance sheet management—to address RoE pressure and valuations over the next five years. The main opportunities for cost-savings will come from adopting new technology in the back office and middle office, process reengineering within these functions, and mutualizing operations

- The survey exposed a strong sentiment among analysts that banks over the past five years have not done enough to deploy technology and reengineer their operations to become more efficient and recover lost profitability

‘REGULATORY CREEP’ IS THE NEW NORMAL

Regulation has helped significantly reduce investment banking risk and made the overall financial system safer, according to more than two-thirds (68%) of the analysts surveyed. That view was especially strong in the United States where 78% of analysts shared this view.

Financial institutions have curbed high-risk activities, reduced leverage levels by half from the peak in 2007 and now hold far more capital. Regulations have improved transparency, pushing more trading onto exchanges.

The impacts on banks’ businesses to date have been significant. Between 2008 and 2013, major banks shed more than 40% of their debt securities, according to the Bank of England. The cost of compliance has been staggering—some of the largest banks have spent an additional $4 billion annually on compliance since the financial crisis.2 But analysts believe that in many areas, regulations are only just beginning to bite and will likely have an even greater impact over the next five years. According to one topranked sell-side analyst, “The screws are still tightening.”

Analysts’ concerns about regulation are far greater in Europe and Asia than in the U.S. More than two-thirds (67%) of European analysts expect regulatory pressures to increase, compared to 39% of U.S. analysts. Analysts in Asia were even more likely to express this view.

The survey reveals a half-dozen major regulations that are expected to have the greatest impact on banks through 2020 and interviews suggest a sense of resignation that regulation is now a continuous process.

“The pattern of the U.S. Federal Reserve is to continually creep capital requirements higher,” said one top buy-side analyst. A leading sell-side analyst said: “You’ll never get to 100% done. It is a live regulatory environment now. The postcrisis modus operandi is that regulation has to continually squeeze and test the industry.”

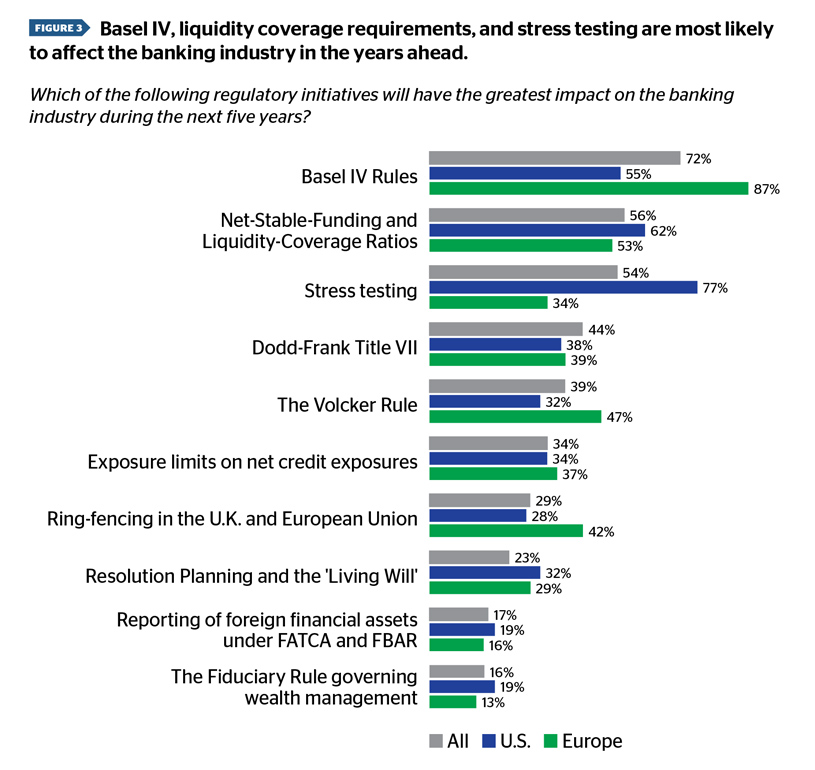

THE BIG SIX

Regulations are driving change in the industry by imposing both structural reforms and significant changes to bank capital requirements. Analysts highlighted six regulatory initiatives that they expect to have a major impact on banks over the next five years. Three of these were cited by more than half the analysts surveyed: so-called “Basel IV” rules about risk-weightings on banks’ assets, rules about how banks must fund long-term assets with suitable long-term liabilities, and annual stress tests. Once again, there was significant variance between views in Europe and Asia, where Basel IV is the major concern, and the U.S., where the stress-testing process is seen as the biggest challenge.

