Top Disruptor Trends Facing APAC Funds in 2024

The $20 trillion APAC asset management industry is going through a period of unprecedented change, underpinned by challenging and complex market conditions, evolving client demographics and behavioral traits, fast-paced digitalization, the emergence of new asset classes, and regulation.

Yoon Ng, Principal, Asset Management Global Advisory Services and Wout Kalis, Head of Asset Management Solutions, APAC at Broadridge look at the top disruptor trends for 2024: namely the advance of Environment, Social, and Governance (ESG) investing in APAC, the growing demand for exchange-traded funds (ETFs), private market funds and multi-manager hedge funds, and the ascendance of digital assets and artificial intelligence (AI).

Summary

- ESG investing in APAC continues to gather momentum, but ESG fund launches in the region will be shaped by local regulation and performance.

- Private debt is an asset class that is growing globally, including here in APAC.

- Appetite for multi-manager hedge funds in APAC shows no sign of slowing this year.

- Retail demand for APAC ETF products will remain strong in 2024.

- Digital assets will become increasingly entrenched in APAC as tokenization and CBDCs become more established, and regulators introduce rules overseeing these new asset classes and their service providers.

- The push by private market managers into retail will continue in 2024.

- AI is set to further transform the asset management industry as the year progresses.

A long game for ESG investing

Large asset owners will continue to embrace ESG investing in 2024, but local regulations and performance will influence the growth of APAC ESG funds.

First Europe, then the U.S., and now APAC, ESG investing has become a worldwide trend, sparked by global events (such as the United Nations’ Climate Change Conference agreement on reducing fossil fuel emissions), regulations (including the EU’s Sustainable Finance Disclosure Regulation and U.K. Sustainability Disclosure Requirements), growing investor demands for sustainable returns, and risk management considerations (like avoiding stranded asset risk).

