Operational Alpha: A Step Change In GenAI Is Becoming Finance's Competitive Edge

Introduction

The pursuit of alpha is no longer confined to investment strategy-operational excellence is now a key differentiator. As settlement windows compress and trade volumes climb, post-trade friction points like settlement fails and inventory fragmentation have become mission-critical challenges. Tools like OpsGPT® are transforming how firms resolve fails-reducing multi-day investigations to minutes-and empowering teams to optimize inventory across systems and legal entities in real time. The payoff is already visible: reduced penalties, unlocked capital, and greater operational efficiency.

Now, the next evolution is underway.

The rise of reasoning models (such as OpenAI o1) and AI agents, powered by a unified data model, is redefining what GenAI can do. No longer limited to language processing, these models can now reason, interpret vast datasets, and make context-aware decisions. This expands the scope of automation-enabling AI to not just support operations, but also orchestrate them through proactive delegation, intelligent exception handling, and adaptive workflows. It’s more than a shift in tooling-it’s a shift in operational thinking.

For firms that embrace this shift, the reward is significant : faster and better informed decisions, sharper risk insights , and lower costs-all powered by a new engine of competitive advantage: operational alpha.

Pressure is mounting on institutions to rethink operations across the trade lifecycle. The move to T+1 settlement in North America—and Europe’s expected shift in 2027-requires faster, leaner post-trade processes. Inconsistencies across global settlement cycles and surging Fixed Income Clearing Corporation (FICC) market volumes (projected to rise by over $4 trillion, according to the DTCC) are further stretching legacy infrastructure. Critical functions like trade matching, margining, and fail resolution are under strain, and stakeholders are pushing for system rationalization to reduce costs and increase agility.

The technology gap between front and back offices is closing fast. GenAI is no longer experimental-it’s essential. Following the deployment of OpsGPT(in September 2023), Broadridge’s GenAI-powered operations solution, firms have seen process times halved in areas like fail research, alongside improvements in risk control, cost efficiency, and governance.

With OpsGPT, firms are deploying intelligent, context-aware automation that not only eliminates repetitive tasks but also surfaces insights and accelerates throughput. Operations teams are adopting a real-time mindset allowing for continuous agility. For back offices long considered reactive, GenAI introduces foresight, adaptability, and scale.

This isn’t about doing the same things faster-it’s about working smarter, with intelligence embedded into the process. In a landscape where milliseconds matter, operational alpha may be the most valuable edge of all.

AI agents lead the operational reset

- Turning fail resolution into prevention: AI agents analyze root causes, classify fails, and guide resolutions-cutting resolution cycles from days to hours and setting the stage for predicting and preventing settlement failures before they occur.

- Optimizing inventory in real time and validating recommendations: Agents diagnose the root cause of delivery fails, recommend transfers, and reconcile records across global accounts-helping firms free up capital, reduce funding costs, improve settlement efficiency and respond to shortfalls proactively.

- Orchestrating operations: AI agents coordinate complex workflows end-to-end-assigning tasks to digital coworkers, automating responses, and executing processes based on natural language prompts or real-time data and validating recommendations.

- Delivering unified operational insight: By integrating data across platforms and entities, agents offer firm-wide transparency-enhancing risk management, decision-making speed, and strategic execution.

- Scaling intelligence, not headcount: With self-learning feedback loops and adaptive logic, AI agents continuously improve processes-fueling operational alpha through smarter systems, not larger teams.

Data strategy unlocks transformational benefits

Behind every successful AI-powered operation is a strong data foundation-and for Broadridge, that foundation is Broadridge Exchange (BRx). BRx is a unified data model that standardizes and harmonizes information across asset classes and systems. Serving as the backbone of Broadridge’s digital infrastructure, BRx enables consistent, interoperable data to flow seamlessly between front, middle, and back-office functions-eliminating silos, makes resources fungible and laying the foundation for advanced analytics, automation, and regulatory reporting.

By consolidating fragmented data sources, BRx drives tangible operational efficiency. It reduces the need for manual reconciliations and improves straight-through processing, ultimately lowering cost and risk. The standardization of data also enhances firms’ ability to manage risk proactively and respond to regulatory demands with greater speed and accuracy.