1. “BASEL IV”

Nearly three-quarters (72%) of analysts see Basel IV having the greatest impact. That number includes 87% of European analysts, 75% of analysts in Asia, and 55% of U.S. respondents.

After the 2007-08 financial crisis, the G20 launched an overhaul of bank regulation known as Basel III. Although it has yet to be fully implemented, supervisors have put forward another series of changes, known informally as “Basel IV.” Their main thrust is to force standardization of risk-weightings on banks’ assets globally and to limit the use of banks’ internal models to set these risk weightings. The changes are expected to have the heaviest impact on European banks in the years ahead.

Assigning higher-risk categories to assets and increasing the riskweightings forces bank capital ratios to fall. As a result, banks must compensate by shrinking their balance sheets or raising more equity. JP Morgan Chase estimates that Europe’s 35 biggest banks will have to increase risk-weighted assets by about 10%, or €1 trillion, requiring €136 billion of additional equity.3

A leading sell-side analyst said, “Risk-weighted assets as a percentage of exposure are very different in the U.S. than in Europe. Risk weightings on mortgages, for example, are much tougher in the U.S. at 35%-40%. Europe’s weightings are in the teens, but I would expect they will go up to U.S. levels.”

2. STRESS TESTING

Stress tests were cited by 54% of all analysts as likely to have the greatest impact on banks. Among U.S. analysts, they were the No. 1 concern, with more than three-quarters (77%)— versus 34% of their European counterparts—expecting them to have the biggest impact on banks over the next five years. The tests, which simulate a bank’s ability to weather a crisis, were introduced under Basel III and in the U.S. by the Federal Reserve in 2009.

The tests have been a major source of tension between banks and regulators in the United States. American banks have complained of a lack of clarity because the U.S. Federal Reserve does not disclose the methodology behind the results. The Fed is unlikely to change its approach because it believes the tests only work well with a degree of opacity. U.S. stress tests are widely seen as tougher than elsewhere.

Some of Wall Street’s biggest banks have been surprised by the disparity between their expectations of how they perform in the tests compared to the Fed’s view, which forced some banks to alter their plans to return billions of dollars to shareholders via dividends. Bankers fear an unpredictable test could lead to a future failure, especially if the Fed raises the minimum capital thresholds for the biggest banks in coming years.

In Europe and Asia, stress tests are less of a concern than in the U.S., where they are viewed as a wild card that could get tougher and tougher. “Historically the EU stress tests were more like an underhand pitch with a softball,” said Brad Hintz, a former Sanford Bernstein analyst who now teaches at New York University’s Stern School of Business. “But the Fed drafts very difficult tests. And the major U.S. banks consider it a binding constraint to their businesses.”

3. NET-STABLE-FUNDING AND LIQUIDITY COVERAGE RATIOS

The NSFR is another Basel III measure, due to come into play in 2018. It aims to make banks safer by matching the funding of long-term liabilities with suitable long-term assets, rather than with volatile sources of funding that can dry up in a crisis. Under NSFR, banks must have enough cash or liquid assets to cover possible outflows in a crisis.

Basel III's Liquidity Coverage Ratio (LCR) requires banks to hold a higher ratio of easy-tosell assets in order to withstand a 30-day liquidity event. It came into force at the beginning of 2015 and will be fully phased in by 2019. Banks came up $341 billion short of LCR targets in March 2015. NSFR and LCR were cited as a chief concern by 56% of all analysts and by two-thirds (66%) of the sell-side analysts in the survey.

4. DODD-FRANK TITLE VII

Dodd-Frank Title VII reforms were a concern for 44% of analysts. These reforms will transform a major portion of the OTC derivatives market into standardized contracts, traded on exchanges and cleared through central clearing platforms. The result will improve liquidity and eliminate bilateral counterparty risk because the rule requires that all exposures be collateralized with government bonds. The change will compress profits in a high-margin business, reducing returns on both equities and fixed income.