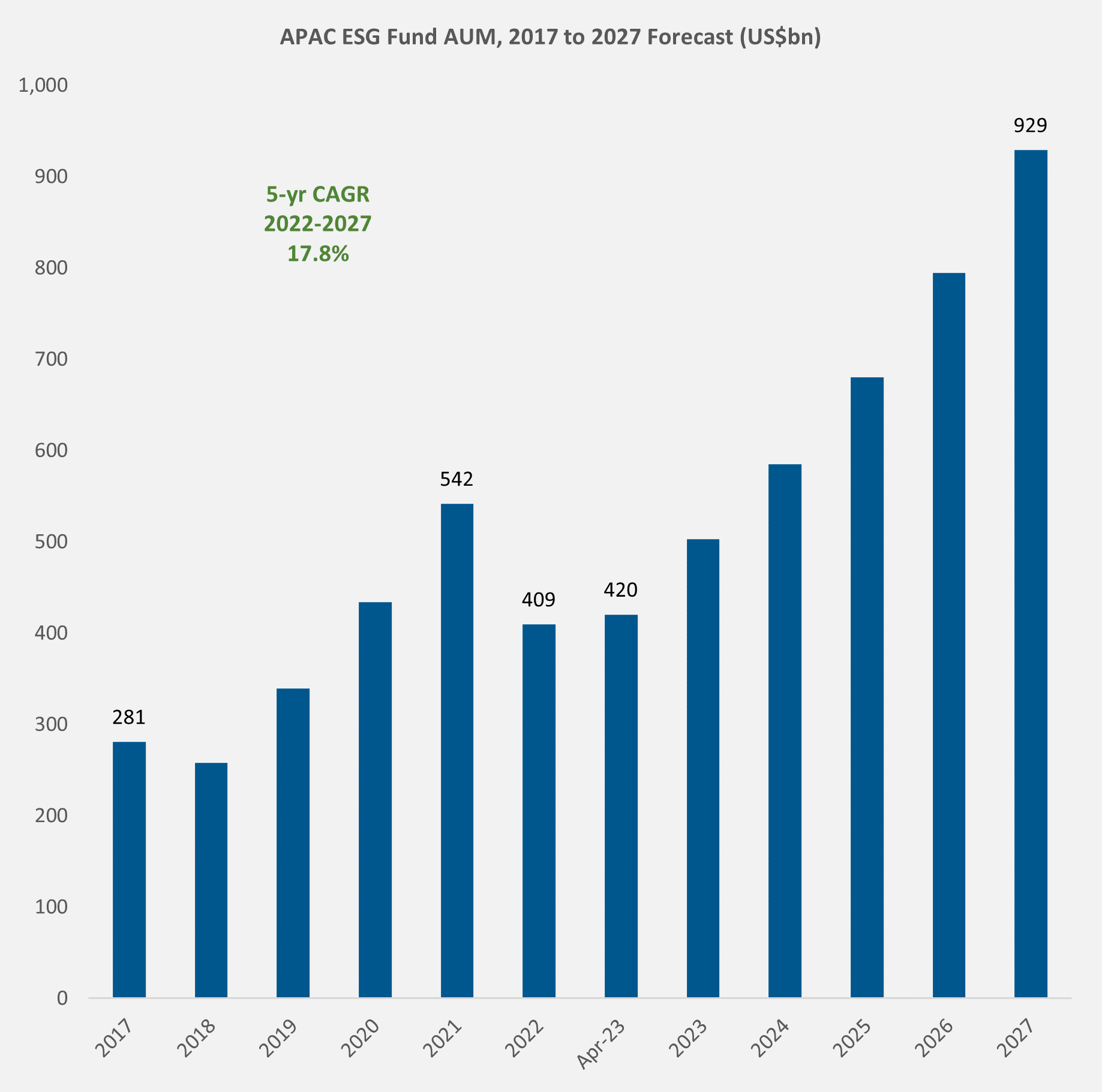

Global assets under management (AUM) in ESG funds have grown exponentially, and APAC is no exception. The region’s ESG fund AUM almost doubled from $281 billion in 2017 to $542 billion in 2021, and this is likely to rise even further with a 17% Compound Annual Growth Rate (CAGR) projected over the next five years.

“ESG investing will continue to be top-driven, with key asset owners in APAC leading the way in the region. Retail demand for ESG will be performance-led and influenced by regulation and the actions of large asset owners,” says Ng. ”More managers will focus their strategies and investments on climate change and the energy transition.”

Despite ESG gaining huge traction globally and within APAC during the last five years, ambiguities remain about ESG labelling, which has given rise to greenwashing. Greenwashing is when companies say they are ESG-conscious for marketing purposes but are not making any tangible sustainability efforts.

“Regulators in APAC are now focusing on creating more ESG clarity for investors,” says Ng.

For instance, regulators in Singapore, Hong Kong and Taiwan have all introduced tougher reporting and disclosure guidelines for ESG funds. These measures are aimed at reducing the risk of greenwashing, as well as making it easier for retail investors to understand what they are buying.

Japan’s $71 billion sustainable fund market is also facing growing scrutiny from the country’s regulator. Only funds that consider ESG as a “key factor” when constructing their investment portfolios are permitted to market themselves as ESG funds. This clampdown, along with the choppy market conditions, have resulted in the number of ESG fund launches in Japan dropping to just 14 between January and November 2023, down from 84 in 2021.

Private debt – a growth market

The APAC private debt industry is expected to continue its expansion at an above average rate in 2024.

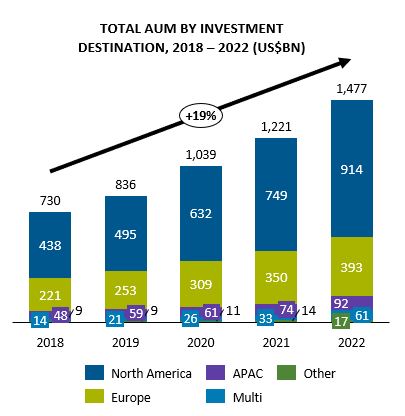

Compared to North America and Europe, the APAC private debt industry is fairly diminutive, managing just $92 billion. However, private debt AUM increased on average by 29% in the five years leading up to September 2022 versus the 17% global average 1 Within APAC, the absence of public debt markets means there will be plenty of opportunities for further private debt growth.

