Portfolio Management

Solve the complexities of diverse portfolios with end-to-end investment portfolio management. Our software removes the obstacles standing in the way of what you do best: earning returns for clients.

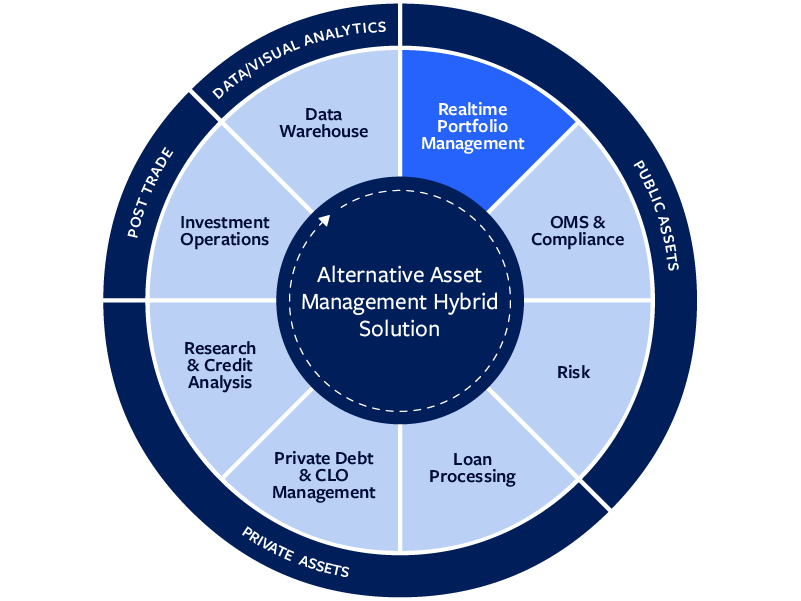

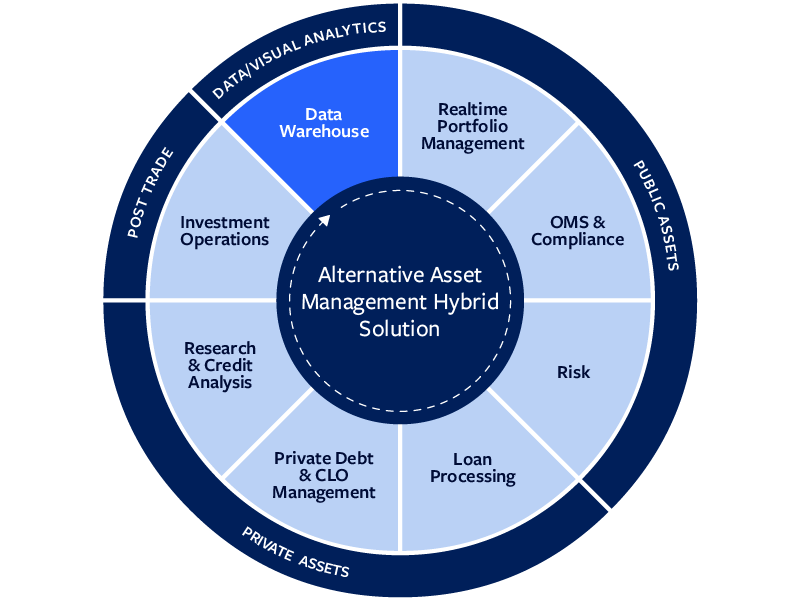

One platform. Every asset class.

Informed decision-making

-

Monitor investments in real time

-

Customize dashboards to fit your workflow

-

Evaluate opportunities and resources using advanced analytics

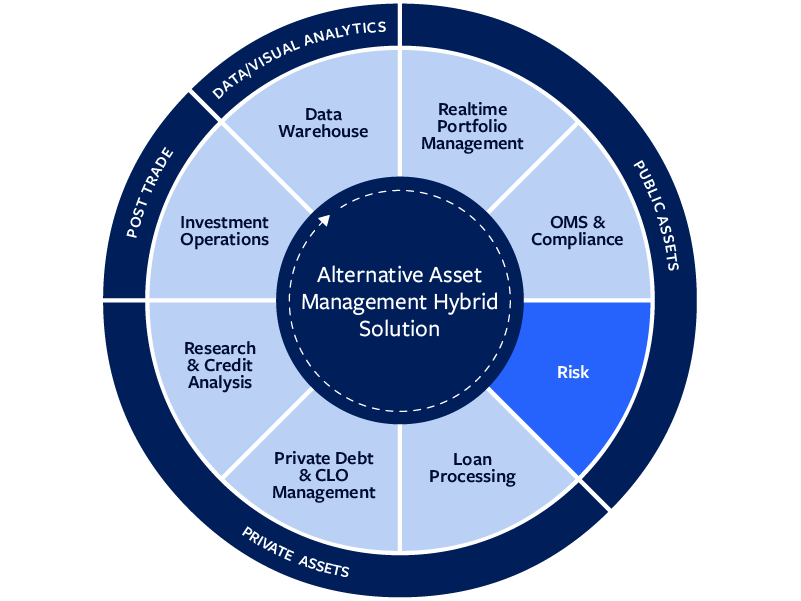

Optimized portfolio rebalancing

-

Manage public and private assets

-

Perform in-depth risk and performance analysis

-

Seamlessly integrate 3rd party data

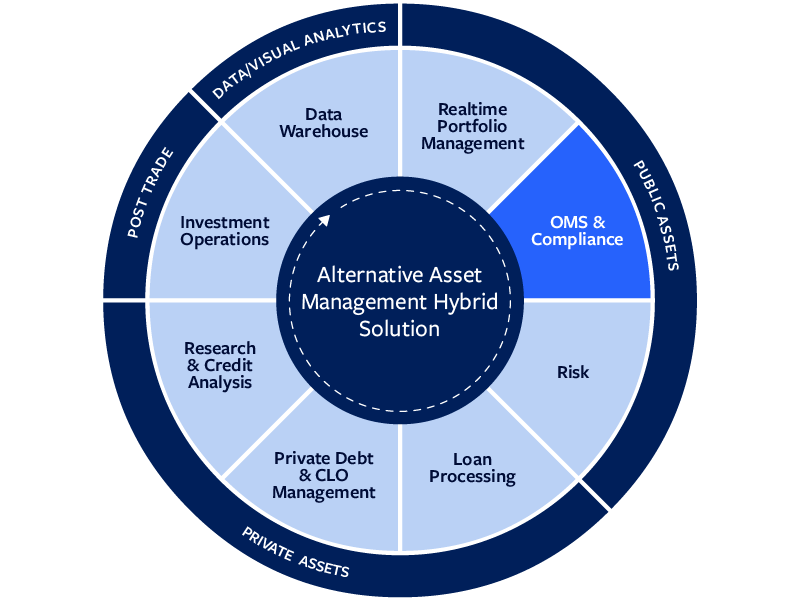

Compliance and regulatory monitoring

-

Adhere to standards for public and private assets

-

Monitor and mitigate potential risks

-

Maintain regulatory integrity

Custom reports and data visualization

-

Generate compliant communications for different stakeholders

-

Leverage customized data models

-

Format reports for desktop, tablets, and mobile

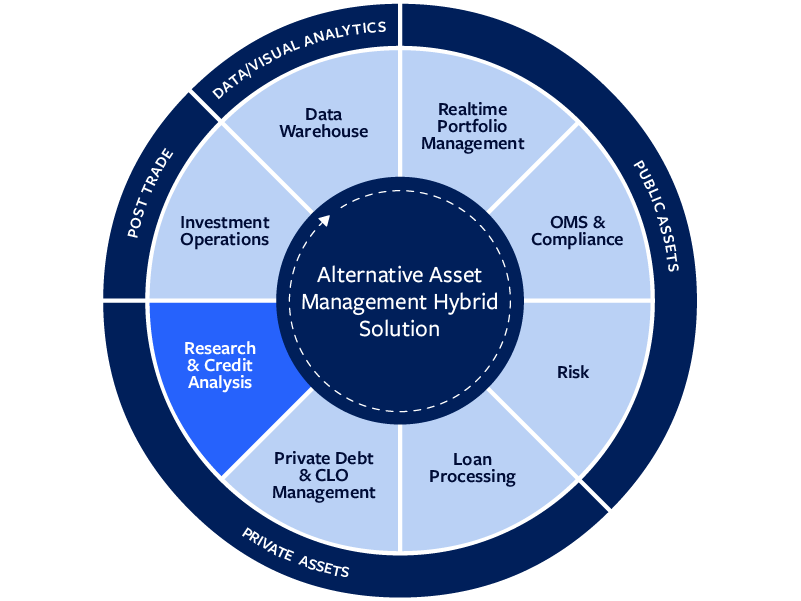

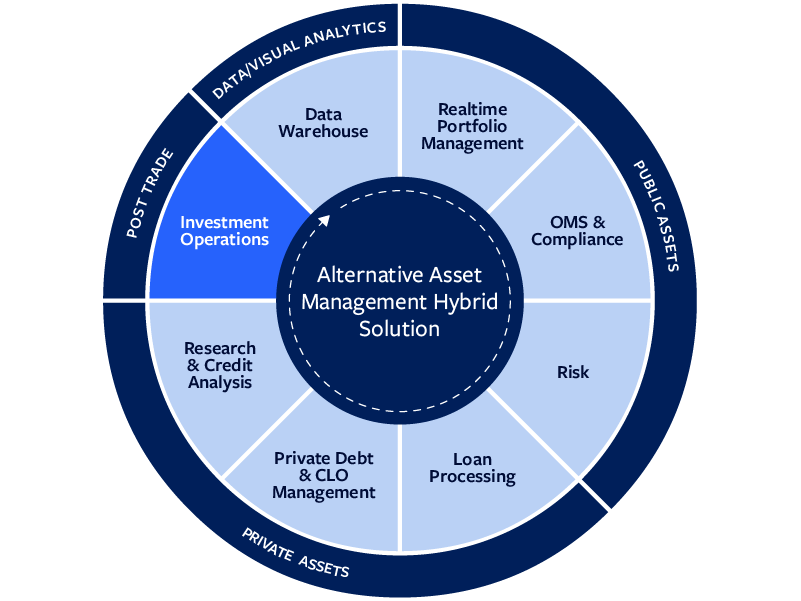

Enhance workflows for the entire front office

Drive efficiency and scale with sophisticated technology built for diverse portfolio strategies.

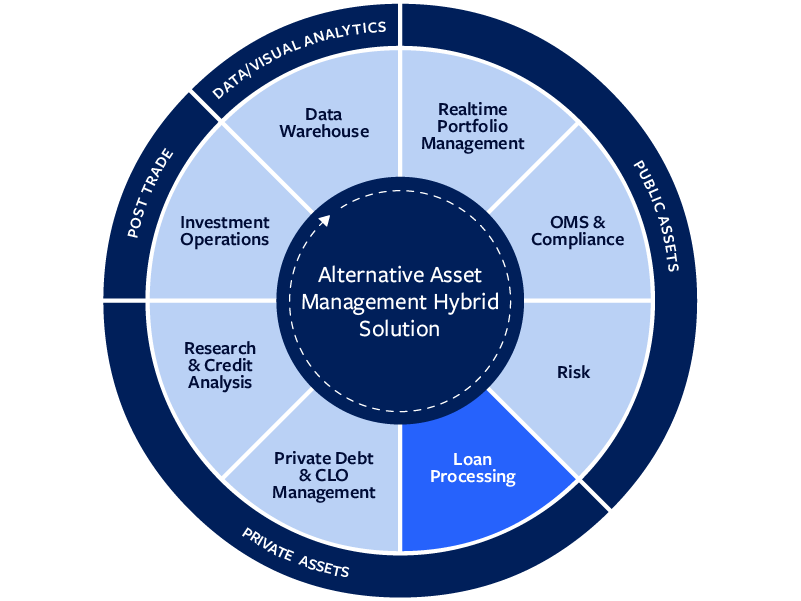

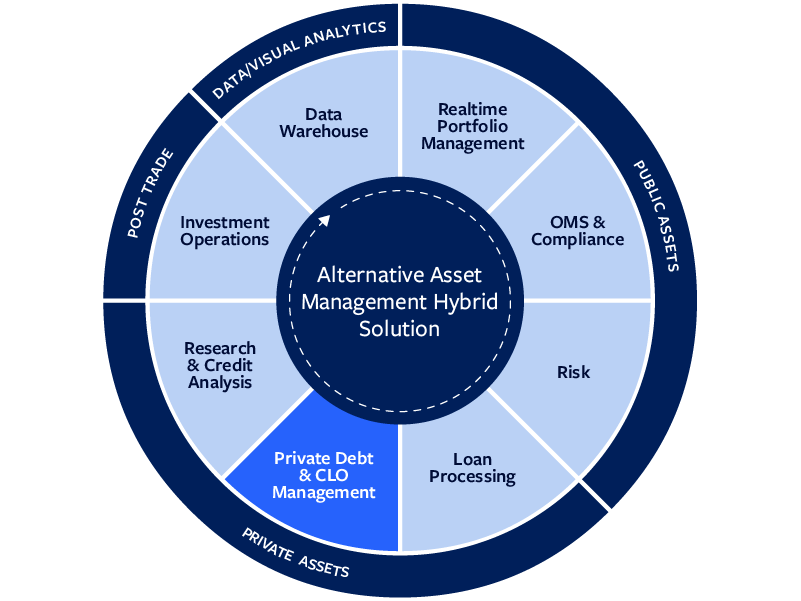

Access and analyze private debt investment details such as performance, risk, and valuation. Add advanced deal structuring capabilities to model, analyze, and optimize CLO structures.

Explore Private Market SolutionsEnhance performance and transparency with a strategic solution for managing publicly traded investments.

Explore Public Market Solutions

Insights & perspectives

What's next for your business?

We want to hear more about what you need to improve your business and drive transformative innovation, efficiency, and growth.

Want to speak with a specialist?