5. THE VOLCKER RULE

The Volcker Rule in the U.S. prohibits banks from engaging in proprietary trading, even though market making activities involve a degree of proprietary risk. Fewer U.S. analysts (32%) see this as having a significant impact than European analysts (47%), who may be fearing similar laws being put in place in the EU or Switzerland.

6. RING-FENCING

European regulators appear to be adopting a different approach to curbing proprietary trading by banks, ring-fencing retail banking and payments systems from more risky investment banking activities. UK banks must separate their retail banking activities into separate businesses to make them easier to resolve in a crisis. Within the European Union, banks must ring-fence trading and investment banking activities. Ring fencing is of greater concern to European analysts—42% cite it as among the most pressing regulations. The added costs to banks under the new rules are estimated at upwards of $30 billion annually.4

MORE DISRUPTION TO TRADING OPERATIONS

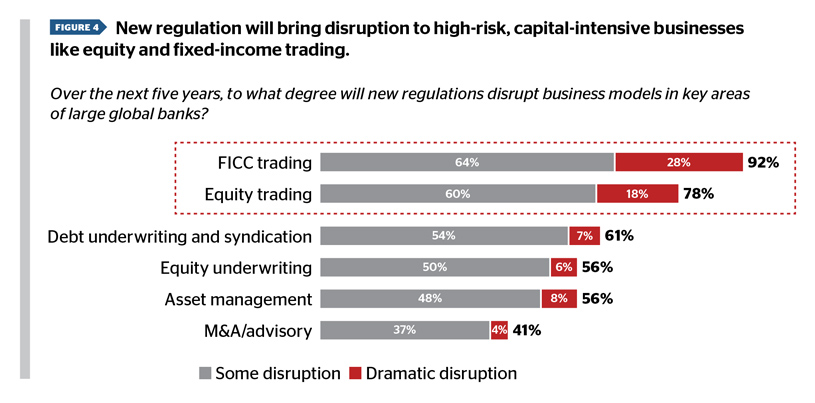

By far the biggest impact of regulation over the next five years will be on banks’ trading operations—historically the highest risk, most capital-intensive part of the business. More than nine in 10 analysts analysts (92%) expect either some disruption or dramatic disruption to business models in FICC trading due to regulation. In equity trading, 78% expect some disruption or dramatic disruption.

Pressures arising from regulation coincide with fundamental changes in capital markets. Investment banks have enjoyed a near 30-year boom in trading, starting with the bond rally of the 1980s and a tech-fueled equity boom in the 1990s. In the 2000s, the surge in real estate-driven mortgage-backed securities and OTC derivatives-trading and the emergingmarkets commodities upswing continued the momentum.

As a result, FICC was the engine for big investment banks, generating almost two-thirds of revenues in 2009. But since then, FICC revenues have declined dramatically to about half those levels by 2014. 5

Yes, margins in institutional equity trading and OTC derivatives were under pressure for some time but, until the financial crisis, high trading volumes and rising leverage helped mask the issues. Now the outlook for trading revenues is sluggish. According to analysts, FICC trading revenues will recover significantly but are still seen growing only 0.2% annually over the next five years and equity trading is expected to grow 2.8% annually.

“Pressures arising from regulation coincide with fundamental changes in capital markets. Over the next five years, they will continue to transform the business models of equity and FICC trading.”

Despite the much tougher outlook for trading, investment banks are reluctant to withdraw from low-growth lines of business. Some hope to tough it out until others capitulate or until profit margins improve. The problem for major banks is knowing whether the changes to the trading environment are cyclical or permanent. There is a general acceptance that once a large bank exits certain business lines, getting back in and rebuilding the business is difficult.

A highly ranked sell-side analyst said: “One reason most investment banks are hesitant to fully pull out is because of the demands of their corporate clients. For example, if your client is General Electric and they want to issue bonds, you need to have the capability to provide that service.”