Now managing almost $1.5 trillion globally, private debt is one of the fastest growing strategies in the alternatives space, a result of today’s market volatility and regulations. Morgan Stanley anticipates the asset class will reach $2.7 trillion by 2027.2

“Due to the floating rate nature of private debt loans, the strategy has weathered the recent interest rate rises well. In the U.S., the failure of several small and medium-sized banks has constricted an already tight lending market even further, while regulations in Europe continue to force banks to scale back their lending activities. In response, more companies are trying to obtain financing from alternative sources, including private debt managers,” says Kalis.

“Similarly, a growing number of banks are stepping away from underwriting private equity Leveraged Buyouts, which is prompting more private debt firms to step in,” he adds.

As a result, there has been an uptick in both long only firms (e.g., Fidelity and Ninety One) and hedge fund managers (such as Sona Asset Management) either launching private debt funds or acquiring them as they increasingly look to diversify their income streams and widen their investor footprints.

Private debt is not without its risks though, with some critics arguing the asset class’s valuation practices are opaque and that it needs to be subject to greater regulatory oversight.

Multi-manager hedge funds continue to capture market share

Multi-manager hedge funds are flourishing in APAC, and this trend shows no sign of changing in 2024.

Hedge funds are doing well globally. The average manager returned 4.9% in 20233 while AUM soared past the $4 trillion milestone as firms successfully navigated the volatile markets.

Multi-manager hedge funds — namely investment firms that run multiple, individual strategies, allowing for returns to be obtained from a wider range of sources at much lower volatility and with better risk diversification — are becoming increasingly popular.

Data suggests that multi-manager hedge funds have outperformed single manager hedge funds. In the 10 years ending on March 31, 2023, Morgan Stanley notes that the Multi-PM Peer Group Composite, comprising 32 members, delivered an average return of 7.97% versus 4.44% at a single-manager hedge fund — with about half the volatility.4

“A lot of the global trends shaping multi-manager hedge funds are being borne out in APAC. Many of the big multi-manager hedge funds have been active in APAC and are hiring or doubling down their market presence. We also hear some family offices are launching external multi-manager hedge funds,” says Kalis.

Multi-manager hedge funds tend to be more complex than single manager hedge funds, however. This means firms need to invest heavily into their risk management so they can track their individual managers’ performance, ideally in real time.

It is vital firms have the right tools to conduct this sort of risk management.

