Multi-Asset Income Continues To Thrive Post Freedoms

Recent fund launches benefit from the multi-asset income bonanza.

Multi-asset income funds can be used by defined contribution (DC) plans in the accumulation phase of an individual’s retirement savings journey, but they have also emerged as popular products for members who opt for drawdown at retirement.

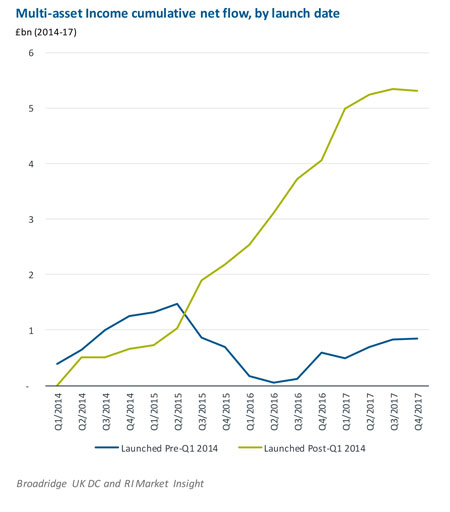

The fact that multi-asset income funds can generate a stable income yield that competes favourably with annuity income rates, while also maintaining asset growth potential and the ability to pass wealth on upon death, makes them attractive among retirees. As shown by the data tracked within Broadridge Global Market Intelligence, which provides an integrated, complete view of both domestic and cross-border funds, it is mainly the funds launched around the time pensions freedoms came into effect in 2015 that have benefited most from this trend.

Insights drawn from our UK DC and RI Insight stream

An intelligence service focused on the UK DC and RI markets

- Analysis of the full retirement savings landscape

- Current and future opportunity analysis

- 10 year forecasts of opportunity and market development

For more information about our data or insights on this topic

Please contact laura.cohen@broadridge.com or call +44 207551 - 3331