ROE: RECOVERING, BUT SQUEEZED

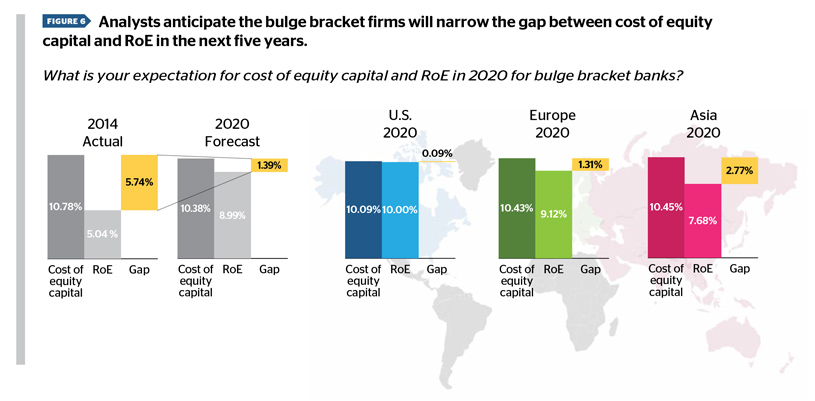

Pressures on investment banking—particularly trading operations—have hurt returns. In 2014—six years after the crisis—the RoE for bulge bracket firms averaged 5.04% while the cost of equity capital was 10.78%.

Analysts see clear signs of RoEs recovering over the next five years, expecting returns to increase by more than three-quarters to an average of 8.99%. There is consensus, too, that the cost of capital will decline—by 40 basis points on average—as balance sheets become less risky. Nevertheless, analysts still expect average returns in five years’ time to fall short of the projected 10.38% cost of equity.

This partly reflects the mathematical inevitability that as capital rules tighten, returns on equity will be squeezed even as business recovers. A top sellside analyst said: “It doesn’t mean the industry cannot be healthy and earnings cannot grow. You will eventually see a recovery in the investment banking industry, even though there will still be downward pressure on RoEs.”

Average RoE expectations among analysts worldwide mask a significant divide between the views of buy-side and sell-side analysts in the U.S. and Europe, as well as those in Asia.

TRANSATLANTIC DIVIDE

U.S. analysts expect average RoEs will nearly double to 10% in the next five years, 9 basis points short of the cost of capital. European analysts are gloomier, seeing average RoE at 9.12% compared to a cost of equity of 10.43% in 2020. The gulf between expectations in the U.S. and Europe reflects the difference in the pace of recovery within the two regions. U.S. banks and regulators moved much faster with restructuring their businesses and putting regulations in place. Meanwhile, the crisis in Europe unraveled at a slower pace and, as a result, regulatory pressures are expected to weigh much more heavily on European banks in the coming years. Over the past few years, European investment banks have been in retrenchment mode and, as a result, U.S. investment banks boosted their operations in Europe, exacerbating problems for their European competitors.6

U.S. regulators were quicker than their EU counterparts at implementing final rules for capital leverage and liquidity. As a result, U.S. management teams accepted that the Basel Accords are a secular shift and that capital markets will be a highly regulated industry from now on. Indeed, many U.S. banks have been quick to recognize that their success depends on being agile in navigating the maze of new regulations.

Analysts are also more optimistic about growth prospects for the industry in the U.S. than in Europe. In all areas of activity except debt underwriting and syndication, annual growth is expected to be lower in Europe over the next five years.

“Analysts expect the gap between cost of equity capital and RoE will narrow substantially in the next five years. U.S. analysts are more optimistic than those in Europe and Asia.”

U.S. analysts expect mean growth rates in FICC trading to average 0.6% versus the 0.23% predicted by European analysts and continued negative growth predicted by Asian analysts. In M&A/ advisory services, the U.S. outlook is 4.90% annualized growth versus 3.58% in Europe.

Some top-rated analysts view the survey’s RoE predictions as too pessimistic and expect that the industry will undertake more rapid change to improve profitability to meet investor demands for better returns.

According to a top buy-side analyst: “The revenue outlook is going to be quite muted for a while. It’s all about cost-cutting, restructuring and getting out of businesses. The banks will be forced to restructure. Investors will pressure them to do so.” History supports this view—low-return businesses don’t typically founder for decades but rather attract buyers and investors who press for change.

THE VIEW FROM ASIA

The mood among analysts in Asia is significantly more downbeat than in the U.S. They are the least optimistic about the outlook for bulge bracket RoE and the cost of capital into 2020, predicting average ROE of 7.68% on an average cost of equity capital of 10.45%. These views are likely influenced by weaker performance in Asia’s emerging markets and slowing growth in China and Japan. Moreover, they reflect a strong sense in the region that the largest regulatory wave has yet to land on Asian shores.