ETFs stay strong and steady

Retail demand to be a major growth driver for ETFs in 2024

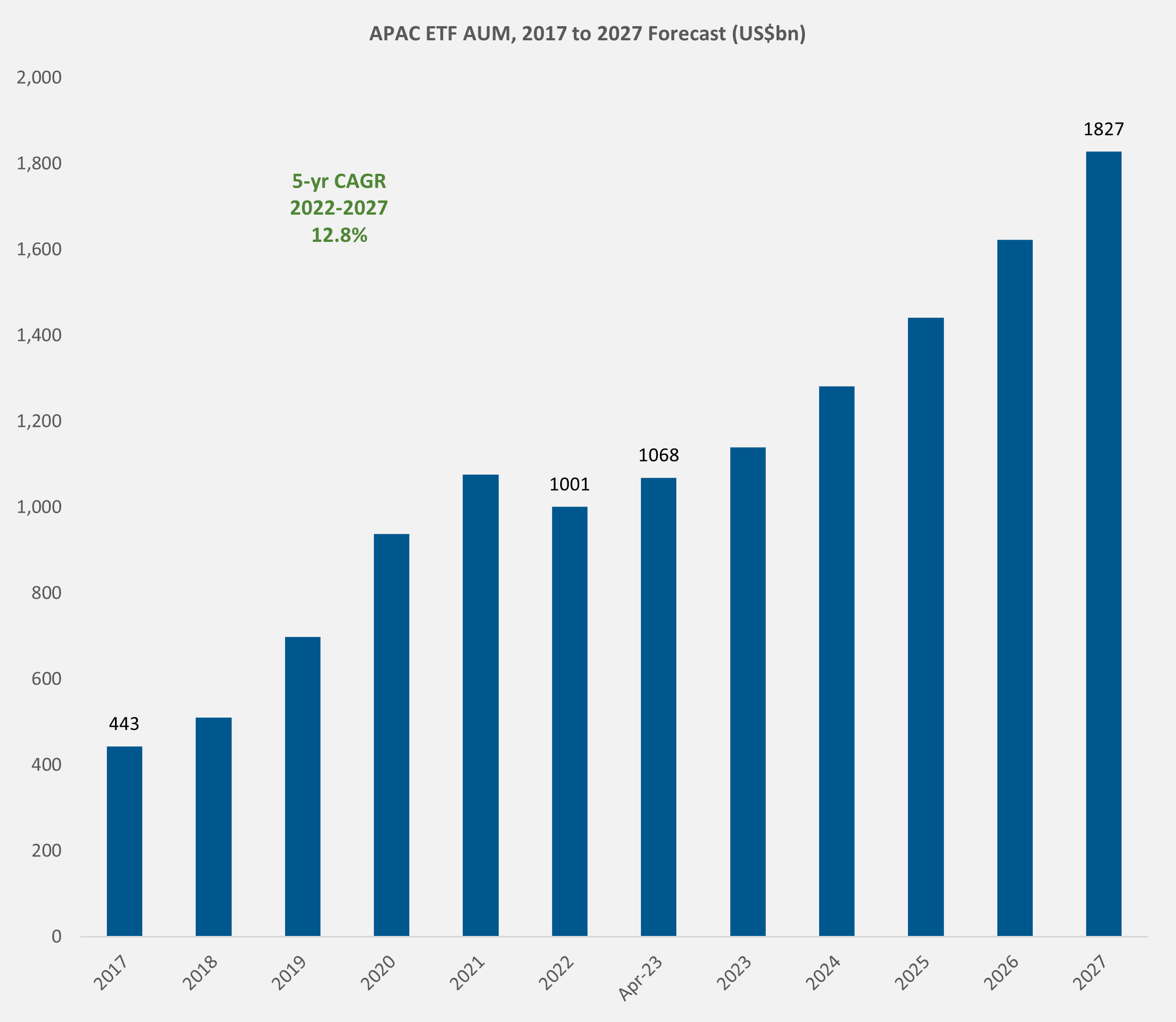

ETF investing in APAC is thriving, with the industry more than doubling from $430 billion in 2017 to $1.1 trillion in 2022.

“Although the first phase of ETF growth was driven by institutions such as the Bank of Japan and insurers, recent growth has been driven by retail investors, attracted to ETFs’ cost efficiencies and product innovations,” according to Ng.

Allocations into Chinese and Taiwanese ETFs have skyrocketed. In China, ETF assets jumped from $49 billion in 2017 to $287 billion in November 2023, as retail investors “buy the dip” amid the market volatility. Meanwhile, bond and equity ETFs in Taiwan have seen their AUM more than quadruple over the last five years.

“Although domestic life insurers account for the bulk of bond ETF AUM in Taiwan, retail investors are building up their holdings. Equity and thematic ETFs are also thriving, buoyed by strong market performance, especially in technology (e.g., 5G) and semiconductor stocks. In addition, many younger investors are being guided towards ETF investing by online investment influencers, highlighting a new marketing trend,” says Ng.