Critically, BRx enables faster adoption of emerging technologies. Whether integrating AI agents, blockchain, or cloud-native platforms, firms benefit from a cleaner, more coherent data layer that accelerates deployment and reduces time-to-value. One application of BRx is Broadridge’s Tradeverse platform, which simplifies access to normalized, cross-system data-empowering teams to execute data tasks faster, with fewer inputs.

“AI solutions are rapidly advancing to use agentic models. Firms need to strategically invest in foundational capabilities such as harmonized data, integrated workflows and multi-asset global capabilities to drive AI enabled operational transformation at scale.”

— Santosh Vazarkar, Head of Product Management, Capital Markets Post Trade, Broadridge

As firms navigate increasingly complex capital markets, BRx provides a strategic advantage. It supports enterprise-wide modernization, improves data transparency, and enables real-time insights-turning operational infrastructure into a source of competitive strength. In short, BRx transforms data into a true enabler of operational alpha.

Cracking the code on settlement fails: The AI agent changing everything

Settlement failures have long been the silent disruptor in post-trade operations-costing firms time, money, and client goodwill. But now Broadridge’s OpsGPT is fundamentally reshaping the equation. At the center of this transformation is a breakthrough AI capability that doesn’t just resolve fails faster-it predicts them before they happen. This leap forward isn't incremental; it’s a true game-changer. Fixing problems before they occur is vastly more powerful-and more profitable-than scrambling to fix them after the fact.

Settlement fails-or simply “fails”-happen when a trade doesn’t settle on its contractual date, often due to mismatches in data, incorrect settlement instructions, or counterparty issues. The scale is staggering: Tier 1 institutions report between 1,000 and 9,000 fails daily, equating to between $0.3 to $5 billion in unsettled value across global markets. And with T+1 settlement and fail penalties mounting, firms can no longer afford to treat fail management as a back-office clean-up exercise. It’s a front-line business risk-and now, an opportunity.

