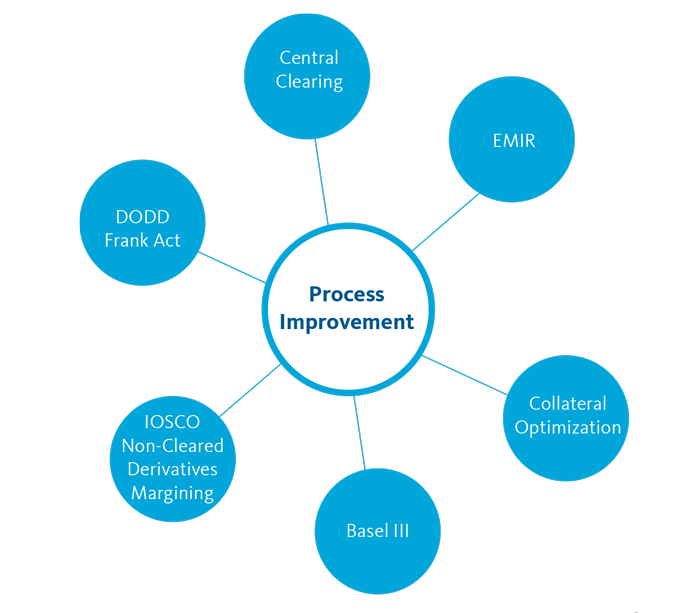

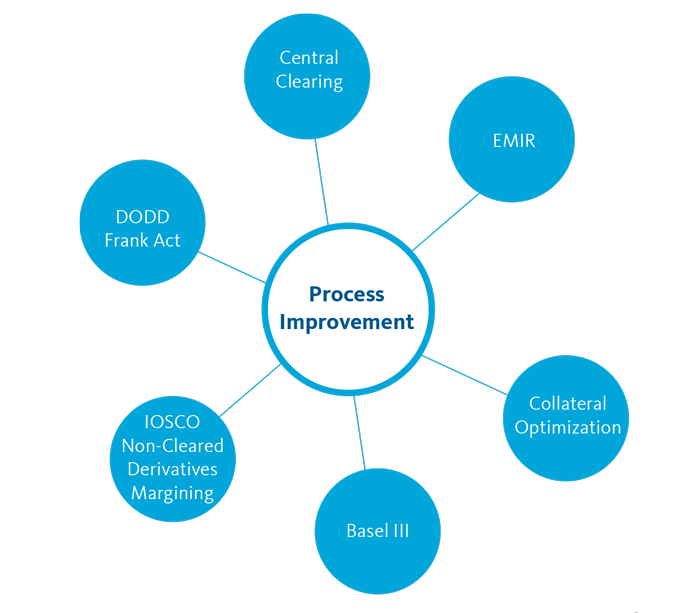

Banks and other financial firms are facing compliance with a high volume of new regulations over the coming years, from Basel Ill, to Dodd Frank in the US and EMIR in Europe.

These new rules are driving a sea change in collateral management by forcing firms to better manage counterparty credit risk, centrally clear derivatives and improve collateral processes and reporting.

The above factors create an increasing demand for high quality collateral, in contrast to a potentially decreasing and more siloed supply.

In the new environment, firms must now increase automation to manage more complex margining processes, while making the most efficient use of scarce collateral assets in order to maintain profitability and bottom line earnings.

The new model that has evolved over the past few years sees our customers using the Broadridge system to centralize inventory and exposures into a collateral hub.

This allows them to keep a tight control of exposure and collateral usage costs on an enterprise-wide basis across all business lines. From there, customers can optimize the use of collateral inventory across a number of different trading opportunities to reduce costs and generate a greater return on economic capital.

