Industry Initiatives

1st Half of 2021: Fixed income / impactTM Updates.

Central Securities Depository Regulation

EU Central Securities Depository Regulation (CSDR) is a European regulatory initiative spawned from the 2008 financial crisis to increase the safety and efficiency of securities settlement and securities settlement infrastructure in the EU. CSDR requires participants to use Legal Entity Identifiers (LEI’s),market/exchange identifiers (MICs) and MiFID definition transaction types when instructing CSDs. The planned implementation date for the new regulations is February 1, 2022.

Broadridge can help your firm better navigate through these choppy regulatory waters: contact your Broadridge Account Manager today to see how your firm can benefit from our existing product line-up.

Features

- Capture Late Matching Fail Penalty (LMFP) and Settlement Fail Penalty (SEFP) amounts from the custodians via daily and monthly MT537 messages

- Post daily accruals, debit trader GL accounts based on the custodians’ daily messages

- Credit/debit cash based on the monthly messages from the custodians

- Monitor breaks between daily and monthly amounts via GL Control Accounts

- Daily and monthly visibility to amounts on the Fail Penalty (FP) Screen

- Download Fail Penalty data

- New Fail Penalty Report

- Post BPS bookkeeping entries for GPS clients, from impact, for International Fixed Income and directly from GLOSS for International Equities

Benefits

- Accurate Books & Records

- Straight-Through Processing (STP)

- Online history/audit trail

- Data download & reporting

LIBOR to SOFR

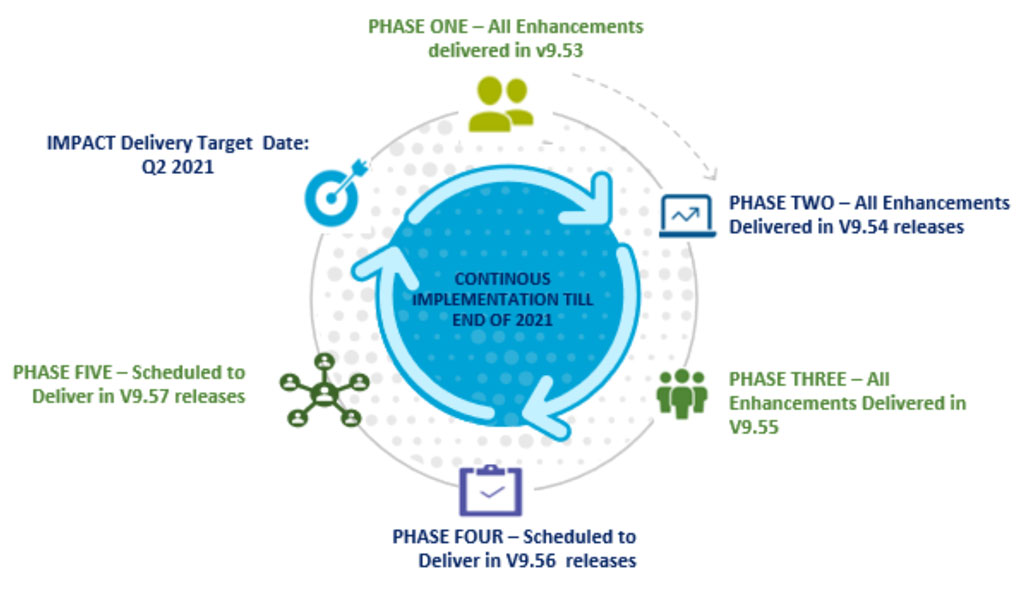

The Federal Reserve has selected the Secured Overnight Funding Rate (SOFR) to replace U.S. LIBOR. In response, Broadridge is creating a suite of enhancements for the impact system, to be delivered in multiple phases. Phase I, Phase II and Phase III are now available for client testing, with the release of Phase IV for testing planned for the end of May 2021 – Phase V should be available in October 2021. Enhancements to impact will include the BOE’s Sterling Overnight Index Average (SONIA) rate and other global rate changes, replacing LIBOR as they continue to emerge.

The enhancements in this suite will apply to the following interest calculations:

- Bought sold interest calculations

- Daily interest calculations

- Coupon calculations

- Monthly clips and open item generation

- GL posting related to interest

- Interest calculations for finance deals

- Support for floating rate instruments

Broadridge Consulting Services is assisting its clients by providing comprehensive support with their end-to-end LIBOR Replacement Programs. Please contact your Broadridge Account Manager today for more details.

Exchange-Traded Funds

Industry changes to the Exchange-Traded Funds (ETF) primary market clearing process were introduced by NSCC in Phase 1 for Equity products. Phase 1 changes included processing of multiple basket types, added flexibility for order customization and the addition of accrued interest. In Phase 1, ETF Participants were still able to submit trades via DTCC Ex-Clearing.

Phase 2 was implemented in April for equity products. In this phase, ETF Participants are required to use NSCC’s CNS processing for settlement of ETF baskets. ETF Agents now submit via RTTM on behalf of the Participants, and settlement occurs via CNS, rather than via DTCC ex-clearing. This change has been mandatory for Equity Products since April 23, 2021.

As part of Phase 2, iProducts/iShares has mandated that predetermined Fixed Income Funds will only be available for trading via CNS. This is not an industry-mandated change for Fixed Income, but it will affect any Broadridge client that trades with any of the iProducts/iShares funds. impact will create CNS obligations for ETF trades submitted by the ETF Agent. The launch date for iProducts/iShares funds was April 30, 2021.

As the process is not yet industry mandated for all Fixed Income products, only two Broadridge clients are currently impacted. If at any point in the future CNS processing for all Fixed Income Funds becomes mandatory, both impact and BPS are prepared to support Broadridge clients.

Industry Initiative Updates

- DTCC pair off service:

- DTCC offers a new automated facility to pair-off members’ failing obligations. This service is optional to participant members and is now fully supported in impact.

- FICC implementation go-live February 1, 2021

- SWIFT 2021:

- Implementation Date November 21, 2021 for MT messaging changes

- For MT to MX migration (ISO 20022), phased implementation begins at the end of FY’22. Full implementation is slated for November 2025.

- FICC Common Margin:

- FICC implementation Date TBD in 2022 (subject to regulatory approval)

Contact Us

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.