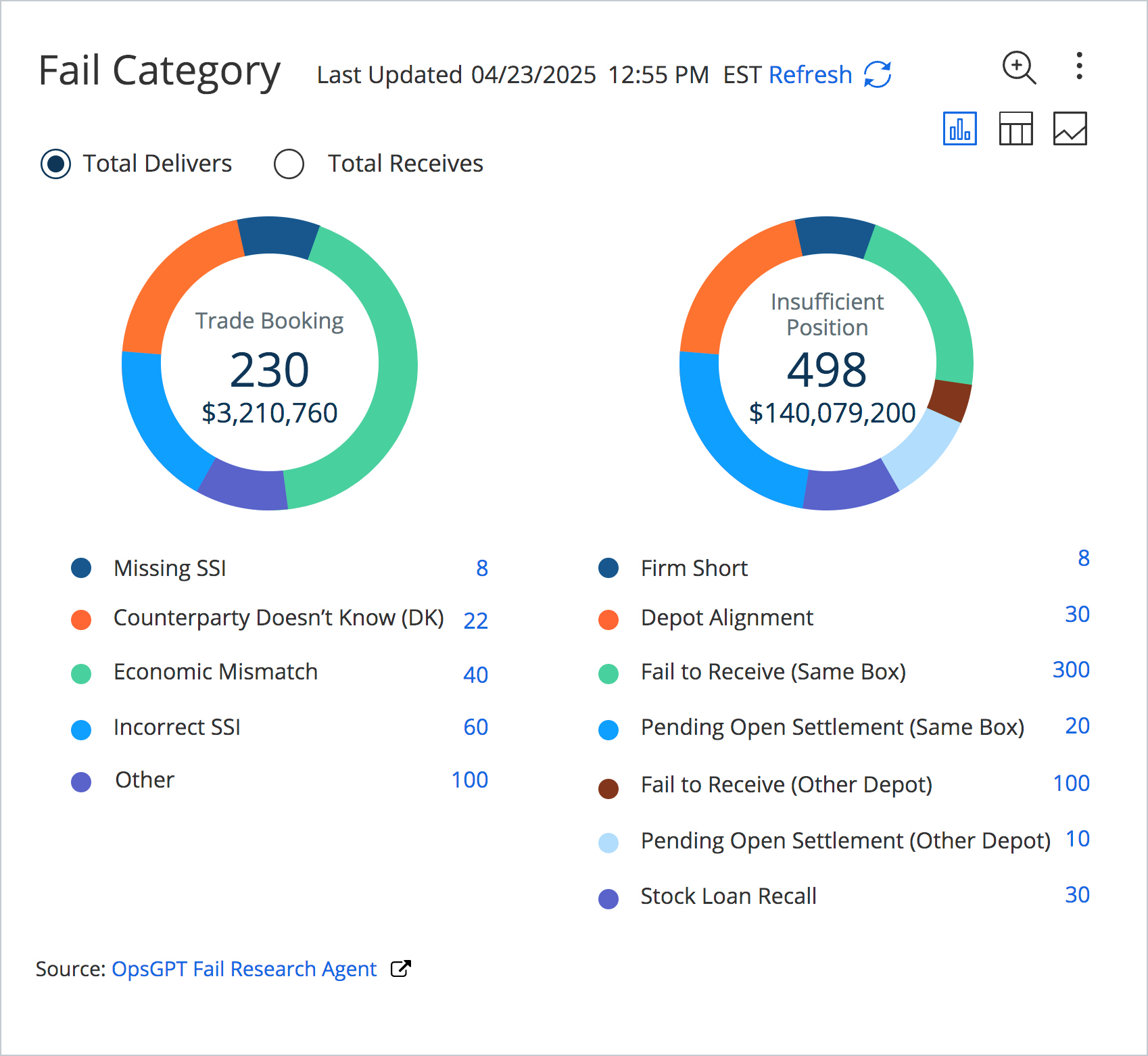

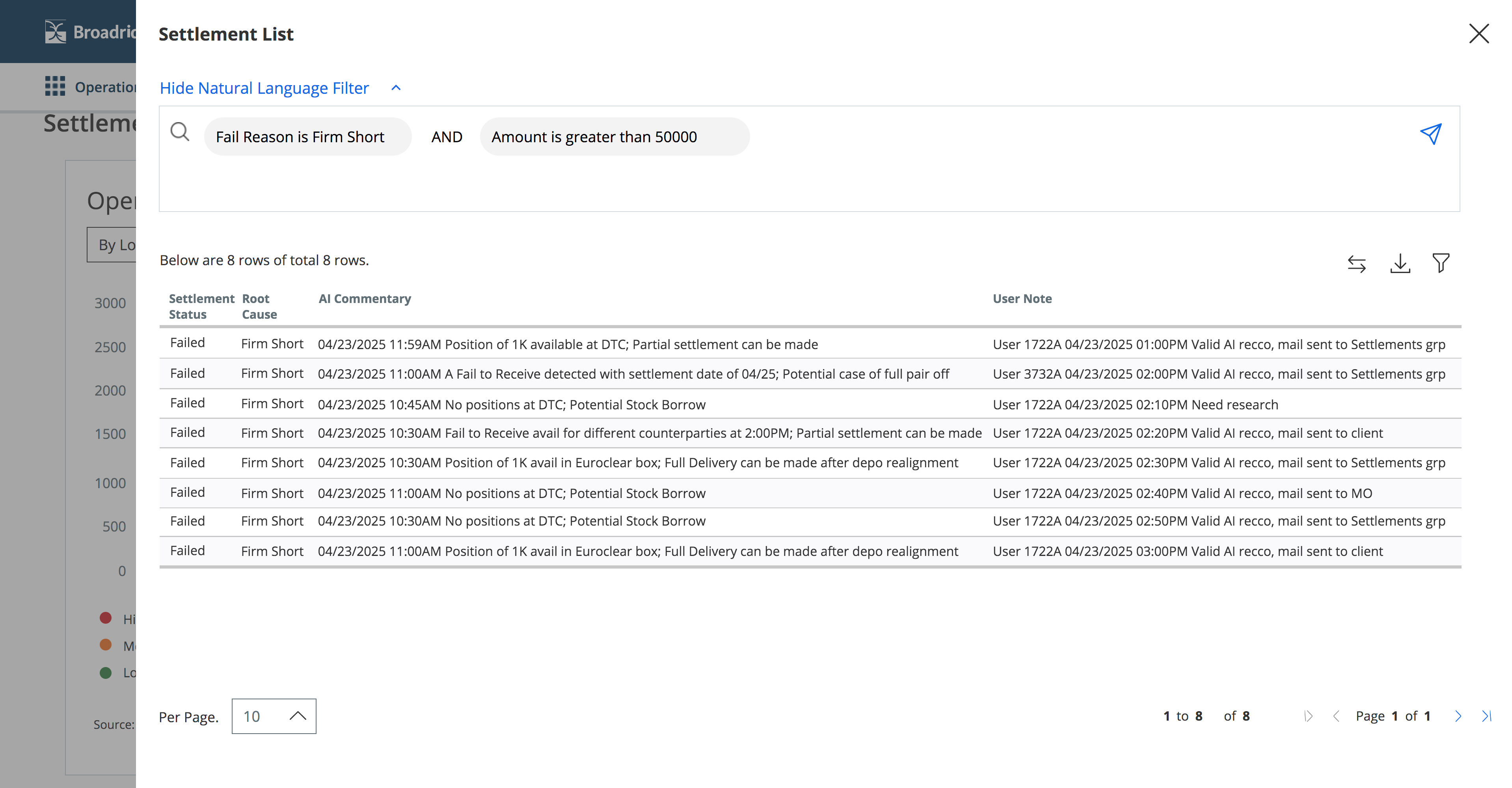

Enter the Fails Research AI Agent, an advanced capability within OpsGPT that redefines fail management from reactive to proactive. By analyzing vast streams of transaction histories, reference data, and platform activity, the AI doesn’t just tell you why a fail happened-it predicts which trades are at risk of failing before settlement is even due. It identifies patterns, flags counterparties with consistent fail behavior, and surfaces risks in real time, enabling teams to intervene early, reroute trades, or renegotiate settlement terms ahead of the problem.

Predictive prevention is fundamentally shifting the posture of operations teams from reactive mode to proactive risk mitigation and strategic control.

While predictive prevention is key, the Fails Research AI Agent also supercharges resolution when fails do occur. It instantly interprets data across multiple platforms and entities, classifying each fail using a standardized taxonomy, explaining the issue in plain language, and recommending next steps—all without the need for hours of manual investigation.

Beyond the immediate operational gains, OpsGPT is building smarter systems over time. With dynamic feedback loops-where users can refine root causes and outcomes-the AI continually improves, making each prediction and resolution sharper and faster.

The impact is already measurable. Clients who use the Fails Research AI Agent can see resolution cycles shrink from days to hours, operational teams are being freed to focus on value-add activities, and reputational risk from chronic fail issues is diminishing. Aged fails that once lingered in the background are now proactively targeted and resolved.

For firms aiming to advance their post-trade operations, cracking the code on settlement fails is becoming more than a compliance necessity. With predictive AI now delivering real-world results, it offers a new path toward greater efficiency, resilience, and the pursuit of operational alpha.

The next frontier in settlement efficiency: From inventory fragmentation to AI-powered inventory optimization

In the relentless push for faster, cleaner settlements, a surprising roadblock continues to stand in the way: inventory fragmentation. Every day, billions in unutilized or misaligned securities sit idle across global entities and accounts-tying up capital, triggering avoidable settlement fails, and inflating operational costs. But that’s about to change.

Broadridge’s OpsGPT is advancing into a new frontier with an emerging capability that combines AI agents with global inventory management. Integrated with the firm’s centralized Global Position Manager (GPM), this solution connects real-time position data across asset classes, markets, systems, and legal entities-using AI agents to monitor, assess, and recommend actions that unlock smarter, faster settlement decisions in seconds, not hours.

“It’s about giving operations users the power to anticipate and resolve settlement failures before they occur. When a fail event is projected due to insufficient position, our system will tell you exactly where inventory exists and help you move it-even if it’s across a different legal entity-so you can fix the issue fast.”

— Chris Bell, Vice President, Product Strategy, Broadridge

These agents detect mismatches between inventory location and demand, recommend proactive transfers, and initiate approval workflows to resolve risks before they materialize. The technology addresses a core pain point: firms often hold the right securities—but in the wrong place. With inventory spread across multiple depots, regions, or affiliated entities, operational teams have lacked real-time visibility to coordinate movements effectively.

OpsGPT’s AI-powered agents cut through this complexity with dynamic transfer logic, interactive position analysis, and live integration with custodians and depositories. Agents even substantiate stock records by reconciling positions with open settlements, delivering real-time confidence in asset availability. Crucially, all actions can be executed directly within the system-minimizing coordination overhead and boosting straight-through processing (STP).

The financial upside is compelling. Based on internal analysis, optimizing just $50 million of daily FTD (Fails-to-Deliver) inventory could result in $2–3 million in annual capital savings, plus over $1 million in fail-related cost reductions. In an environment where capital efficiency is everything, those gains are hard to ignore.

This capability works in tandem with the Fails Research AI Agent, creating a cohesive post-trade intelligence network.

With predictive inventory optimization, AI agents will soon be able to forecast shortfalls and reposition assets before trades are even booked. The result: smarter use of securities, lower funding costs, and fewer operational fire drills.

In a market where T+1 and real-time expectations are rapidly becoming the norm, AI-driven inventory optimization - isn’t just operationally efficient. It’s a direct path to operational alpha.

Bringing AI to the Inbox: Automating Trade Support Through Email Integration

In post-trade operations, efficiency often hinges on a simple but stubborn bottleneck: email. Everyday, operations teams field thousands of status checks and exception requests from colleagues across the middle office, many of whom lack direct access to systems like such as Broadridge global post trade processing engines. The result? Manual queries, fragmented workflows, and hours spent retrieving trade statuses and replying by hand.

That’s changing fast.

A new AI-powered email integration capability within OpsGPT is eliminating the need for human intervention in these routine exchanges. Instead of relying on manual lookups, the system now reads inbound emails, interprets the intent, queries OpsGPT for the appropriate data, and replies and resolves.

Take a common scenario: a trade support email asking for the settlement status of a specific transaction. With email integration in place, the message is received, parsed, and translated into a natural language instruction for OpsGPT, which queries the appropriate post-trade system. Once the response is retrieved, the AI crafts a clear, context-aware reply and automatically sends it back to the original requestor-no swivel-chairing or copying and pasting required.

The benefits are substantial: hundreds of hours saved per month, fewer errors from manual data entry, and improved responsiveness across the firm. And it's not just about reading data-future use cases include acting on it too. For example, users will soon be able to trigger trade settlement or position transfers directly through email prompts, with OpsGPT executing actions via actionable APIs and confirming outcomes automatically.

Scheduled reporting is also being reimagined. Hourly or daily inventory and fail summaries can now be generated and distributed via automated emails-replacing the need for repetitive lookups, spreadsheet pivots, and manual report prep.

As firms push for leaner, smarter post-trade workflows, OpsGPT’s email integration turns every inbox into a high-impact productivity channel-eliminating friction and unlocking new efficiencies.

Reimagining Operations to Retain and Reward Talent

In post-trade operations, success is no longer measured solely by efficiency gains-it’s about empowering the people behind the process. For years, back-office roles have been plagued by complexity, high turnover, and limited growth paths. But GenAI is rewriting that narrative.

OpsGPT is making operations roles more intuitive, meaningful, and future-ready. With natural language capabilities, users can ask simple, conversational questions-like “Where can I find my failed trades?” or “What’s the status of this settlement?”-and receive instant, accurate, answers. No more navigating dozens of screens or memorizing complex system codes. Analysts and associates can onboard faster, perform with greater confidence, and focus on value-add work instead of endless lookups.

For a generation that expects intuitive digital tools, this shift is vital. Traditional post-trade systems often feel outdated - discouraging engagement and limit career potential. As Sujoyini Mandal noted, high attrition among junior operations professionals is often rooted in the repetitive, manual nature of the work. By automating these tasks and opening up opportunities for strategic problem-solving, OpsGPT helps firms not only retain talent longer but also reinvigorate the appeal of operations as a career path.