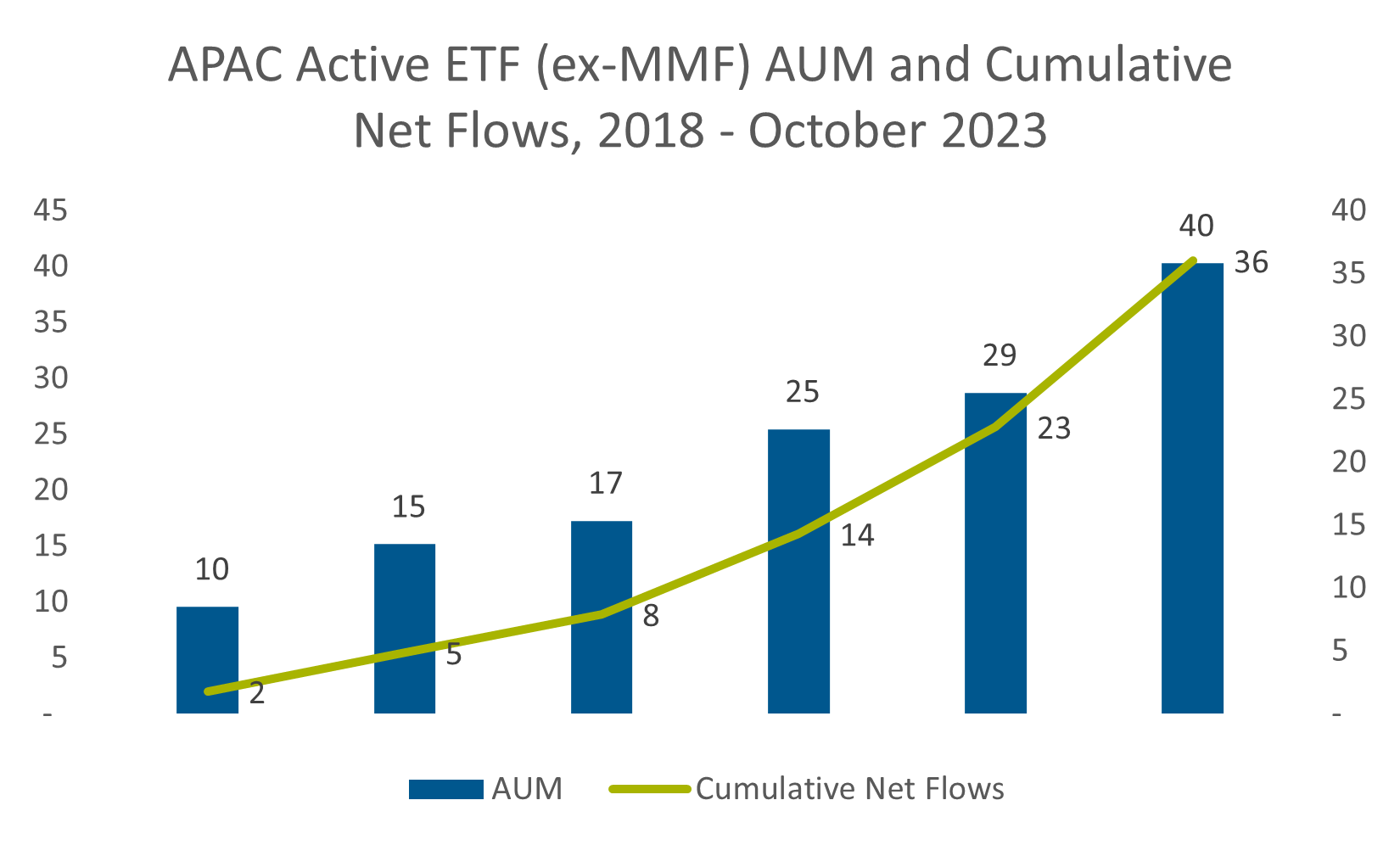

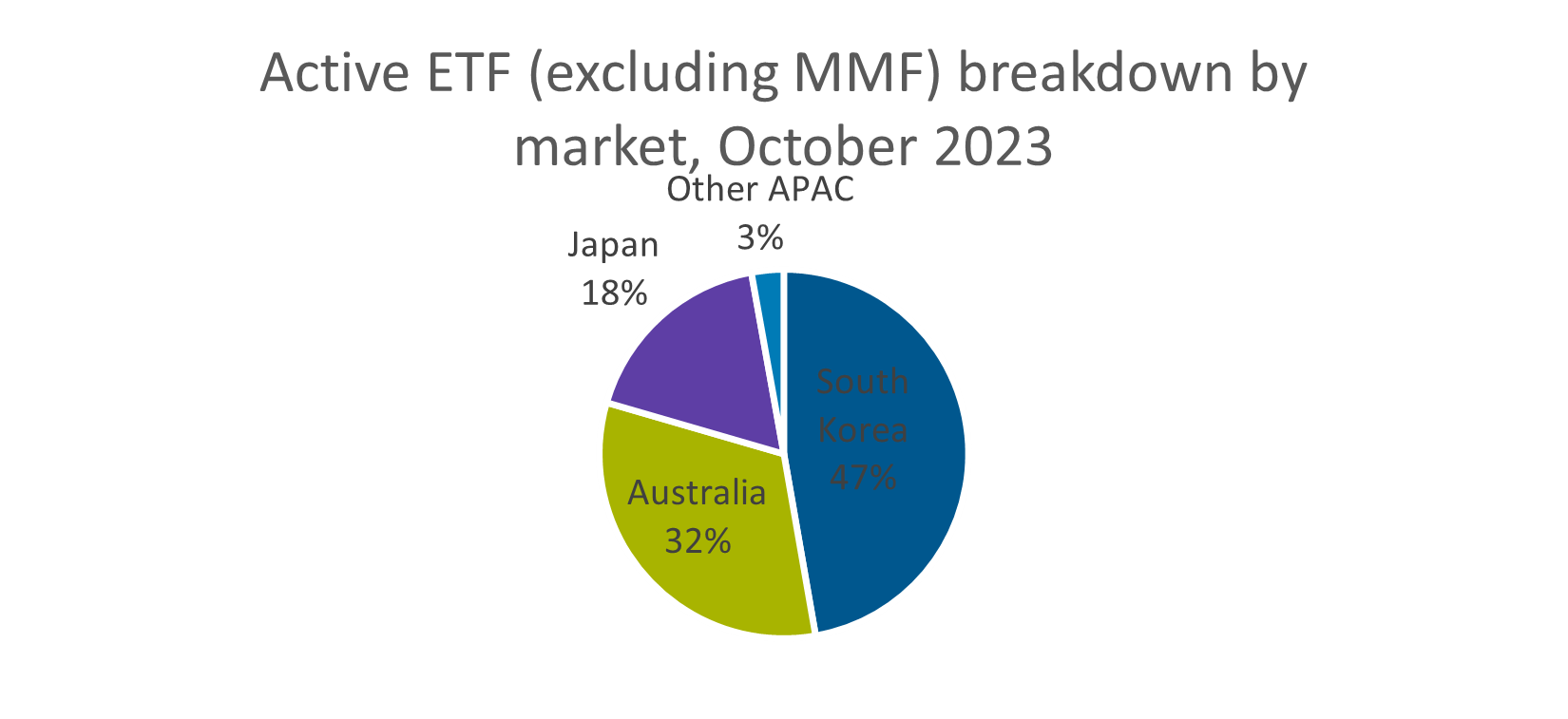

Active ETFs are also thriving in APAC. Broadridge data shows active ETFs in APAC currently account for $40 billion in assets or slightly below 5% of all long-term ETF AUM in the region, up from just $11.5 billion in 2017, with Australia and South Korea being the biggest markets (See chart).

Investor appetite for active ETFs in Australia and South Korea is gaining momentum for several reasons.

“In Australia, the spotlight on cost versus value investing has catalyzed growth in the ETF space with investors gravitating towards active ETFs which afford low-cost global access. In South Korea, the combination of the loosening of ETF regulations and the proliferation of new index launches have spurred growth. Mixing high-alpha technology stocks with bonds has proven to be a winning formula for some of the largest ETF providers. Future growth will bank on the ability to deliver investors’ needs innovatively in a cost efficient manner,” says Ng.

Digital assets – APAC gains ground

As 2024 progresses, more asset managers in APAC will start taking an interest in digital assets.

Some managers believe tokenization could help them attract more capital.

“Tokenization would allow for managers to fractionalize their funds, making them cheaper for investors to buy. In addition to making mutual funds less expensive, tokenization will also make the fund buying experience more digital and seamless, in what could help firms attract younger investors,” says Ng.

A handful of APAC markets are embracing tokenization. For instance, the Monetary Authority of Singapore (MAS) is conducting a series of experiments with leading financial institutions on how tokenization can be applied to digital asset trades, foreign currency payments, multi-currency clearing and settlement, automated portfolio rebalancing, and fund management. 5

On tokenization, J.P. Morgan and Apollo recently engaged with a group of fintechs to demonstrate a proof of concept showing how asset managers could tokenize a fund on a blockchain.6

A number of central banks will also continue their work on Central Bank Digital Currencies (CBDCs), a digital form of fiat cash, which proponents believe will speed up international payments and cross-border settlements. According to the Atlantic Council, 11 countries are now live with CBDCs, 21 are piloting them, and 33 are in the development stages.7

Although the Securities and Exchange Commission (SEC) has approved a spot bitcoin ETF, the collapse of FTX and the recent fines levied against Binance have rattled a lot of institutional investors, many of whom will not touch digital assets unless there is better regulation.

Efforts to regulate digital assets and their service providers in APAC are firmly underway, a move that could help stimulate liquidity in these nascent asset classes. Hong Kong, for example, has introduced a licensing regime for digital asset trading platforms. 8

“One of the big barriers to entry for institutional asset managers when exploring digital assets is the lack of regulation and counterparty risk. By introducing a regulatory framework overseeing providers, such fears could be allayed,” says Kalis.

Private market firms try to target a new investor segment

In 2024, APAC private market firms will try and diversify their client bases by targeting retail investors.

Private market firms are now targeting high-net-worth investors and retail investors, the latter being a client demographic with very limited exposure to alternatives generally. According to Broadridge’s Global Demand Model (GDM), individual investors account for about 39% of the $56 trillion in APAC AUM, yet account for just 15% of the alternative funds market.”

A handful of managers, including BlackRock, have since launched retail private debt funds with minimum investment thresholds as low as $70,000. In Asia, private market manager Hamilton Lane, together with ADDX, a tokenization platform and Endowus, a robo-advisor, are all offering private market solutions to wealthy or affluent investors.

“Other managers focused on the private markets are leveraging investment platforms, which can lower the boundaries for investment, particularly for retail. These platforms create fund structures that work as pooling vehicles, to then invest in either third party or proprietary funds, or offer the infrastructure required to support private market investment from the wealth management segment,” says Ng.

Artificial intelligence (AI) – the ultimate game changer

In 2024, APAC managers will start mapping out how AI could potentially transform their businesses.

Despite the market uncertainty, Broadridge’s Digital Transformation Study revealed that financial institutions plan to ramp up their overall spend on next generation technology by 20% over the next two years. In addition, another 71% of firms reported that AI is significantly changing how they work.

“By combing through data, AI solutions including Large Language Models (LLMs) can unlock all sorts of opportunities for fund managers. Many financial firms in APAC are currently getting to grips with the technology and what it means for their organizations,” says Kalis.

Potential use cases for AI include automated financial reporting, earnings analysis, market research, finance planning, risk assessment and management, performance management, and client communications. 9

The efficiencies being realized by AI should not be underestimated. One tool— BondGPT — lets traders identify information about bond options in real time, a process that previously took more than 20 minutes.10

Meanwhile, Broadridge’s new Global Demand Model measures and analyzes demand for asset management products today and in the future. The platform tracks over $100 trillion of global assets and uses next generation AI-driven models to help managers optimize their distribution and product strategies.

References

1 Asia Pacific Private Debt: An industry poised for growth. (2022) . Cleary Gottlieb

2 Outlook: Private Credit. (2023, September 15). Morgan Stanley.

3 Emerging Markets Hedge Funds Surge as Inflation Falls. Hedge Fund Research.

4 How Multi-Manager Platforms Find Strength in Numbers. (2023, July 27). Morgan Stanley Investment Management.

5 CoinDesk – November 15, 2023 – Singapore Central Bank starts tokenisation plots alongside J.P. Morgan, BNY Mellon, DBS

6 CoinDesk – November 15, 2023 – J.P. Morgan, Apollo tokenise funds in proof of concept with Axelar, Oasis, Provenance

7 Atlantic Council – Central Bank Digital Currency tracker

8 Finance Asia -November 7, 2023 – Navigating digital asset custody in Hong Kong

9 Alpha Sense – December 11, 2023 – Generative AI in Financial Services

10 Finextra – November 15, 2023 – Generative AI’s next generation: Enter the agents

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |