Industry Initiatives

LIBOR/SOFR

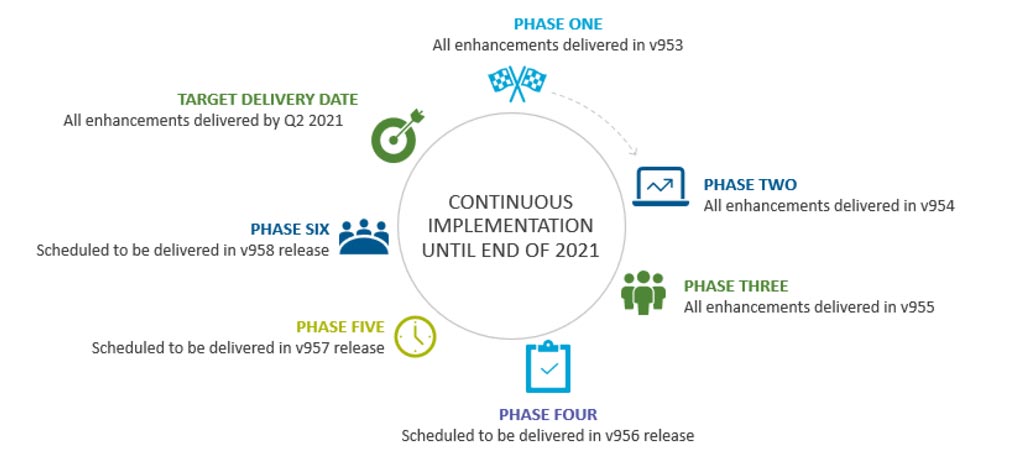

In response to the transition away from the London Interbank Offered Rate (LIBOR), Broadridge is creating a suite of enhancements for the impact™ system to be delivered in multiple phases. The latest phase to be introduced is Phase Six, with enhancements scheduled to be introduced in v958 & v959 of impact™. This phase will introduce enhanced trade confirms for SOFR/SONIA rates, as well as improved integration with Broadridge MSD (Master Security Description) based on new functionality delivered in previous phases.

The existing enhancements in the LIBOR/SOFR suite will apply to the following for SOFR/SONIA:

- Bought/sold interest calculations

- Daily interest calculations

- Coupon calculations

- Monthly coupon clips and open item generation

- GL posting related to interest

- Interest calculations for finance deals

- Support for floating rate instruments

Broadridge is also analyzing potential changes required to support other global rates as they continue to emerge. This includes the indices ESTR, CORRA, SARON, and TONAR.

- The ESTR, or Euro Short-Term Rate, is an interest rate calculated and published by the European Central Bank. This benchmark reflects the overnight borrowing costs of banks and represents the average interest rate attached to loans from the previous business day of transactions in the European market.

- The Canadian Overnight Repo Rate Average (CORRA) measures the cost of overnight general collateral funding in Canadian dollars using Government of Canada treasury bills and bonds as collateral for repurchase transactions. The Bank of Canada calculates CORRA based on transaction-level repo data government securities distributors and other institutions submit to the Investment Industry Regulatory Organization of Canada.

- The Swiss Reference Rate (SARON) is the Swiss Franc (CHF) reference rate, reflecting both actual transactions and binding quotes of the underlying Swiss repo market. The SARON 1-month Compound Index reflects the aggregation of all daily SARON rates over a single month.

- TONAR, the Tokyo Overnight Average rate, is based on transactions in the overnight borrowing market in Japanese markets. It is a volume weighted average of all uncollateralized overnight trades settled on the same day as the trade date and maturing the following business date.

DTCC T+1 Accelerated Settlement

Broadridge remains engaged in industry forums to stay aligned with the proposed T+1 change. Currently no additional development is required for impact™, which already processes US Treasuries on a T+1 basis. Minor configuration changes would be required in the system to accommodate T+1 settlement for other fixed income asset classes in the updated scope. Existing security skeletons for these assets must be updated with the new default settlement date (T+1). Configuration changes will also be required to populate the messages to DTC with the correct business date based on T+1.

The industry will see many benefits from transitioning to a T+1 settlement cycle, including but not limited to:

- Mitigation of settlement risk by enhancing market transparency.

- Improved collateral utilization in times of high volatility.

- Increased operational efficiencies by decreasing reliance on manual processes.

Review the DTCC white paper for more information regarding the initiative.

BNY Global Tri-Party Processing

BNY Mellon acts as the tri-party agent for dealers and investors trading in U.S. markets. This activity is supported today through Broadridge’s impact™ platform by allowing clients to leverage our technology to interface with BNY’s RepoEdge tri-party platform, which processes U.S. dollar denominated deals and allocations.

In Asian/Pacific and European markets, BNY acts as a tri-party agent as well and processes this activity through its BNY Global system: participants are able to establish unique identifiers at BNY to distinguish between domestic and global accounts and submit tri-party deals in various currencies for global accounts

Impact has been enhanced to allow firms to submit non-U.S. dollar denominated deals to the BNY Global platform, allowing firms to process their domestic and global allocations concurrently through our existing tri-party dashboard. We’ve also enhanced our tri-party reports and screens to include additional fields such as deal currency, ISIN, SEDOL and country of origin.

Implementation Dates and Reminders

- FRB Implementation date: moved to January 5, 2022

- CSDR - Implementation date: February 1, 2022

- FICC CM - FICC Client Phase 1 Testing completed September 20th, 2020; MRO Connectivity test in March 2022; Implementation delayed until 2022

- FED ACAP - FED Implementation date: Postponed until Q2 2023

- ISO 20022 - Phased implementation - Starting from end of 2022. Full implementation in November 2025

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.