Cutting Edge Solutions

Products, services, and expertise to support your fixed income business.

LTX®

LTX, a new AI-driven digital trading platform, was launched earlier this year to improve liquidity and efficiency in the corporate bond market. Built on Broadridge’s fixed income post-trade processing platform, LTX empowers Dealers and their buy-side customers to better connect and trade corporate bonds using Artificial Intelligence. It also provides next-gen protocols that enable Dealers to more efficiently aggregate liquidity and trading opportunities across their vast customer network. LTX digitizes workflows to help traders and salespeople optimize trading opportunities, while the institutional investor community gains visibility into market liquidity like never before to achieve improved best execution from their dealer.

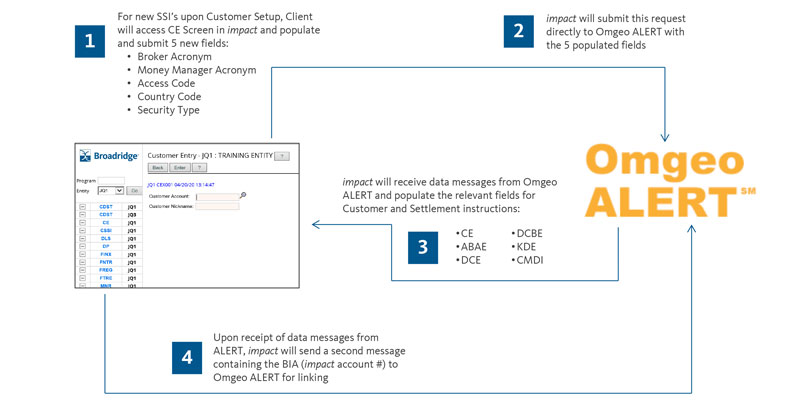

OMGEO ALERT Standing Settlement Instructions (SSIs) Auto Retrieval

Creating new buy-side client sub-accounts can be a manually intensive process that is susceptible to input errors. The risk of fails exists not only from erroneously entered new sub-accounts but also when a sell-side firm is not made aware when their buy-side clients update their SSIs in ALERT. Broadridge’s recently-enhanced workflow streamlines the process allowing for a direct interface to ALERT, providing a much more robust and efficient process to auto-retrieve SSIs from ALERT for new account creation. It also makes those same automated retrievals for existing accounts on which the client updated their SSIs in ALERT. Firms using impact™ can benefit from the service to further secure customer SSI data, help reduce fails and fail charges due to incorrect SSIs, and free up capacity on your new accounts team.

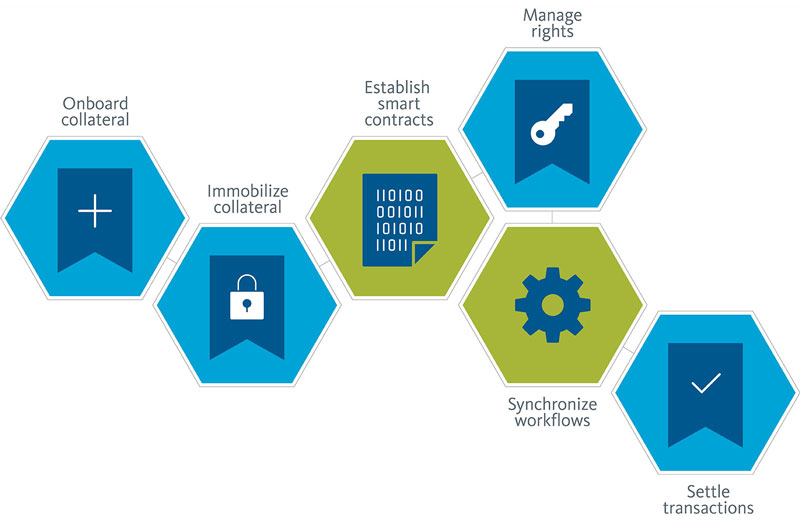

Distributed Ledger Repo (DLR)

DLR, Broadridge’s Blockchain technology offering, is ramping up with three clients committed to the platform and various others in stages of engagement. The immediate benefits for clients being on this network are specific to their organizations; however, the savings are scalable and increase as the network grows, and clients begin to trade bilaterally with one another. This network value exemplifies how we can help our clients realize significant cost savings and operational efficiencies via disruptive technologies.

DTCC Pledge

The DTC collateral loan service allows participants to pledge securities as collateral for loans or other purposes via their impact™-only entity, which already connects to DTC directly. Participants can also release collateral allocated to their pledge accounts. Through the new impact™ DTCC Pledge offering, operations will have the ability to reconcile their free and pledged positions and initiate free pledge and release requests at DTC through a single intuitive dashboard. Firms subscribed to the functionality can also leverage enhanced reporting and functionality within the system to better optimize their operational processes.

Processing Features and Requirements

| Tri Party Collateral Allocation file from the clearing bank would be modified to maintain the memo position and memo location depending on the memo flag set in the UID account on the file. | |

| Capability to support same date settlement activity – Recall/Release pledge securities if not available. | |

| Coupon & P&I Payments will be tracked by DTC. The open items for the pledged positions should be generated against DTC. The Clearing Bank Pledgee positions should not be considered for these payments. | |

| Option to flag securities not eligible for Pledge process at the Depository Level (DE), Product Level (SKLE), Security Level (NSEX), and Product Level (PGCE). A Day 1 Conversion program will assist clients in flagging existing securities. | |

| Verify we can reconcile remaining pledge position at BNY. | |

| Option to validate Bulk Release or Auto Submit to DTC. | |

| Ability for user to assign a minimum lot limit to be pledged on a security or skeleton level. | |

| Create a report that displays the pledge and pledge release activity for any given date or date range. | |

| The user, when set with appropriate privileges, will have the ability to override the amounts calculated by the system and still have the instructions transmitted. | |

| The DTC COL instruction must be generated using the static data stamped on each DME pledge/pledge release transaction. Major lifecycle events will have COL instructions automatically generated. | |

| DTC response messages must be accepted, processed, and their status updated on each transaction record for view by the user on a real-time basis on Pledge Status. | |

| Updates to the CSSI, CDST, DP, DLS, and RCA screen to allow the user to view Pledge positions. | |

| Position reconciliation between the system and DTC will be possible by automatically processing the APIBAL report. |

Contact Us

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.