Asian analysts were nearly twice as likely as U.S. analysts (75% versus 39%) to expect regulatory pressure on global securities firms to increase—rather than remain the same or decrease— over the next five years. Nearly half of Asian analysts (49%) believe new regulations since the 2008 financial crisis have not improved the stability of the financial system, compared with 22% of U.S. analysts.

“Asia is behind the curve in regulation and has not yet faced the post-financial-crisis global regulatory pressures around risk,” said Neil Katkov, senior vice president for Asia at Celent. “Hence, regulatory pressures in Asia are likely to increase.”

While the U.S. Federal Reserve and European Central Bank have the ability to drive a centralized agenda, Asia lacks a single regulator able to coordinate efforts across the region. That challenge is exacerbated by a region with very different economies and markets, and by often conflicting interests and policymaking efforts.

Asian analysts are particularly downbeat about the outlook for FICC trading—predicting annualized revenue declines through 2020 of 0.78%, on average, compared with U.S. analysts who predict positive growth of 0.61%. Due to regulatory restrictions, the range of FICC products is limited in numerous markets in Asia, including China and Indonesia, and also in developed economies such as South Korea. Some bond markets, such as China’s, are essentially closed to foreign participation. In addition, commodities markets have fallen, threatening profitability in that segment.

Analysts based in Asia were more than twice as likely as U.S. analysts (33% versus 15%) to say the world’s largest banks have gone “too far” in reducing their global footprints—something many analysts see as a strategic error that will mean global banks will miss coming opportunities in Asia or diminish the market’s competitiveness.

With trading and clearing costs higher than in the U.S. and Europe due to market fragmentation, Asian analysts were more likely than those in any other region to emphasize the need for back-office technology and outsourcing. Neil Katkov of Celent said, "The importance of the cross-border trading opportunities across the fragmented Asian markets calls for outsourced and cloud-based solutions.”

PATH TO PROFITABILITY: LOOKING WITHIN

Given limitations on revenue growth, analysts expect banks will look elsewhere to boost returns — by reducing costs through restructuring, reengineering, or via mergers and disposals.

Across the sample, rationalizing and disposing business units is seen by analysts as the best way for banks to improve overall performance, as cited by 93% of analysts. Indeed 45% see it as a “significant opportunity”; among European analysts 58% expressed this view.

Asked which RoE components would have the greatest impact on bank valuations over the next five years, 38% cited cost controls and managing profit margins, 32% said improving balance sheets and 30% cited revenue growth. Among analysts in Europe, 45% favored cost controls.

Analysts expect further capacity reductions as the number of bulge-bracket firms declines—most analysts expect the number of firms providing services, executing trades, and issuing securities in most markets globally will shrink to seven from nine.

Banks have already made significant progress cutting staff to reduce unsustainable costs and restructuring to improve profits. According to research firm Coalition Analytics, the top 10 investment banks cut jobs within their FICC and equity trading units by 22% between 2010 and 2015.7

Most of the analysts surveyed (52%) said banks have reduced front-office compensation costs appropriately in the past five years; another 16% felt they had gone too far. But some of the analysts interviewed expect further reductions. “There are still folks earning a lot of money. For instance, remuneration may have come down by 40% to $600,000, but is there any rule which says it can’t come down to $400,000? There is more to be done in compressing compensation levels in the upper echelons of these cost structures,” said a top-ranked sell-side analyst.

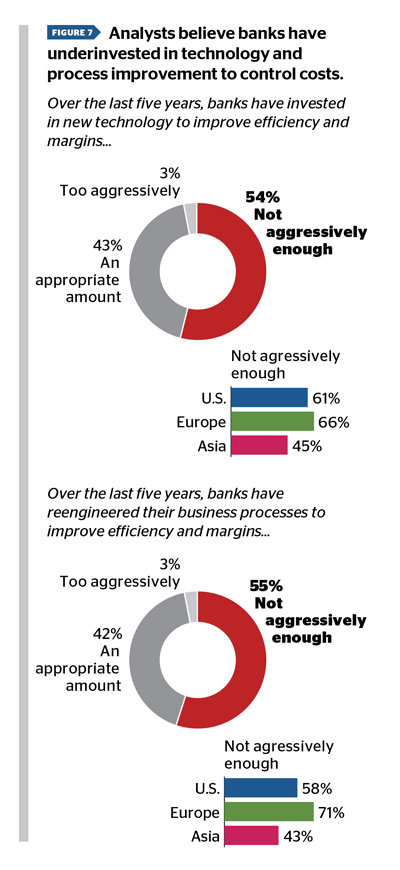

Banks have cut aggressively elsewhere too, but the largest number of analysts do not think those measures—particularly process-reengineering and use of technology—have been enough.