By humanizing technology, GenAI becomes not just a lever for productivity-but a platform for attracting, developing, and empowering the next generation of operational leaders.

AI Workers on Demand: The Next Leap in Operational Intelligence

Beyond supporting humans, OpsGPT is laying the foundation for a new class of digital coworkers: AI workers. These are not just data extractors-they’re intelligent agents capable of executing operational tasks based on natural language instructions.

Need to bulk-settle a batch of trades? Clean up a portfolio of aged fails? Trigger a specific workflow based on an email? OpsGPT's AI workers can take over these functions through predefined instruction sets that connect directly to back-end systems via APIs. Users simply upload a formatted Excel file or submit a request via chat or email, and the AI worker processes the action, confirms completion, and logs the response-all without manual intervention.

This vision of agentic AI unlocks exponential potential. Think: one agent, many workers-each assigned to handle a distinct task in parallel, with built-in logic to re-check data, fetch supporting information, and retry if necessary. It's the kind of system that mirrors human operations teams-but faster, smarter, and without burnout.

By freeing up people to focus on exceptions, insights, and innovation, AI doesn’t just make operations more efficient-it makes them more human. In doing so, firms gain not only operational alpha but also cultural resilience-where talent thrives, teams collaborate seamlessly, and the next generation of operational leaders is already in the making.

As AI systems evolve from support tools to autonomous actors, ensuring their trustworthiness becomes even more essential.

Trust by Design: Broadridge’s Framework for Responsible AI Adoption

As generative AI transforms capital markets, one question continues to dominate boardroom conversations: Can we trust it? At Broadridge, the answer is a resounding yes-but only with the right architecture, controls, and governance in place.

From the beginning, Broadridge has taken a “trust by design” approach to AI, developing a multi-layered framework that safeguards data, prevents hallucinations, ensures compliance, and gives firms the confidence to adopt GenAI solutions like OpsGPT at scale. This framework is not theoretical-it’s embedded into the core of every Broadridge AI product and has matured significantly over the past year, supported by foundational platforms like BRx and Tradeverse APIs that power secure, scalable data access across the enterprise.

“The trust model isn’t an afterthought—it’s foundational. It defines how we build, what partners we use, and how we safeguard clients’ data and confidence.”

— Sujoyini Mandal, Vice President, Strategy & Business Development, Broadridge

A common concern among capital markets firms is that proprietary or sensitive information could inadvertently be exposed or used to train third-party models. Broadridge’s architecture is designed to prevent data leakage by default. GenAI models are not trained on client data, and all usage is tightly scoped through secure APIs, role-based access, anonymization protocols, and hosted cloud environments. This architecture is further strengthened by BRx’s harmonized data fabric and Tradeverse’s federated API access model, which ensure only curated, authorized datasets feed into AI workflows.

A common concern among capital markets firms is that proprietary or sensitive information could inadvertently be exposed or used to train third-party models. Broadridge’s architecture is designed to prevent data leakage by default. GenAI models are not trained on client data, and all usage is tightly scoped through secure APIs, role-based access, anonymization protocols, and hosted cloud environments. This architecture is further strengthened by BRx’s harmonized data fabric and Tradeverse’s federated API access model, which ensure only curated, authorized datasets feed into AI workflows.

For example, OpsGPT’s data retrieval process draws exclusively from verified internal sources, ensuring that no business data is ever exposed to public LLMs like OpenAI’s ChatGPT. Even in partnerships with model providers, Broadridge enforces contractual safeguards and technical boundaries that guarantee confidentiality and control.

In financial services, accuracy is mission-critical. Rather than generating synthetic content, Broadridge’s GenAI tools retrieve responses by querying curated, structured data using advanced retrieval-augmented generation (RAG) techniques. This eliminates hallucinations and improves the trustworthiness of every answer. Built-in features like structured query playback, output validation, and financial terminology mapping help ensure each response meets the high standards of industry users.