Integrated Enterprise-Wide Collateral Management

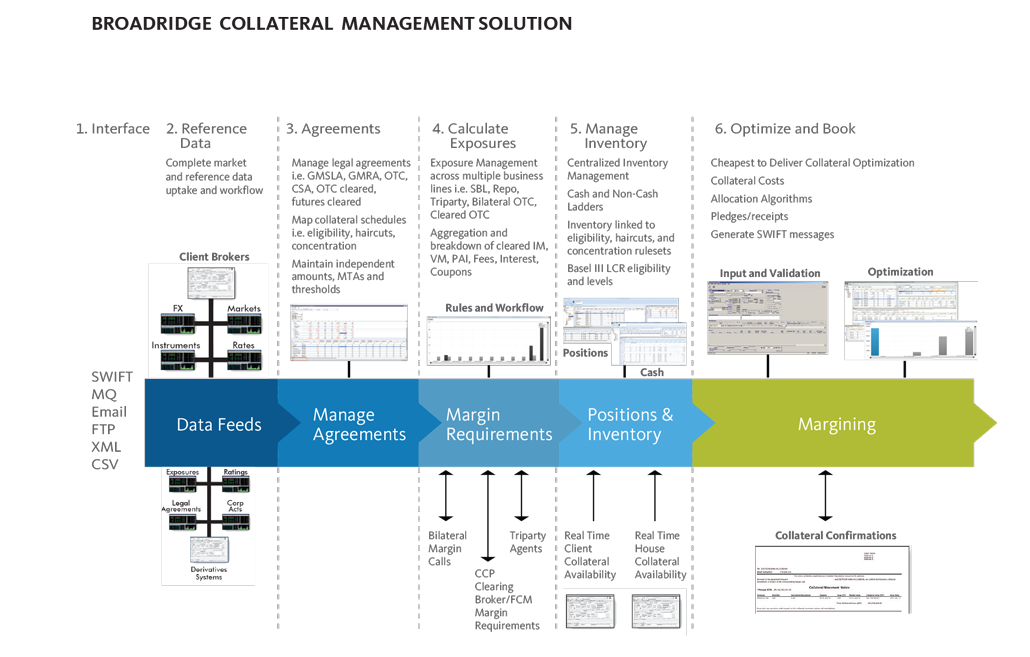

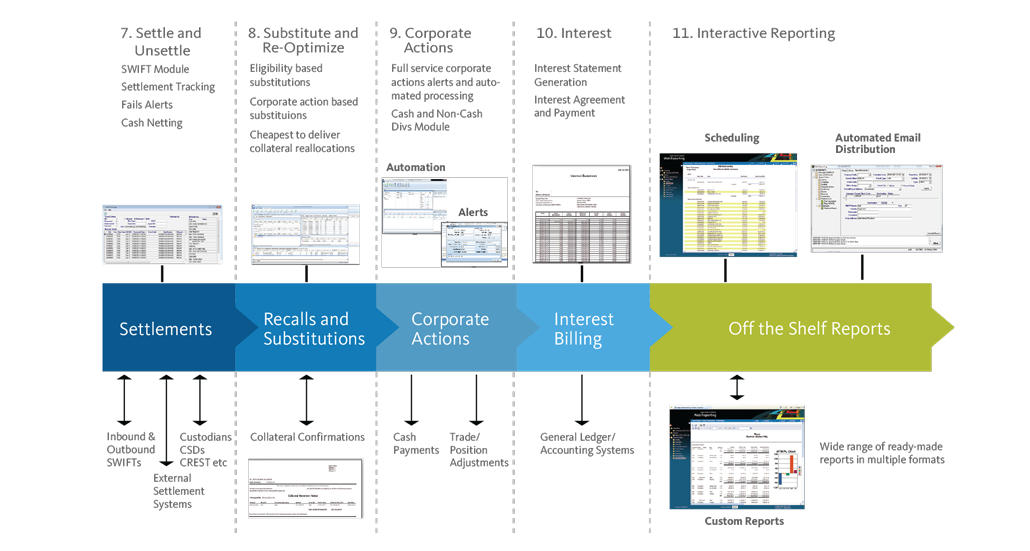

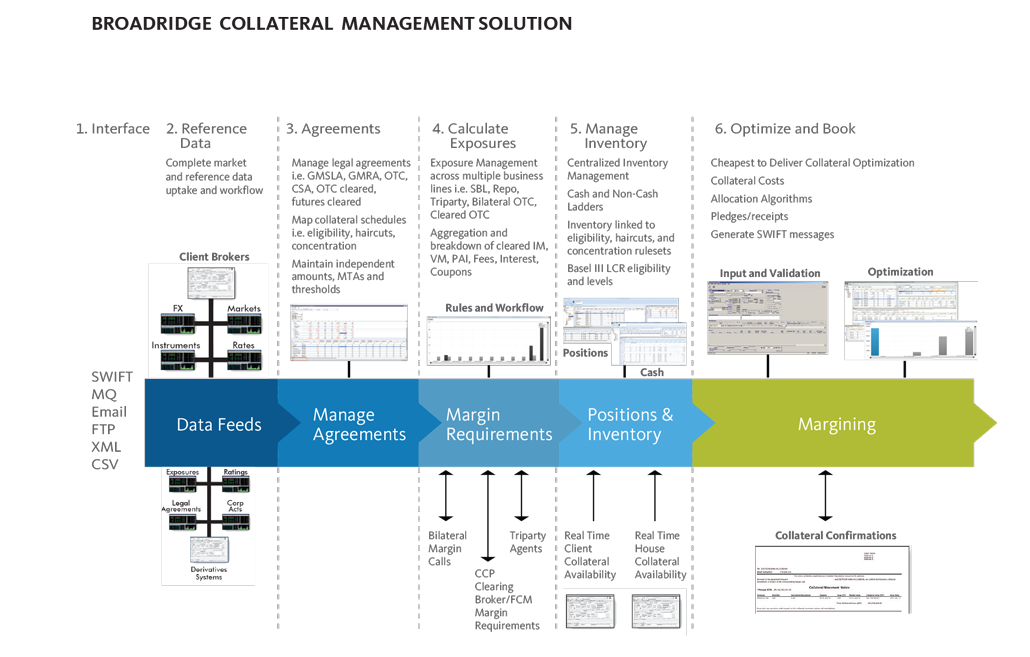

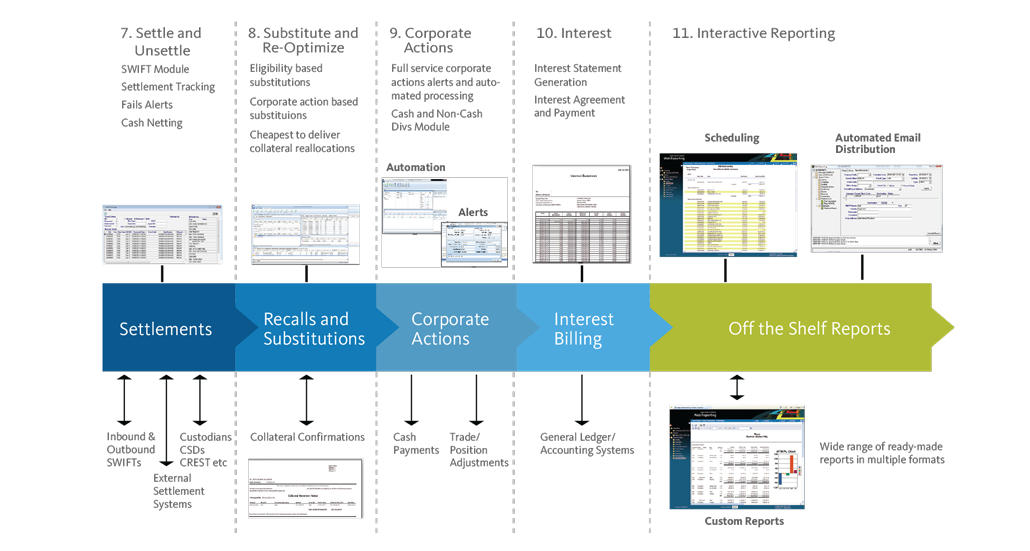

The Broadridge Collateral Management system provides an enterprise-wide, cross-product collateral management solution for securities lending, repo, and bilateral/cleared OTC/exchange-traded derivatives collateral.

The solution offers the ability to view exposures in real time across business lines, providing a centralized view of collateral needs versus collateral availability.

It also provides tools to automate manual processes, mitigate operational risk more effectively and respond more easily to regulatory change, while making the optimum use of balance sheet and retaining vital liquidity.

Features

- Manage collateral for Securities Lending, Repo, Triparty and Cleared/Bilateral, Exchange Traded and OTC Derivatives

- Workflow Support for CCP collateral management (EMIR and Dodd Frank)

- Front-to-back office functionality from inventory management and collateral booking through to settlement

- Process cash and non-cash collateral on a pool or trade basis

- Basel Ill Liquidity Coverage Ratio support

- Automate collateral management processes such as marks and margin calls with real-time updates

- Centralize collateral trading into a single profit center

- Automate mapping of legal agreements CSA/CSD/ GMRA/GMSLA etc.

- Define and apply sophisticated schedules for haircuts and collateral eligibility

- Run on-demand collateral concentration scenario analysis

- Automate collateral substitutions using cheapest to deliver algorithms

- Dispute resolution workflow

- Improve decision making with accessible real-time reporting

- Interface with a wide range of third party systems and trading platforms

- Large selection of off-the-shelf and custom reporting options

Benefits

- Strengthen risk management

- Single collateral platform

- Clear view of counterparty exposures across multiple business lines

- Integration of inventory with eligibility, haircut and concentration limits

- Automation of manual processes

- Intuitive workflow

- Reduced costs

- Boost revenues through better collateral optimization, allocation and utilization across business units

- Broaden the range of collateral usage through visibility of inventory versus acceptability

- Ease the burden of EMIR, Dodd Frank and Basel Ill Compliance

- Reduced operational risk

- Quick and easy to deploy