More than half (55%) of analysts believe banks have not been sufficiently aggressive about reengineering their business processes to improve efficiencies and margins over the past five years. A similar majority believe banks have not invested enough in new technology to improve profitability. European analysts were even stronger in their views—71% say banks have not been aggressive enough about reengineering processes and 66% say banks have not invested enough in new technology. Faced with growing regulatory demands in recent years, investment in new technology has had to take a back seat.

One of the challenges facing the industry is to do away with the product silos that have traditionally seen equities and fixed income operate as separate entities with extensive duplication of functions and back-office services. Brad Hintz says: “The Street has cut back within each silo but done very little reengineering across the business. They need to break down the walls of the feudal kingdoms and get their back offices working together.”

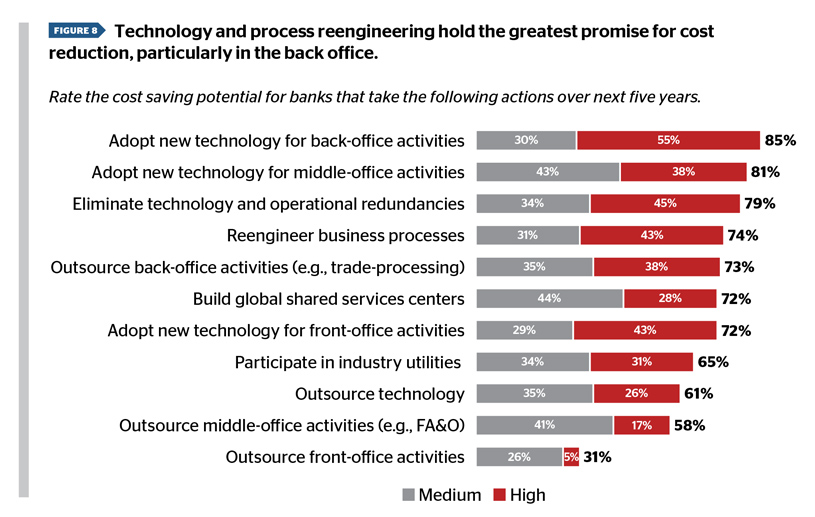

The most promising areas identified for cost savings were in back-office processing and technology, where most investment banks have little ability to differentiate themselves. By rationalizing and standardizing non-differentiating backoffice functions, banks can transform and create scale efficiencies. These initiatives will free up capital and resources to focus on core talents such as trading, risk management, marketing, client development and distribution.

“The Street has cut back within each silo but done very little reengineering across the business.”

Analysts see adopting new back-office technology as offering the biggest potential for cost savings over the next five years. More than half (55%) of analysts rated new back-office technology as having high potential for cost savings and a further 30% viewed it as having medium potential. In the U.S., 66% of analysts cited the back office as offering high potential for cost-savings.

Some analysts believe new technologies, such as blockchain, offer potential to take out costs. According to a leading sell-side analyst: “One of the challenges with the trading environment is that you have trades that fail to settle. Encrypted data that everyone shares could materially bring down reconciliation and failure costs.”

Overall, analysts favor “mutualization” strategies among the banks, where fixed operations and technology costs are shared with other firms through outsourcing arrangements or industry utilities. Nearly half (49%) of all analysts, and 57% of buy-side analysts, cited high potential savings in such strategies.

Trade processing is an area ripe for cost reduction through standardization and process transformation. The industry spends $17 billion to $24 billion on trade processing, of which $6 billion to $9 billion is spent on standardized trades. By sharing these costs through an independent trade-processing utility, banks could cut costs by up to 40%—by $2 billion to $4 billion annually—according to a recent analysis by Broadridge based on Morgan Stanley/Oliver Wyman data.8

A highly ranked analyst said, “There is a lot of duplicated cost. This hasn’t been tackled before because participants have never trusted each other enough. They need to get together and cooperate to create shared utilities. There are some signs of that with, for instance, the chat room Symphony.”

Of buy-side analysts surveyed, 37% cited industry utilities in particular as having high potential for cutting costs. Some analysts were doubtful of consortium-based initiatives. “My experience has made me skeptical of any cooperative effort by these banks,” said a top buy-side analyst.

However, one top sell-side analyst believes the industry will be driven down this route. “Out of necessity, the industry will have to get there. If they all shared the cost of a more efficient clearing and settlement infrastructure, it would be a lot cheaper for everybody.”

CONCLUSION

The investment banking industry has recovered significantly since the financial crisis and is much leaner and fitter than it was in 2007-08. Regulatory changes have also ensured that individual banks and, indeed the system as a whole are in much better shape. Risk and speculative activity have been reduced, and the industry is in better condition to withstand a future downturn.

However, investment banks still face challenging times. With the notable exception of FICC trading, activity levels have recovered across business lines. But the much tougher regulatory environment, which requires banks to hold far higher levels of capital, means that the industry will continue to struggle to earn adequate returns on equity.

In order to meet shareholder expectations, the survey of buy-side and sell-side analysts suggests that the industry needs to take more transformative measures to restructure and reduce costs.

Banks have largely exhausted opportunities for reducing costs within their existing business models—front-office headcount is down by about 22% since 2010—and, increasingly, the industry will need to look at taking more fundamental measures to reduce costs.

Many of the biggest opportunities for cost-saving now lie in the back and middle offices, where banks can introduce new technology, automate procedures, reengineer processes, and mutualize huge amounts of duplicated costs within the investment banking industry.

Hard times are not over for capital markets institutions. The next five years will still be challenging as banks push to deal with the pressures of regulation and meeting their cost of capital. But by restructuring and finding greater efficiencies, banks have a chance to build new strength and thrive.

ABOUT THIS RESEARCH

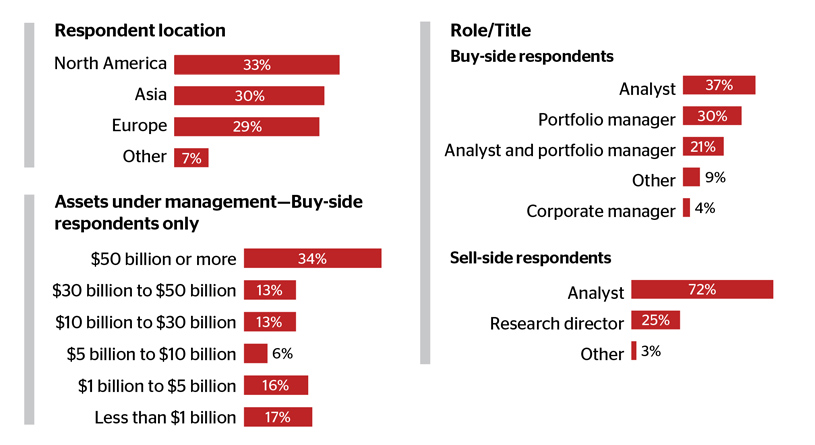

This research was conducted to assess the direction of the banking industry based on the collective views of leading analysts. Broadridge, along with Brad Hintz, a faculty member at New York University’s Stern School of Business who was a top-ranked banking analyst for more than a decade, and other advisors, collaborated with Institutional Investor’s custom research unit to conduct an online survey of 147 buy-side and sell-side analysts who focus on financial institutions around the world. In addition, interviews were conducted with four top-ranked analysts from leading asset management firms and brokerdealers to provide qualitative insights and analysis.

The respondents in this survey have a uniquely authoritative voice. Buy-side respondents vote in the banking sectors of II’s annual rankings of sell-side analysts, the industry’s definitive ranking of equity research analysts. Similarly, sell-side respondents are analysts who cover the banking industry and received votes from buyside analysts and investors in II’s most recent rankings. Respondents from both the buy side and sell side were vetted by Institutional Investor’s strict voter screening and verification criteria. No compensation was provided to the analysts who participated in the study or interviews.

In total, we gathered 147 responses from buyside (56%) and sell-side analysts (44%). The demographic breakout of this population is shown below:

View a full list of references for this white paper.