As regulation tightens around AI, Broadridge has taken a proactive stance-embedding compliance monitoring into the very core of its AI products. OpsGPT includes agents that screen outputs to ensure they align with financial regulations and internal policies. The AI platform is built to adapt in real time, updating guardrails and workflows as the regulatory environment evolves.

Trust isn’t just a technology challenge-it’s a strategic and cultural imperative. Every AI use case goes through a rigorous enterprise governance process involving risk committees, design pattern reviews, and stakeholder alignment across product, engineering, compliance, and legal teams. From vendor due diligence to model evaluation, no AI capability moves forward without a full understanding of its risk and impact profile.

With over $10 trillion in securities processed daily, Broadridge has built long-standing relationships with the world’s largest financial institutions on the foundation of trust. That same foundation now underpins its approach to AI. Clients can be confident that they’re not just gaining access to next-generation capabilities- but are enhanced by the strategic investments in BRx and Tradeverse that uniquely position Broadridge to scale trusted AI securely across markets and clients.

As GenAI adoption accelerates, trust is becoming the ultimate differentiator. Thanks to its future-ready architecture, Broadridge is helping clients move faster and smarter-without compromising the values that matter most.

Built for Scale: Broadridge’s AI Engine Shifts into High Gear

Broadridge is rapidly expanding the reach and impact of its AI program, building a future-ready ecosystem that combines cutting-edge technology with responsible innovation. At the core of this evolution is its continuously advancing AI platform, made possible through a unique, harmonized data ontology and designed to support a growing array of models, tools, and intelligent workflows. These aren’t theoretical innovations-they’re already driving real-world impact. A recent example: Broadridge’s new email automation capability has cut Bank Payment Obligation (BPO) inbox volumes by an impressive 68%, showcasing the practical power of AI to streamline time-consuming manual tasks. Meanwhile, the rollout of self-service APIs and design improvements focused on user experience are accelerating adoption across Broadridge platforms and client segments.

This expansion is not happening in isolation. It’s underpinned by the Office of AI Oversight and Governance (OAIG), a dedicated function ensuring that all AI deployments adhere to the highest standards of security, ethics, transparency, and regulatory compliance. By embedding governance into every layer of development-from data handling and model selection to output monitoring-Broadridge is reinforcing trust at scale, even as it pushes the boundaries of what's possible.

The commercial upside of this AI acceleration is already coming into focus. AI-powered capabilities like real-time inventory and depot optimization are helping clients unlock trapped capital and improve trade matching, allowing firms to deploy assets more dynamically and profitably. With less idle inventory and more effective settlement strategies, firms are able to enhance returns while reducing operational drag.

Broadridge’s AI program isn’t just about deploying smarter tools-it’s about enabling smarter strategy. That’s the vision behind AI-in-a-Box, an emerging, all-in-one enterprise solution designed to guide clients through every stage of AI implementation-from identifying high-impact use cases to model governance and platform integration. With these tools and frameworks in place, Broadridge is not only helping firms catch up to the AI revolution-it’s equipping them to lead it.

GenAI in Operations: From Experiment to Essential Infrastructure

Generative AI is no longer a future consideration-it is becoming foundational to how financial firms operate. Broadridge’s 2025 Digital Transformation & Next-Gen Technology Study highlights this shift, with 72% of firms reporting moderate to large GenAI investments this year, up from 40% in 2024. Among technology and operations leaders, the consensus is clear: GenAI’s greatest near-term impact will be on employee productivity, with top use cases focused on cost reduction, process efficiency, and improving client and employee experience. Notably, 35% of firms expect to realize ROI within six months of deployment.

OpsGPT reflects this momentum in action. It’s enabling teams to resolve settlement fails in minutes, improve throughput, and prioritize actions that once required hours. As capabilities expand-across inventory optimization, email automation, self-service interfaces, and more-firms are beginning to reimagine what post-trade operations can and should look like.

The implications go well beyond efficiency. By integrating AI into daily operations, firms gain a measurable edge in how quickly they respond to market shifts, manage risk, and unlock capital. This is the emergence of operational alpha—not just doing more with less, but operating with greater clarity, speed, and adaptability. For institutions facing rising complexity and shrinking margins, that advantage is no longer optional-it’s essential.

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |